Florida Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

It is feasible to invest time online seeking the legal template that satisfies the federal and state criteria you require.

US Legal Forms offers a vast array of legal documents that are reviewed by experts.

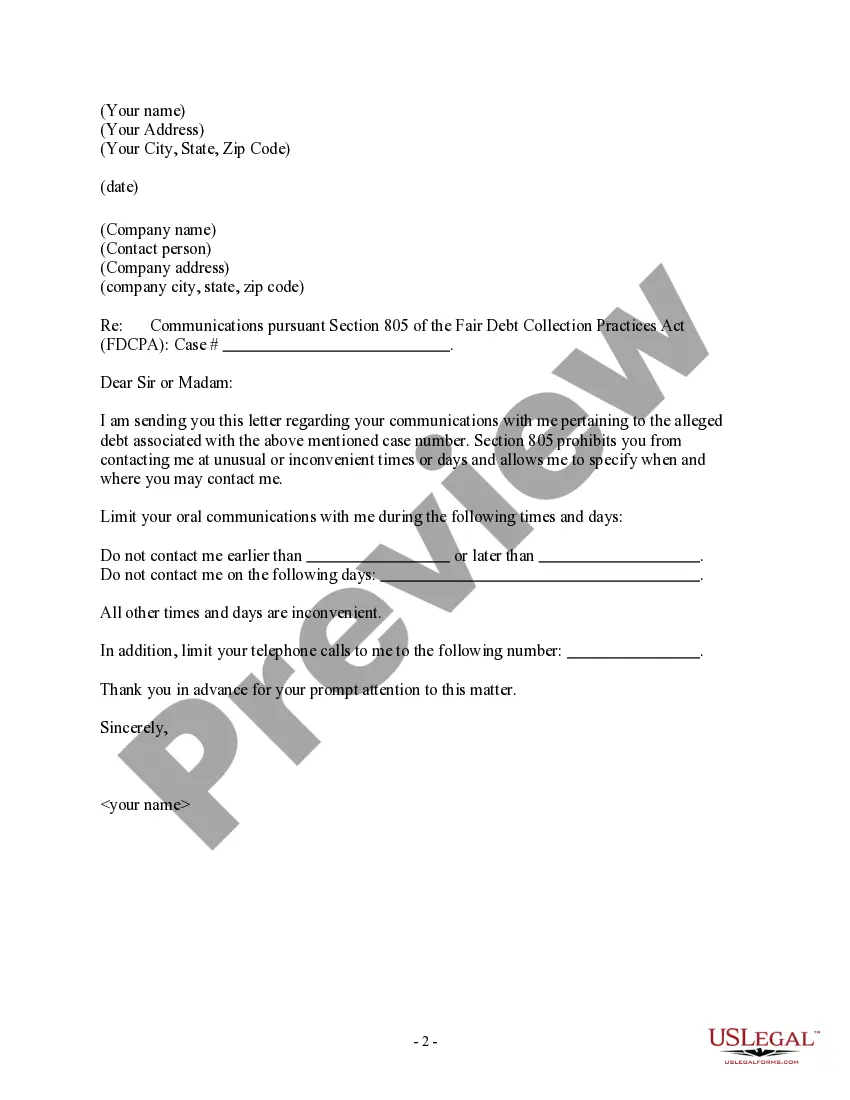

You can download or print the Florida Letter to Debt Collector - Only contact me on the specific days and times provided by your service.

If you want to find another version of the form, use the Search field to locate the template that fulfills your requirements and specifications.

- If you possess a US Legal Forms account already, you may sign in and click the Download button.

- Then, you can complete, modify, print, or sign the Florida Letter to Debt Collector - Only contact me on the specific days and times.

- Every legal template you purchase is yours indefinitely.

- To obtain another copy of any acquired form, navigate to the My documents section and click the appropriate button.

- If you are utilizing the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the document description to confirm that you have chosen the right template.

Form popularity

FAQ

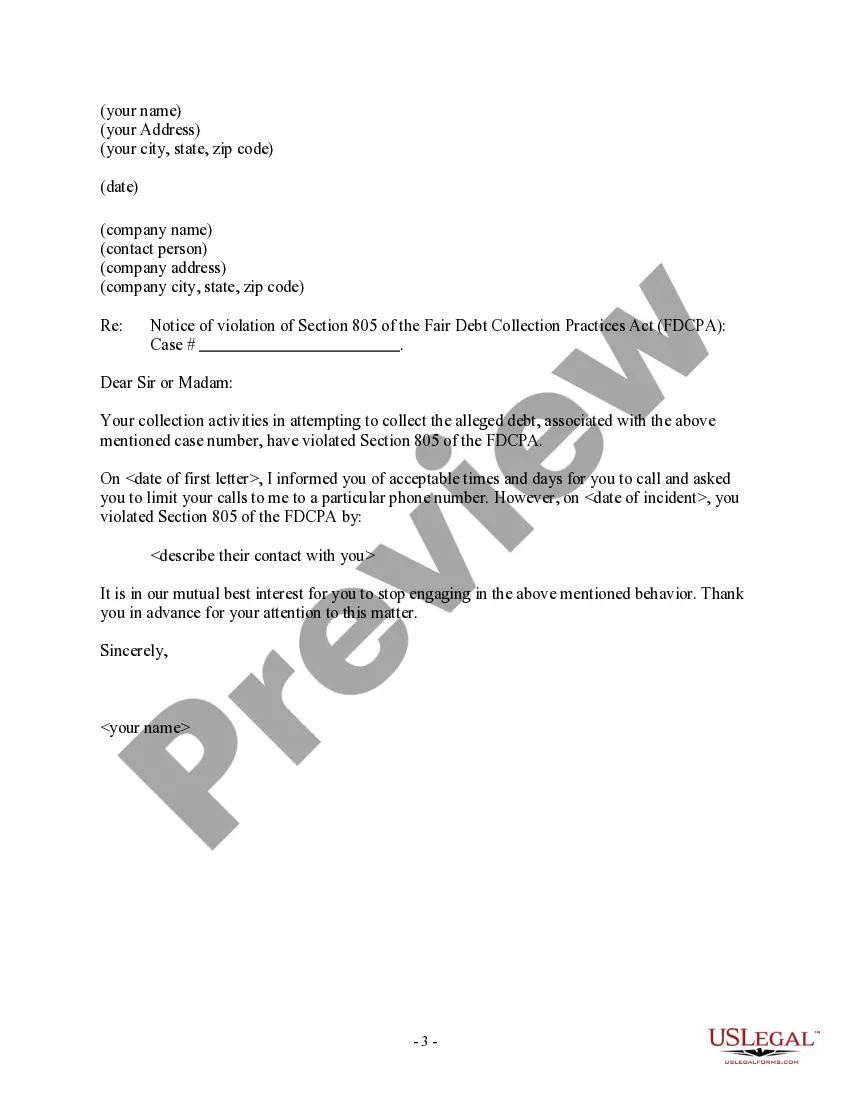

When a debt collector contacts you, avoid making promises you cannot keep. Don't admit to owing the debt or share personal financial details, as this could lead to further complications. Instead, use a Florida Letter to Debt Collector - Only call me on the following days and times to assert your rights and manage the communication effectively. You can also seek help on platforms like US Legal Forms to craft a professional letter that outlines your preferences.

The only permissible means of communicating is by regular mail. Alberta and Nova Scotia have a similar "three strikes" rule limiting the amount of contact from collectors within a seven-day consecutive period.

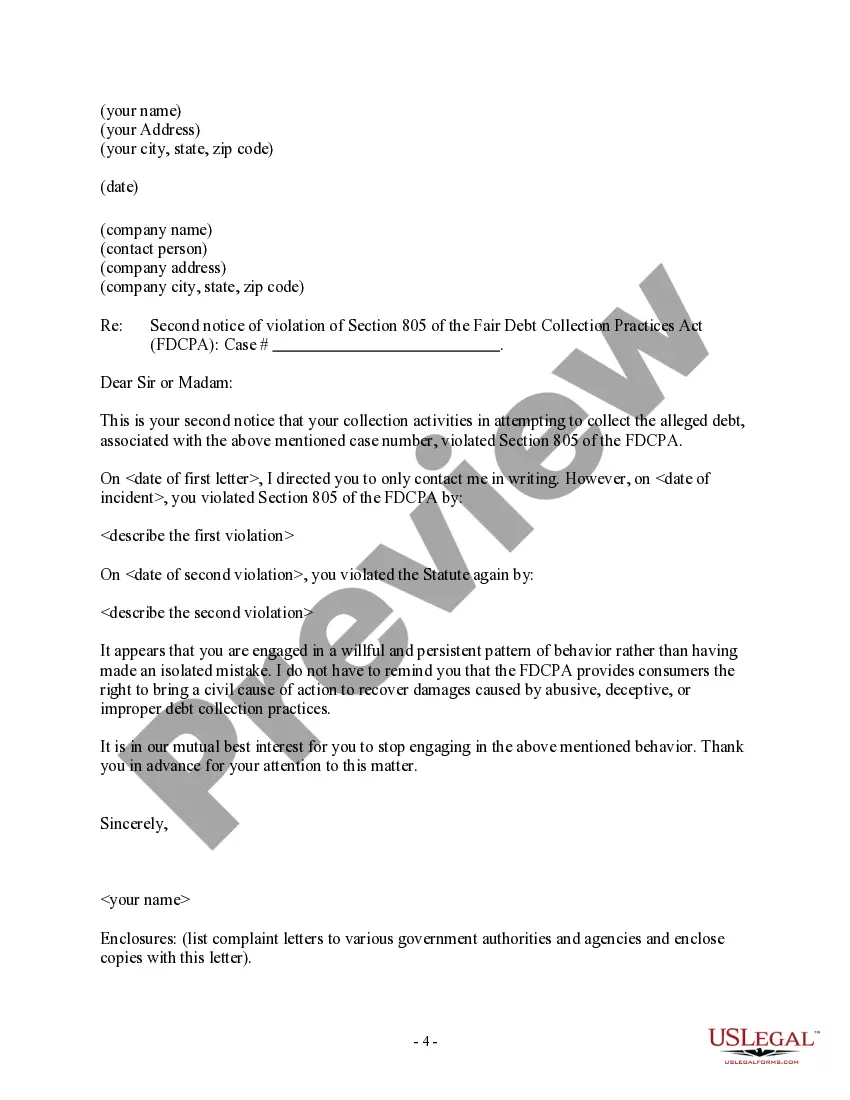

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

Debt collectors can't contact you before 8 a.m. or after 9 p.m., unless you agree to it. They also can't contact you at work if you tell them you're not allowed to get calls there. How can a debt collector contact me?

Federal law protects you against harassment and unfair treatment by debt collectors. While they can call on Sundays, they can't call outside normal hours or at inconvenient times. Read more to learn how you can take back your Sundays by learning about consumer protection laws and how collection agencies work.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Generally, debt collectors cannot call you at an unusual time or place, or at a time or place they know is inconvenient to you and they are prohibited from contacting you before 8 a.m. or after 9 p.m.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.