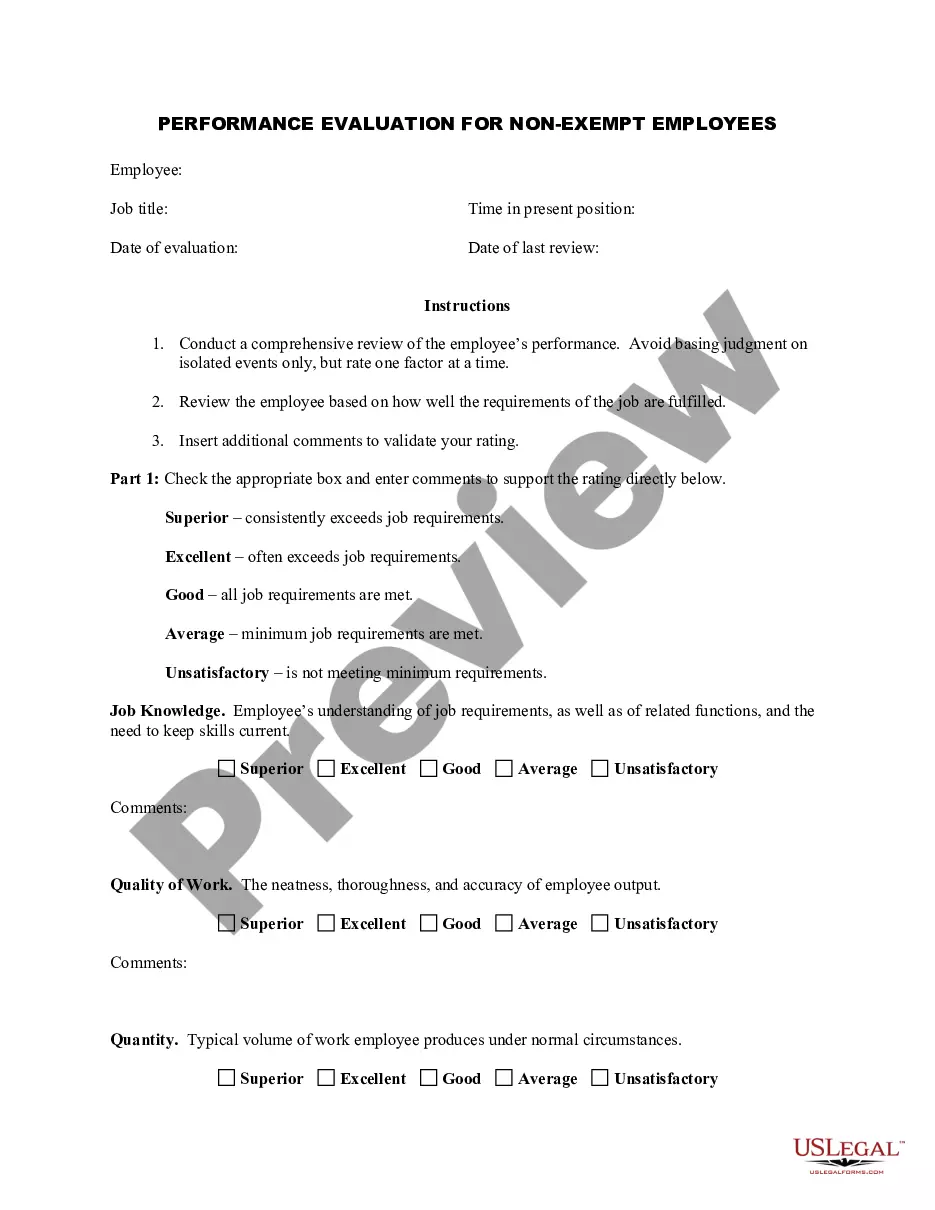

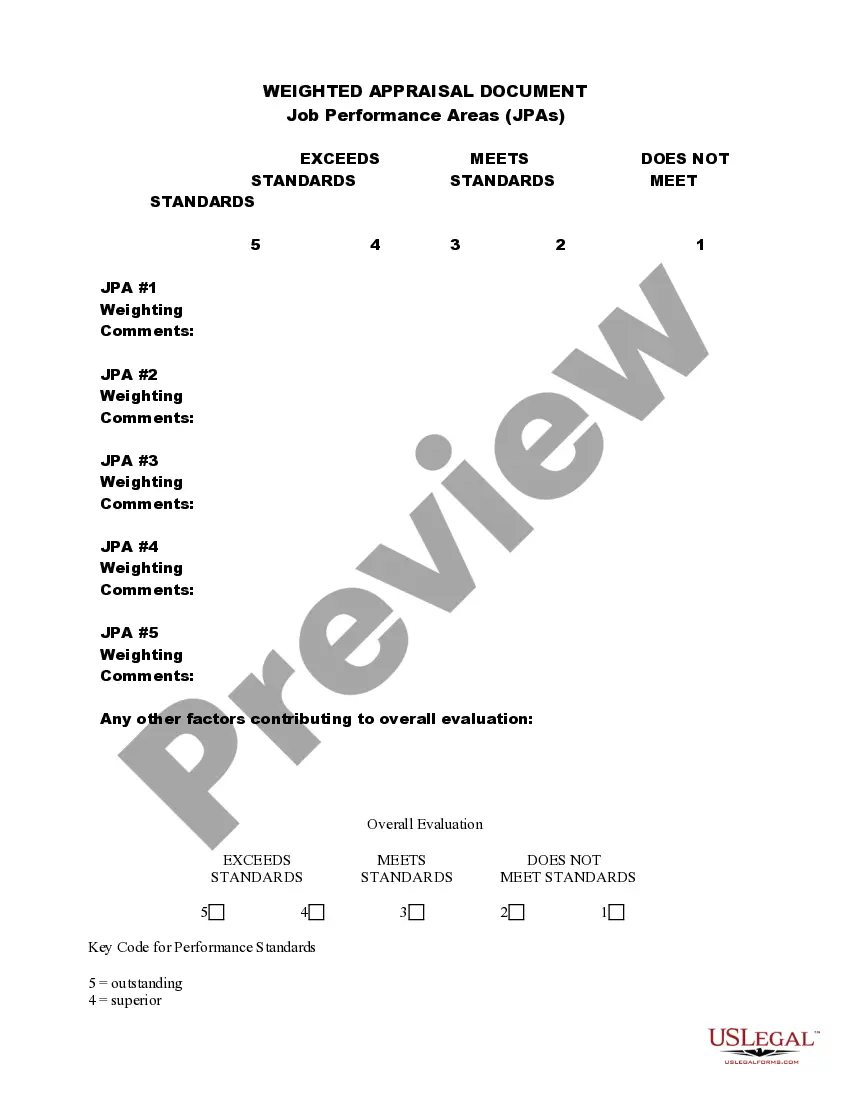

Georgia Employee Evaluation Form for Sole Trader

Description

How to fill out Employee Evaluation Form For Sole Trader?

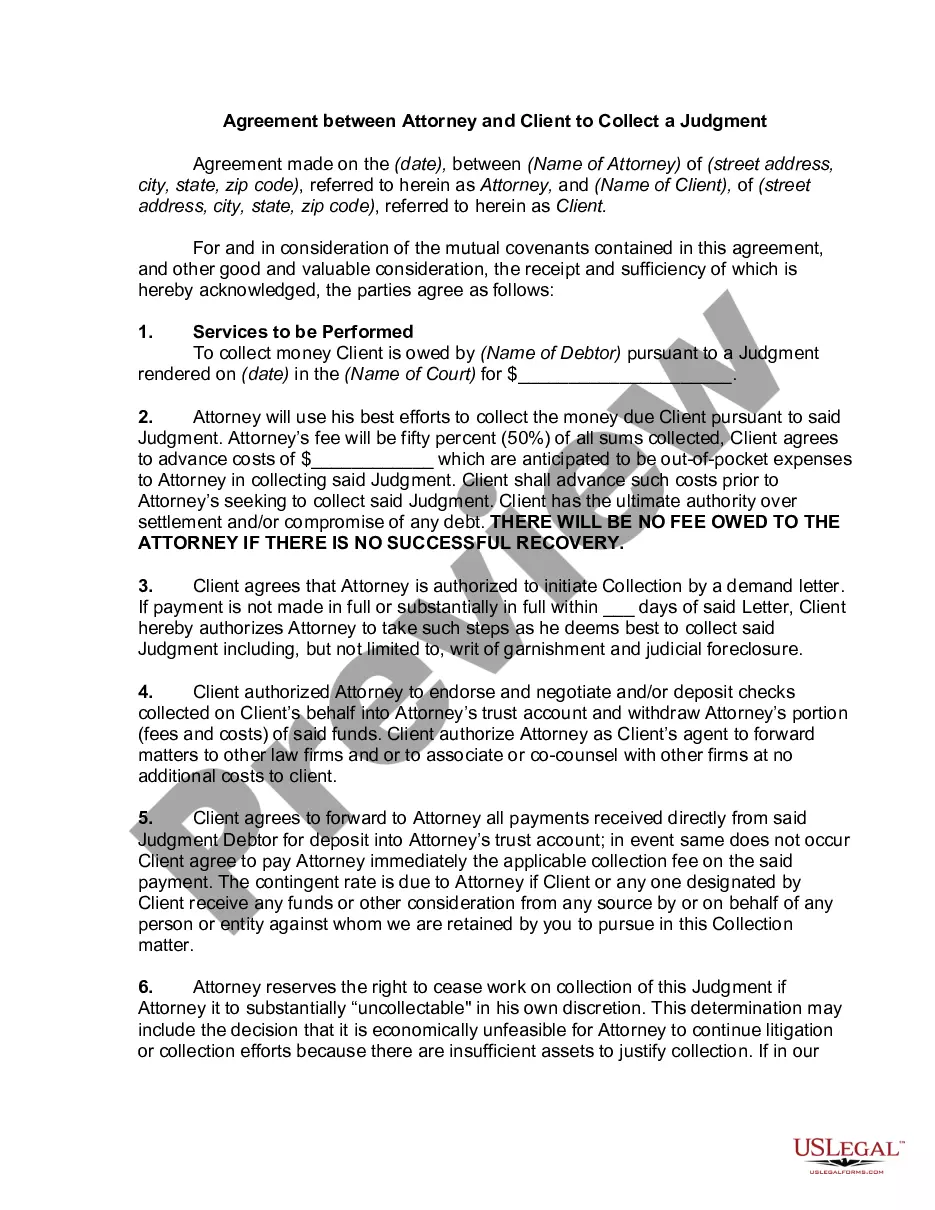

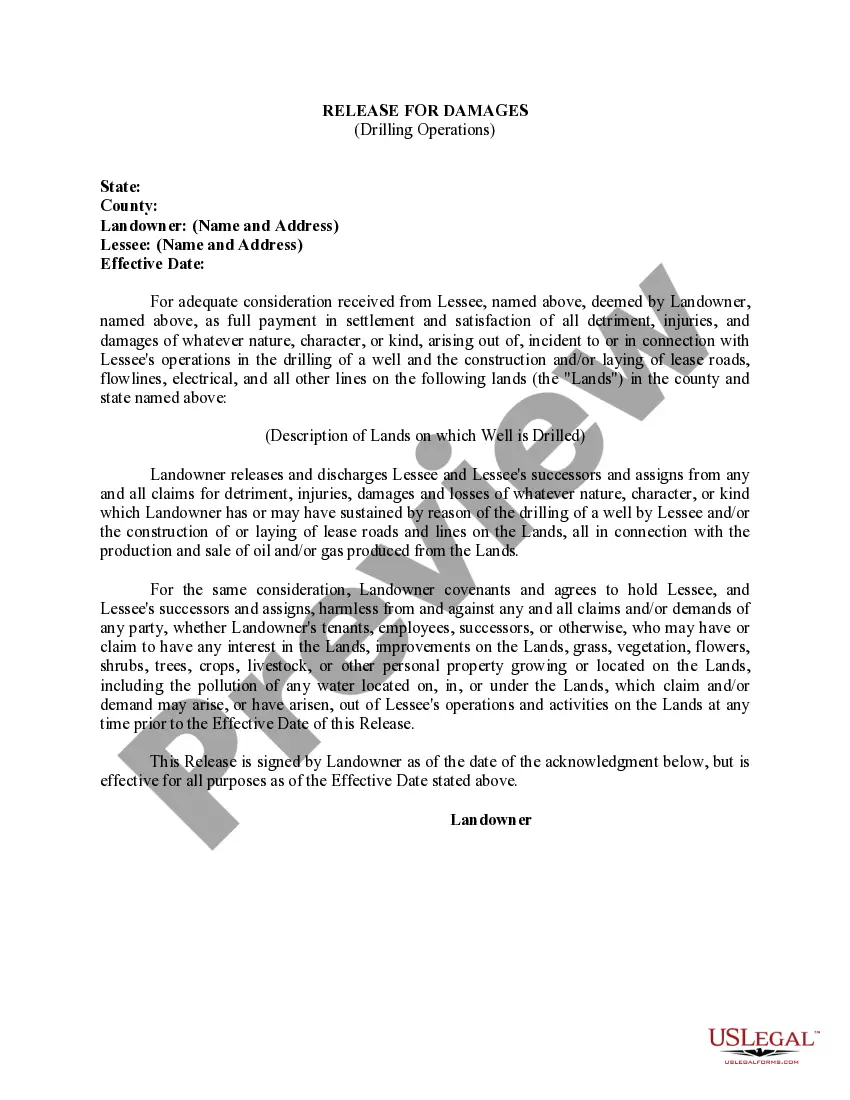

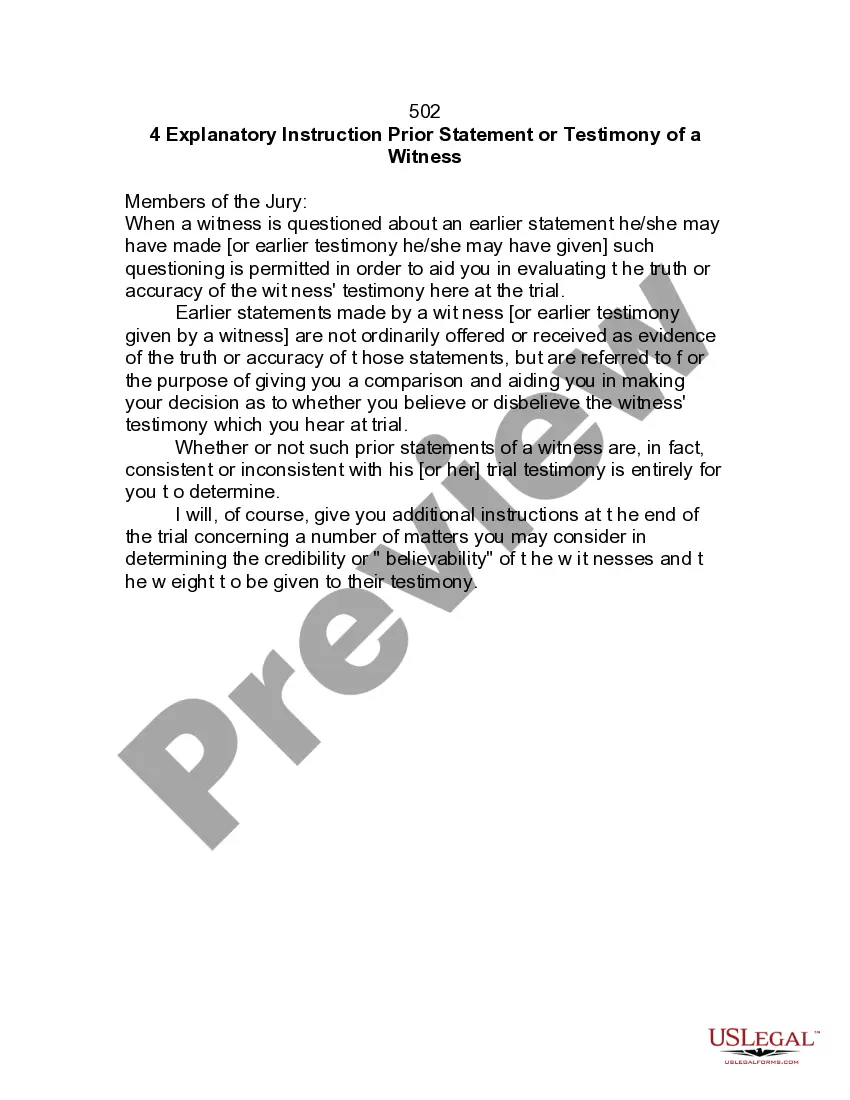

If you wish to sum up, obtain, or generate certified documents templates, utilize US Legal Forms, the largest collection of certified forms, accessible online.

Utilize the site's straightforward and convenient search feature to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search area at the top of the page to find alternative versions of your legal document template.

Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and provide your details to register for an account.

- Use US Legal Forms to find the Georgia Employee Performance Review Form for Sole Proprietor in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Georgia Employee Performance Review Form for Sole Proprietor.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for your correct city/state.

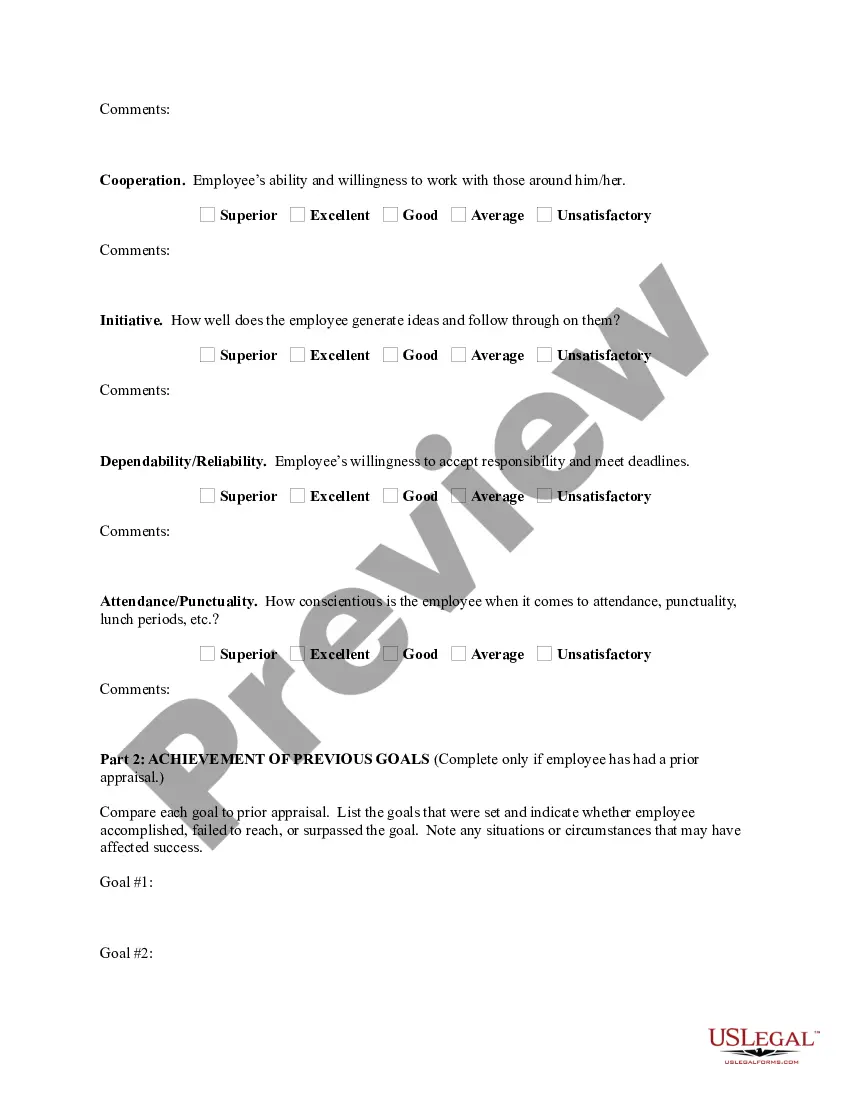

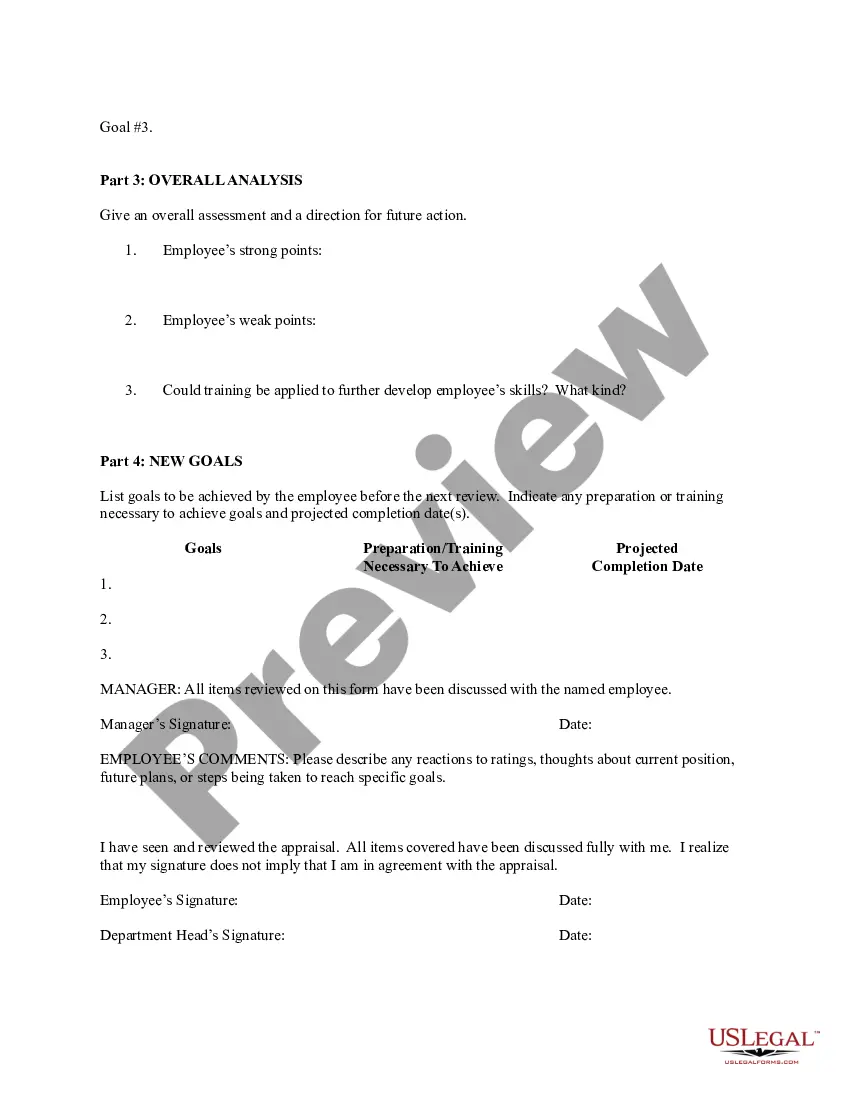

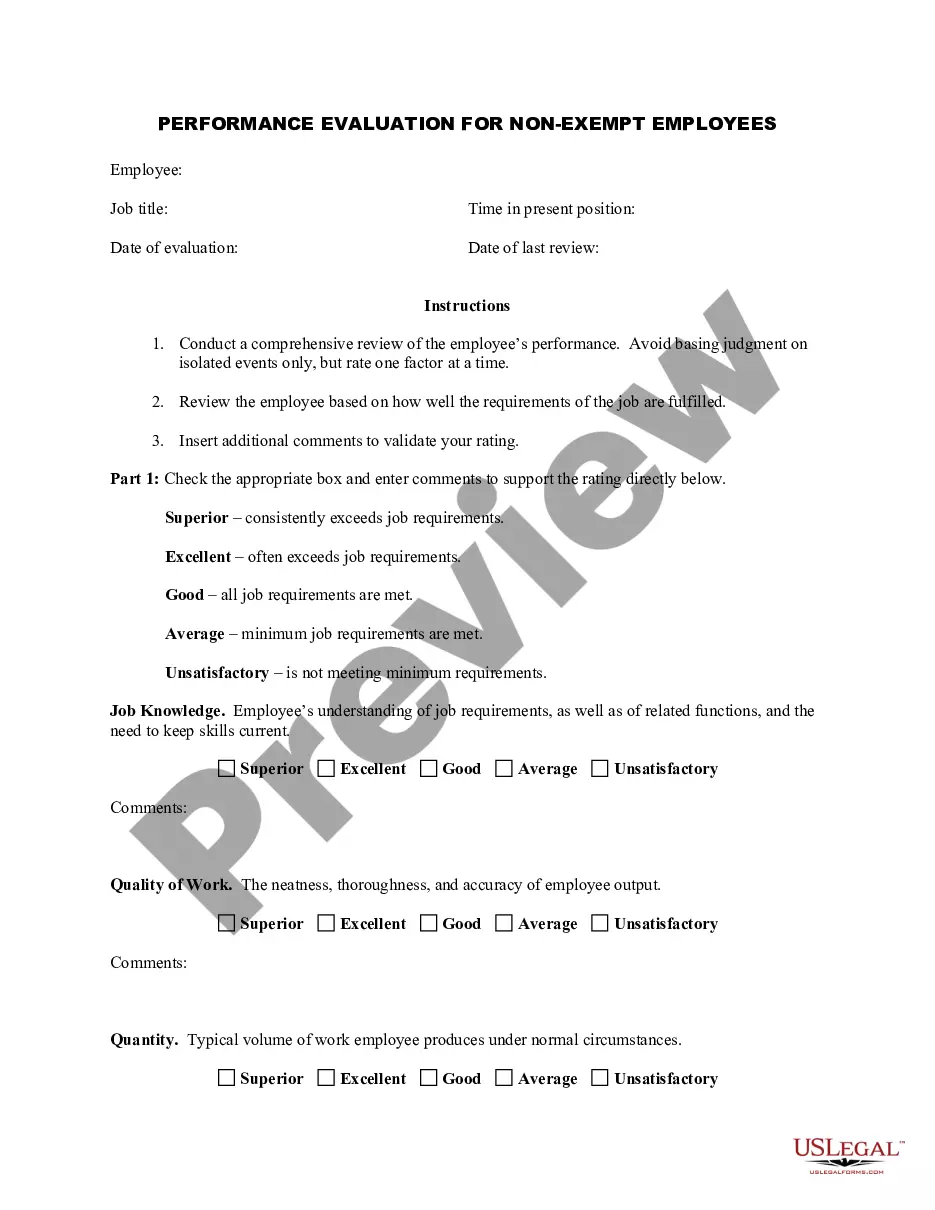

- Step 2. Use the Preview option to review the form's details. Make sure to check the summary.

Form popularity

FAQ

The self-employment tax in Georgia mirrors the federal self-employment tax rate, which is currently 15.3%. This tax covers Social Security and Medicare, applicable to net earnings from self-employment. It is important for sole traders to account for this tax when filing their annual income tax returns. Using the Georgia Employee Evaluation Form for Sole Trader can help you track income and expenses, making tax calculation easier.

500 Individual Income Tax Return.

You are required to file a Georgia Income Tax Return Form 700 if your business is required to file a Federal Income Tax Form 1065 and your business: Owns property or does business in Georgia. Has income from Georgia sources; or. Has members domiciled in Georgia.

Application for Extension of Time for Filing State Income Tax Returns.

Make your checks or money order payable to the Georgia Department of Revenue. Fill out your check or money order correctly. Verify that the written and numerical amounts match, include taxpayer name(s), address, account #/SSN, and tax year. Cut the payment voucher along the dotted lines.

This form may be used to record the weekly examination of Lifting Equipment used on construction sites, as set out in the Safety, Health and Welfare at Work (General Application) Regulations, 2007. This form was produced by the HSA to facilitate the recording of the weekly examination as per these regulations.

Exemptions. The state of Georgia has personal exemptions to lower your tax bill further. The exemption is $2,700 for single filers, heads of households or qualifying widowers, $3,700 for married filing jointly and separately, and $3,000 per qualifying dependent.

All corporations that own property or do business in Georgia, or that have income from Georgia sources are required to file a Georgia income tax return Form 600.

Every resident and nonresident fiduciary having income from sources within Georgia or managing funds or property for the benefit of a resident of this state is required to file a Georgia income tax return on Form 501 (see our website for information regarding the U.S. Supreme Court Kaestner Decision).

Obtain Business Licenses and PermitsThere isn't a requirement in Georgia for sole proprietors to acquire a general business license, but depending on the nature of your business you may need other licenses and/or permits to operate in a compliant fashion.