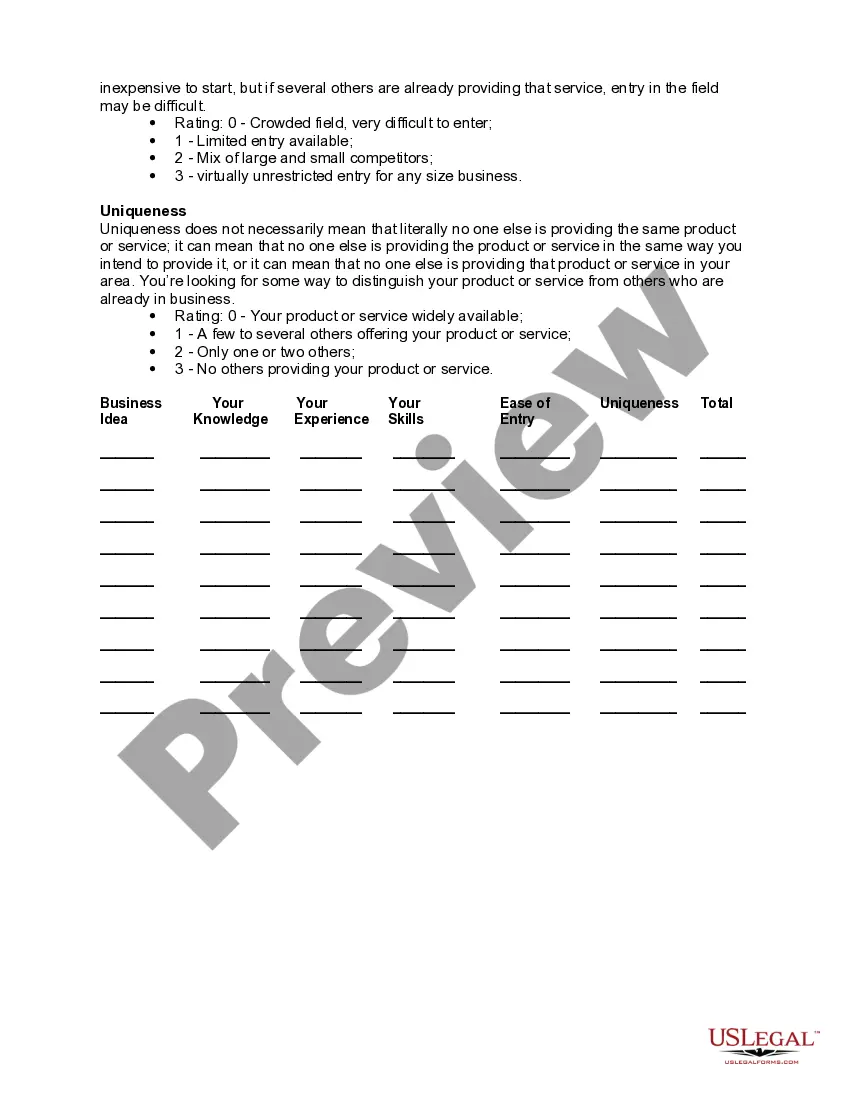

Georgia Business Selection Worksheet

Description

How to fill out Business Selection Worksheet?

You might spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can easily download or print the Georgia Business Selection Worksheet from the service.

Review the form description to ensure you have chosen the right template. If available, utilize the Review option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, modify, print, or sign the Georgia Business Selection Worksheet.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, confirm that you have selected the correct document template for the state/town of your choice.

Form popularity

FAQ

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

If you put "0" then more will be withheld from your pay for taxes than if you put "1"--so that is correct. The more "allowances" you claim on your W-4 the more you get in your take-home pay. Just do not have so little withheld that you owe at tax time.

How to Complete the W-4 Tax FormDetermine your allowances.Fill out your personal information.Claim an exemption if it applies.Fill out itemized deductions, if you're using them.Figure out how much additional withholding you need.

Tips. While claiming one allowance on your W-4 means your employer will take less money out of your paycheck for federal taxes, it does not impact how much taxes you'll actually owe. Depending on your income and any deductions or credits that apply to you, you may receive a tax refund or have to pay a difference.

What is difference in withholding amount between Married , 0 and Married 1 personal allowance? The more allowances an employee claims, the less is withheld for federal income tax. If you claim 0 allowances, more will be withheld from your check than if you claim 1. The amount also depends on how often you get paid.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

Should I 0 or 1 on a Form W4 for Tax Withholding Allowance being a dependent? If you put "0" then more will be withheld from your pay for taxes than if you put "1"--so that is correct. The more "allowances" you claim on your W-4 the more you get in your take-home pay.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

According to Liberty Tax declaring one as your tax withholding is a good bet if you're single and you work just your 9 to 5. This allowance could get you a refund. If you claim zero, the most will be taken out of your paycheck and you will most likely get a refund.

A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee's paycheck. The Internal Revenue Service (IRS) Form W-4 is used to calculate and claim withholding allowances.