North Carolina Receipt for Payment of Account

Description

How to fill out Receipt For Payment Of Account?

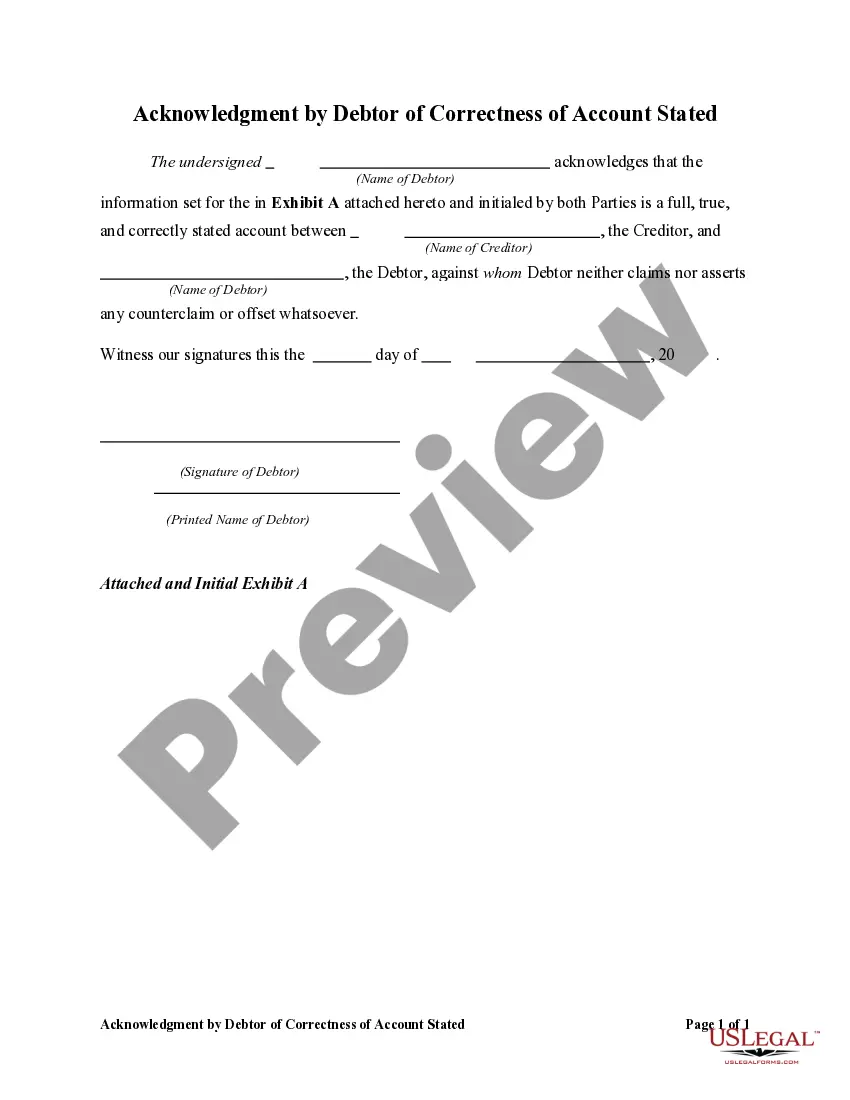

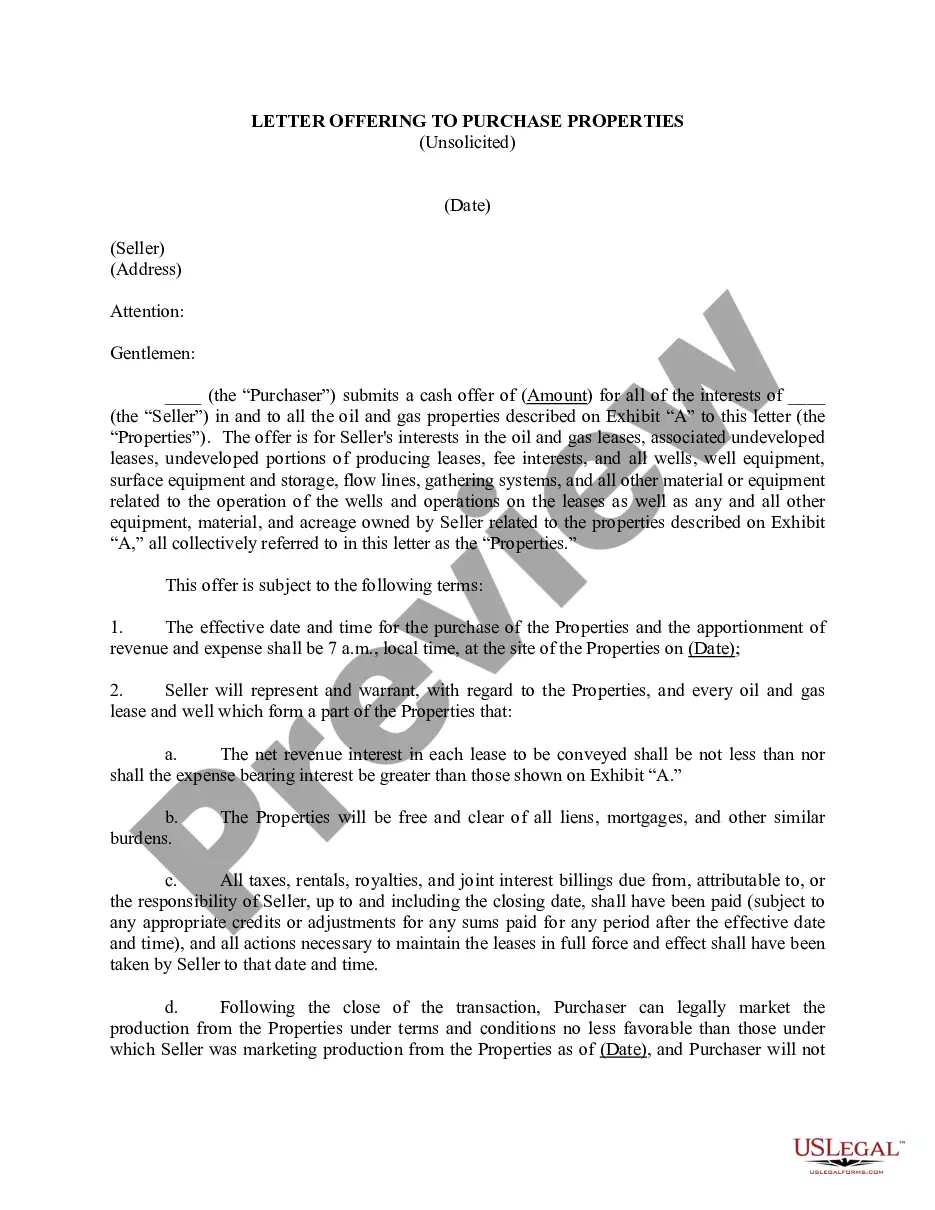

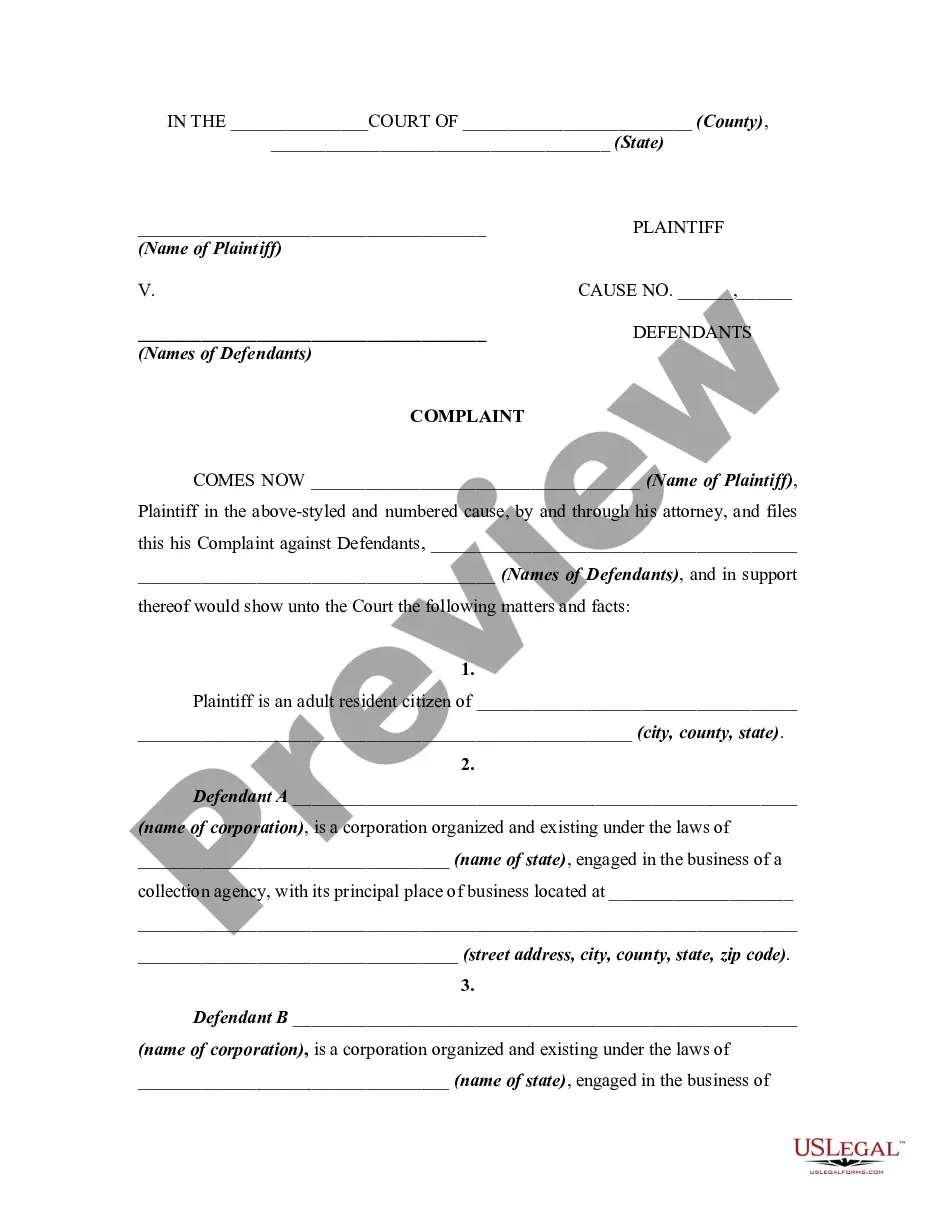

Choosing the right legal record template might be a have difficulties. Obviously, there are a variety of layouts available on the net, but how do you obtain the legal develop you need? Make use of the US Legal Forms internet site. The service delivers 1000s of layouts, for example the North Carolina Receipt for Payment of Account, that you can use for organization and personal demands. All of the kinds are examined by specialists and meet up with state and federal requirements.

In case you are currently authorized, log in for your accounts and click the Obtain key to get the North Carolina Receipt for Payment of Account. Use your accounts to appear with the legal kinds you may have ordered earlier. Visit the My Forms tab of the accounts and obtain an additional backup from the record you need.

In case you are a brand new consumer of US Legal Forms, listed below are basic guidelines that you should comply with:

- Initial, ensure you have selected the right develop for the metropolis/region. You can look through the form while using Review key and look at the form description to make certain it will be the best for you.

- In the event the develop does not meet up with your expectations, take advantage of the Seach discipline to obtain the proper develop.

- Once you are certain that the form is suitable, select the Buy now key to get the develop.

- Select the costs strategy you desire and type in the essential information. Make your accounts and pay money for an order using your PayPal accounts or charge card.

- Opt for the submit file format and down load the legal record template for your system.

- Comprehensive, change and print out and signal the acquired North Carolina Receipt for Payment of Account.

US Legal Forms is the biggest catalogue of legal kinds that you can find different record layouts. Make use of the company to down load expertly-produced files that comply with express requirements.

Form popularity

FAQ

Taxpayers may pay their tax by using a credit/debit card (Visa/MasterCard) or bank draft via our online payment system, or by contacting an agent at 1-877-252-3252.

If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640. When, Where, and How to File Your North Carolina Return - NCDOR ncdor.gov ? taxes-forms ? when-where-and-... ncdor.gov ? taxes-forms ? when-where-and-...

You can also pay your estimated tax online. For details, visit .ncdor.gov and search for "online file and pay." For calendar year filers, estimated payments are due April 15, June 15, and September 15 of the taxable year and January 15 of the following year. Estimated Income Tax - NCDOR NCDOR (.gov) ? taxes-forms ? estimated-inco... NCDOR (.gov) ? taxes-forms ? estimated-inco...

If there is a debit block on your account: Provide your financial institution with the NCDOR Company ID 9044030460.

I was not aware that I owe the Department. Who can I call to get more information? You can call toll-free at 1-877-252-3052 to get information about your balance with the Department. The Refund Process - NCDOR ncdor.gov ? refund ncdor.gov ? refund

The NCDOR website offers online bank draft and credit/debit card payment options. ACH Credit and ACH Debit batch methods are popular payment options for many businesses and service providers. Some eFile providers also offer bank draft payments for certain tax types using eFile tax prep software products. Payment Options for Businesses - NCDOR NCDOR (.gov) ? file-pay ? ebusiness-center NCDOR (.gov) ? file-pay ? ebusiness-center

Card payments cannot be canceled once submitted. If you make a card payment and later decide to reverse the transaction, you may be subject to penalties, interest or other fees imposed by the Department of Revenue for nonpayment or late payment of tax.

The e-Business Center allows you to view your filing and paying history and grant a representative access to your account. To use the e-Business Center you must register your business with NCDOR and create an NCID user ID and password.