Georgia Sales Receipt

Description

How to fill out Sales Receipt?

Are you currently in a position that requires documents for possibly business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms provides a wide variety of form templates, such as the Georgia Sales Receipt, which can be tailored to comply with state and federal requirements.

Once you find the right form, click Get it now.

Choose the pricing plan you want, fill out the necessary information to create your account, and purchase your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Georgia Sales Receipt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

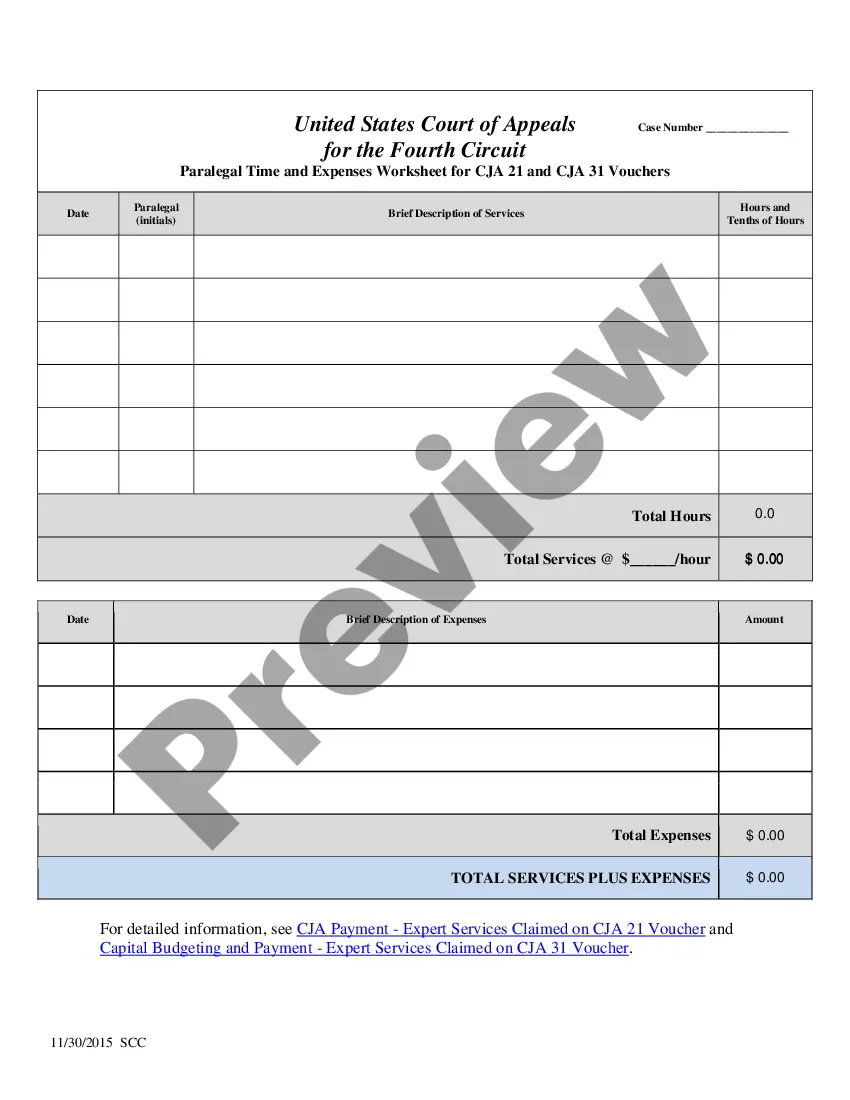

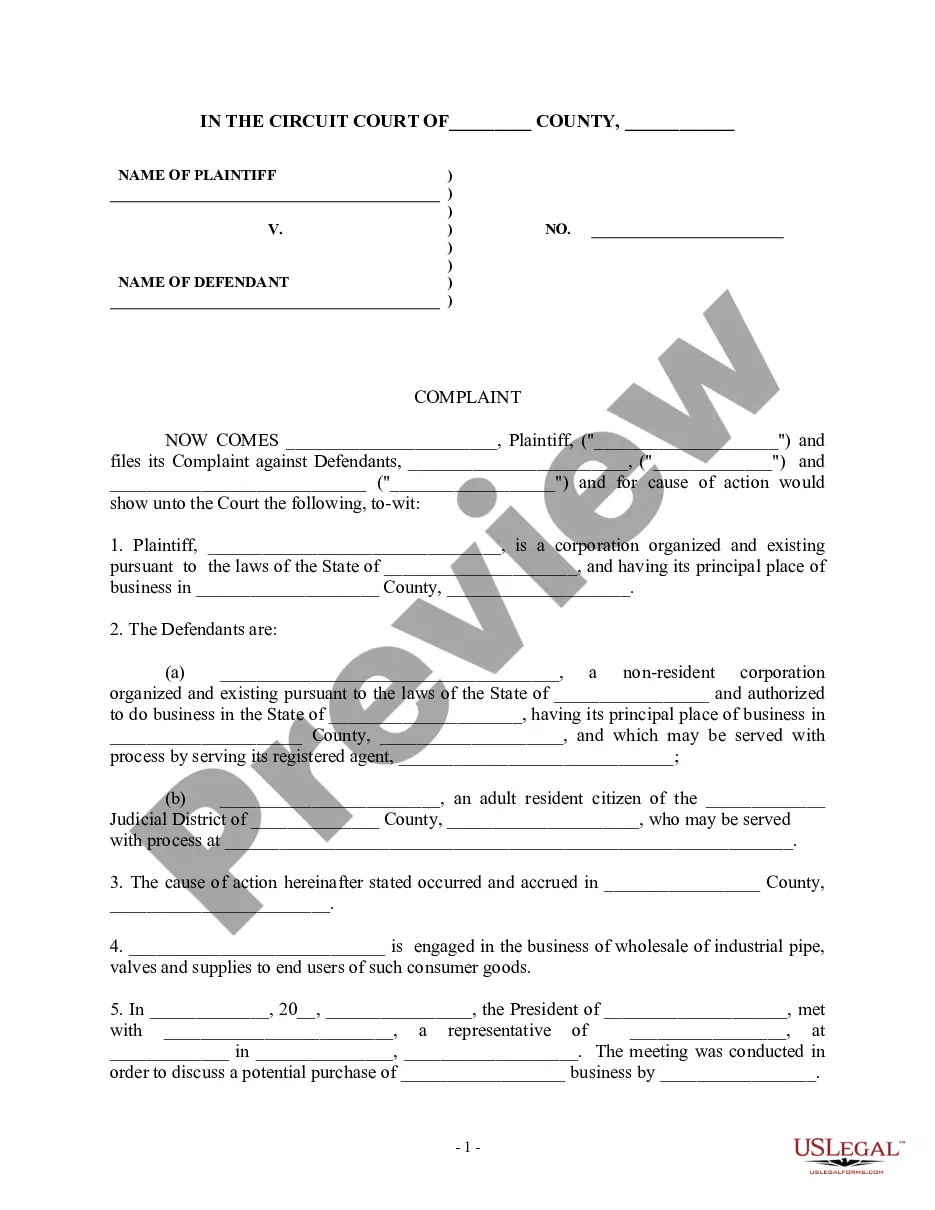

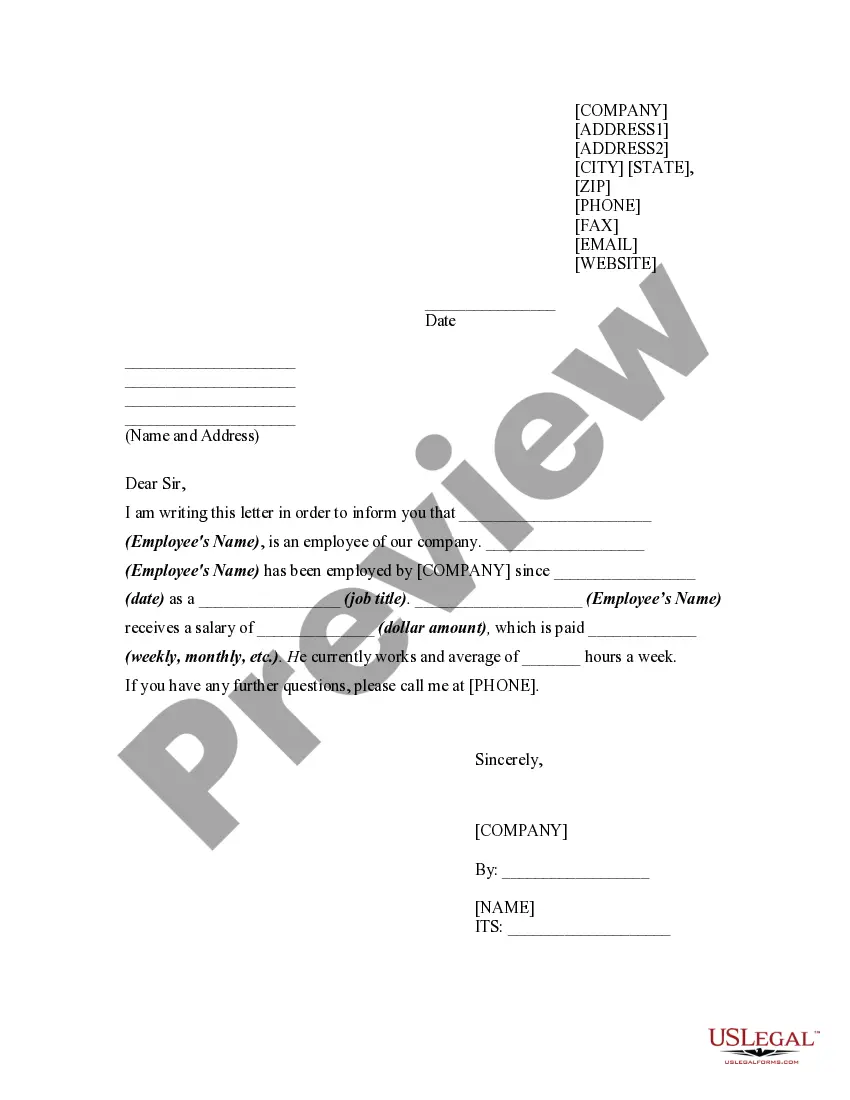

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find a form that meets your needs.

Form popularity

FAQ

To acquire a Georgia sales tax ID number, you will need to register your business with the Georgia Department of Revenue. You can complete this process online or by contacting their office directly to obtain the necessary forms. Once registered, this ID will help you comply with sales tax regulations, which is crucial when generating a Georgia Sales Receipt for tax purposes.

No, a sales tax ID and an Employer Identification Number (EIN) are not the same in Georgia. The sales tax ID is specifically for businesses to collect and remit sales tax, while an EIN is used for tax reporting and identification purposes. It's important to apply for both if you plan to operate a business, especially when documenting sales with a Georgia Sales Receipt.

Yes, a handwritten bill of sale is legal in Georgia as long as it includes essential information regarding the transaction, such as the names of both parties, a description of the goods, and signatures. However, while it may be convenient, using a standardized form may reduce the chance of errors or omissions. Remember, pairing it with a Georgia Sales Receipt ensures you have all documentation in order.

In Georgia, a vehicle bill of sale does not legally require notarization, yet notarizing the document can add an extra layer of authenticity. It's often seen as a good practice to protect both the buyer and seller in disputes. Additionally, having a notarized bill can simplify the vehicle registration process alongside the Georgia Sales Receipt.

A T 7 bill of sale in Georgia serves as a legal document that records the transfer of ownership of goods or property between a buyer and a seller. It is particularly useful when dealing with vehicles and personal property sales, providing both parties with a record of the transaction. This document can be used alongside a Georgia Sales Receipt for tax purposes and maintaining accurate records.

Yes, if you are selling taxable goods or services in Georgia, you need a sales and use tax license. This license allows you to collect sales tax from your customers legally. Applying for this license is straightforward, and once obtained, it will support your operations when issuing Georgia Sales Receipts.

To claim sales tax on your taxes, you need to maintain accurate records of the sales tax you have collected. When filing your tax return, report this amount as a liability rather than an income. Keep in mind that claiming sales tax correctly can impact your financial health, and using tools that help you manage your Georgia Sales Receipt can facilitate this process.

In QuickBooks, you can record sales and use tax by creating a sales receipt or an invoice. When entering the sale, ensure you include the sales tax amount and categorize it correctly under sales tax accounts. This streamlines your accounting process and ensures your Georgia Sales Receipt aligns with your overall financial reporting.

Sales and use tax is not considered an expense for your business. Instead, it is a liability because you collect this tax from customers on behalf of the state. However, when you remit the sales tax collected to the government, it will reduce your liability accounts. This is an important distinction to understand when managing your Georgia Sales Receipt.

To obtain a sales and use tax number in Georgia, visit the Georgia Department of Revenue website and complete the registration form. You will need to provide information about your business and its operations. Once registered, you will receive your tax number, which you can use to prepare and submit sales tax returns. Properly using this number helps you issue valid Georgia Sales Receipts seamlessly.