Georgia Sample Letter for Short Sale Request to Lender

Description

How to fill out Sample Letter For Short Sale Request To Lender?

You can spend multiple hours online looking for the official document template that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can obtain or create the Georgia Sample Letter for Short Sale Request to Lender from the platform.

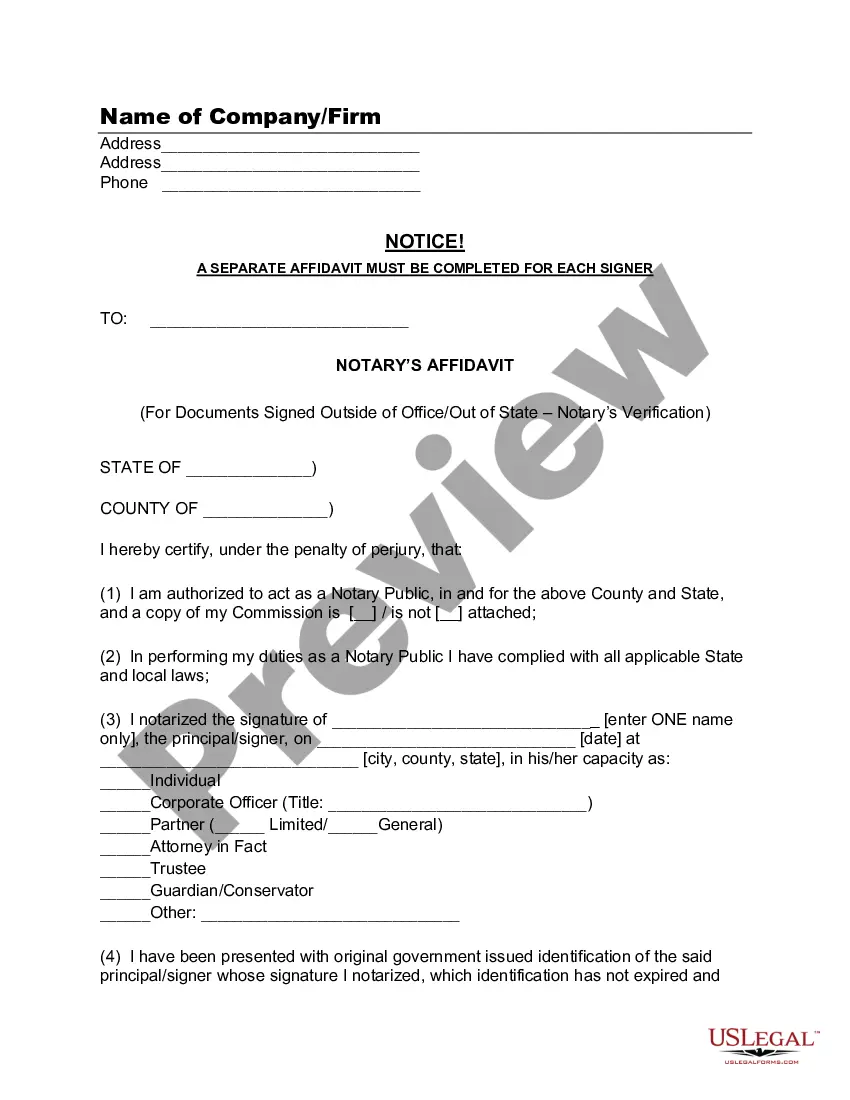

If available, utilize the Preview button to examine the document template as well. If you wish to find an additional version of the form, use the Search field to discover the template that suits your needs and requirements. Once you have located the template you want, click Purchase now to proceed. Select the pricing plan you desire, enter your details, and create an account on US Legal Forms. Complete the transaction using your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make changes to your document if necessary. You can complete, edit, sign, and print the Georgia Sample Letter for Short Sale Request to Lender. Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the Georgia Sample Letter for Short Sale Request to Lender.

- Each legal document template you receive is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the correct form.

Form popularity

FAQ

The amount a bank will accept on a short sale can vary greatly, but it often ranges from 10% to 25% less than the outstanding mortgage balance. Factors such as the property's condition, the local market, and the lender's policies play a crucial role in determining this figure. By using a Georgia Sample Letter for Short Sale Request to Lender, you can effectively communicate your situation and potentially negotiate a more favorable outcome. This letter serves as an essential tool to help you present your case clearly and professionally.

To request a short sale, start by contacting your lender to express your intent and the reasons behind it. Prepare documentation that includes financial statements and hardship letters. Using a Georgia Sample Letter for Short Sale Request to Lender can enhance your request by clearly outlining your situation and urging the lender to consider your offer. This structured approach can significantly improve your chances of approval.

Short sales typically have a less severe impact on your credit compared to a foreclosure. While both options will reflect negatively on your credit report, a short sale can indicate to future lenders that you took proactive steps to address financial difficulties. This could improve your chances of obtaining a mortgage in the future. To navigate this process effectively, reference a Georgia Sample Letter for Short Sale Request to Lender.

To request a short sale, begin by contacting your lender to discuss your financial difficulties. Prepare a Georgia Sample Letter for Short Sale Request to Lender, detailing your situation and the need for a short sale. Providing clear documentation will help speed up the approval process and facilitate a smoother negotiation with the lender.

When writing a letter to a mortgage company for hardship, clearly and concisely explain your financial situation. Include details about your income, expenses, and any supporting documentation. You can also refer to a Georgia Sample Letter for Short Sale Request to Lender, which provides a useful template to guide you in crafting a compelling letter that addresses your specific challenges.

If you're planning to buy a short sale, you should talk to the listing agent. At the very least, before writing an offer, ask your agent to speak to the listing agent. You'll find different skill sets and education levels among real estate agents.

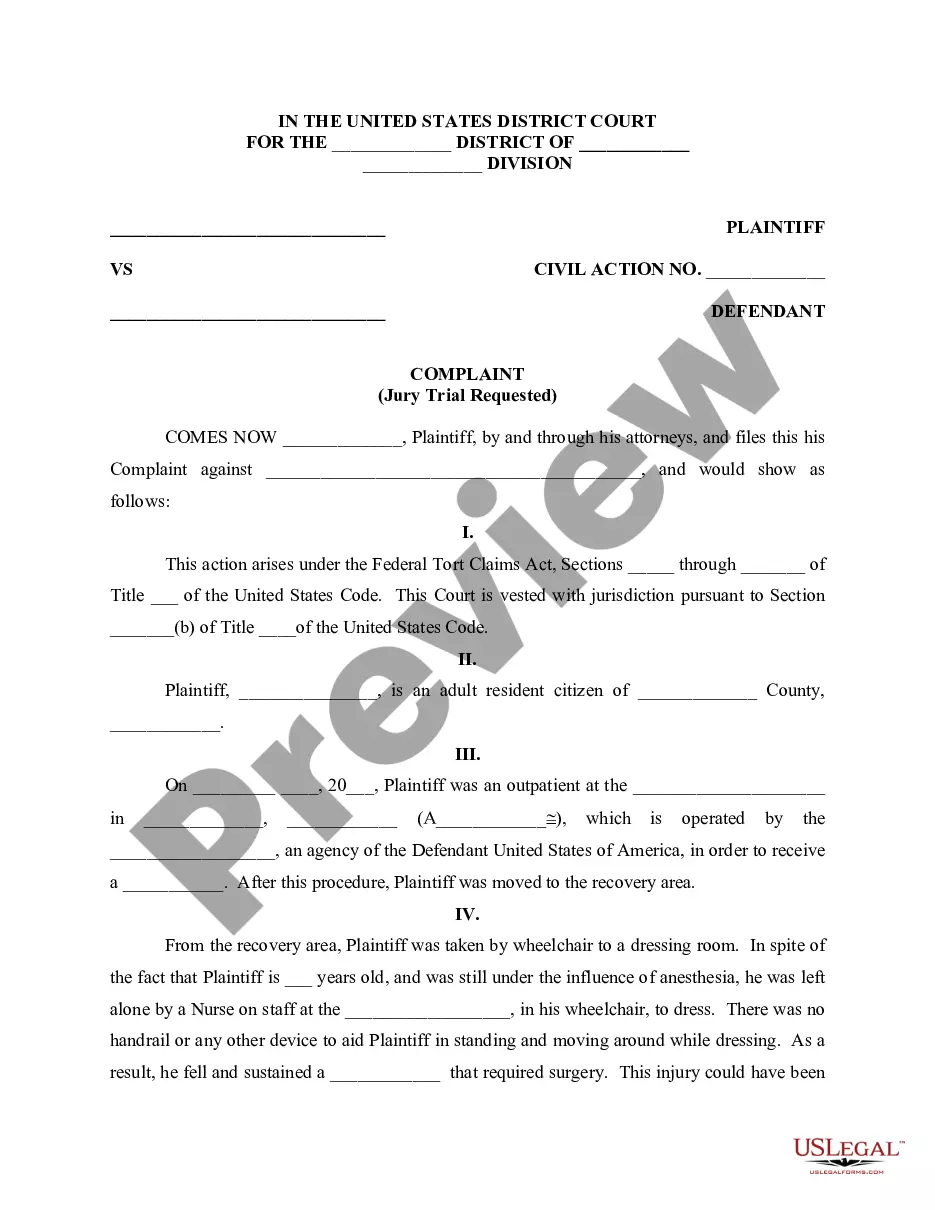

The term short sale in real estate refers to a sale that takes place when a financially distressed homeowner sells their property for less than the amount due on the mortgage. The buyer of the property is a third party (not the bank), and all proceeds from the sale go to the lender.

A short sale is when a mortgage lender agrees to accept a mortgage payoff amount less than what is owed in order to facilitate a sale of the property by a financially distressed owner. The lender forgives the remaining balance of the loan.

Yet short sales can be difficult transactions; the lender must accept less than the total mortgage amount due. Not all lenders will even negotiate a short sale, so it's important that the buyer / seller have a good real estate agent or attorney to sell the idea to the lender's loss mitigation department.

In the body of the letter, state the hardship that led you to fall behind on your mortgage payments. Explain to the lender what happened and why it was beyond your control. Keep your explanation brief. The goal of the hardship letter is to explain to the lender the nature of your hardship.