Florida Payroll Deduction — Special Services is a convenient and efficient method provided for employees in Florida to manage their finances effortlessly. Payroll deduction refers to the process of deducting a predetermined amount from an employee's salary or wages and allocating it towards various special services offered within Florida. This automated process ensures that employees have a seamless way to access and pay for these special services without any additional effort. There are several types of Florida Payroll Deduction — Special Services available to employees, catering to different needs and preferences. These include: 1. Health Insurance Premiums: Employees can opt to have their health insurance premiums deducted directly from their payroll. This ensures that they never miss a payment and guarantees continuous coverage. 2. Retirement Contributions: Florida offers various retirement plans, such as the Florida Retirement System (FRS), and employees can choose to contribute a certain percentage of their earnings towards their retirement fund. This deduction is automatically taken from their paycheck and deposited into their retirement account, helping them save for the future. 3. Charitable Donations: Employees can participate in charitable giving programs through payroll deduction. These programs allow employees to choose a charitable organization or multiple organizations of their preference, and a designated amount is deducted from their paycheck each pay period. This effortless process makes it easy for employees to contribute to causes they care about. 4. Savings Accounts: Florida Payroll Deduction — Special Services also include the option to contribute to various savings accounts. Employees can opt for deductions towards college savings plans, emergency funds, or general savings accounts. This helps individuals build financial resilience and prepare for future expenses. 5. Parking Fees and Transit Passes: Some employers in Florida provide the option for employees to deduct parking fees or monthly transit passes directly from their payroll. This convenient service ensures that transportation expenses are taken care of effortlessly and promotes eco-friendly practices. 6. Gym Memberships: Certain employers offer gym memberships and wellness programs as special services. Employees can choose to have the membership fees deducted from their payroll, encouraging them to prioritize their physical and mental well-being conveniently. It is important to note that the availability and types of Florida Payroll Deduction — Special Services may vary depending on the employer and the specific agreements they have in place. Employees are advised to consult with their employers or HR departments to understand the services available to them and the requisite procedures to enroll in these services. Overall, the Florida Payroll Deduction — Special Services provide employees with a hassle-free way to access and manage various financial services, ensuring convenience and peace of mind.

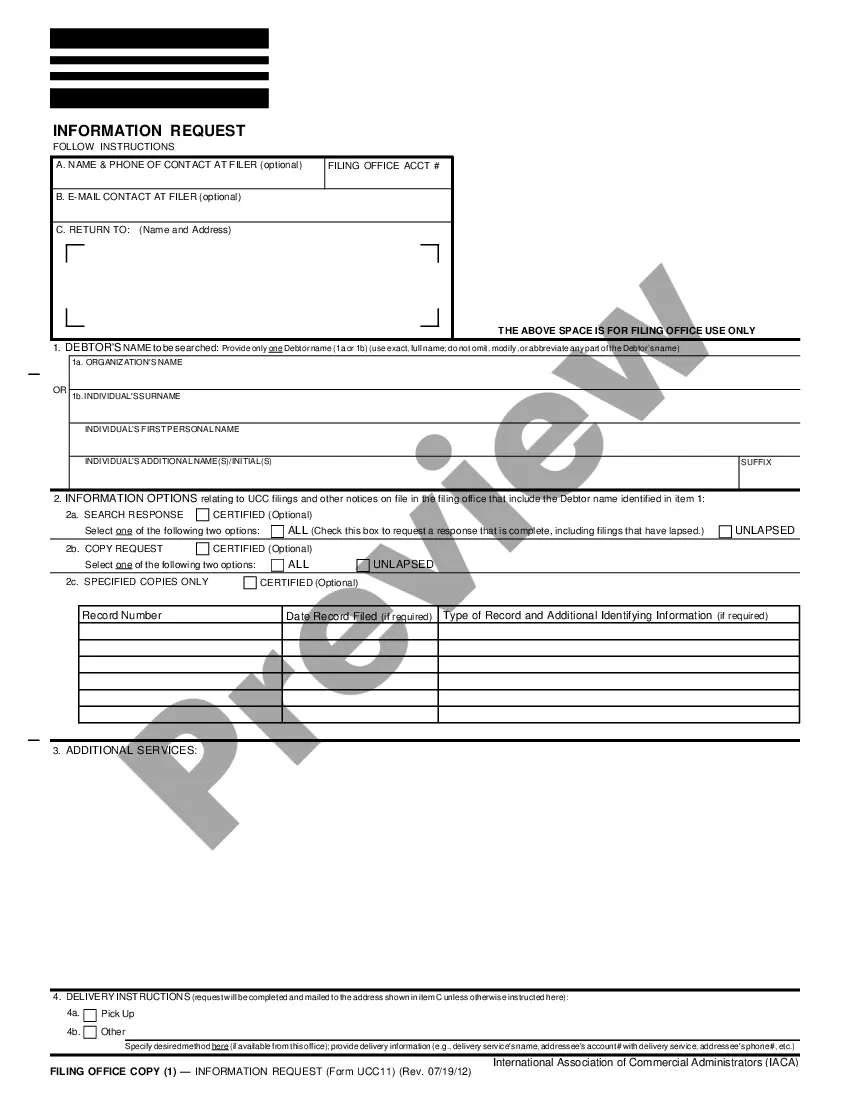

Florida Payroll Deduction - Special Services

Description

How to fill out Florida Payroll Deduction - Special Services?

Are you within a placement that you need to have paperwork for both enterprise or person purposes virtually every day time? There are tons of legal record themes available on the net, but locating versions you can rely on is not effortless. US Legal Forms gives a large number of form themes, much like the Florida Payroll Deduction - Special Services, that are written to fulfill federal and state needs.

If you are presently acquainted with US Legal Forms website and have an account, merely log in. Following that, you can download the Florida Payroll Deduction - Special Services design.

Should you not have an account and want to begin using US Legal Forms, follow these steps:

- Find the form you want and make sure it is to the correct city/region.

- Make use of the Preview switch to review the shape.

- Browse the outline to actually have chosen the correct form.

- When the form is not what you`re searching for, use the Lookup field to discover the form that fits your needs and needs.

- If you obtain the correct form, click Get now.

- Pick the rates prepare you need, submit the specified information to make your money, and pay money for the order with your PayPal or credit card.

- Decide on a practical paper structure and download your version.

Find every one of the record themes you may have bought in the My Forms food selection. You can get a additional version of Florida Payroll Deduction - Special Services anytime, if required. Just click the necessary form to download or produce the record design.

Use US Legal Forms, the most substantial variety of legal forms, in order to save time as well as stay away from faults. The services gives professionally manufactured legal record themes that you can use for a selection of purposes. Make an account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

Running Payroll in FloridaStep by Step InstructionsStep 1: Set up your business as an employer.Step 2: Register with Florida.Set up your payroll process.Step 4: Collect employee payroll forms.Step 5: Collect, review, and approve time sheets.Step 6: Calculate payroll and pay employees plus taxes.More items...?

What are payroll deductions?Income tax.Social security tax.401(k) contributions.Wage garnishments.Child support payments.

Pre-tax deductions: Medical and dental benefits, 401(k) retirement plans (for federal and most state income taxes) and group-term life insurance. Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments. Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations.

There are four basic types of payroll taxes: federal income, Social Security, Medicare, and federal unemployment. Employees must pay Social Security and Medicare taxes through payroll deductions, and most employers also deduct federal income tax payments.

There are three basic categories of deductions employers make from pay: legally required deductions, deductions for the employer's convenience and deductions for the employee's benefit.

Some mandatory payroll tax deductions that employers are required by law to withhold from an employee's paycheck include: Federal income tax withholding. Social Security & Medicare taxes also known as FICA taxes. State income tax withholding.

Some common voluntary payroll deduction plan examples include: 401(k) plan, IRA, or other retirement savings plan contributions. Medical, dental, or vision health insurance plans. Flexible spending account or pre-tax health savings account contributions.

Payroll deductions are the specific amounts that you withhold from an employee's paycheck each pay period. There are two types of deductions: voluntary deductions, such as health insurance and 401(k) deductions, and mandatory deductions (those required by law), such as federal income taxes and FICA taxes.