Florida Hardware Purchase and Software License Agreement

Description

How to fill out Hardware Purchase And Software License Agreement?

Selecting the optimal authorized document template can be challenging.

Clearly, there are numerous templates accessible online, but how do you find the authorized form you require.

Utilize the US Legal Forms website. The platform provides thousands of templates, including the Florida Hardware Purchase and Software License Agreement, which can be utilized for both business and personal purposes.

If the form does not satisfy your needs, use the Search field to find the appropriate form. Once you are convinced that the form is accurate, click the Buy now button to purchase the form. Choose the payment plan you prefer and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the authorized document template to your device. Complete, edit, print, and sign the obtained Florida Hardware Purchase and Software License Agreement. US Legal Forms is the largest collection of legal forms where you can explore various document templates. Use the service to acquire professionally crafted documents that meet state requirements.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Acquire button to obtain the Florida Hardware Purchase and Software License Agreement.

- Use your account to browse through the authorized forms you have bought previously.

- Navigate to the My documents tab in your account and download an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have chosen the correct form for your city/state. You can browse the template using the Review button and examine the form details to confirm it is the right one for you.

Form popularity

FAQ

Software licenses in Florida can have tax implications, generally depending on how the software is delivered or accessed. For taxable software, users may incur sales tax on the license purchase. It’s crucial to review local laws or consult a tax professional, especially when considering a Florida Hardware Purchase and Software License Agreement.

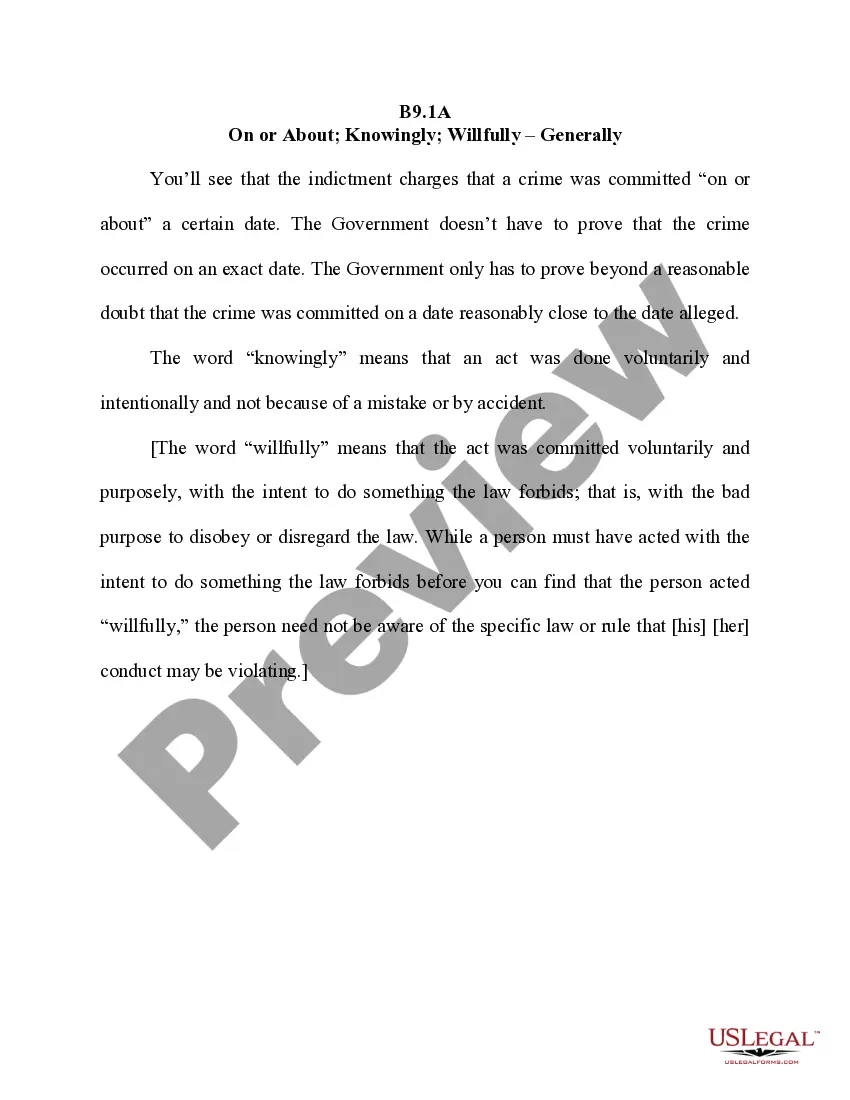

Licensing is a legal permission granting someone the right to use a product or intellectual property. In technology, it often refers to software use rights, such as those found in a Florida Hardware Purchase and Software License Agreement. Understanding licensing can enhance your compliance and usage strategies.

An example of a licensing agreement is when a technology firm licenses its software to another company for specific use. This agreement will specify the terms, such as fees and length of use. If you need guidance, consider using a template for a Florida Hardware Purchase and Software License Agreement from US Legal Forms.

A Service Level Agreement (SLA) focuses on the performance and quality of service, while an End User License Agreement (EULA) outlines how software can be used. Both agreements serve different functions; however, a Florida Hardware Purchase and Software License Agreement often incorporates aspects of both. Understanding these distinctions can guide you in your licensing journey.

Coca-Cola operates using licensing agreements for its brand and products. They allow other companies to produce beverages under the Coca-Cola name, indicating a commercial strategy based on licensing. If you are interested in licensing in a different context, explore how a Florida Hardware Purchase and Software License Agreement might apply.

A common example of a licensed product is software that requires a license key for users to access or use the program. This could include anything from productivity applications to video games. Understanding these products may help you better navigate a Florida Hardware Purchase and Software License Agreement.

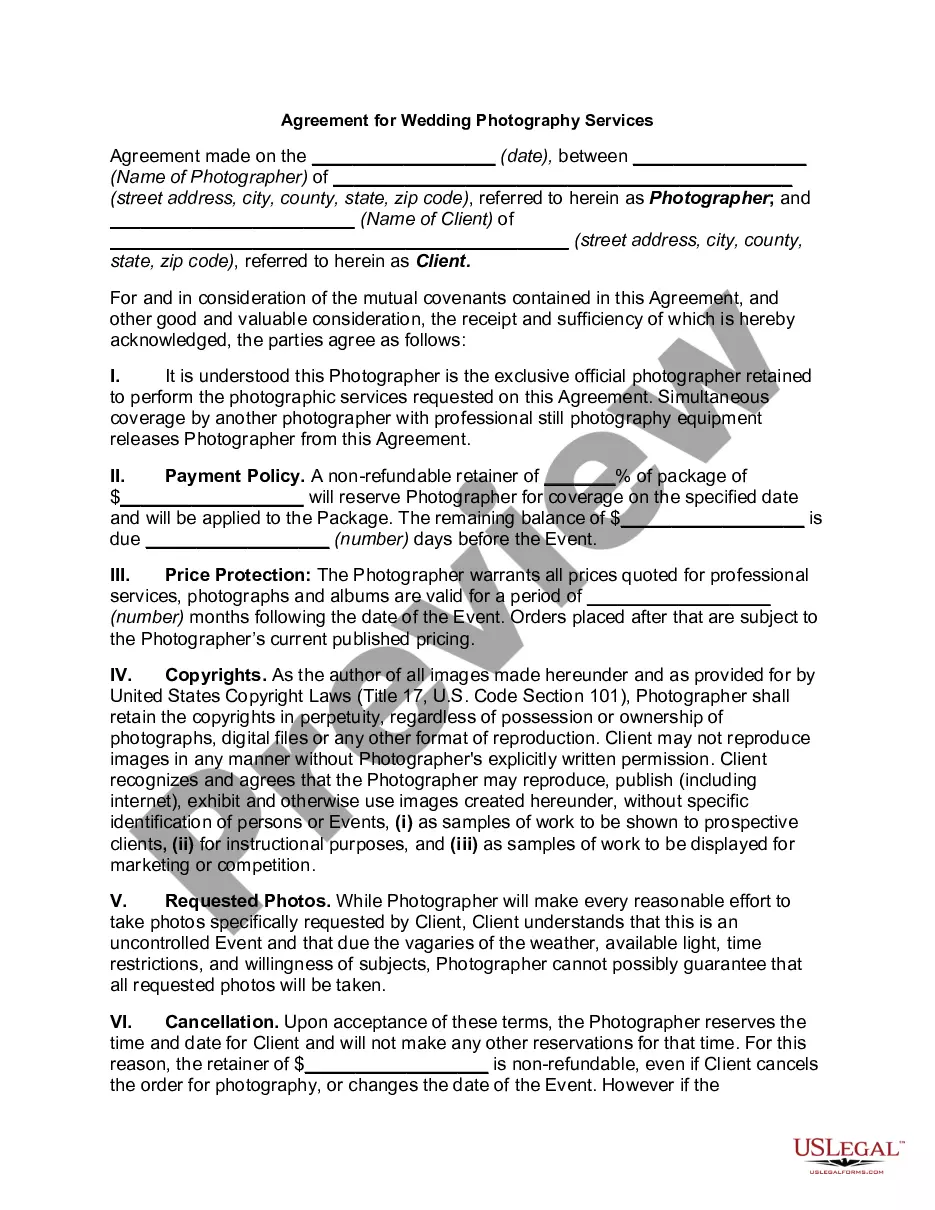

When writing a user license agreement, outline the rights granted to the user and any restrictions that apply. Specify how the software or hardware can be used to avoid misuse. Consider using US Legal Forms to find an example that incorporates key elements of a Florida Hardware Purchase and Software License Agreement.

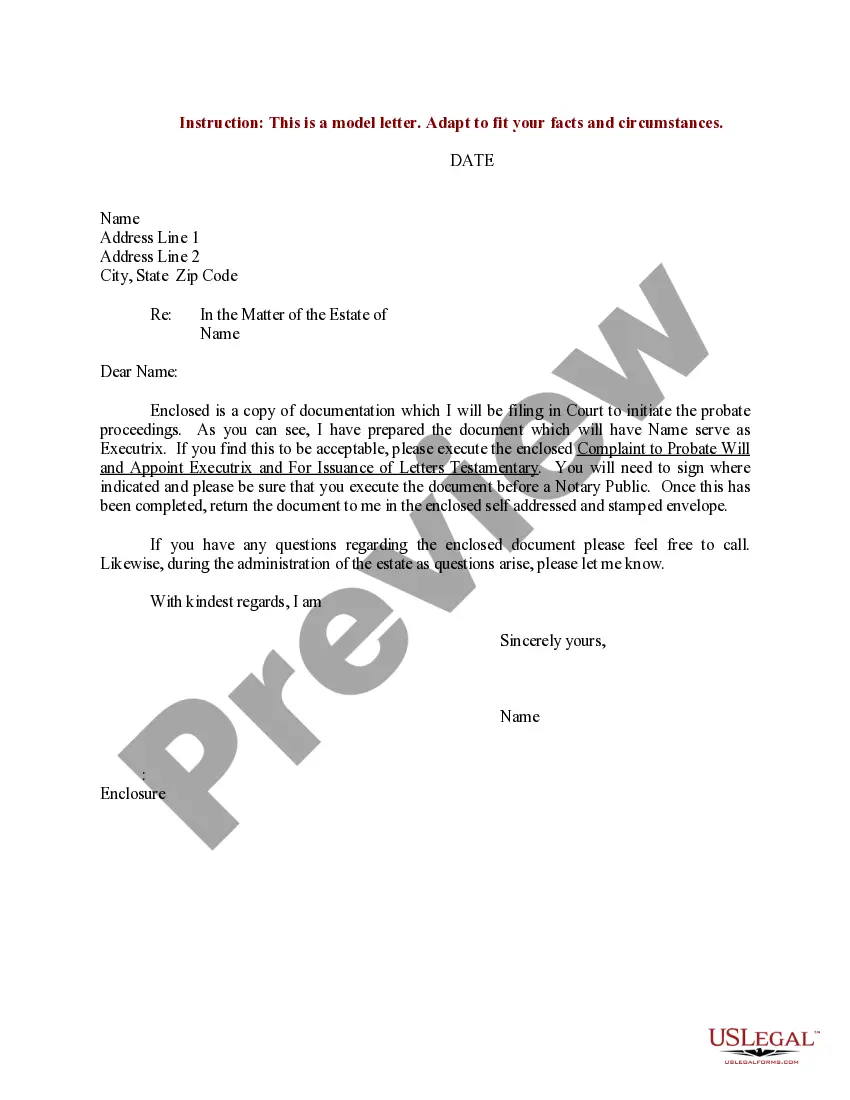

To create a licensing agreement, start by clearly defining the parties involved, the licensed products, and the scope of use. Include specific terms regarding fees, duration, and limitations. Be sure to consult resources, such as US Legal Forms, for templates that can guide you in drafting a Florida Hardware Purchase and Software License Agreement that meets your needs.