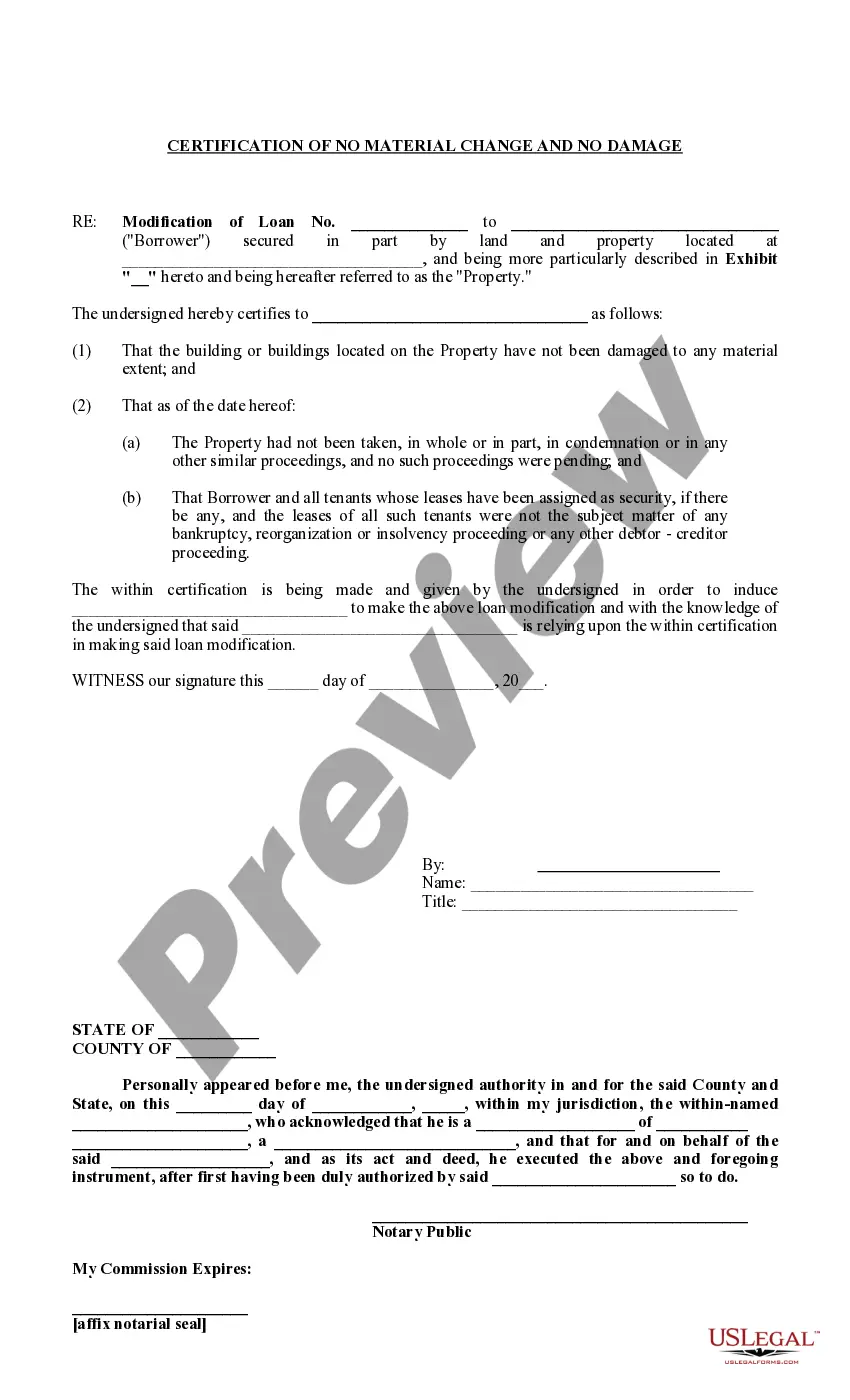

Florida Borrowers Certification of No Material Change No Damage

Description

How to fill out Borrowers Certification Of No Material Change No Damage?

Discovering the right lawful file design can be a battle. Naturally, there are a lot of templates available on the Internet, but how do you get the lawful form you need? Utilize the US Legal Forms web site. The assistance gives a large number of templates, including the Florida Borrowers Certification of No Material Change No Damage, that can be used for enterprise and private needs. All of the types are examined by experts and meet up with federal and state requirements.

Should you be already registered, log in in your account and click on the Obtain option to get the Florida Borrowers Certification of No Material Change No Damage. Use your account to appear with the lawful types you may have acquired previously. Proceed to the My Forms tab of your respective account and acquire an additional version from the file you need.

Should you be a fresh consumer of US Legal Forms, listed here are straightforward guidelines for you to stick to:

- Initially, make certain you have selected the proper form to your metropolis/county. You may look through the form making use of the Preview option and look at the form outline to guarantee it is the best for you.

- In case the form will not meet up with your preferences, use the Seach field to discover the correct form.

- When you are certain the form is proper, click the Acquire now option to get the form.

- Select the costs strategy you want and type in the necessary information. Create your account and pay for the order with your PayPal account or credit card.

- Pick the document formatting and acquire the lawful file design in your product.

- Full, change and printing and indicator the attained Florida Borrowers Certification of No Material Change No Damage.

US Legal Forms is definitely the biggest local library of lawful types that you can find various file templates. Utilize the company to acquire professionally-produced files that stick to state requirements.

Form popularity

FAQ

Borrower Certification means, with respect to any request for a Loan, a certification of the Borrower stating that (i) no Default or Event of Default will occur or be continuing after giving effect to such Loan, and (ii) the proceeds of such Loan will be used solely for Permitted Uses.

(20) ?Material change? means a change that would be important to a reasonable borrower in making a borrowing decision, and includes a change in the interest rate previously offered a borrower, a change in the type of loan offered to a borrower, or a change in fees to be charged to a borrower resulting in total fees ...

The borrower's certification and authorization also authorizes the lender to share information in the loan application with other parties. It also gives the lender the right to verify information in the loan application, credit application, and employment history.

Summary. This certificate of borrower (limited liability company) is a form of officer's certificate delivered by a borrower (that is organized as a limited liability company) to the lender at the closing of an acquisition loan transaction.

The first is that you certify that all information you have given ? on the application, and in subsequent paperwork ? is true and complete. Secondly, you are authoring the release of credit, employment, and other information as needed to process and close your home loan.

Definition 1: The borrower's certification and authorization also authorizes the lender to share information in the loan application with other parties. It also gives the lender the right to verify information in the loan application, credit application, and employment history.

The borrower authorization form is a standard form that is signed by a loan applicant authorizing the lender to verify his/her information from a third party.

The rule prohibits a creditor or any other person from paying, directly or indirectly, compensation to a mortgage broker or any other loan originator that is based on a mortgage transaction's terms or conditions, except the amount of credit extended.