Florida Self-Employed Industrial Laundry Services Contract

Description

How to fill out Self-Employed Industrial Laundry Services Contract?

If you intend to finalize, retrieve, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need.

A range of templates for business and personal purposes are organized by categories and jurisdictions, or keywords. Use US Legal Forms to obtain the Florida Self-Employed Industrial Laundry Services Contract in just a few clicks.

Every legal document template you acquire is yours indefinitely. You will have access to every document you downloaded within your account. Click the My documents section and select a document to print or download again.

Stay competitive and download, and print the Florida Self-Employed Industrial Laundry Services Contract with US Legal Forms. There are thousands of professional and state-specific forms that you can use for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to get the Florida Self-Employed Industrial Laundry Services Contract.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

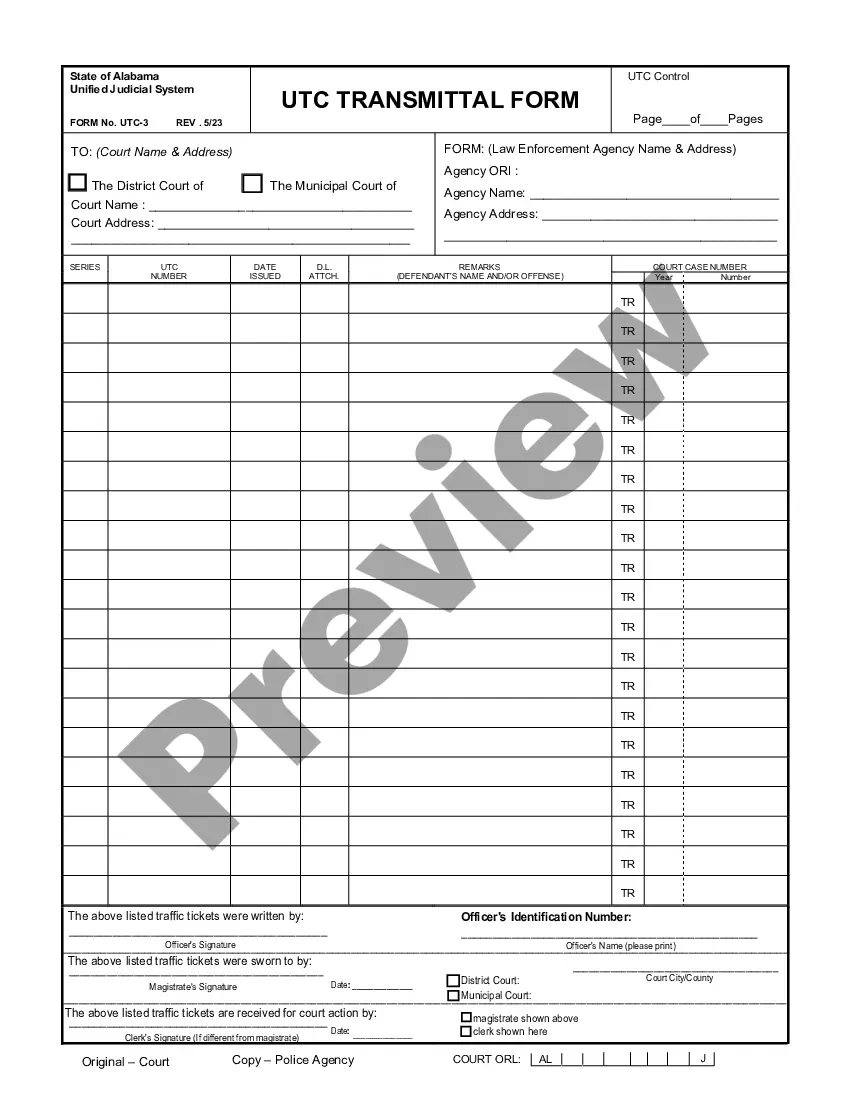

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other types within the legal document category.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Florida Self-Employed Industrial Laundry Services Contract.

Form popularity

FAQ

Contractual service refers to any service provided based on a formal agreement between parties. This can include various sectors, such as cleaning, maintenance, and laundry services. In the case of a Florida Self-Employed Industrial Laundry Services Contract, the agreement outlines specific duties and obligations, creating a clear understanding for both the service provider and the client.

The four primary types of laundry services include self-service laundromats, full-service laundry, commercial laundry, and industrial laundry services. Each type caters to different needs, from personal laundry to large-scale operations. A Florida Self-Employed Industrial Laundry Services Contract is particularly relevant for those in the industrial sector, ensuring compliance and service quality.

A contractual laundry service is a specialized agreement where a provider commits to delivering laundry processing and related services to a client. This arrangement is beneficial for businesses that require consistent and reliable laundry solutions. By utilizing a Florida Self-Employed Industrial Laundry Services Contract, both parties can establish expectations and protect their interests.

Writing a contract as an independent contractor involves outlining the terms and conditions of your services clearly. Start by defining the scope of work, payment details, deadlines, and responsibilities. Using a Florida Self-Employed Industrial Laundry Services Contract template from USLegalForms can simplify this process and help ensure you cover all necessary elements.

Contractual services refer to services provided under a legally binding agreement between two or more parties. In the context of a Florida Self-Employed Industrial Laundry Services Contract, these services typically include laundry processing, delivery, and other related tasks. This arrangement ensures clarity and security for both the service provider and the client.

The new independent contractor law in Florida clarifies the classification of workers, impacting how businesses engage self-employed individuals. This law aims to ensure that workers are correctly classified to protect their rights and benefits. For those in the laundry industry, having a Florida Self-Employed Industrial Laundry Services Contract can help you comply with these regulations while clearly outlining the terms of your services. Staying informed about these changes will help you maintain your business's integrity and legality.

In Florida, laundromats are primarily regulated by the Department of Business and Professional Regulation (DBPR). This department ensures compliance with health and safety standards, as well as business licensing requirements. If you operate a self-employed industrial laundry service, understanding these regulations can help you navigate the legal landscape effectively. Using a Florida Self-Employed Industrial Laundry Services Contract can also provide clarity and protect your business.

In Florida, an independent contractor operates under a specific agreement, often defined in a Florida Self-Employed Industrial Laundry Services Contract. This individual typically controls their work hours, methods, and the tools used for their tasks. Importantly, they do not receive employee benefits and are responsible for their own taxes. Understanding these qualifications helps ensure compliance and can enhance your business operations.