Georgia Receipt for Balance of Account

Description

How to fill out Receipt For Balance Of Account?

US Legal Forms - one of the largest repositories of legal templates in the country - offers a vast selection of legal document samples that you can download or print.

By using the website, you'll find thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can quickly access the latest forms such as the Georgia Receipt for Balance of Account.

If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose the payment plan you prefer and provide your details to create an account.

- If you already have a subscription, Log In to download the Georgia Receipt for Balance of Account from your US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If this is your first time using US Legal Forms, follow these simple steps to get started.

- Ensure you have selected the correct form for your city/state.

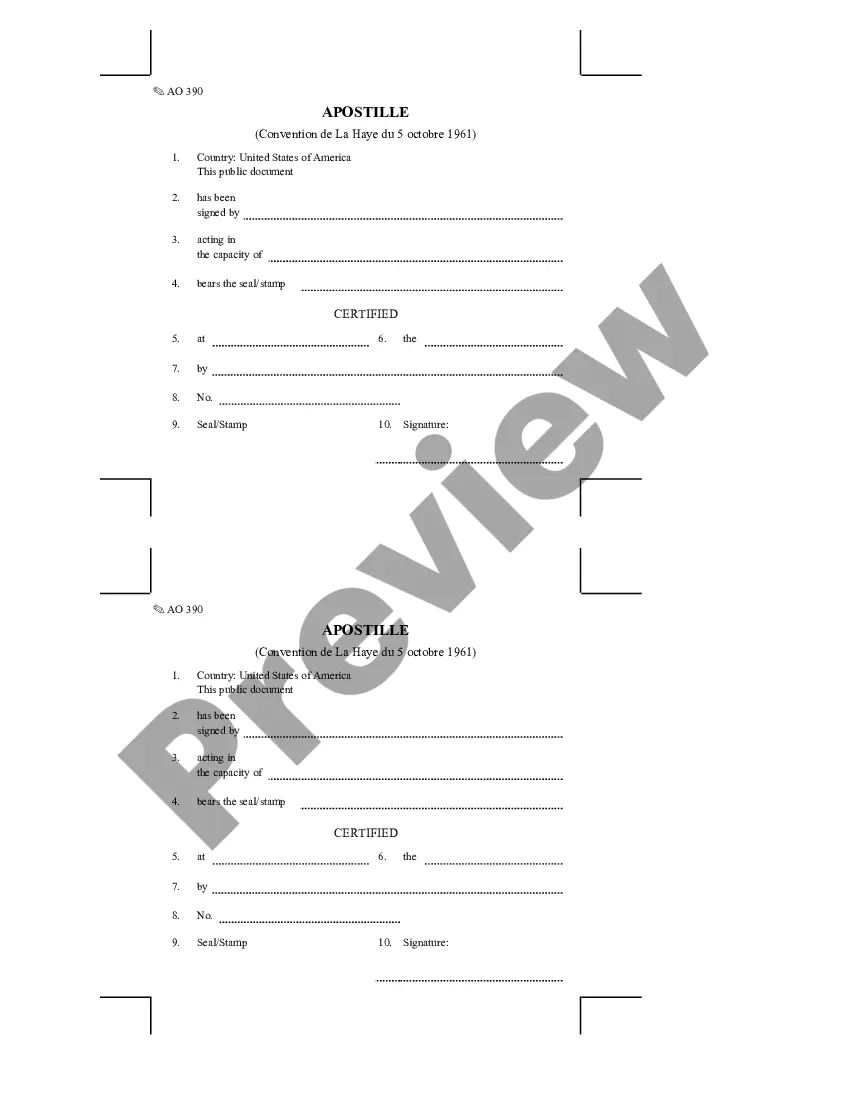

- Click the Preview button to review the form's content. Check the form description to confirm that you have chosen the right form.

Form popularity

FAQ

A tax clearance certificate is a document issued by a state government agency, usually the Department of Revenue. It certifies that a business or individual has met their tax obligations as of a certain date.

ATLANTA You may have received a letter from the Georgia Department of Revenue asking you to verify your ID this tax season. This is because tax fraud is on the rise and the Georgia Department of Revenue is implementing new security enhancements to help protect taxpayers.

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

Criminal Debt Payments such as Restitution, Fines and Special Assessments can be paid through Pay.gov. CVB fines must be paid through CVB and can be reached by calling (800) 827-2982 or clicking the CVB tab.

Deposit funds to your Georgia inmate's trust fund account over the phone by calling JPAY at 1-800-574-5729. This company charges a fee for sending the funds....You can send funds to an inmate by:Walk In.Internet.Mail.Phone.

Restitution payments will be submitted to the Georgia Department of Corrections, the same as other fees, and subsequently distributed to the victim(s). Parolees are required to pay a minimum of $30.00 per month.

The mission of the Department of Revenue is to administer the tax laws of the State of Georgia fairly and efficiently in order to promote public confidence and compliance, while providing excellent customer service. The Georgia Department of Revenue, created in 1938, is the primary tax-collecting agency.

The Statute of Limitations (SOL) The DOR has five years from the date of assessment to file a tax lien if the assessment was issued on or after February 21, 2018. Once the DOR files a tax lien, they have ten years from that date to collect the unpaid taxes.

When people talk about income tax enforcement, they usually think of the Internal Revenue Service (IRS) that collects tax payments on behalf of the federal government. However, residents of Georgia not only have to file their taxes with the IRS but also with the Georgia Department of Revenue.

Where do I go to check the balance of my fine, restitution assessment? The U. S. Attorney Financial Litigation Unit maintains the payment history of fines and restitution made to this Court. Please call 912-652-4422 or 912-201-2598 for specific details.