Georgia Private Placement Subscription Agreement

Description

How to fill out Private Placement Subscription Agreement?

You are able to devote several hours online looking for the authorized file web template that fits the state and federal needs you need. US Legal Forms supplies 1000s of authorized forms which are examined by experts. You can easily download or produce the Georgia Private Placement Subscription Agreement from your service.

If you already have a US Legal Forms profile, you are able to log in and click on the Acquire switch. After that, you are able to comprehensive, modify, produce, or signal the Georgia Private Placement Subscription Agreement. Each authorized file web template you acquire is yours permanently. To obtain yet another duplicate of any obtained form, proceed to the My Forms tab and click on the related switch.

If you are using the US Legal Forms website for the first time, keep to the basic recommendations beneath:

- Very first, be sure that you have selected the right file web template to the region/town that you pick. Browse the form explanation to ensure you have selected the correct form. If offered, make use of the Preview switch to check from the file web template at the same time.

- In order to get yet another edition of the form, make use of the Search discipline to discover the web template that meets your requirements and needs.

- When you have located the web template you want, click Get now to move forward.

- Select the costs strategy you want, type in your accreditations, and register for an account on US Legal Forms.

- Full the deal. You can utilize your charge card or PayPal profile to cover the authorized form.

- Select the format of the file and download it to the gadget.

- Make adjustments to the file if needed. You are able to comprehensive, modify and signal and produce Georgia Private Placement Subscription Agreement.

Acquire and produce 1000s of file web templates utilizing the US Legal Forms web site, which offers the most important selection of authorized forms. Use specialist and state-certain web templates to take on your small business or person requires.

Form popularity

FAQ

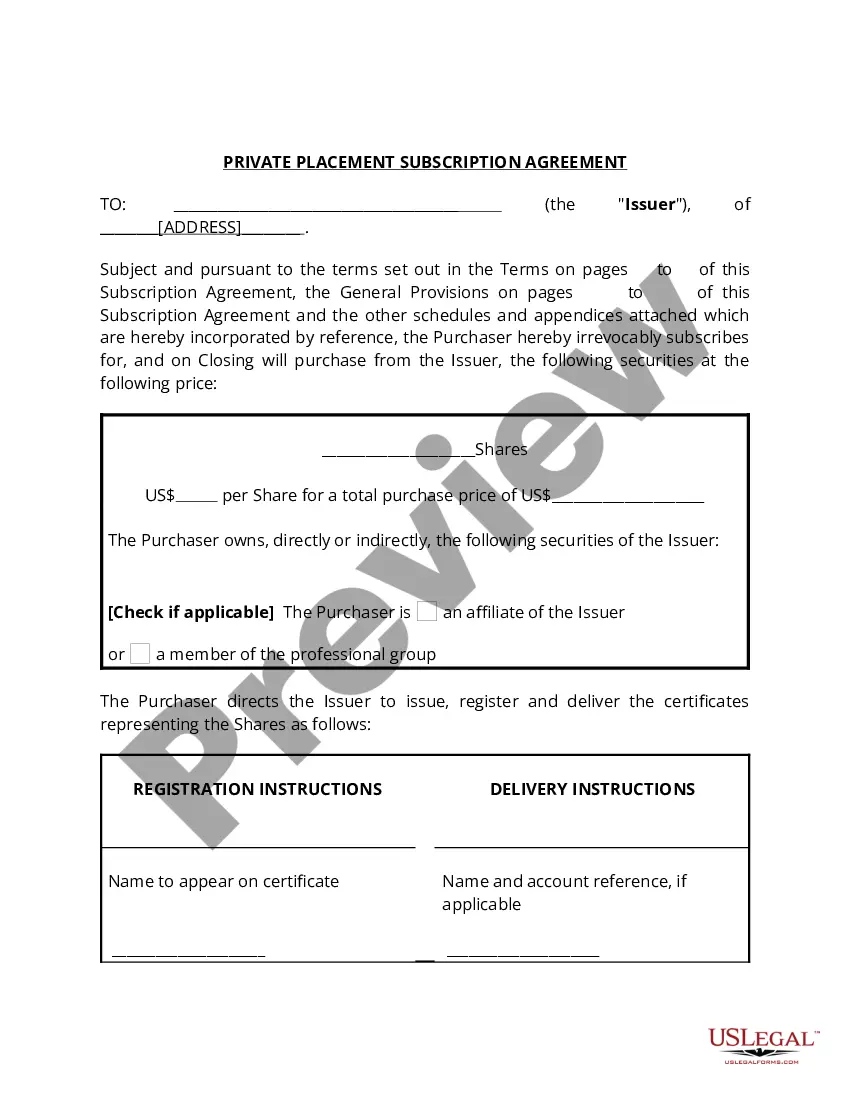

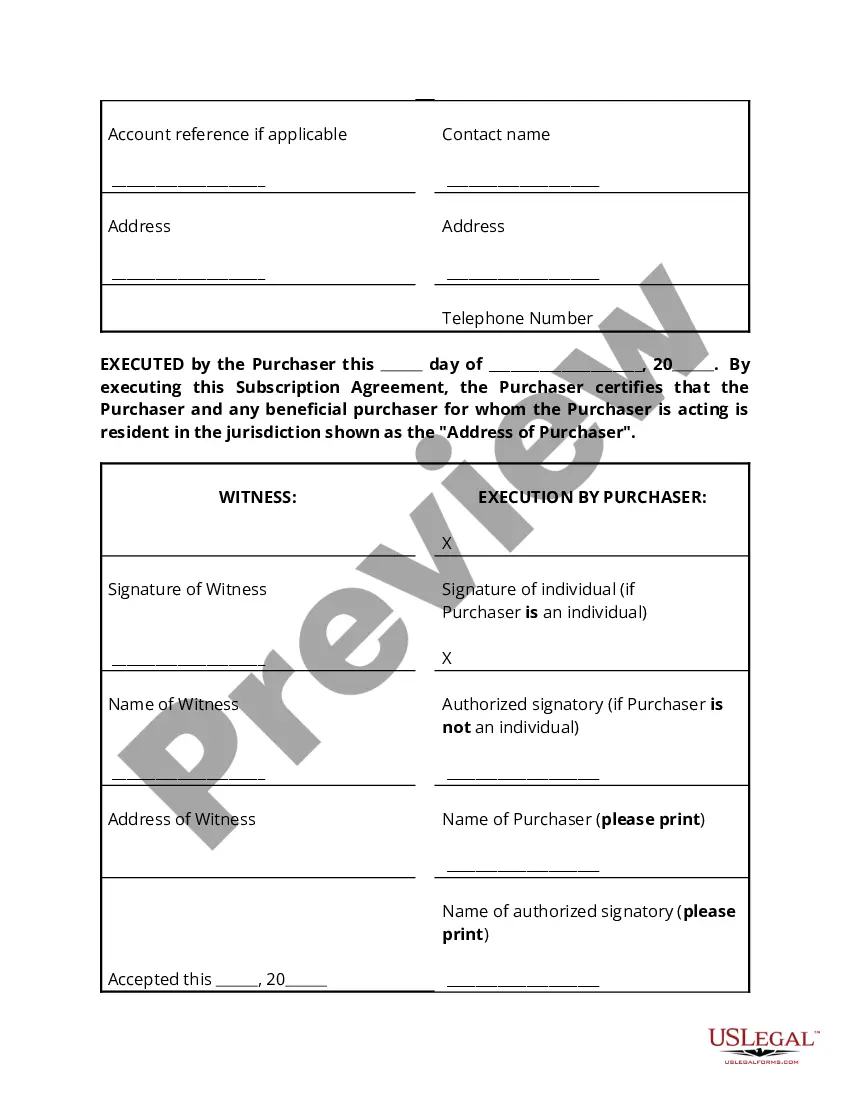

What information is typically included in a subscription agreement? Company information. Expectations of both parties. Agreement to subscribe (this includes the number of shares and price) Rights attached to the subscription. ... Terms for termination before completion. Nomination onto board. Confidentiality provisions.

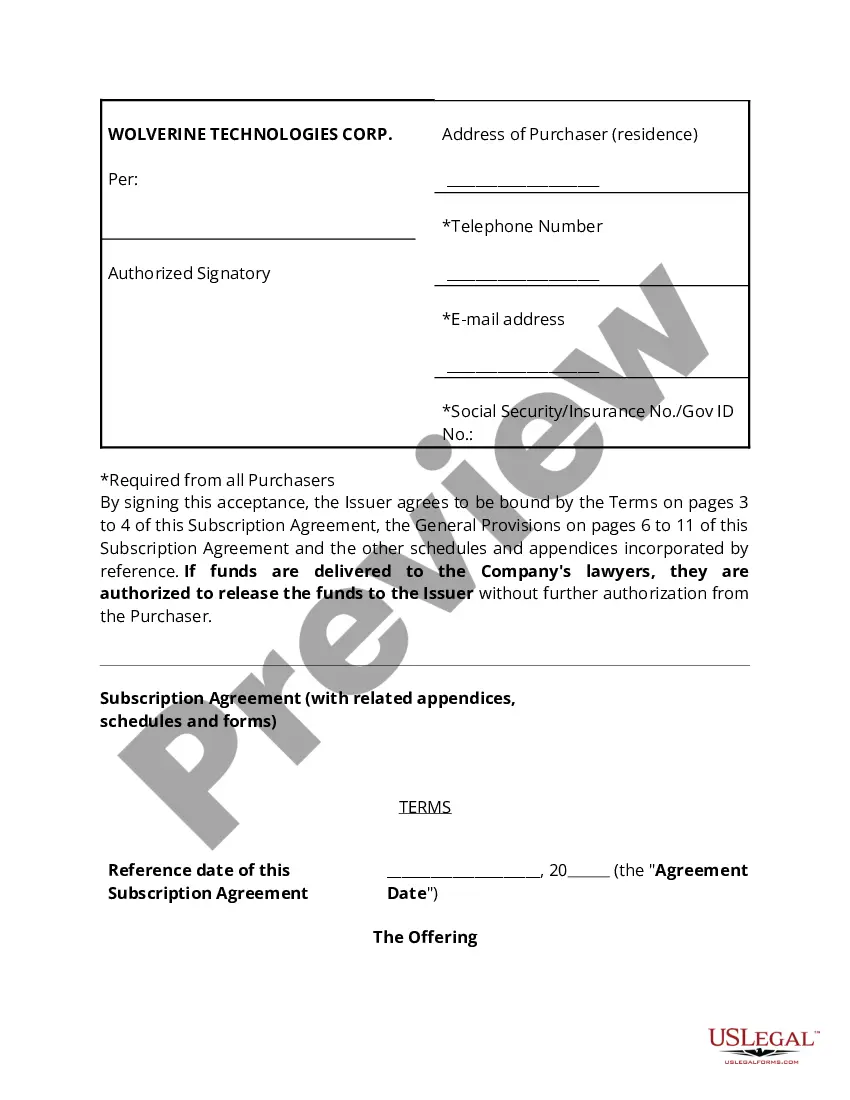

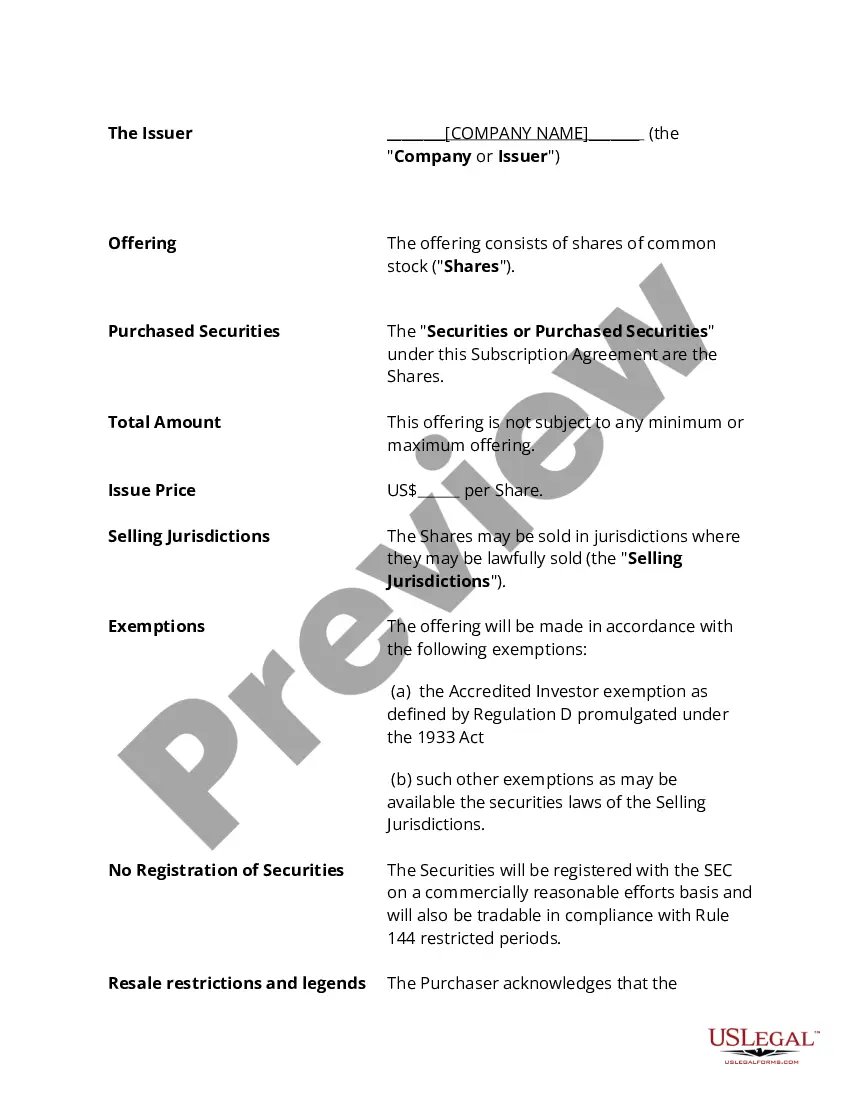

How is a Subscription Agreement different from a Private Placement Memorandum (PPM)? The PPM goes into the specifics of the offering, whereas the Subscription Agreement acts as the purchase agreement to acquire interests in the offering.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

A subscription agreement is between a company and a private investor to sell a specific number of shares at a specific price. This investor fills out a form documenting his or her suitability for investing in the partnership. A subscription agreement can also be used to sell stock in a privately owned business.

The Operating Agreement outlines how the governing body will operate. The Subscription Agreement is the legally binding agreement between the investor and the Issuer.

The Private Placement Memorandum (PPM) itself doesn't represent the actual ?offering.? Instead, it serves as a disclosure document that comprehensively describes the offering, encompassing its structure, strategies, regulation, financing, use of funds, business plan, services, risks, and management.

The PPM goes into the specifics of the offering, whereas the Subscription Agreement acts as the purchase agreement to acquire interests in the offering.

While contracts tend to be rigid, one-off agreements, subscriptions are often delivered under a Master Services Agreement (MSA), which can provide a more flexible framework for the ongoing relationship.