Florida Sample Letter for Short Sale Request to Lender

Description

How to fill out Sample Letter For Short Sale Request To Lender?

US Legal Forms - one of the best collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

With the website, you can find countless forms for business and personal purposes, organized by categories, states, or keywords. You can access the most current versions of forms like the Florida Sample Letter for Short Sale Request to Lender in moments.

If you have an active monthly subscription, Log In and download Florida Sample Letter for Short Sale Request to Lender from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the acquired Florida Sample Letter for Short Sale Request to Lender. Every template added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you want. Access the Florida Sample Letter for Short Sale Request to Lender with US Legal Forms, the most extensive library of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your region/county.

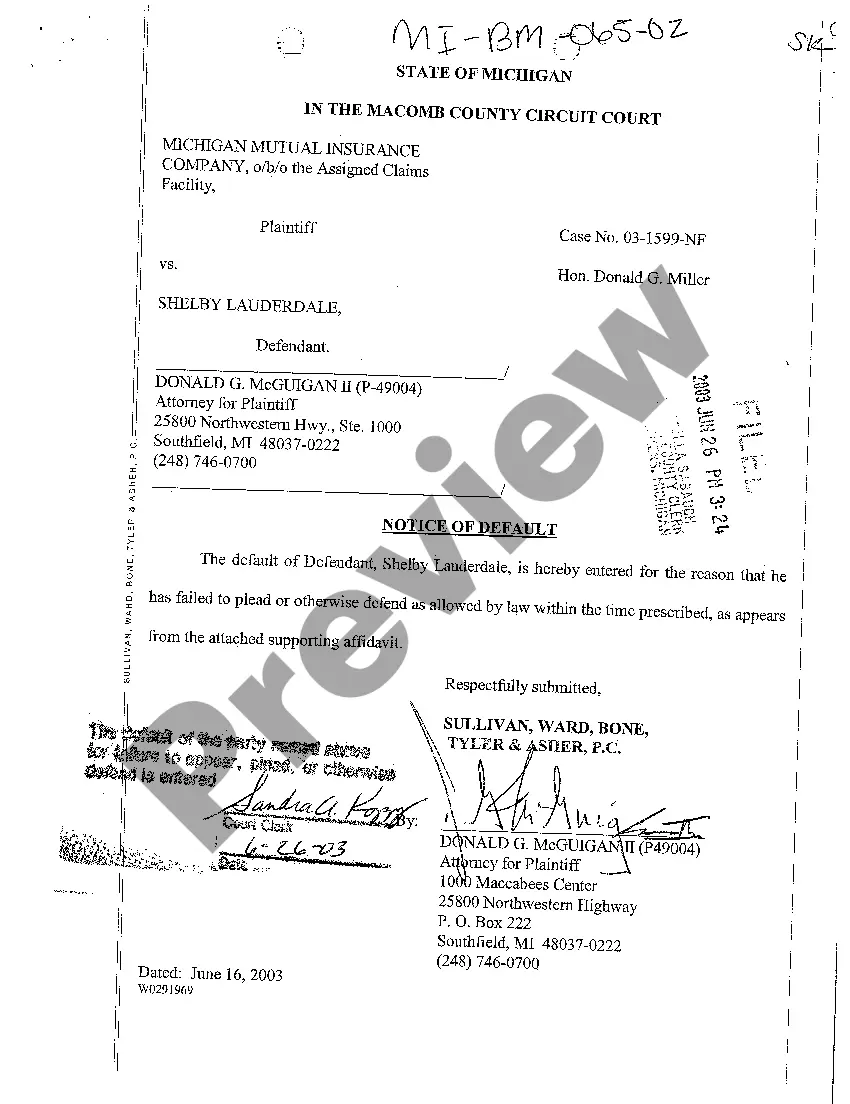

- Use the Preview button to review the form's content.

- Check the form description to confirm you have chosen the right form.

- If the form does not meet your requirements, use the Search section at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose your billing plan and provide your details to register for an account.

Form popularity

FAQ

When writing a letter to your mortgage company for hardship, start by clearly stating your situation. You should include specific details about your financial difficulties and how they affect your ability to make mortgage payments. It's helpful to mention your desire to avoid foreclosure and express your interest in pursuing a short sale, especially with a Florida Sample Letter for Short Sale Request to Lender. For a more structured approach, consider using the resources available on the UsLegalForms platform, which can guide you in drafting an effective and persuasive letter.

A lender can take anywhere from 30 days to 120 days to approve a short sale, depending on their internal protocols and your circumstances. If you provide a comprehensive Florida Sample Letter for Short Sale Request to Lender along with all required documentation, it may help in speeding up their decision. Keep in mind that every case is different, so staying proactive and informed will benefit you. Regularly check in with your lender to keep the process moving.

The time it takes for a bank to approve a short sale can vary widely, but typically it may range from a few weeks to several months. Factors include the lender's specific processes and the complexity of your case. Submitting a well-prepared Florida Sample Letter for Short Sale Request to Lender can speed up the review process. It’s advisable to remain patient and follow up regularly on the status of your application.

To get short sale approval, you must submit an organized package of information to your lender. This package should include your Florida Sample Letter for Short Sale Request to Lender, financial statements, and a detailed explanation of your hardship. Maintaining open communication with your lender can also help ease the approval process. Additionally, consider working with a real estate professional experienced in short sales.

A short sale may be denied for various reasons, including insufficient documentation or failure to demonstrate financial hardship. If the lender believes they can recover more through a foreclosure, they might reject the request. Moreover, not using a Florida Sample Letter for Short Sale Request to Lender can lead to misunderstandings about your situation. It is crucial to present a complete, convincing case to improve your chances.

A short sale approval letter is a document from your lender confirming that they agree to allow the sale of your property for less than the mortgage balance. This letter outlines the terms and conditions of the short sale. When crafting your Florida Sample Letter for Short Sale Request to Lender, ensure you emphasize your need for this approval letter to move forward with the sale.

Short sales can have an impact on your credit score, but typically less severe than a foreclosure. While your score may drop, the overall effect depends on various factors, including how you manage other debts. Using a Florida Sample Letter for Short Sale Request to Lender can show your proactive approach, which may help mitigate some negative effects.

Requesting a short sale involves a few vital steps. First, you must reach out to your lender and state your request clearly. Providing a Florida Sample Letter for Short Sale Request to Lender can greatly streamline this process, as it details your financial hardship and justifies your request to sell the property for less than what you owe.

To ask for a short sale, you should first contact your lender and express your intent to pursue this option. It's important to gather necessary documents, such as financial statements, and prepare a Florida Sample Letter for Short Sale Request to Lender detailing your situation. This letter serves as your formal request and outlines why you need the lender's approval.

When it comes to a short sale, a bank might accept an offer that is less than the amount owed on the mortgage. Typically, banks evaluate the current market value of the property and the homeowner's financial situation. By using a Florida Sample Letter for Short Sale Request to Lender, you can formally present your case and potentially secure a more favorable outcome.