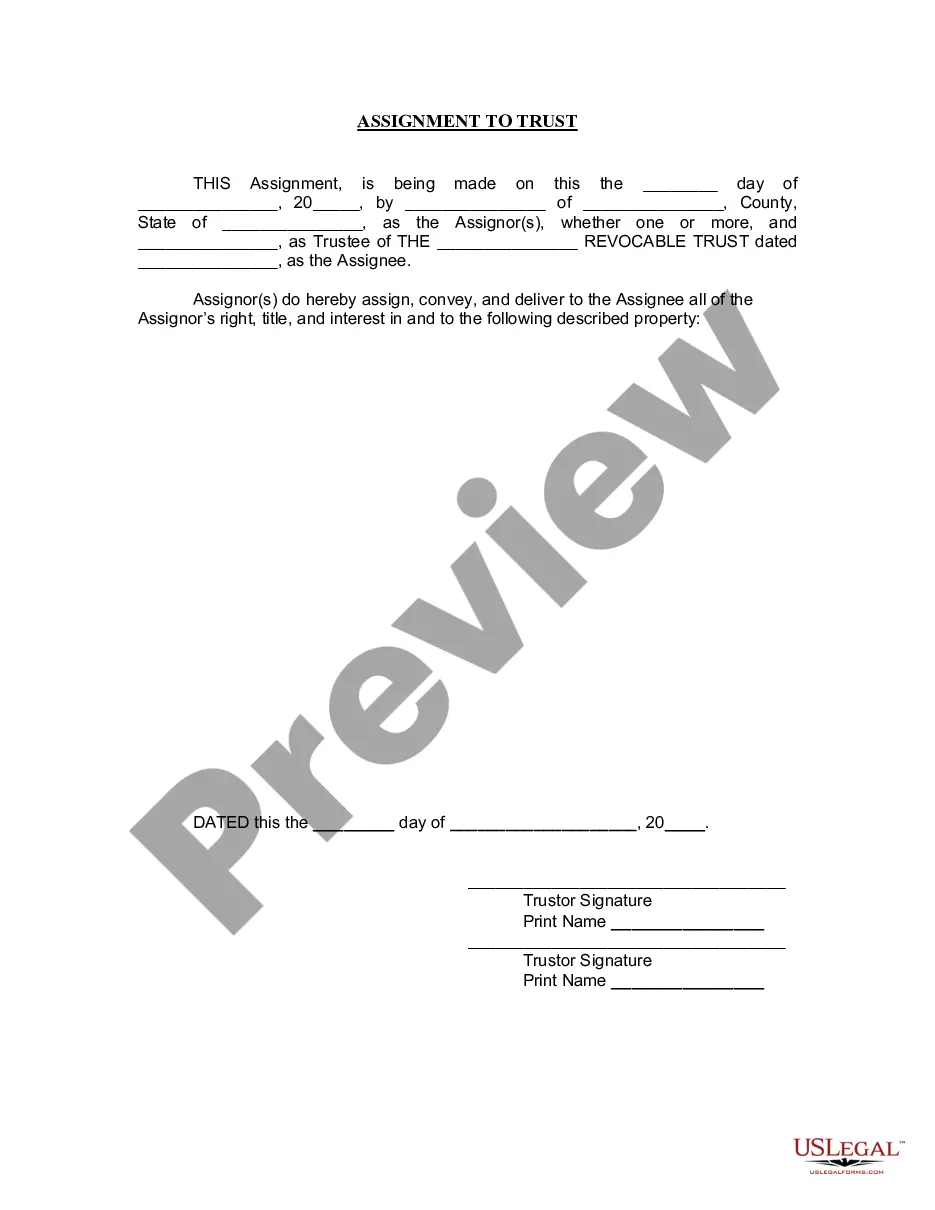

This due diligence workform is used to review property information and title commitments and policies in business transactions.

Georgia Fee Interest Workform

Description

How to fill out Fee Interest Workform?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast assortment of legal document templates that you can download or create.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the latest forms such as the Georgia Fee Interest Workform in just a few minutes.

If you already have an account, Log In and download the Georgia Fee Interest Workform from the US Legal Forms collection. The Download button will be available on each form you view. You can access all previously downloaded forms in the My documents tab of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and obtain the form on your device. Make changes. Fill out, modify, and print and sign the downloaded Georgia Fee Interest Workform.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to examine the content of the form.

- Review the form summary to ensure you have chosen the right one.

- If the form does not meet your needs, use the Search area at the top of the screen to find a suitable alternative.

- If you are satisfied with the form, confirm your choice by clicking on the Buy now button.

- Then, select your payment plan and provide your details to register for an account.

Form popularity

FAQ

Filling out the Georgia G4 requires you to provide personal information along with the number of withholding allowances you are claiming. To simplify this process, you can use the Georgia Fee Interest Workform, which helps ensure your data is accurate and aligns with current tax regulations. Keeping this information correct is crucial to avoid over- or under-withholding.

The Georgia state income tax withholding form is known as the G4, used by employers to establish or modify employee withholding allowances. It’s essential for ensuring that correct amounts are withheld from employees' paychecks. Using the Georgia Fee Interest Workform can help manage this process smoothly.

Georgia allows the provisions of IRS Section 163(j), which focuses on limiting business interest deductions. Taxpayers should carefully navigate these limits when preparing their returns. The Georgia Fee Interest Workform can help properly address interest expenses, ensuring compliance with both state and federal regulations.

The 183-day rule in Georgia determines tax residency for individuals based on the number of days spent in the state. If you spend 183 days or more in Georgia during the tax year, you are generally considered a resident for tax purposes. For accurate tax filings, understanding this rule when filling out the Georgia Fee Interest Workform is essential.

Georgia offers tax reciprocity with several states, including Maryland and New York, which helps prevent double taxation for residents working across state lines. This can greatly simplify the tax filing process for Georgia residents. Utilizing tools like the Georgia Fee Interest Workform can clarify these requirements while promoting compliance.

Georgia form 501 must be filed by individuals who exceed certain income thresholds, typically those who owe more state taxes. This is particularly crucial for taxpayers claiming credits or those who have tax withholdings that need to be adjusted. Additionally, the Georgia Fee Interest Workform can help ensure all related forms are filed accurately.

Yes, Georgia does adhere to IRS Section 163(j), which addresses limitations on interest expense deductions. Business entities in Georgia, when completing the Georgia Fee Interest Workform, must keep this regulation in mind. It helps ensure that they are following both federal and state guidelines correctly while maximizing deductible interest expenses.

The $500 check in Georgia is typically issued to eligible individuals as part of a state refund initiative. This initiative aims to provide financial relief to residents, and understanding the criteria for eligibility is vital when utilizing the Georgia Fee Interest Workform. By knowing who qualifies, you can ensure you benefit from this financial support effectively.

The legal interest rate in Georgia, as defined by the state law, typically stands at 7% per year unless otherwise specified in a written contract. This rate is crucial for various financial agreements, including loans and leases, particularly when utilizing the Georgia Fee Interest Workform. Understanding this rate helps you make informed decisions while managing your financial obligations.