Florida Statement to Add to Credit Report

Description

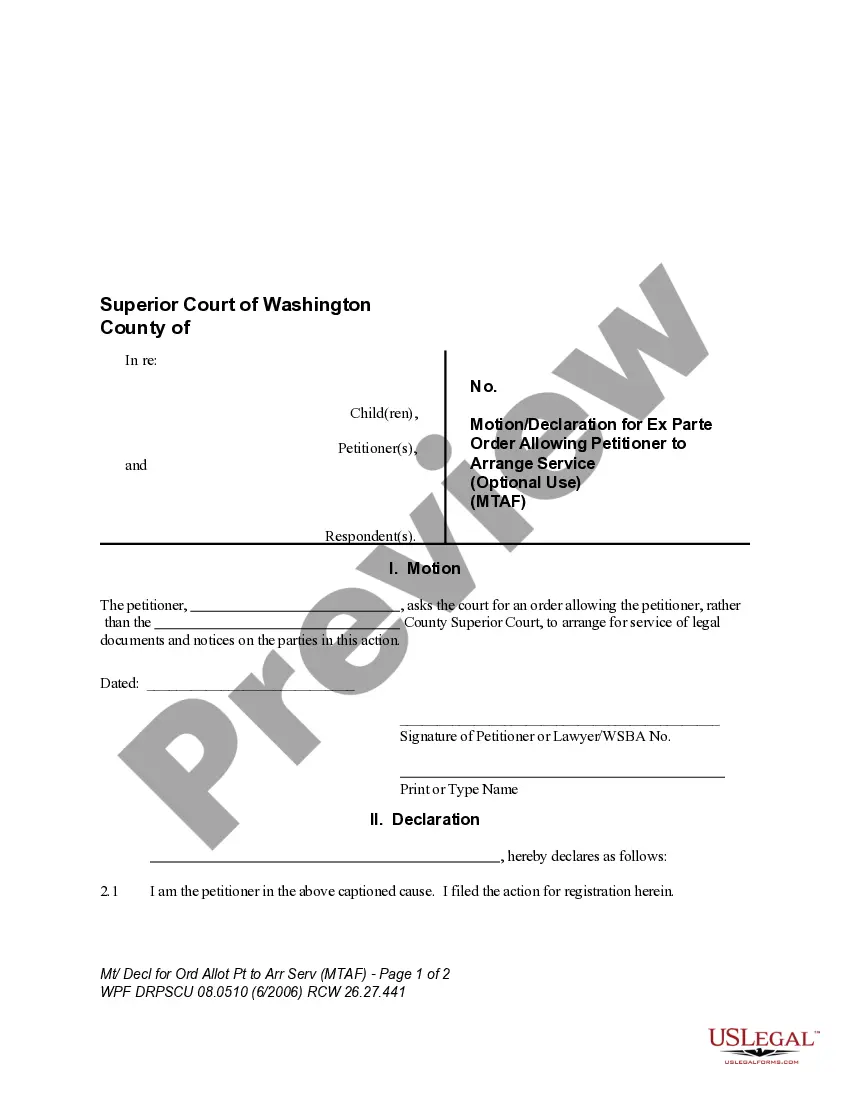

How to fill out Statement To Add To Credit Report?

If you want to complete, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Use the site’s simple and user-friendly search to find the documents you need. Numerous templates for business and personal use are sorted by categories and states, or keywords. Utilize US Legal Forms to find the Florida Statement to Add to Credit Report in just a few clicks.

If you are currently a US Legal Forms user, Log In to your account and click on the Download button to obtain the Florida Statement to Add to Credit Report. You can also access forms you previously downloaded from the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form’s content. Don’t forget to read through the summary. Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template. Step 4. Once you have located the form you need, select the Get now option. Choose the pricing plan you prefer and enter your details to create an account. Step 5. Complete the payment. You can use your Visa or Mastercard or PayPal account to finalize the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Florida Statement to Add to Credit Report.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Every legal document template you purchase is yours permanently.

- You have access to every form you downloaded in your account.

- Visit the My documents section and select a form to print or download again.

- Be proactive and download, and print the Florida Statement to Add to Credit Report with US Legal Forms.

- There are thousands of professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

To get an account added to your credit report, you should first ensure that the creditor reports to the major credit bureaus. If they do, simply opening an account with them is usually sufficient. If you encounter issues, you can reference the Florida Statement to Add to Credit Report to clarify your situation, and consider using US Legal Forms to help streamline the process.

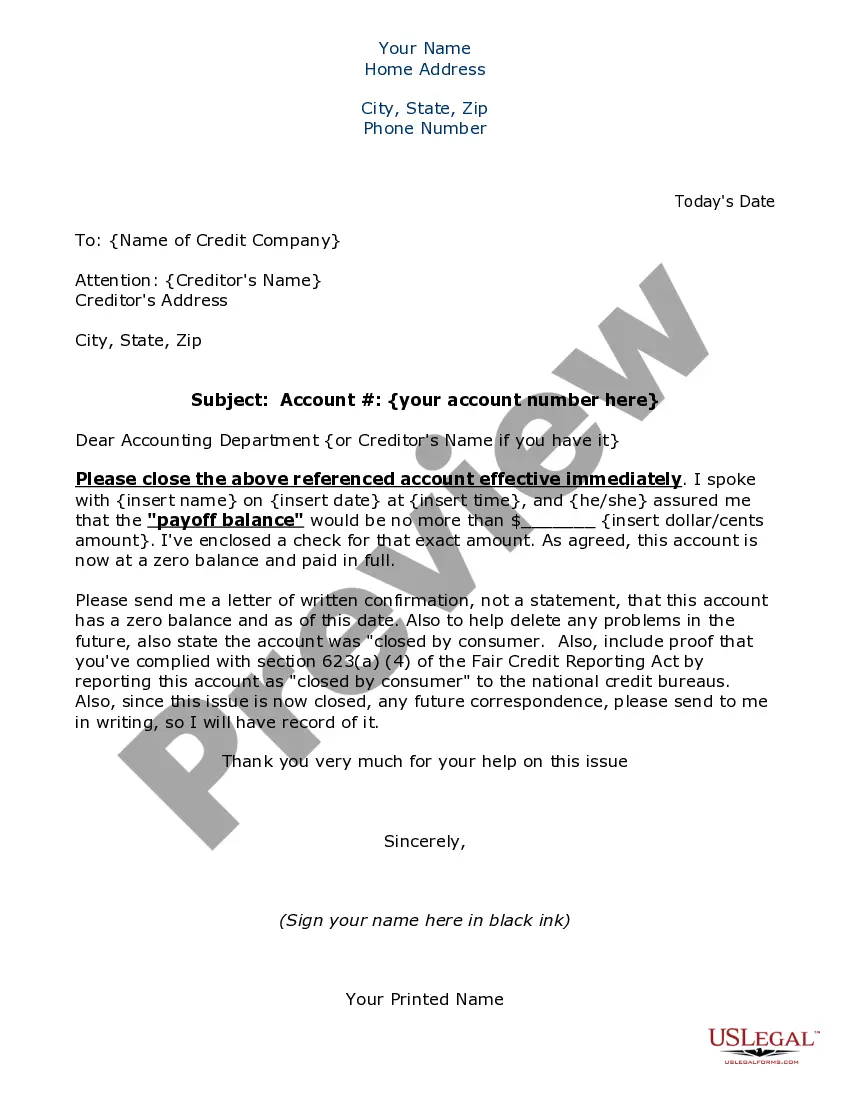

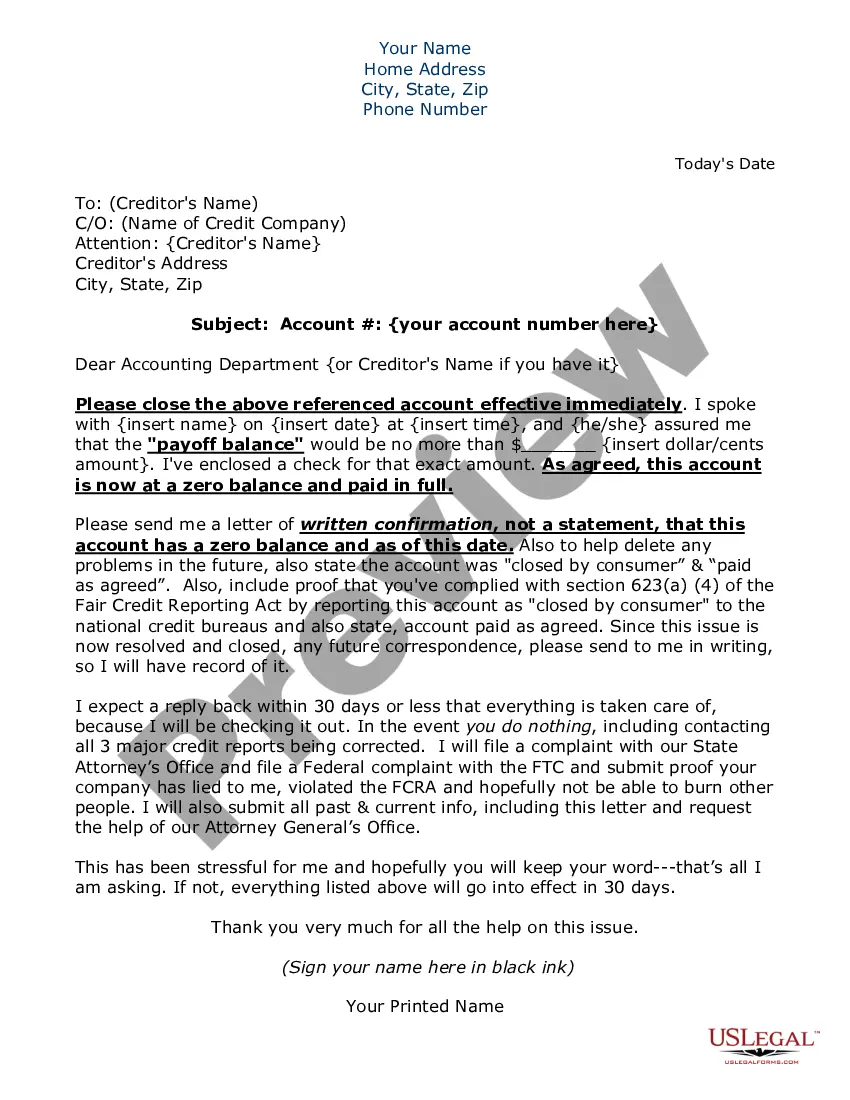

To add a statement to your credit report, you typically need to contact the credit reporting agencies directly. You can submit your statement in writing, ensuring it adheres to the requirements for the Florida Statement to Add to Credit Report. Alternatively, you can use services like US Legal Forms, which can guide you through the process efficiently.

Yes, you can add a statement to your credit report. The Florida Statement to Add to Credit Report is specifically designed for this purpose. By including a statement, you provide valuable information that helps explain any discrepancies or unique circumstances that may affect your credit history.

Achieving an 800 credit score in 45 days is challenging but possible with dedication and the right strategies. Focus on paying down existing debts, ensuring timely payments, and reducing your credit utilization ratio. Additionally, using the Florida Statement to Add to Credit Report can highlight any positive changes in your credit behavior, which may assist in boosting your score.

Yes, you can include a statement on your credit report, and the Florida Statement to Add to Credit Report allows you to convey important context about your credit history. This statement can be up to 100 words long. It helps potential lenders understand your financial situation better, which may positively influence their decision.

A 609 letter is a written request that you can send to credit bureaus to dispute inaccurate information on your credit report. It references Section 609 of the Fair Credit Reporting Act, which allows you to request proof of the debt. By utilizing a 609 letter, you can push for the removal of unverified debts, helping improve your credit score. If you're looking for ways to manage your credit report effectively, consider using our Florida Statement to Add to Credit Report feature on USLegalForms, which guides you through the process.

A personal statement on a credit report allows you to provide context about your financial situation. For example, you might explain a period of unemployment that affected your payment history. This statement can be especially useful when combined with a Florida Statement to Add to Credit Report, as it helps lenders understand your unique circumstances. You can craft this statement through platforms like US Legal Forms, ensuring it is clear and impactful.

Putting a freeze on your credit can be a smart decision, especially if you are concerned about identity theft. By freezing your credit, you restrict access to your credit report, making it harder for fraudsters to open new accounts in your name. This proactive measure can give you peace of mind while you learn more about options like a Florida Statement to Add to Credit Report, which can clarify your financial history. Remember, you can always lift the freeze temporarily if you need to apply for new credit.