Florida VETS-100 Report

Description

How to fill out VETS-100 Report?

Are you currently in a situation where you require documents for either professional or personal reasons every single day.

There are numerous trustworthy document templates available online, but finding ones you can depend on is not easy.

US Legal Forms provides thousands of template documents, such as the Florida VETS-100 Report, designed to comply with federal and state regulations.

Once you find the correct form, click on Purchase now.

Choose the pricing plan you prefer, fill out the necessary information to create your account, and complete your order using your PayPal or credit card. Select a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Florida VETS-100 Report at any time if needed. Click on the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. This service provides professionally designed legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Florida VETS-100 Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your correct city/state.

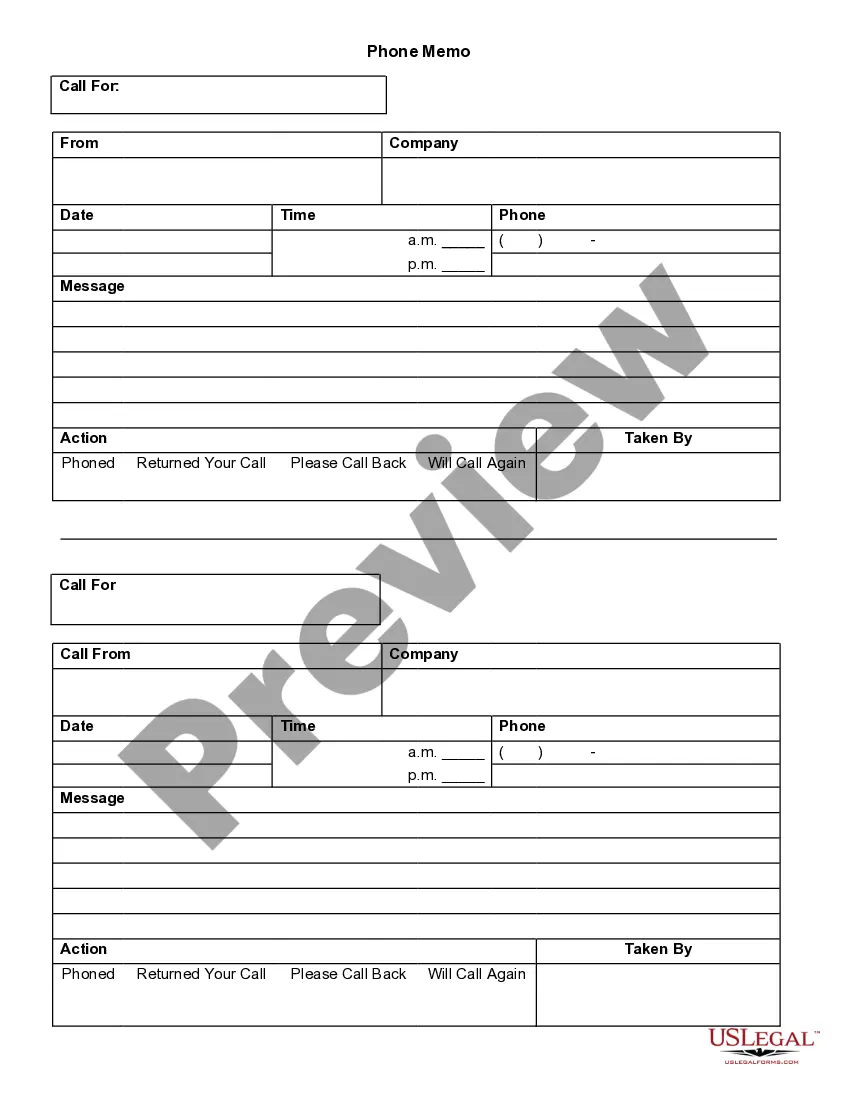

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn't what you’re looking for, utilize the Search field to find the form that meets your needs and criteria.

Form popularity

FAQ

The VETS-4212 form has not replaced the Florida VETS-100 Report; rather, it serves a different purpose. While the VETS-100 is used for reporting the employment of veterans by federal contractors, the VETS-4212 focuses on the hiring of veterans and special disabled veterans. It is important for businesses to understand the distinction between the two forms to ensure compliance and fulfill their obligations accurately. For clarity and assistance with the Florida VETS-100 Report, consider utilizing platforms like USLegalForms.

The VETS-100 and VETS-4212 reports serve different purposes for veteran-owned businesses. The VETS-100 Report focuses on reporting veteran employment within federal contractors, providing key data on hiring practices. Meanwhile, the VETS-4212 Report emphasizes veterans’ employment and retention specifically by federal contractors. By understanding both reports, veteran businesses can navigate the landscape more effectively and take advantage of the benefits available through programs supporting veterans in Florida.

Additional Homestead Exemption for Low Income Seniors Age 65+ A lesser-known additional homestead exemption will allow an ADDITIONAL $25,000.00 - $50,000.00 to be deducted from the property's assessed/taxable value.

Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption.

If veterans are trying to get a 100 percent VA disability rating, and they do not have a 100 percent rating for any one service-connected condition, the only way to get there is to reach a combined disability rating of 95 percent or higher according to VA math.

A veteran can receive a temporary 100% rating when they are hospitalized for 21 or more days for a service-connected condition. A veteran can receive a 100% rating if they are having surgery for a service-connected condition and will require an extensive recovery time that limits their mobility.

If a Veteran is awarded a 100 percent combined rating and they believe they're qualified for a permanent and total rating, the Veteran can ask the VA to award the permanent and total distinction. To do this, they can simply write the VA a letter requesting the benefit.

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

Homestead Exemption Florida resident veterans with an honorable discharge and are 100% permanently and totally disabled as well as quadriplegic veterans are exempt from paying property tax on their residence. Unremarried surviving spouses may also be eligible.

A disabled veteran in Florida may be able to reduce their property's assessed value by $5,000 if they are 10 percent or more disabled from a result of service. If the veteran is 100 percent disabled as a result from service then they may receive a full property tax exemption.