Georgia Grantor Retained Annuity Trust

Description

How to fill out Grantor Retained Annuity Trust?

If you need to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the largest repository of valid forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents required.

A selection of templates for business and personal applications is categorized by types and jurisdictions, or keywords.

Step 4: Once you have located the required form, click on the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5: Process the payment. You can use a credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the Georgia Grantor Retained Annuity Trust in a few clicks.

- If you are already a US Legal Forms member, Log In to your account and select the download option to obtain the Georgia Grantor Retained Annuity Trust.

- You can also view forms you previously obtained in the My documents section of your account.

- If it’s your first time using US Legal Forms, follow the steps below.

- Step 1: Ensure you have selected the form for the correct city/state.

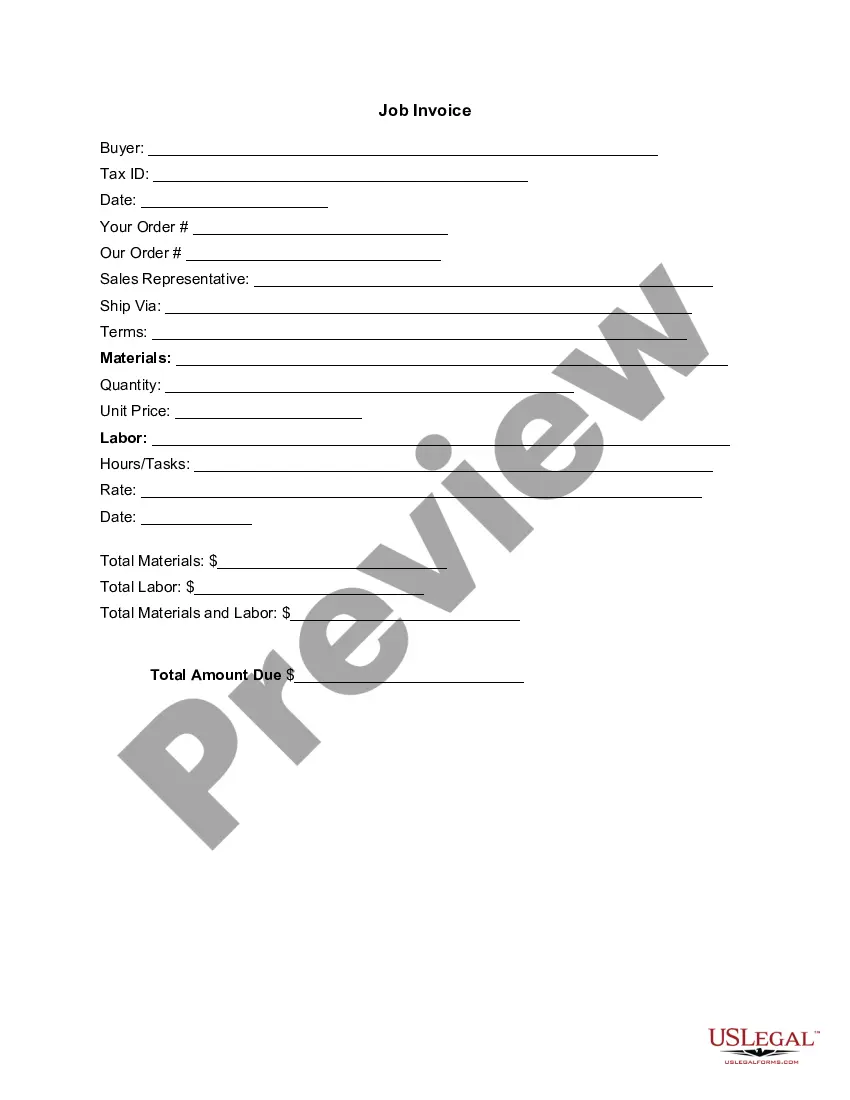

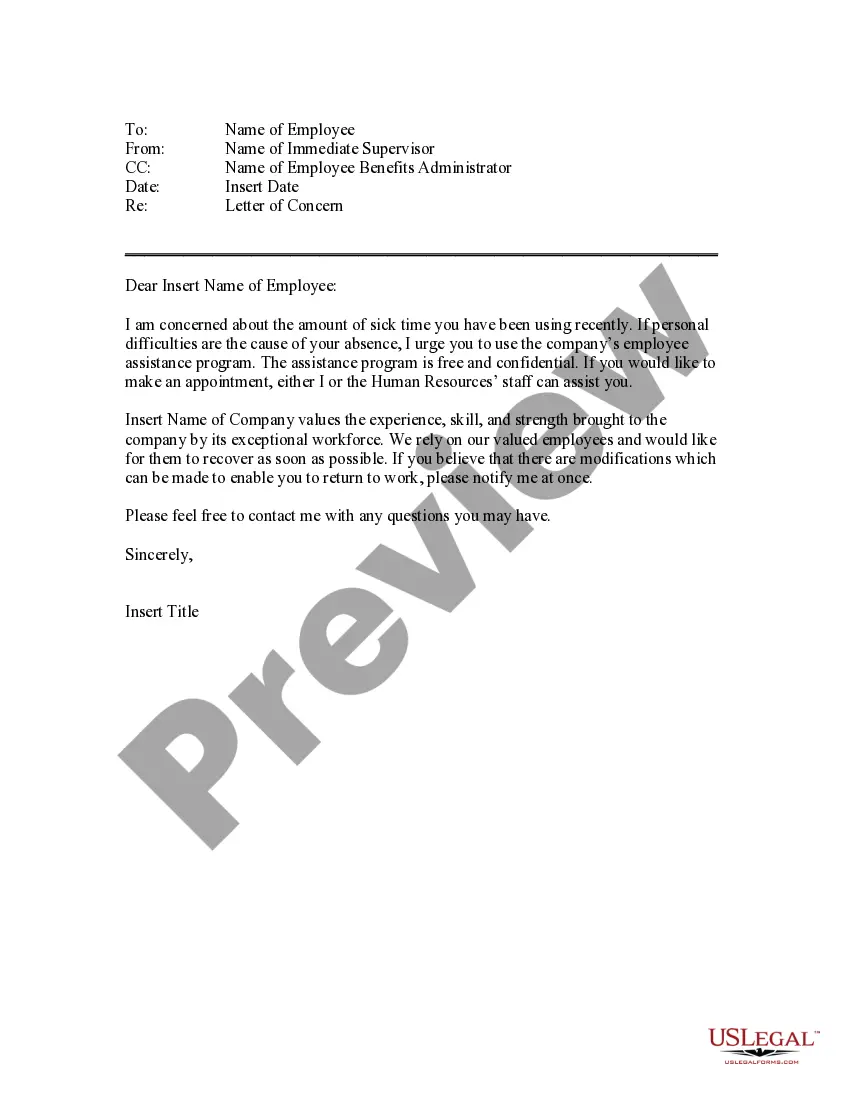

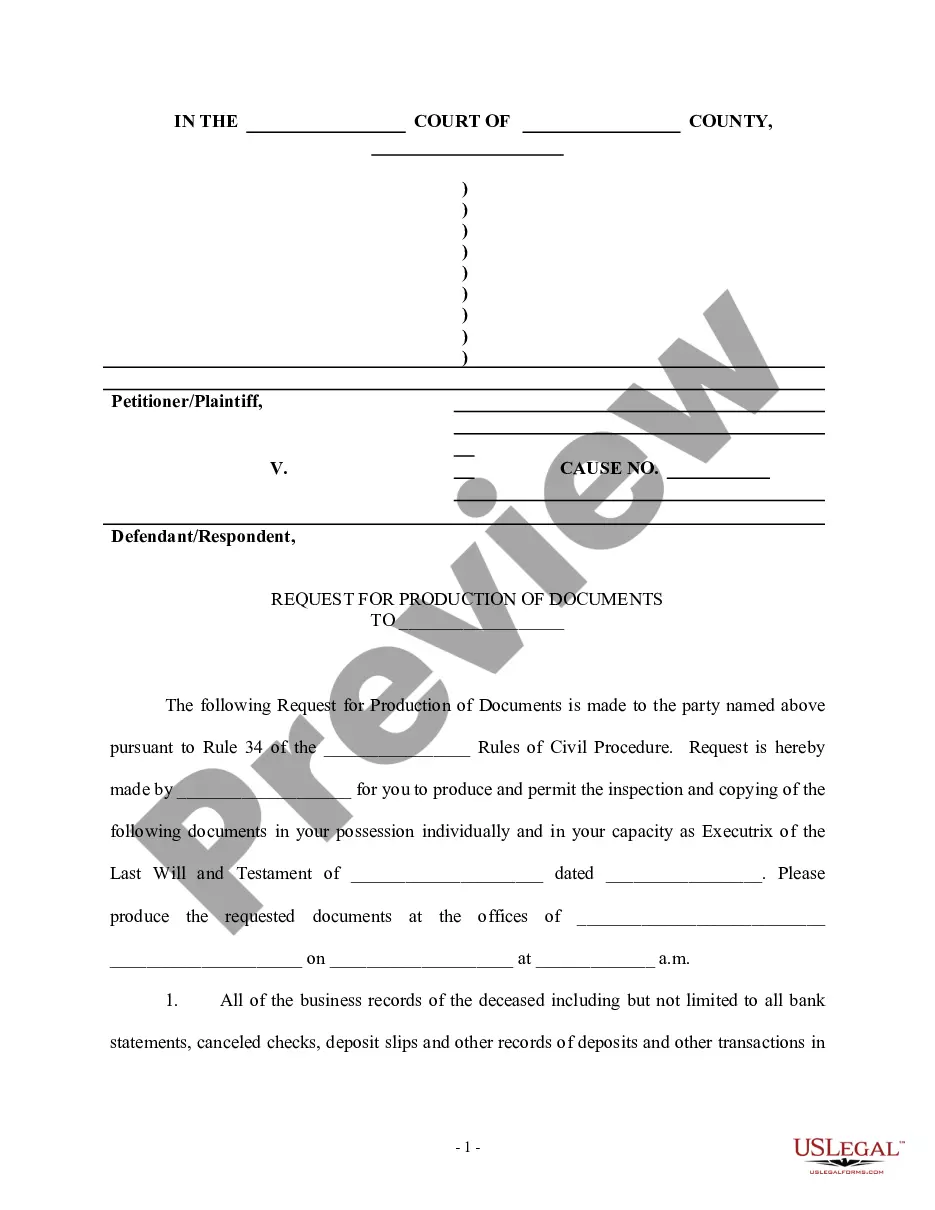

- Step 2: Use the Preview function to review the form’s content. Don’t forget to check the details.

- Step 3: If you are unsatisfied with the form, use the Search box at the top of the screen to find other versions in the legal form format.

Form popularity

FAQ

A Georgia Grantor Retained Annuity Trust (GRAT) allows you to transfer assets to beneficiaries while retaining an annuity payment for a specified period. Essentially, you make a gift to the trust, and you receive fixed annual payments from the trust during its term. When the term ends, the remaining trust assets pass to your beneficiaries without incurring gift tax. This structure helps in reducing the taxable value of your estate.

With respect to income taxes, the grantor is treated as the owner of the assets during the GRAT term and reports all income earned by the GRAT on his individual income tax return. To avoid having to file its own fiduciary income tax return, the GRAT should not apply for a separate taxpayer identification number.

By removing the growth from your estate, you can reduce the overall size of your estate and hopefully avoid or lessen estate taxes in the future. GRATs work best when interest rates are low, which lowers the IRS Section 7520 hurdle rate.

GRATs are taxed in two ways: Any income you earn from the appreciation of your assets in the trust is subject to regular income tax, and any remaining funds/assets that transfer to a beneficiary are subject to gift taxes.

Tax Implications of the GRAT During the term of the GRAT, the Donor will be taxed on all of the income and capital gains earned by the trust, without regard to the amount of the annuity paid to the Donor.

Tax Implications of the GRAT During the term of the GRAT, the Donor will be taxed on all of the income and capital gains earned by the trust, without regard to the amount of the annuity paid to the Donor.

Grantor retained annuity trusts (GRAT) are estate planning instruments in which a grantor locks assets in a trust from which they earn annual income. Upon expiry, the beneficiary receives the assets with minimal or no gift tax liability. GRATS are used by wealthy individuals to minimize tax liabilities.

Tax Implications of the GRAT During the term of the GRAT, the Donor will be taxed on all of the income and capital gains earned by the trust, without regard to the amount of the annuity paid to the Donor.

A GRAT is an irrevocable trust that allows the trust's creator known as the grantor to direct certain assets into a temporary trust and freeze its value, removing additional appreciation from the grantor's estate and giving it to heirs with minimal estate or gift tax liability.

A grantor retained annuity trust (GRAT) is a financial instrument used in estate planning to minimize taxes on large financial gifts to family members. Under these plans, an irrevocable trust is created for a certain term or period of time.