Florida LLC Operating Agreement - Taxed as a Partnership

Description

How to fill out LLC Operating Agreement - Taxed As A Partnership?

If you wish to finish, retrieve, or print authorized document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you need.

Various templates for commercial and personal purposes are categorized by types and regions, or by keywords.

Step 4. Once you have found the form you need, select the Get now button. Choose the pricing plan you prefer and enter your details to sign up for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to process the payment.

- Utilize US Legal Forms to acquire the Florida LLC Operating Agreement for S Corp with just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and hit the Acquire button to find the Florida LLC Operating Agreement for S Corp.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the guidelines below.

- Step 1. Make sure you have selected the form for the correct state/region.

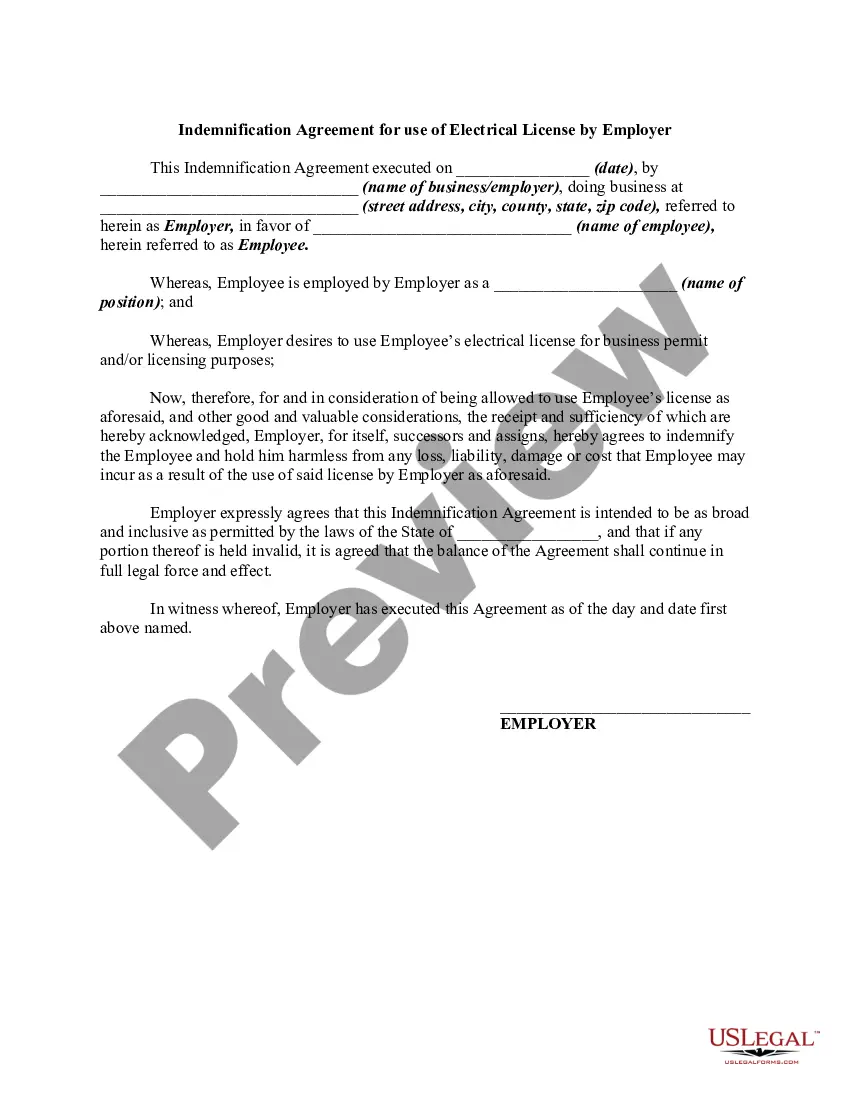

- Step 2. Use the Preview option to review the form's content. Be sure to read the information carefully.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To add a partner to an LLC in Florida, members must follow the guidelines set forth in the operating agreement. If you do not have an existing agreement, you should create one that includes partnership procedures. This might involve drafting an amendment and obtaining member approval. If your LLC is structured with a Florida LLC Operating Agreement - Taxed as a Partnership, ensure that you reflect new ownership proportions and other relevant details in your documentation effectively.

Florida doesn't require that you have an Operating Agreement for your Limited Liability Company (LLC), but it is recommended that you have one. When setting up your company, it's beneficial to seek legal advice from a Florida LLC Business litigation attorney.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business.

Once you have confirmed that the name is available, you may begin the LLC filing process.Step 1 Nominate a Registered Agent.Step 2 Entity Type.Step 3 Filing Fee.Step 4 Operating Agreement.Step 5 Employer Identification Number (EIN)

The Florida LLC articles of organization require the following information:The LLC's name and principal place of business.Registered agent's name and Florida street address (P.O.Registered agent's signature.Names and addresses of the LLC's members.Name and address of the LLC's manager if manager-managed.More items...

If you do choose to draft an LLC Operating Agreement for your Florida LLC, there is no requirement for it to be notarized. You can simply print out the agreement, have all members sign it, give a copy to all members, and keep an additional copy on file.

Similarly, corporations (S corps and C corps) are not legally required by any state to have an operating agreement, but experts advise owners of these businesses to create and execute their version of an operating agreement, called bylaws.

A Florida LLC operating agreement is a legal document that allows the member(s)/owner(s) of a business to outline the initial formation articles, standard operating procedures, and other important aspects of the entity that shall be agreed upon by its members.

Florida doesn't require that you have an Operating Agreement for your Limited Liability Company (LLC), but it is recommended that you have one. When setting up your company, it's beneficial to seek legal advice from a Florida LLC Business litigation attorney.