Georgia Internal Revenue Service Ruling Letter

Description

How to fill out Internal Revenue Service Ruling Letter?

If you wish to total, acquire, or print lawful papers web templates, use US Legal Forms, the largest assortment of lawful forms, that can be found on-line. Take advantage of the site`s easy and practical lookup to obtain the papers you require. Various web templates for enterprise and personal uses are sorted by classes and states, or key phrases. Use US Legal Forms to obtain the Georgia Internal Revenue Service Ruling Letter in a few clicks.

If you are currently a US Legal Forms consumer, log in in your profile and then click the Obtain key to obtain the Georgia Internal Revenue Service Ruling Letter. Also you can accessibility forms you previously downloaded within the My Forms tab of your profile.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape to the correct town/land.

- Step 2. Take advantage of the Review method to check out the form`s content. Don`t overlook to read the information.

- Step 3. If you are not satisfied with the develop, take advantage of the Look for field at the top of the screen to get other versions of the lawful develop web template.

- Step 4. Upon having found the shape you require, click the Get now key. Choose the rates plan you favor and add your references to register for the profile.

- Step 5. Approach the financial transaction. You should use your credit card or PayPal profile to perform the financial transaction.

- Step 6. Choose the formatting of the lawful develop and acquire it on the gadget.

- Step 7. Complete, edit and print or sign the Georgia Internal Revenue Service Ruling Letter.

Every lawful papers web template you purchase is yours eternally. You might have acces to each and every develop you downloaded with your acccount. Click on the My Forms segment and decide on a develop to print or acquire once again.

Remain competitive and acquire, and print the Georgia Internal Revenue Service Ruling Letter with US Legal Forms. There are millions of professional and state-distinct forms you can use to your enterprise or personal requirements.

Form popularity

FAQ

For more information about certificates of compliance or tax clearance letters, contact your local service center or call the Department's Taxpayer Assistance at 850-488-6800 Monday-Friday, excluding holidays.

Most of our letters provide specific instructions of what you need to do, for example: Log in to the Georgia Tax Center and follow the directions provided, or. Let you know that your vehicle registration is suspended or will be suspended soon. The letter will tell you what you need to do to legally drive your vehicle.

Please email OGC@dor.georgia.gov. Complete the form to email your questions or feedback Select the most appropriate subject from the drop down list and use the free form box to submit your comments. Information for reaching the Commissioners Office and more information on the Department of Revenue.

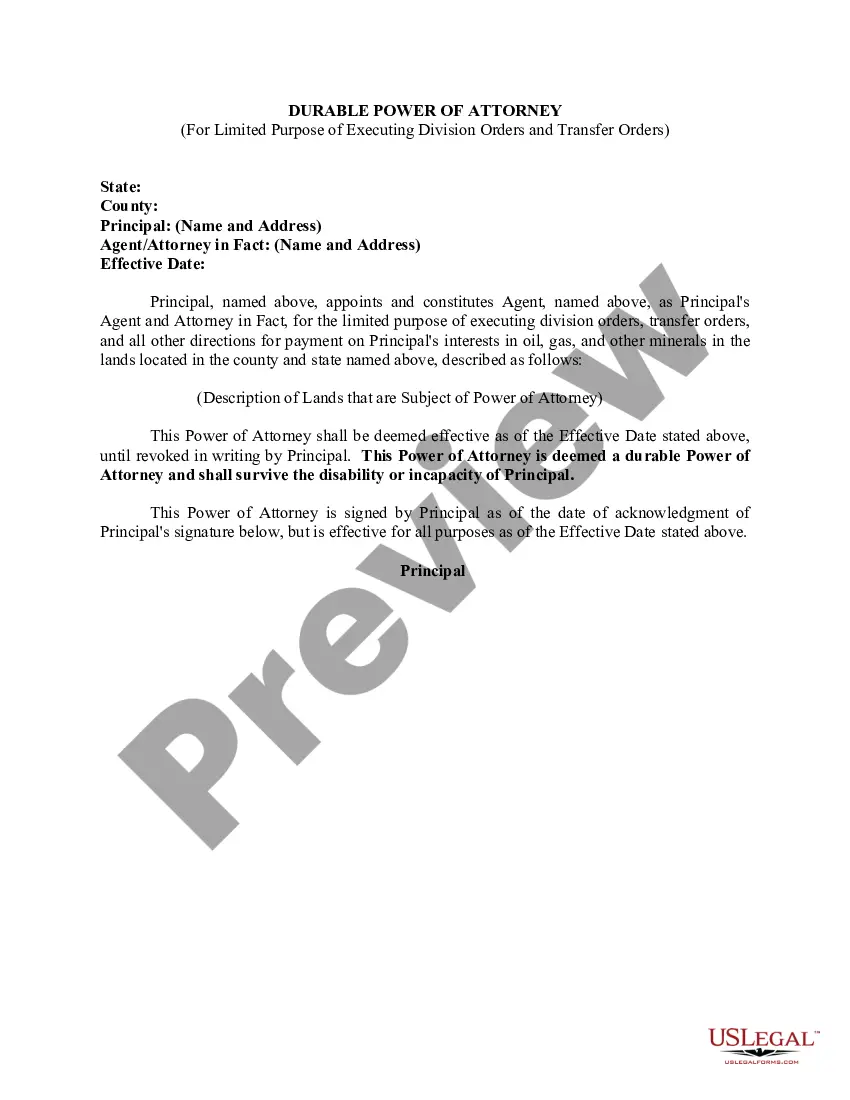

A private letter ruling, or PLR, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's represented set of facts. A PLR is issued in response to a written request submitted by a taxpayer. A PLR may not be relied on as precedent by other taxpayers or by IRS personnel.

How do I get a Tax Clearance Letter? Login to the Georgia Tax Center (GTC) Under "I Want To...", click on "See more links ..." Click on Request Tax Clearance Letter. Click "Submit"

Who was eligible for the Georgia tax refund checks? Georgia workers who paid state income tax in 2021 and 2022 will be eligible. Taxpayers must have filed by the deadline of April 18 (the same deadline as federal Tax Day) to ensure they would get the newest payment.

The Georgia Tax Center (GTC) is your one-stop shop for electronic filing and paying taxes. You can file and pay the following taxes and fees: Sales and use tax. International fuel tax. Withholding income tax.

Most commonly, states issue clearance certificates, demonstrating that an individual is compliant with all taxes and other obligations as of the date of the certificate. Those seeking clearance certificates will have to request them from state authorities, usually the state's Department of Revenue.