Georgia Construction Contract Cost Plus or Fixed Fee

Overview of this form

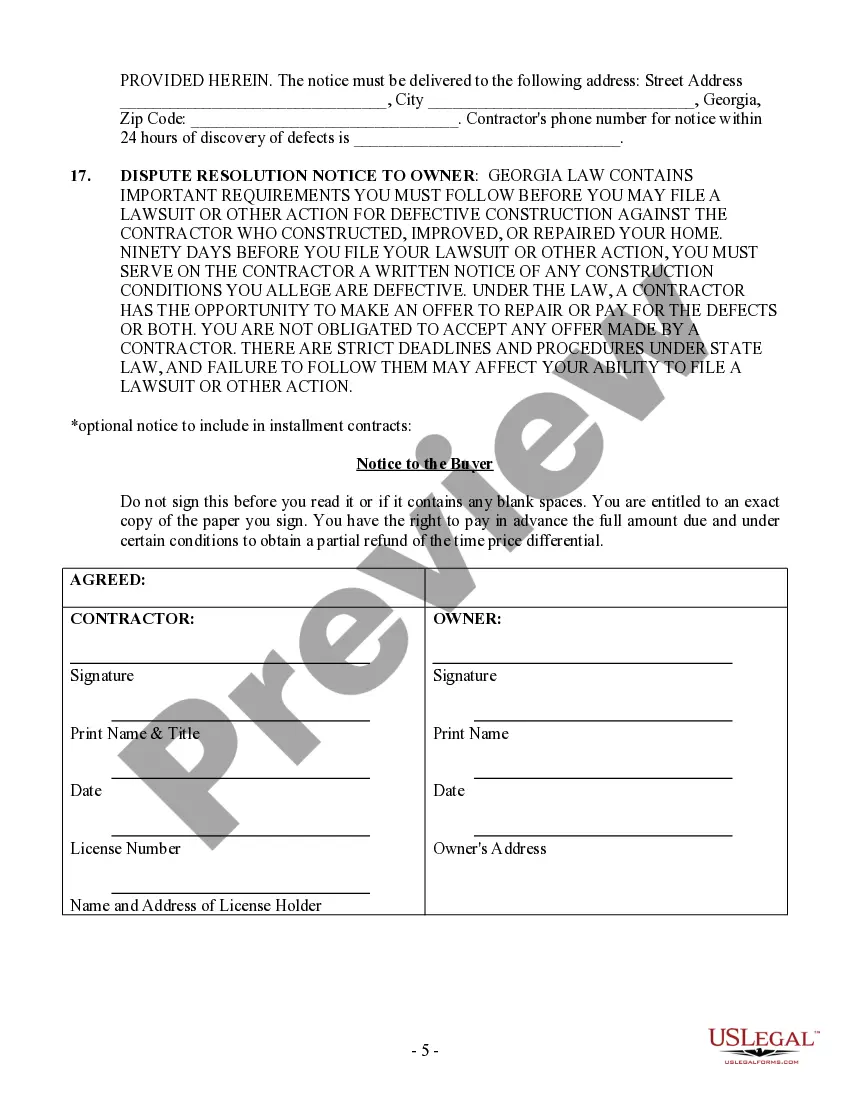

The Construction Contract Cost Plus or Fixed Fee is a legal document used to outline the terms and conditions for a construction project. This form allows for either a cost plus or fixed fee payment arrangement, which means that the pricing structure can vary depending on the agreement between the property owner and the contractor. This contract is particularly relevant in the State of Georgia, ensuring compliance with local laws while detailing the scope of work, site regulations, warranty, and insurance obligations. Unlike standard contracts that may focus solely on fixed costs, this form provides flexibility in handling expenses, making it essential for both parties in a construction agreement.

Key parts of this document

- Work site identification and location specifications

- Permits and regulatory approvals responsibility

- Soil conditions and liability clauses

- Insurance requirements for the contractor

- Provision for changes in scope of work via change orders

- Contract price setup for cost plus or fixed fee arrangements

- Warranties covering construction work performed

- Provisions for late payments and defaults

When to use this document

This form is useful in situations where a property owner engages a contractor to complete a construction project, whether it is a new build, renovation, or remodeling. It is especially suitable when the payment structure needs to accommodate variable costs associated with materials or labor, offering either a specific fixed fee or a cost plus arrangement. Additionally, this contract is pertinent when the project site requires specific regulatory compliance and permits.

Intended users of this form

This form is intended for:

- Property owners looking to hire contractors for construction projects

- Contractors engaged in residential or commercial construction

- Professionals needing a clear agreement to outline responsibilities, costs, and project scope

- Individuals or businesses operating in Georgia, seeking state-compliant construction contracts

Instructions for completing this form

- Identify the parties involved by entering the names of the property owner and contractor.

- Specify the location of the work site to clearly define where the project will occur.

- Detail the scope of work by outlining the project tasks and expectations.

- Determine the payment structure, indicating whether the contract is based on a cost plus or fixed fee arrangement.

- Include any necessary permits and insurance details required for the project.

- Sign and date the document to finalize the agreement between both parties.

Notarization requirements for this form

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to clearly define the scope of work can lead to misunderstandings.

- Not obtaining the required permits prior to starting construction.

- Neglecting to include insurance obligations within the contract.

- Overlooking the necessity for written change orders for any changes made to the initial agreement.

- Missing signatures or incorrect dates can invalidate the contract.

Benefits of using this form online

- Instant access to downloadable legal forms drafted by licensed attorneys.

- Edit and customize the form as needed to fit specific project requirements.

- Convenient and secure process for signing and storing contracts digitally.

- Avoid delays associated with traditional legal consultations by utilizing online resources.

Looking for another form?

Form popularity

FAQ

A cost-plus contract, also known as a cost-reimbursement contract, is a form of contract wherein the contractor is paid for all of their construction-related expenses. Plus, the contractor is paid a specific agreed-upon amount for profit.

A Cost-Based Pricing Example Suppose that a company sells a product for $1, and that $1 includes all the costs that go into making and marketing the product. The company may then add a percentage on top of that $1 as the "plus" part of cost-plus pricing. That portion of the price is the company's profit.

A cost-plus contract is an agreement to reimburse a company for expenses incurred plus a specific amount of profit, usually stated as a percentage of the contract's full price.

Determine your COGS (cost of goods sold). For example $40 . Find out your gross profit by subtracting the cost from the revenue. Divide profit by COGS. Express it as a percentage: 0.25 100 = 25% . This is how to find markup... or simply use our markup calculator!

Cost Plus Contract Advantages Higher quality since the contractor has incentive to use the best labor and materials. Less chance of having the project overbid. Often less expensive than a fixed-price contract since contractors don't need to charge a higher price to cover the risk of a higher materials cost than

In the cost plus a percentage arrangement, the contractor bills the client for his direct costs for labor, materials, and subs, plus a percentage to cover his overhead and profit. Markups might range anywhere from 10% to 25%.

A cost plus percentage of cost contract or CPPC is a cost reimbursement contract containing some element that obligates the non-state entity to pay the contractor an amount, undetermined at the time the contract was made and to be incurred in the future, based on a percentage of future costs.

Cost Plus Contract Disadvantages For the buyer, the major disadvantage of this type of contract is the risk for paying much more than expected on materials. The contractor also has less incentive to be efficient since they will profit either way.

WHY USE A COST-PLUS CONTRACT? A cost-plus contract is an attractive option for a contractor for these two reasons: The contractor cannot produce a proposal for the work because of incomplete information about the project, and therefore transfers the risk of the cost of the project to the owner.