Georgia Demand Promissory Note

Description

How to fill out Demand Promissory Note?

You can spend hours online searching for the legal format that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that have been reviewed by experts.

You can effortlessly download or print the Georgia Demand Promissory Note from their service.

To find another version of your form, use the Search area to obtain the format that suits your needs and requirements.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Georgia Demand Promissory Note.

- Every legal document you purchase is your property forever.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct format for your area/city of choice.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

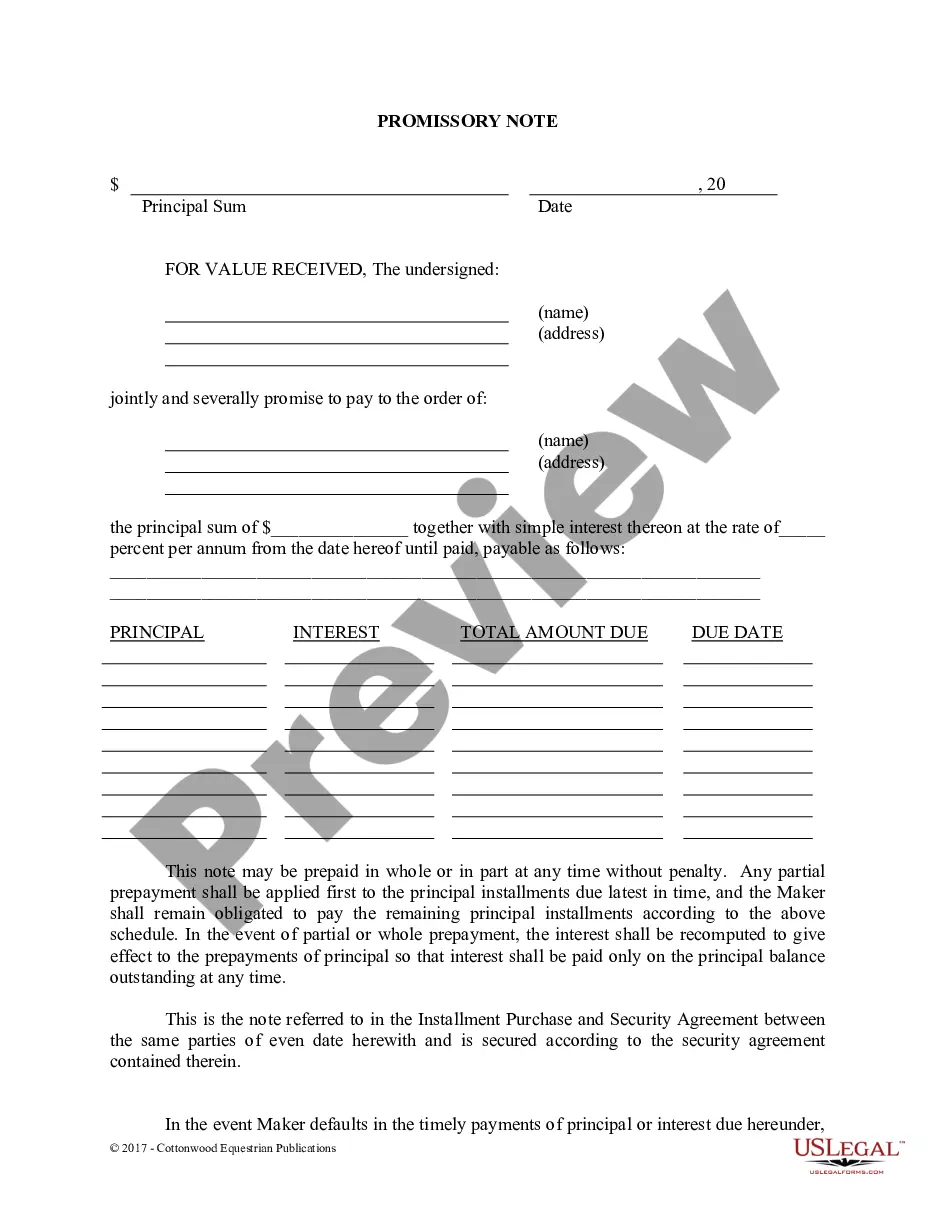

Filling out a promissory note, specifically a Georgia Demand Promissory Note, involves writing the lender's and borrower's names, addresses, and the amount borrowed. Additionally, you should include repayment terms stating it is payable on demand. Don’t forget to sign and date the document at the end. Using templates from US Legal Forms can simplify this and help you adhere to local regulations.

In Georgia, notarization of promissory notes is not a strict requirement for them to be valid. However, notarization can provide useful legal safeguards, helping to authenticate the signatures and terms of the Georgia Demand Promissory Note. It is advisable to consider notarization, especially for larger amounts, to prevent future disputes.

While a promissory note does not necessarily require a witness, having one can strengthen the document’s enforceability. In the case of a Georgia Demand Promissory Note, a witness can affirm that both parties willingly entered into the agreement. Including a witness can add an extra layer of protection in case of disagreements.

A promissory note can still be valid even if it is not notarized, as long as both parties agree to its terms. However, having a notary can provide additional legal protection and help validate the agreement if a dispute arises. It is wise to consult legal advice to understand the implications specific to your Georgia Demand Promissory Note.

Yes, a promissory note can indeed be payable on demand. This type of Georgia Demand Promissory Note allows the lender to request payment at any time without prior notice. Such flexibility can benefit lenders seeking quick access to their funds.

To demand payment on a promissory note, you must formally notify the borrower. This often involves sending a written demand letter that outlines the amount due and specifies the terms of the Georgia Demand Promissory Note. Ensure that you keep copies of all communications in case legal action becomes necessary.

A promissory note is payable on demand if it includes that stipulation. In the context of a Georgia Demand Promissory Note, this means the lender can request full payment at any time without prior notice. This feature significantly impacts how borrowers manage their finances. It’s essential for both parties to be clear on these terms to avoid misunderstandings.

The key difference lies in payment terms. A standard promissory note specifies dates for repayments, while a Georgia Demand Promissory Note allows lenders to demand payment whenever they choose. This flexibility can be beneficial for lenders who need access to funds quickly. Borrowers should consider their financial situations when entering into this kind of agreement to ensure they can meet potential demands.

Yes, a promissory note can be a demand instrument if it allows the lender to request payment at any time. A Georgia Demand Promissory Note is specifically designed to function this way, giving lenders an edge in managing collections. Understanding this classification can be vital for both lenders and borrowers. It outlines the responsibilities and expectations clearly.

To obtain a copy of your promissory note, you can reach out to the individual or entity that issued it. If it was created using a service like US Legal Forms, you can usually access it through your account or contact customer support for assistance. Keeping a digital or physical copy is essential for your records.