This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

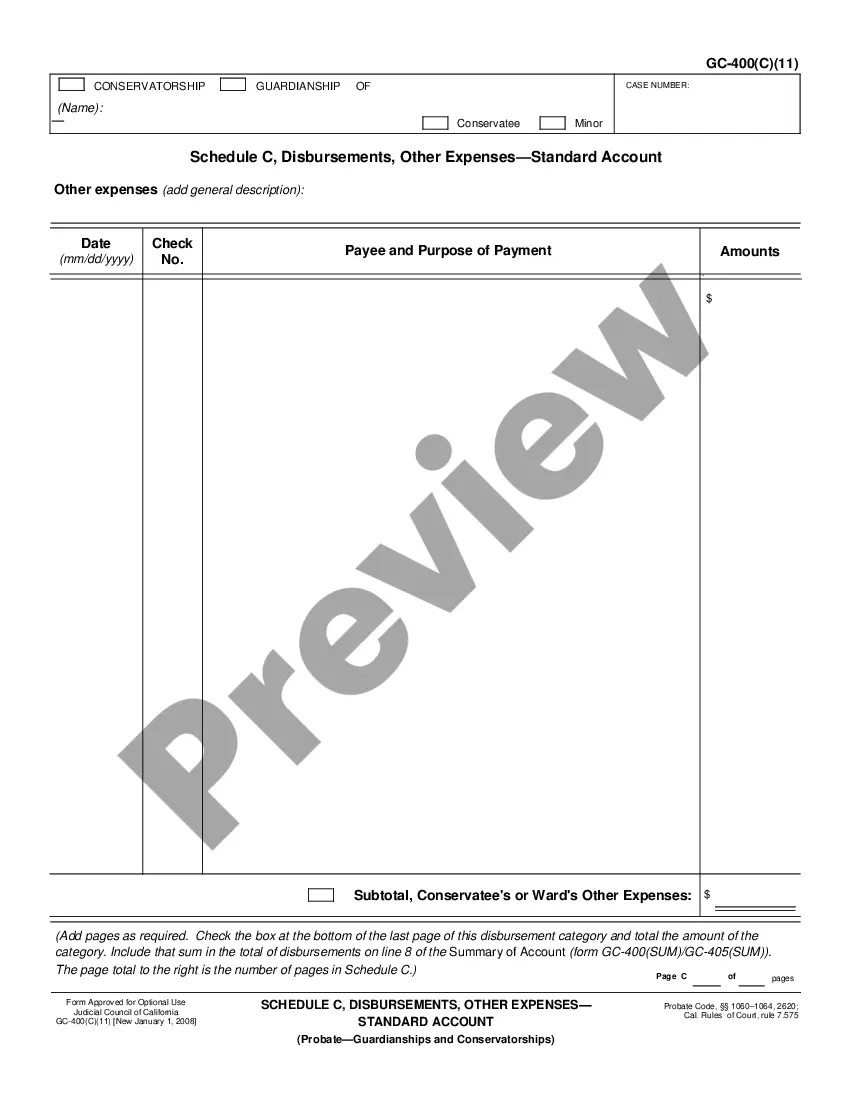

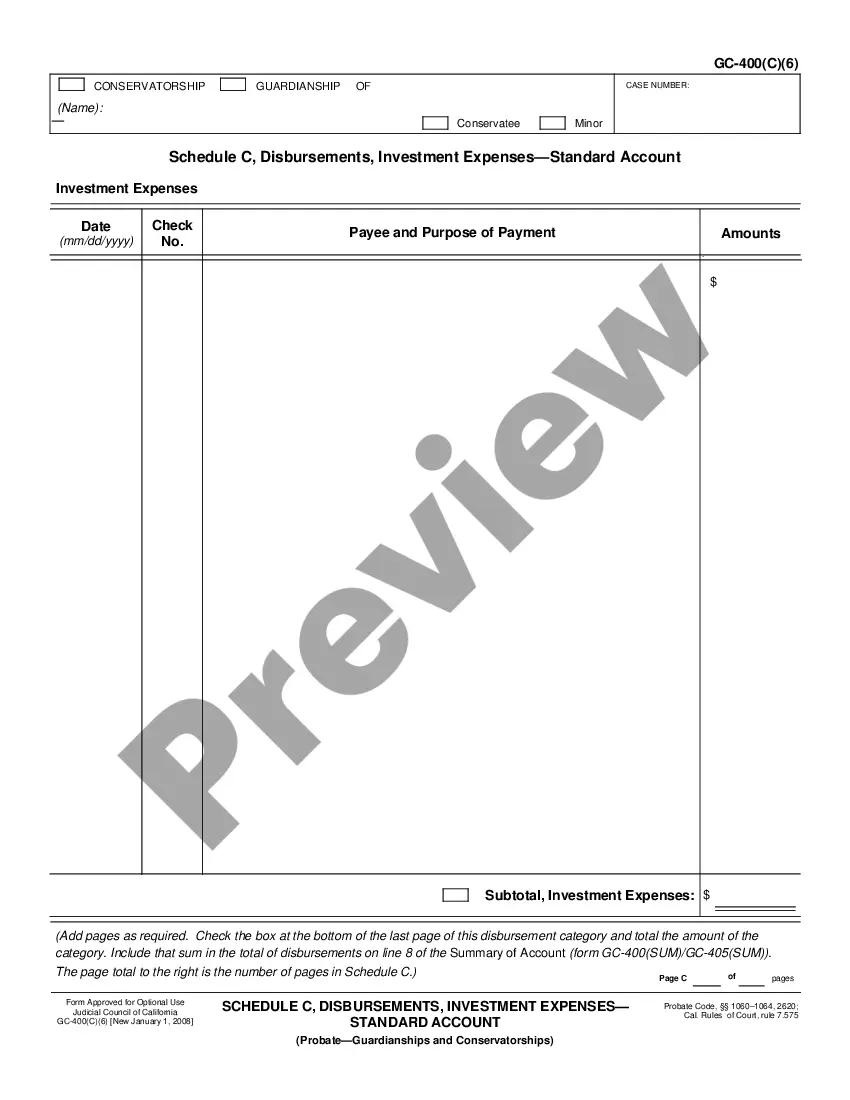

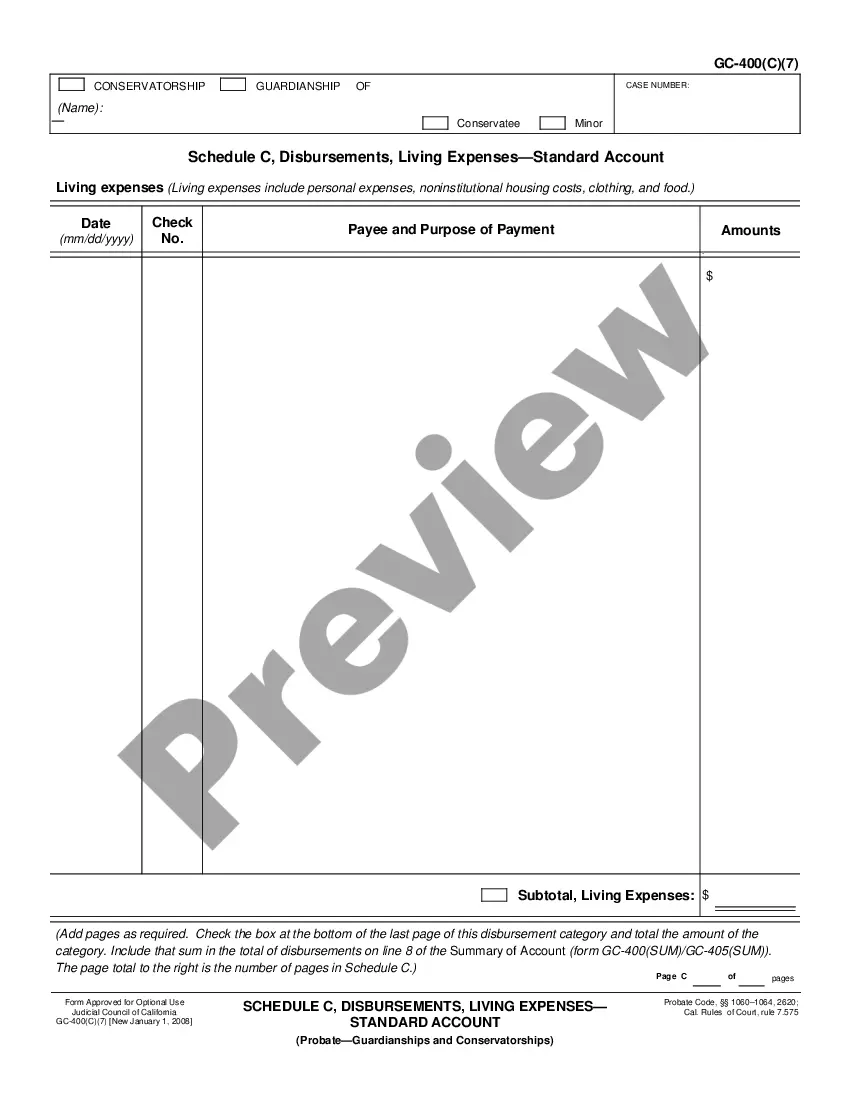

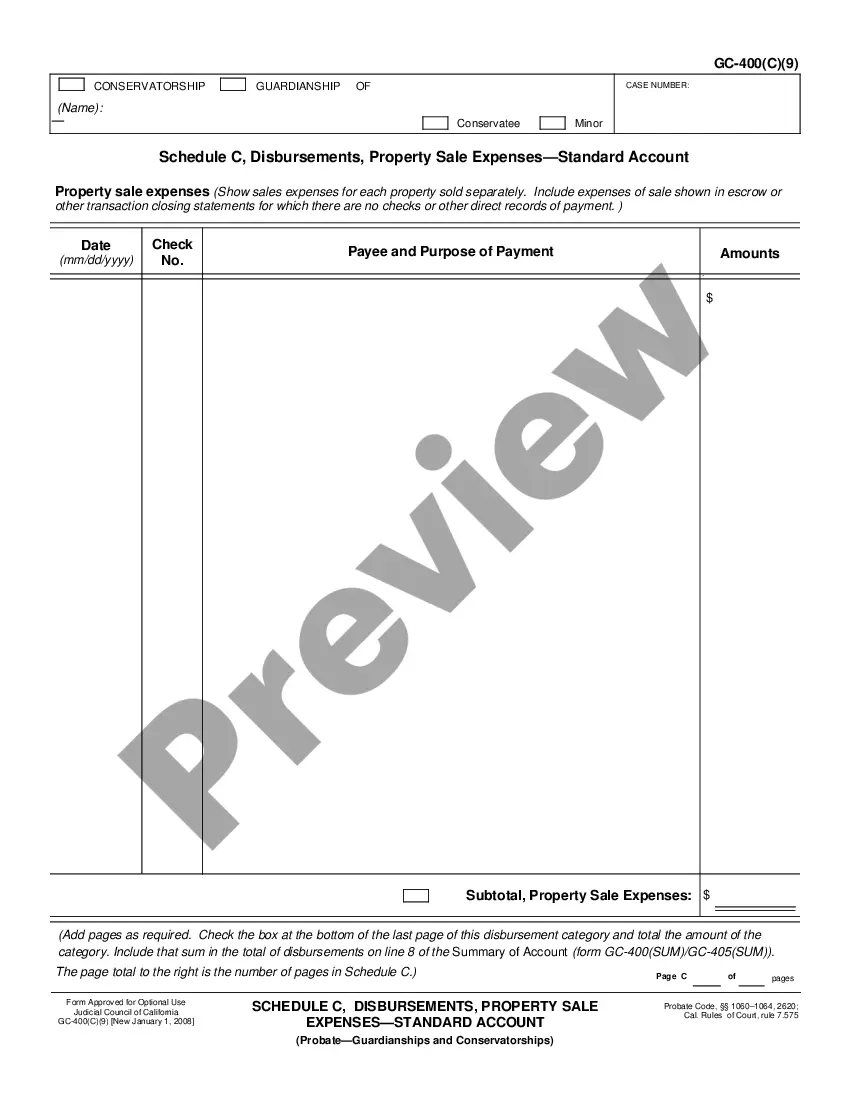

California Schedule C, Disbursements, Rental Property Expenses - Standard Account

Description

How to fill out California Schedule C, Disbursements, Rental Property Expenses - Standard Account?

If you are seeking precise California Schedule C, Disbursements, Rental Property Expenses - Standard Account templates, US Legal Forms is the perfect solution for you; obtain documents created and verified by state-certified legal experts.

Utilizing US Legal Forms not only spares you from issues related to legal documents; but also saves you time, effort, and money! Downloading, printing, and completing a professional form is significantly cheaper than hiring an attorney to do it for you.

And that's all. In a few effortless clicks, you possess an editable California Schedule C, Disbursements, Rental Property Expenses - Standard Account. Once you establish your account, all future requests will be managed even more efficiently. With a US Legal Forms subscription, simply Log In to your account and click the Download button found on the form’s page. Thus, whenever you need to access this template again, you will always be able to locate it in the My documents section. Don't waste your time and effort sifting through numerous forms on various platforms. Purchase accurate templates from a single reliable platform!

- To get started, complete your registration process by entering your email and creating a password.

- Follow the steps below to set up an account and obtain the California Schedule C, Disbursements, Rental Property Expenses - Standard Account template to solve your concerns.

- Make use of the Preview option or review the file description (if available) to ensure that the form is what you need.

- Verify its legality in your state.

- Click Buy Now to place an order.

- Choose a recommended pricing plan.

- Create your account and pay using your credit card or PayPal.

- Select a suitable format and download the form.

Form popularity

FAQ

To record rental expenses on your California Schedule C, you first need to categorize each expense accurately. Start by tracking your costs related to upkeep, repairs, and property management. It is essential to maintain clear documentation, including receipts and invoices, as these support your claims for disbursements. Using a reliable platform like uslegalforms can simplify this process, ensuring you effectively manage your rental property expenses under the Standard Account.

Classifying rental property expenses involves categorizing them based on their nature and purpose. Common categories include repairs, maintenance, and utilities, which should all be tracked under California Schedule C, Disbursements, Rental Property Expenses - Standard Account. It helps to use an organized accounting system or service like uslegalforms that allows for easy input and classification of each expense. Proper classification not only aids in accurate tax reporting but also helps you understand your property's financial performance.

To document your rental property expenses effectively, keep organized records that include receipts, invoices, and bank statements. Utilizing a reliable platform like uslegalforms can simplify the process by providing templates for expense tracking that align with California Schedule C, Disbursements, Rental Property Expenses - Standard Account requirements. Ensure that each expense is categorized correctly to support your tax filings and maximize potential deductions. A systematic approach to documentation will make tax season much easier for you.

When your rental property is not in service, you may still incur expenses that qualify for California Schedule C, Disbursements, Rental Property Expenses - Standard Account. These can include maintenance costs, property taxes, and insurance premiums, even if the property is currently unoccupied. It is important to track these expenses accurately, as they can impact your overall tax deductions. Remember, fully understanding your expenses helps you maximize your deductions once the property is back in service.

Expenses that are capitalized on a rental property typically include significant improvements, renovations, or additions that enhance property value. These costs are not deducted in the year incurred; instead, they are added to the property's basis and depreciated over time. Understanding this distinction is crucial for tax reporting, especially when using the California Schedule C, Disbursements, Rental Property Expenses - Standard Account approach. For in-depth guidance, consider utilizing resources provided by uslegalforms.

To categorize expenses for rental property, you should separate them into distinct groups such as necessary repairs, property management fees, and utilities. Each expense category should be accurately recorded in your bookkeeping system, such as the California Schedule C format. This organized approach enhances clarity and helps you better assess the financial performance of your rental properties. For further assistance, you can explore uslegalforms for helpful resources.