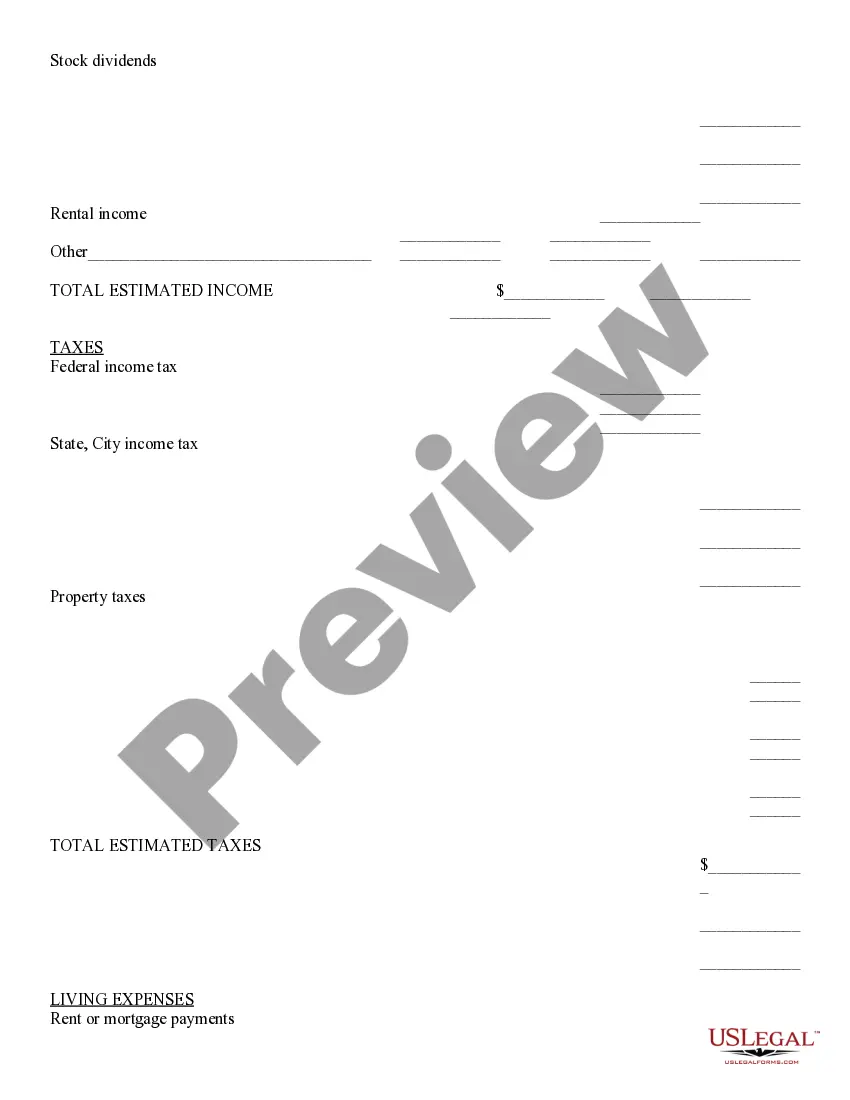

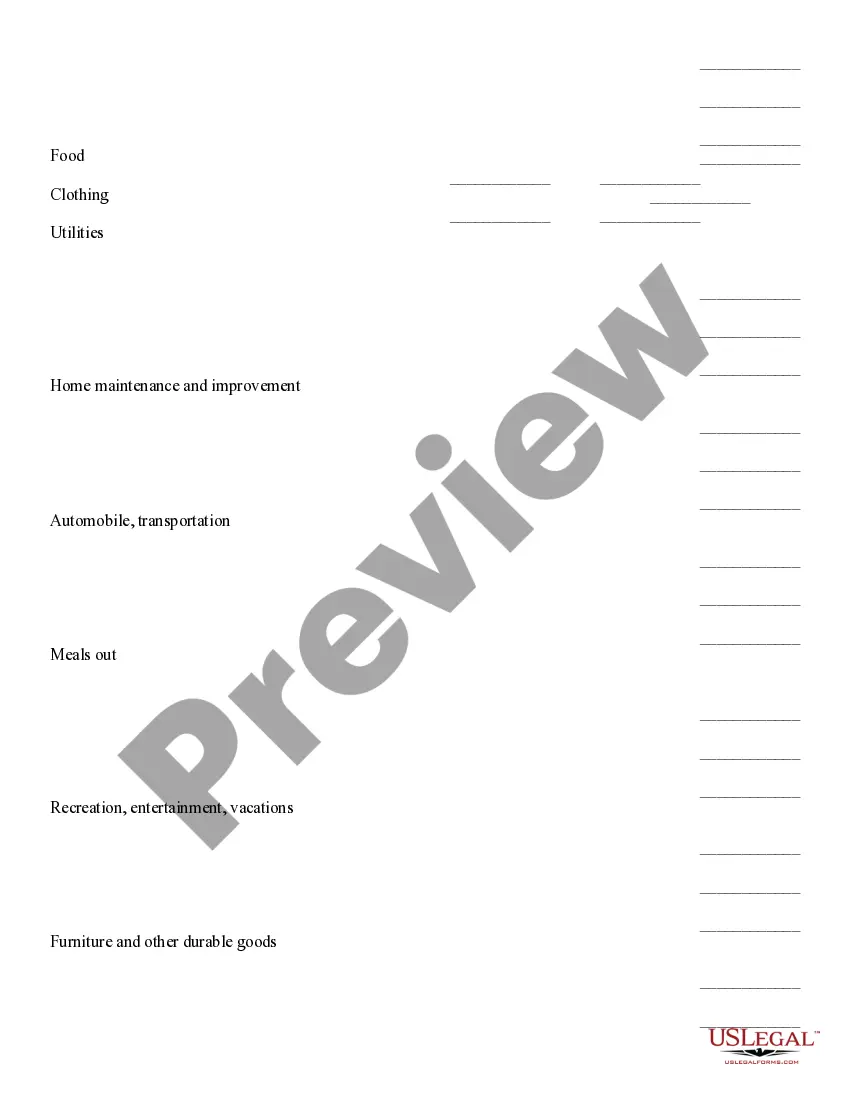

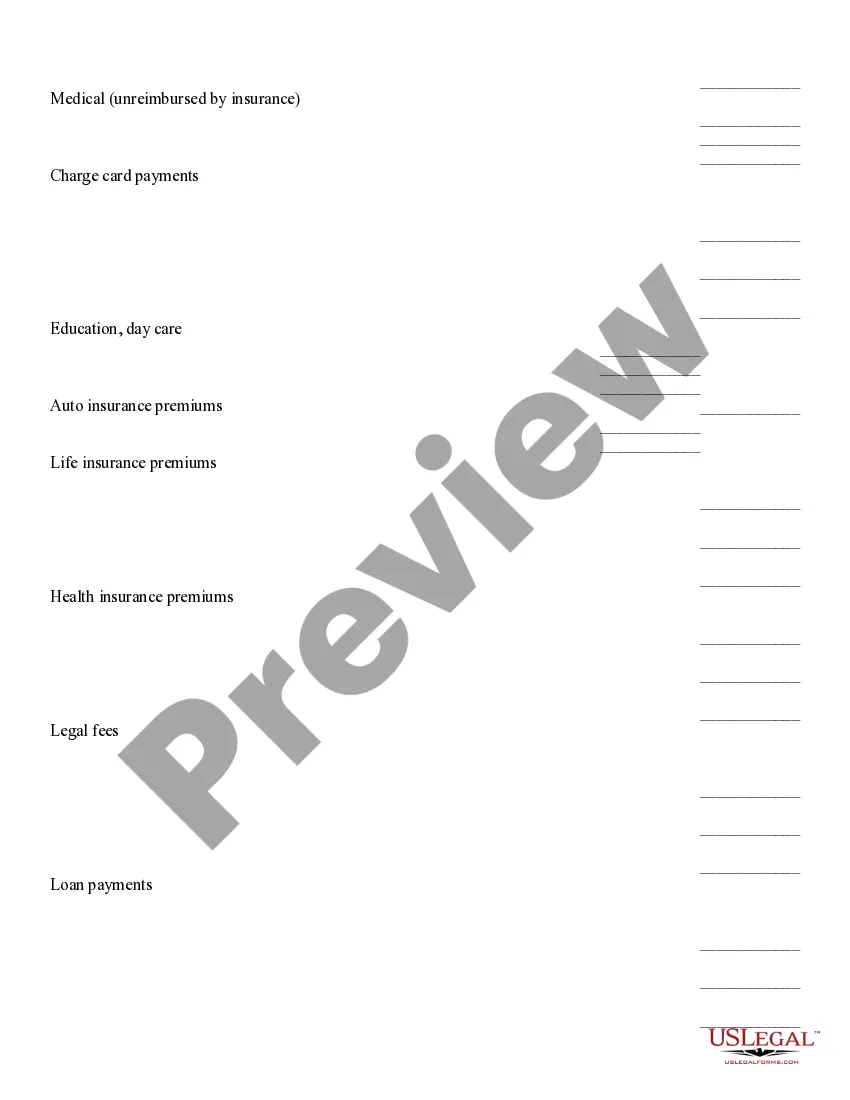

Georgia Retirement Cash Flow

Description

How to fill out Retirement Cash Flow?

You might spend time online trying to locate the legal document template that meets the state and federal requirements you desire.

US Legal Forms offers a plethora of legal forms that have been examined by professionals.

You can download or print the Georgia Retirement Cash Flow from our platform.

If available, use the Preview option to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then click the Download button.

- Then, you can complete, modify, print, or sign the Georgia Retirement Cash Flow.

- Every legal document template you purchase is yours for a lifetime.

- To obtain an extra copy of a purchased form, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your location/city.

- Review the form description to verify that you have chosen the right form.

Form popularity

FAQ

No. Taxable Social Security and Railroad Retirement on the Federal return are exempt from Georgia Income Tax. The taxable portion is subtracted on schedule 1 of Form 500.

APPROVED: A 3% monthly cost of living adjustment (COLA) for retirees and beneficiaries. The COLA will be paid as a 1.5% increase as of July 1, 2021 and 1.5% increase as of January 1, 2022 with the following stipulations: must have a retirement effective date on or before 12/1/2020 for the July 2021 COLA, and.

Georgia allows taxpayers age 62-64 to exclude up to $35,000 or retirement income on their tax return. Taxpayers under age 62 and permanently disabled also qualify for the exclusion. Taxpayers age 65 or older can exclude up to $65,000 of their retirement income on their tax return.

Retirees to receive 3% COLA beginning July 2022. Retired teachers and state employees who have been on the TCRS retired payroll for at least 12 consecutive months as of July 1, 2022 will receive a 3% cost-of-living adjustment, the highest increase available under laws governing TCRS.

Georgia was named the best state to retire in 2021 by a Bankrate study, because it has a lot of the same qualities as Florida but at a more affordable price, according to Jeff Ostrowski, an analyst at Bankrate.com. The study ranked states using five categories: affordability, wellness, crime, weather and culture.

APPROVED: A 3% monthly cost of living adjustment (COLA) for retirees and beneficiaries. The COLA will be paid as a 1.5% increase as of July 1, 2021 and 1.5% increase as of January 1, 2022 with the following stipulations: must have a retirement effective date on or before 12/1/2020 for the July 2021 COLA, and.

No. Taxable Social Security and Railroad Retirement on the Federal return are exempt from Georgia Income Tax. The taxable portion is subtracted on schedule 1 of Form 500.

Georgia was named the best state to retire in 2021 by a Bankrate study, because it has a lot of the same qualities as Florida but at a more affordable price, according to Jeff Ostrowski, an analyst at Bankrate.com. The study ranked states using five categories: affordability, wellness, crime, weather and culture.

Georgia is very tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%.

Thursday is pay raise day for 270,000 state, public university and K-12 employees in Georgia. April 1, 2022, at a.m.