Georgia Startup Costs Worksheet

Description

How to fill out Startup Costs Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can purchase or create.

By utilizing the website, you can obtain thousands of forms for business and personal needs, organized by categories, states, or keywords. You can retrieve the latest versions of forms like the Georgia Startup Costs Worksheet in just a few minutes.

If you already have a monthly subscription, Log In and download the Georgia Startup Costs Worksheet from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously acquired forms in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the file format and download the form to your device. Make edits. Complete, modify, print, and sign the downloaded Georgia Startup Costs Worksheet. Every template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to obtain or print another copy, simply go to the My documents section and click on the form you want. Get access to the Georgia Startup Costs Worksheet with US Legal Forms, one of the most extensive repositories of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements.

- If you're using US Legal Forms for the first time, here are simple steps to help you get started.

- Confirm that you have selected the appropriate form for your area/county.

- Click the Preview button to review the details of the form.

- Examine the form's information to ensure that you have selected the correct form.

- If the form doesn't meet your requirements, utilize the Search feature at the top of the page to find one that does.

- If you are satisfied with the form, finalize your choice by clicking the Purchase now button.

- Then, select the payment plan that suits you and provide your information to create an account.

Form popularity

FAQ

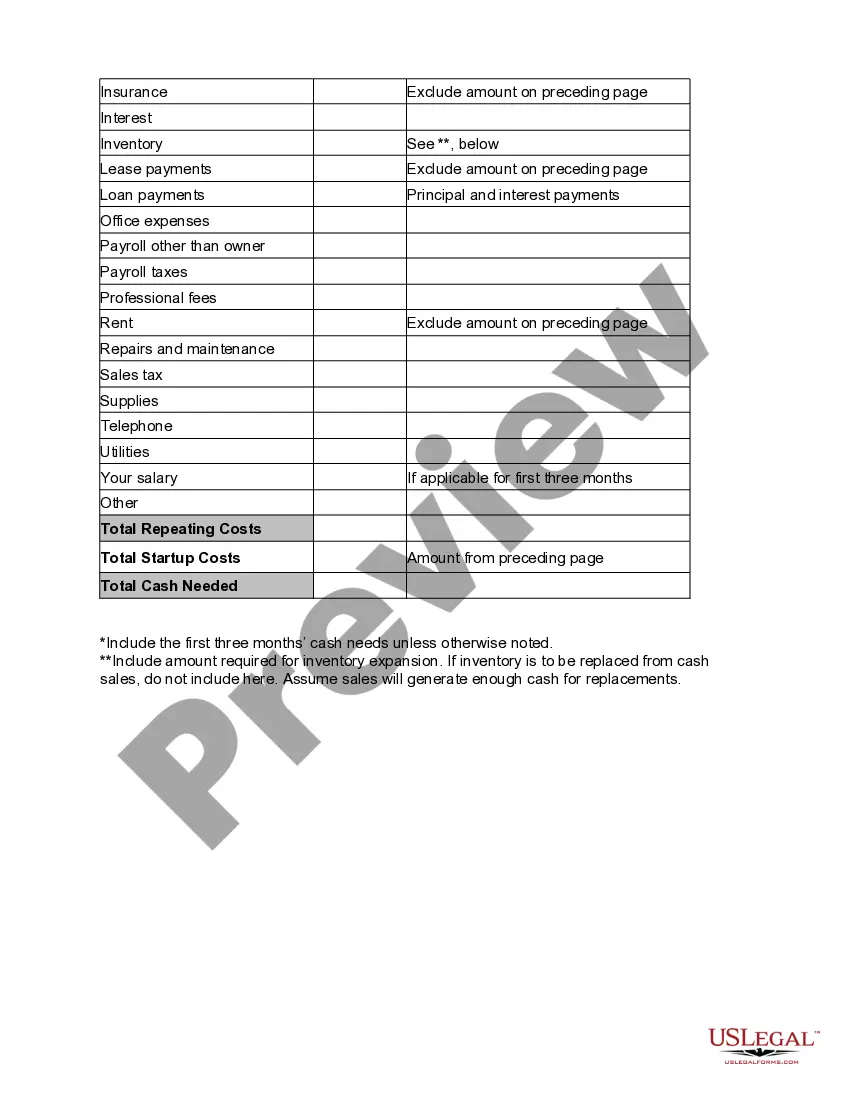

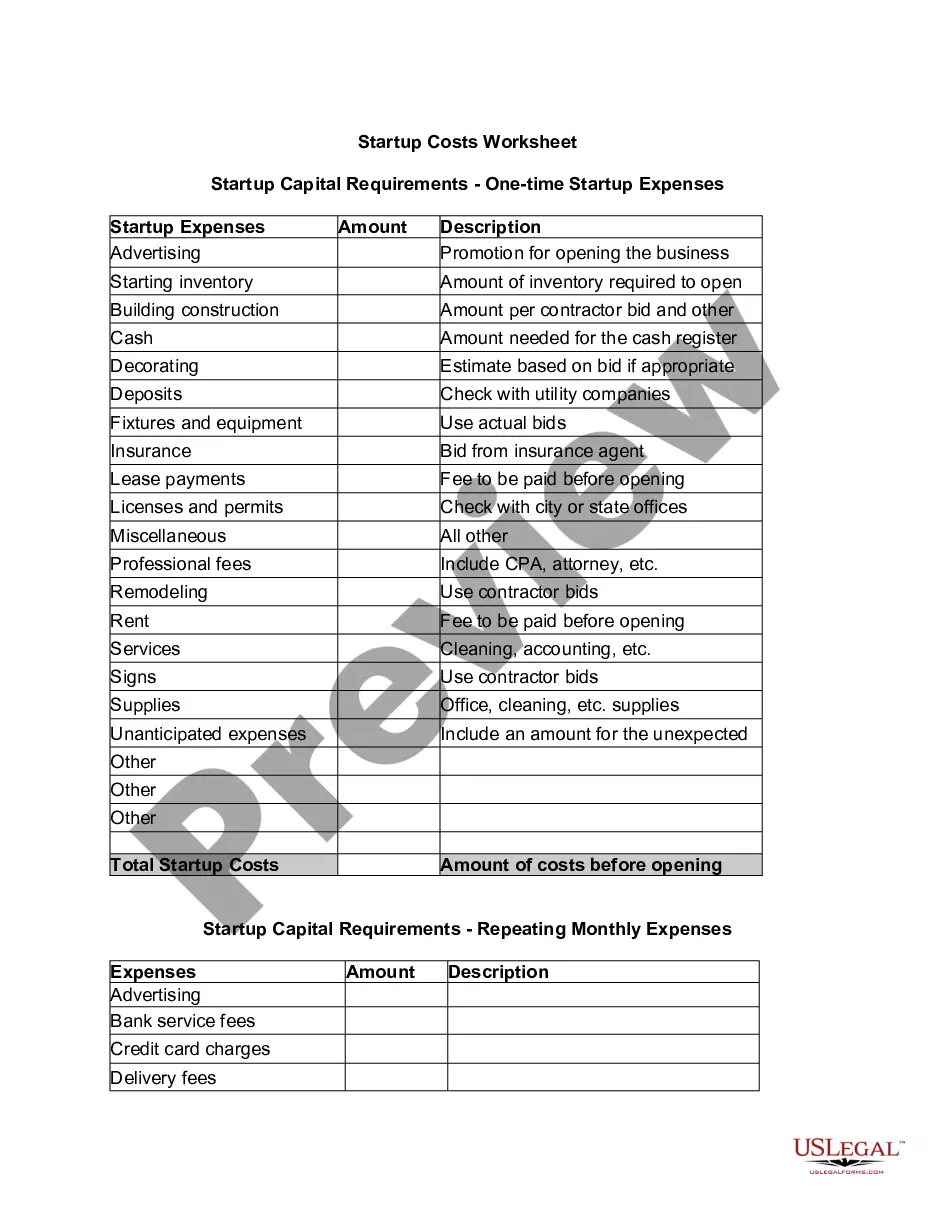

When calculating startup costs, be sure to include both fixed costs, such as rent or lease payments, and variable costs, like inventory and supplies. These two components provide a clear picture of your startup’s financial requirements. Utilizing the Georgia Startup Costs Worksheet helps you keep track of these essential expenses and ensures that you understand your total investment.

Startup capital is the money needed to start a new business. Startup capital might be needed to pay for office space, permits, licenses, inventory, product development, manufacturing, marketing, or any other expense that results from starting a new business.

Under Generally Accepted Accounting Principles, you report startup costs as expenses incurred at the time you spend the money. Some of your initial expenses, such as buying equipment, are not classified as startup costs under GAAP and have to be capitalized, not expensed.

You can either deduct or amortize start-up expenses once your business begins rather than filing business taxes with no income. If you were actively engaged in your trade or business but didn't receive income, then you should file and claim your expenses.

What are examples of startup costs? Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.

The capital requirement is the sum of funds that your company needs to achieve its goals. Plainly speaking: How much money do you need until your business is up and running? You can calculate the capital requirements by adding founding expenses, investments and start-up costs together.

When calculating your business startup costs, a good rule of thumb is to be able to cover six months' worth of expenses upfront. So don't count on your business's revenue to start easing your costs until at least after that early period is over.

According to the U.S. Small Business Administration, most microbusinesses cost around $3,000 to start, while most home-based franchises cost $2,000 to $5,000. While every type of business has its own financing needs, experts have some tips to help you figure out how much cash you'll require.

For those companies reporting under US GAAP, Financial Accounting Standards Codification 720 states that start up/organization costs should be expensed as incurred.

Under GAAP, you report organizational or startup costs as an expense when you incur them. If you spend $5,000 on employee training prior to opening, you'd record $5,000 as a startup expense and reduce your cash account by $5,000. When you make out your taxes, the accounting for startup costs is more complicated.