Georgia Service Bureau Form

Description

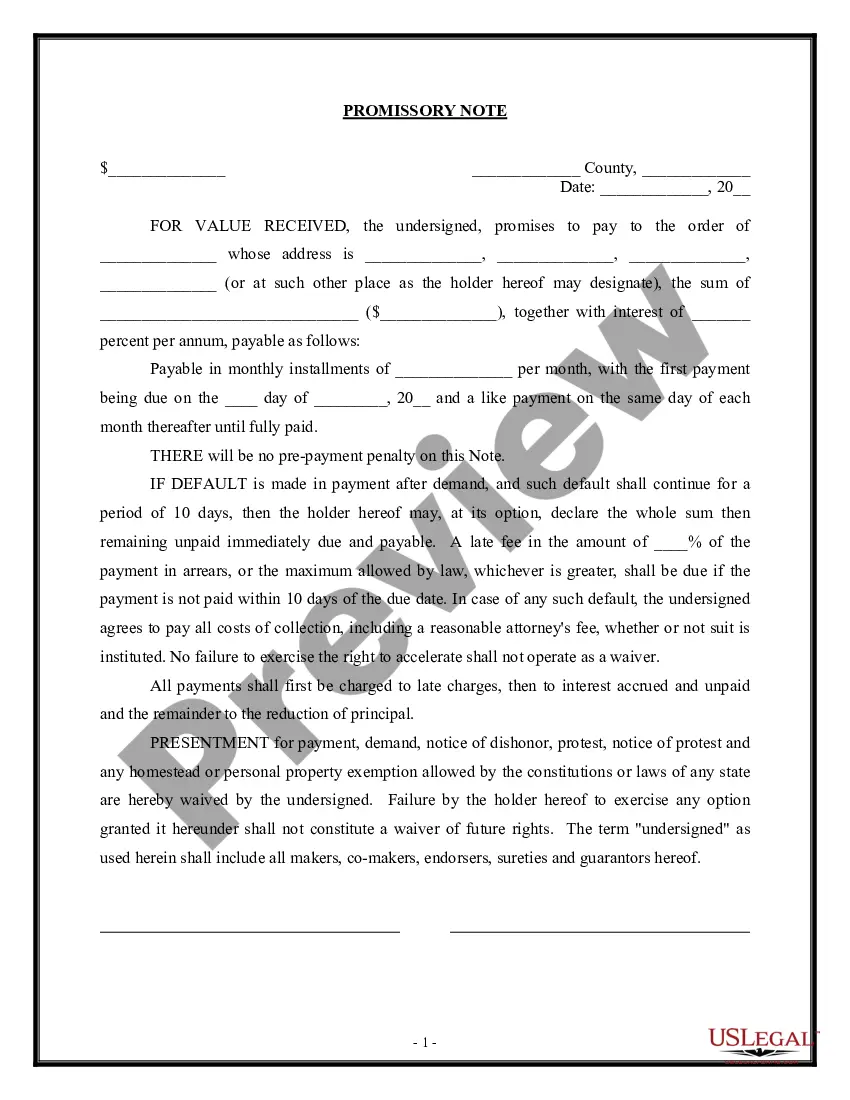

How to fill out Service Bureau Form?

US Legal Forms - one of the largest collections of authentic forms in the country - provides a diverse selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the Georgia Service Bureau Form in moments.

If you already possess a membership, Log In and download the Georgia Service Bureau Form in the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms within the My documents section of your account.

- Ensure you have selected the correct form for your region/area.

- Click on the Review button to check the form's details.

- Read the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Acquire now button.

- Then, choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

You Can Owe Georgia State Income Tax on Florida Wages If you live in Florida and work in Georgia, you'll usually have Georgia tax withheld from your paycheck and file a Georgia tax return as well as a federal tax return at the end of the year. You won't be taxed by Florida, since that state doesn't tax anyone's income.

Nonresidents, who work in Georgia or receive income from Georgia sources and are required to file a Federal income tax return, are required to file a Georgia income tax return.

A retirement exclusion is allowed provided the taxpayer is 62 years of age or older, or the taxpayer is totally and permanently disabled. Retirement income includes items such as: interest, dividends, net rentals, capital gains, royalties, pensions, annuities, and the first $4000.00 of earned income.

Submit the completed Articles of Organization, transmittal, form, and $110 filing fee to the Secretary of State's Corporations Division.

Can I electronically file a return if I am claiming IND-CR credits, taxes paid to another state or business pass through credits (BEST)? Yes, Georgia will accept all electronic returns with credits. You do not need to mail in any forms unless they are requested by the Department.

If one spouse is a resident and one is a part-year resident or nonresident, enter 3 in the residency status box and complete Form 500, Schedule 3 to calculate Georgia taxable income. Part-year Residents.

If you are a legal resident of another state, you are not required to file a Georgia income tax return if: Your only activity for financial gain or profit in Georgia consists of performing services in Georgia for an employer as an employee.

You do not have to register your business with the state of Georgia unless you are planning to incorporate, become a specific legal entity or if you plan to do business with the state, in which case you will need to become a registered vendor through the Department of Administrative Services.

Create & File RegistrationVisit the Secretary of State's online services page.Create a user account.Select create or register a business.Fill out the required information about your business entity (listed above).Pay the $100 filing fee by approved credit card: Visa, MasterCard, American Express, or Discover.

This form may be used to record the weekly examination of Lifting Equipment used on construction sites, as set out in the Safety, Health and Welfare at Work (General Application) Regulations, 2007. This form was produced by the HSA to facilitate the recording of the weekly examination as per these regulations.