Georgia Grant of Conservation Right and Easement

Description

How to fill out Grant Of Conservation Right And Easement?

You may commit hrs online trying to find the legal record design that fits the federal and state specifications you require. US Legal Forms supplies a huge number of legal forms that are reviewed by specialists. It is simple to acquire or produce the Georgia Grant of Conservation Right and Easement from my service.

If you currently have a US Legal Forms profile, you can log in and then click the Download switch. Afterward, you can total, modify, produce, or sign the Georgia Grant of Conservation Right and Easement. Each and every legal record design you purchase is your own forever. To obtain one more copy for any bought kind, check out the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms website the very first time, stick to the basic directions under:

- Initial, be sure that you have chosen the best record design for that region/town of your choosing. See the kind information to make sure you have selected the proper kind. If available, use the Review switch to appear from the record design too.

- In order to locate one more variation of your kind, use the Look for industry to get the design that meets your requirements and specifications.

- Upon having located the design you would like, simply click Get now to continue.

- Pick the prices prepare you would like, type your credentials, and register for a free account on US Legal Forms.

- Comprehensive the purchase. You can use your charge card or PayPal profile to cover the legal kind.

- Pick the file format of your record and acquire it to your system.

- Make adjustments to your record if needed. You may total, modify and sign and produce Georgia Grant of Conservation Right and Easement.

Download and produce a huge number of record templates while using US Legal Forms web site, that offers the greatest selection of legal forms. Use professional and status-distinct templates to tackle your business or personal requirements.

Form popularity

FAQ

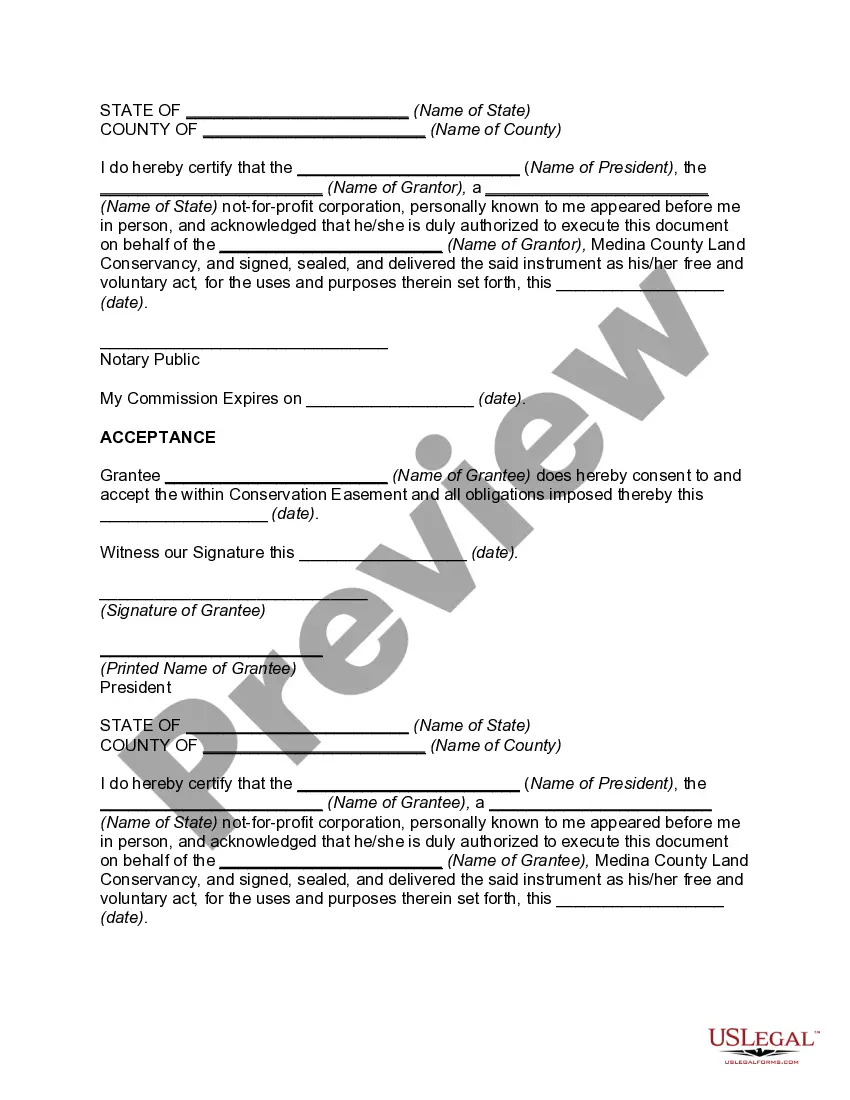

In order to be recordable, an easement deed must be signed by the grantor and must contain two witnesses, one of whom must be the notary with his seal attached. If one of the witnesses is not a notary, then there must be an acknowledgment by a notary attached to the deed ( 44-2-21 and 44-2-14).

All property in Georgia is taxed at an assessment rate of 40% of its full market value. Exemptions, such as a homestead exemption, reduce the taxable value of your property.

Conservation use property is assessed at 40% of current use value which gives a reduced assessment to the owner of this type property when compared to other property assessed at 40% of fair market value.

Generally, a minimum of 10 acres is required for enrollment, but some counties have recently increased the minimum acreage to 25 acres. No more than 2,000 acres can be enrolled in CUVA by any one non-industrial, private landowner. Foreign citizens and foreign corporations are not eligible to enroll.

The law does allow the original covenant holder to deed family members which are related to the original covenant holder, at least to the fourth degree of civil reckoning, to build a home and live on the land (up to 5 acres) currently enrolled in a CUVA covenant without penalty during the life of the original covenant.

Preferential Agricultural Property This means that this type of property is assessed at 30% of fair market value rather than 40%. Property that qualifies for this special assessment must be maintained in its current use for a period of 10 years.