Georgia Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association

Description

How to fill out Notice Of Meeting To Pass On Resolution To Incorporate Non-Profit Association?

Selecting the optimal authorized document format can be quite a challenge. Naturally, there are numerous web templates accessible online, but how can you locate the authorized document you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Georgia Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association, suitable for business and personal needs. All forms are reviewed by professionals and meet state and federal requirements.

If you are already registered, Log In to your account and click the Download button to obtain the Georgia Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association. Use your account to search through the authorized forms you have purchased previously. Visit the My documents section of your account to retrieve another copy of the document you need.

Complete, modify, print, and sign the downloaded Georgia Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association. US Legal Forms is the largest repository of authorized forms where you can find numerous document templates. Utilize the service to obtain professionally crafted documents that comply with state standards.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

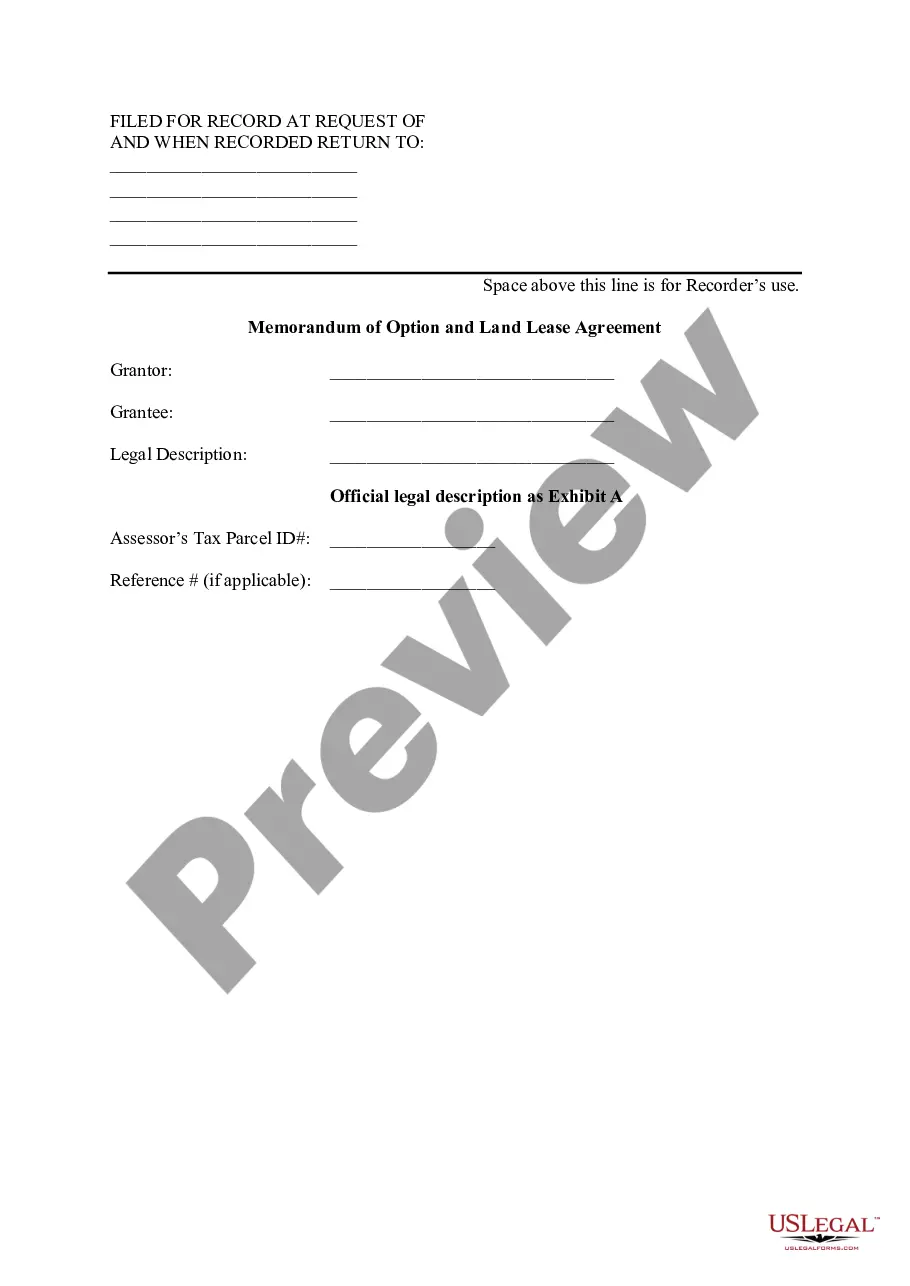

- First, ensure you have selected the correct form for your area/state. You can view the form with the Review button and read the form details to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is acceptable, click the Buy now button to purchase the form.

- Choose the pricing plan you want and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

- Select the document format and download the authorized document to your system.

Form popularity

FAQ

In Georgia, LLCs are generally required to file an annual tax return, unless they meet specific exceptions. After incorporating your non-profit through a Georgia Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association, be mindful that your tax obligations may vary based on revenue and structure. It is advisable to consult a tax professional to ensure compliance and understand your organization's responsibilities. Proper filing helps maintain your non-profit's good standing.

Corporate bylaws are legally required in Georgia. The board of directors usually adopts initial bylaws at the first organizational meeting.

Generally, if a substantial part of a company's ordinary business takes place in Georgia, it is considered to transact business in Georgia.

According to the Official Code of Georgia Annotated § 14-2-202, the Articles of Incorporation must include the following information:The name of the corporation.The number of shares the corporation is authorized to issue.The street address, including the county, and the name of the corporation's registered agent.More items...

To create a 501(c)(3) tax-exempt organization, first you need to form a Georgia corporation, then you then apply for tax-exempt status from the IRS and the State of Georgia. Here are the details. Choose directors for your nonprofit. Choose a name for your nonprofit.

To start a nonprofit corporation in Georgia, you must file nonprofit articles of incorporation with the Georgia Secretary of State. You can submit your nonprofit's articles online or by mail. The articles of incorporation cost $100 to file.

The state of Georgia only requires nonprofit organizations to have one board member, but the IRS rarely provides tax-exempt status with less than three unrelated board members. It is recommended for nonprofits to have three to twenty-five board members depending on the size and purpose of the organization.

Apply for Permits and LicensesThe majority of Georgia nonprofits will not need a state-level business license of any kind. However, your county or city may have separate requirements and you can research local requirements through your city hall.

I am occasionally asked who should sign the bylaws. The question presumes that bylaws must be signed. Although the California General Corporation Law requires that the original or a copy of the bylaws be available to shareholders (Section 213), it does not require that corporate bylaws be signed.

How to Start a Nonprofit in GeorgiaName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.Publish Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.More items...