A Partial Release of Property from Security Deed, Mortgage, effectively releases the Borrower from a portion of his/her original mortgage, or loan, commitment. This particular type of release is to be used when releasing an individual from his/her mortgage, not a corporation.

Georgia Partial Release of Property From Security Deed - Mortgage - Individual

Description

Key Concepts & Definitions

Partial Release of Property from Security Deed: This process involves the release of a portion of the property that is held as collateral against a mortgage. This can occur when a borrower wants to sell part of their property, refinance, or has paid a significant portion of the mortgage.

Secured Mortgage Loans: These are loans where the borrower provides a property as collateral to ensure loan repayment.

Loan to Value Ratio (LTV): This is a financial term used by lenders to express the ratio of a loan to the value of the asset purchased.

Step-by-Step Guide

- Assess the Requirement: Determine if a partial release of property is possible based on the borrower obligations under the mortgage loan conditions.

- Prepare Documentation: Collect necessary documents including mortgage agreement, property details, and personal finance analytics.

- Contact Financial Services: Engage with your lender to discuss the feasibility of the deed release and the impact on the loan to value ratio.

- Verification Process: Undergo the contact verification process required by the lender to authenticate identity and intent.

- Approval and Processing: If approved, the lender will process the partial release, adjust the secured mortgage terms, and issue new documentation.

Risk Analysis

- Financial Risk: There might be financial implications such as changes in mortgage conditions or interest rates.

- Legal Risk: Failure to adhere to proper procedures could result in legal complications or invalidation of the partial release.

- Market Risk: Changes in the real property investment market could affect the value of the remaining property.

Best Practices

- Detailed Record Keeping: Maintain accurate and detailed records of all transactions and communications with your lender.

- Legal Consultation: Consult a real estate or a financial lawyer to get a clear understanding of your obligations and rights.

- Regular Updates: Stay informed about changes in mortgage laws and real estate market conditions that might affect your property's value or your mortgage terms.

Common Mistakes & How to Avoid Them

- Insufficient Documentation: Always ensure all required documentation is complete and submitted on time. Keep copies for your records.

- Lack of Communication: Maintain open and regular communication with your lender to avoid any misunderstanding regarding the debt settlement options and secured mortgage modifications.

- Neglecting Fine Print: Read and understand all the terms and conditions in your mortgage agreement to avoid adverse consequences.

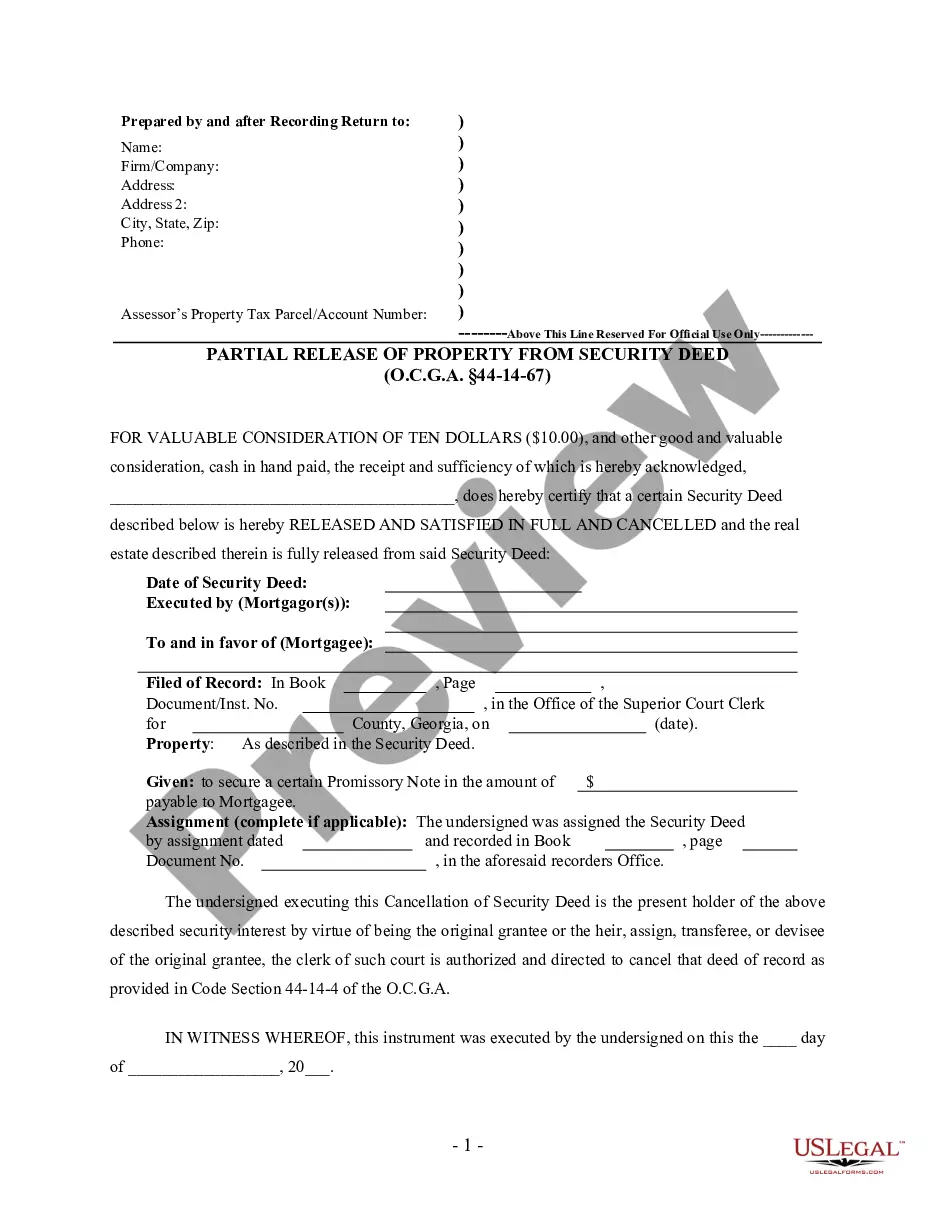

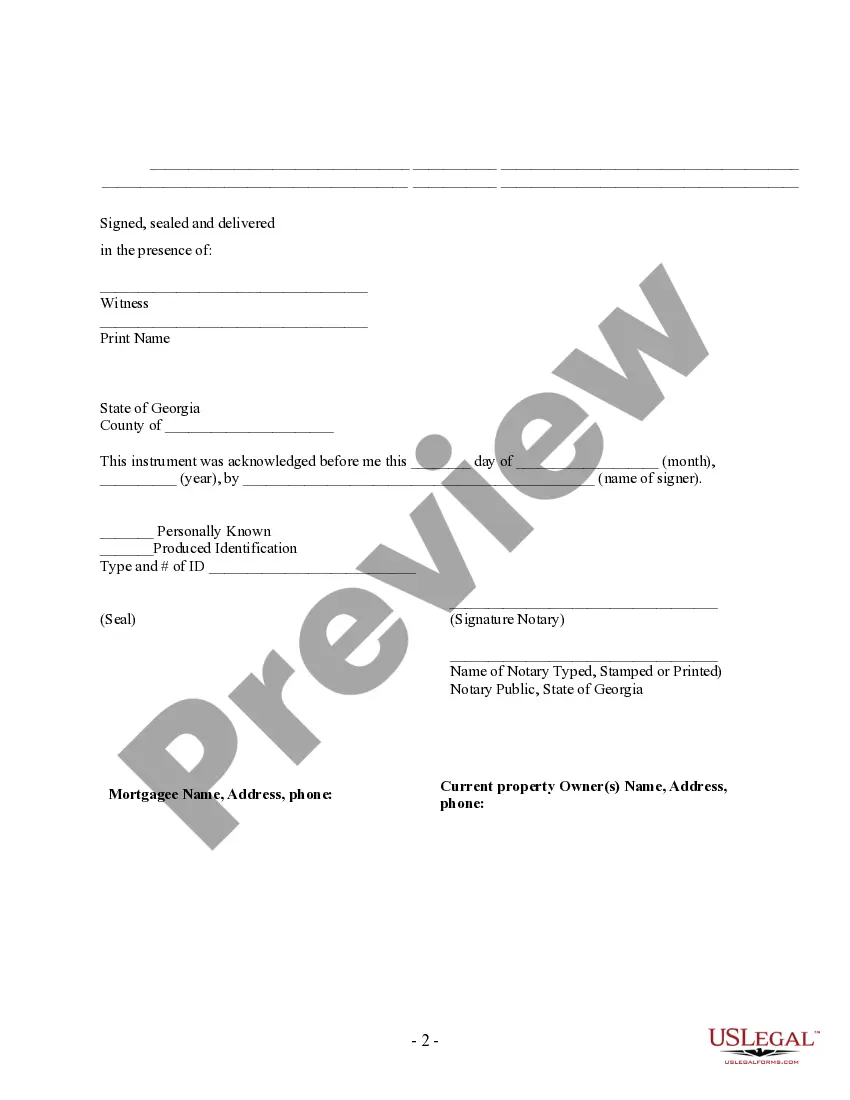

How to fill out Georgia Partial Release Of Property From Security Deed - Mortgage - Individual?

Acquire the most extensive collection of legal documents.

US Legal Forms is essentially a resource where you can discover any specific state form within moments, including the Georgia Partial Release of Property From Security Deed - Mortgage - Individual examples.

There's no need to squander your time looking for a court-acceptable template. Our certified experts guarantee that you receive current samples with each use.

After selecting a pricing option, set up your account. Make payment through credit card or PayPal. Download the sample to your device by clicking on the Download button. That's it! You need to complete the Georgia Partial Release of Property From Security Deed - Mortgage - Individual form and review it. To ensure accuracy, consult with your local attorney for assistance. Register and easily browse over 85,000 useful forms.

- To take advantage of the library of documents, select a subscription and create an account.

- If you are already registered, simply Log In and click Download.

- The Georgia Partial Release of Property From Security Deed - Mortgage - Individual file will be quickly saved in the My documents section (a section for every form you store on US Legal Forms).

- To create a new profile, follow the easy instructions below.

- If you're about to use a state-specific sample, make sure to select the correct state.

- If possible, review the description to learn all the details of the document.

- Utilize the Preview feature if available to examine the document's content.

- If everything is accurate, click Buy Now.

Form popularity

FAQ

A partial release of property from a mortgage allows an owner to remove a portion of the property from the mortgage agreement, usually after certain conditions are met. This option is particularly useful for owners with blanket mortgages who want to sell, refinance, or manage individual properties. The process often requires proper documentation and lender approval to ensure compliance with the terms. For those navigating this path, a Georgia Partial Release of Property From Security Deed - Mortgage - Individual can simplify the process, and tools from US Legal Forms can provide necessary legal support.

A partial lien release is a legal document that removes a lien from a specific property, while the lien remains on other properties. This type of release is often requested when a borrower has fulfilled part of their mortgage obligations or has sold a portion of their real estate. Knowing how to initiate a partial lien release can optimize your asset management. For a detailed approach to a Georgia Partial Release of Property From Security Deed - Mortgage - Individual, consider looking at resources provided by US Legal Forms.

Obtaining a partial release of mortgage can vary based on the lender's policies and the specific terms of your mortgage. Generally, you must demonstrate that you have met certain obligations, such as paying down the mortgage or selling a property under the blanket mortgage. With clear communication and proper documentation, navigating the process becomes much smoother. If you need assistance, consider using platforms like US Legal Forms to guide you through the paperwork associated with a Georgia Partial Release of Property From Security Deed - Mortgage - Individual.

A partial release of a deed of trust allows for a segment of the secured property to be removed from the deed of trust while retaining the remaining property as collateral. This process is often initiated when a borrower sells a portion of the property or pays down a portion of the debt. In Georgia, understanding this process can benefit property owners looking to optimize their real estate investments. US Legal Forms offers tools to assist in navigating partial releases effectively.

A partial release of lien refers to the removal of a lien from a specific property or portion of a property while keeping it on the remaining assets. This action typically occurs after a borrower has fulfilled certain payment obligations. In Georgia, a partial release can provide flexibility in property management and financing options. Leveraging resources from US Legal Forms can simplify this process significantly.

A partial release of easement is a legal process where a property owner agrees to relinquish certain rights of usage over a specific area of land. This can allow for changes in land use or access while still maintaining other easements intact. In the context of Georgia, understanding the implications of a partial release can enhance property value and usability. You can find clear forms and guidance on this through US Legal Forms.

A partial release clause in a mortgage allows the borrower to release a portion of the secured property from the security deed. This is particularly useful when you want to sell a part of your land or property without affecting your entire mortgage. The clause typically outlines specific conditions and may require payment to the lender for the release. Knowing about the Georgia Partial Release of Property From Security Deed - Mortgage - Individual can significantly aid you in managing your property and mortgage effectively.

To obtain a partial release of a mortgage, you must first contact your lender and request this option. Often, lenders require specific documentation, such as proof of payment or a new appraisal of the property. After all requirements are met, the lender can prepare the necessary release documents. Utilizing a platform like USLegalForms can streamline this process for a Georgia Partial Release of Property From Security Deed - Mortgage - Individual.

A partial release is often included when a borrower wishes to sell a portion of their property while retaining the remaining area under the mortgage. This type of release allows flexibility in managing property assets, particularly in real estate transactions. The process for obtaining this release falls under the guidelines of a Georgia Partial Release of Property From Security Deed - Mortgage - Individual, which can help you navigate these situations smoothly.

The statute of limitations on a security deed in Georgia is typically six years from the last payment made on the mortgage. After this period, the lender may lose the ability to collect on the debt secured by the deed. It is crucial to understand these timelines to maintain your rights and obligations regarding a Georgia Partial Release of Property From Security Deed - Mortgage - Individual.