Florida Release and Indemnification of Personal Representative by Heirs and Devisees

Description

How to fill out Release And Indemnification Of Personal Representative By Heirs And Devisees?

If you require extensive, download, or printing legal document formats, use US Legal Forms, the largest assortment of legal templates available online.

Take advantage of the site's simple and user-friendly search to find the documents you need.

Various forms for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you want, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Florida Release and Indemnification of Personal Representative by Heirs and Devisees with just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Obtain button to receive the Florida Release and Indemnification of Personal Representative by Heirs and Devisees.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

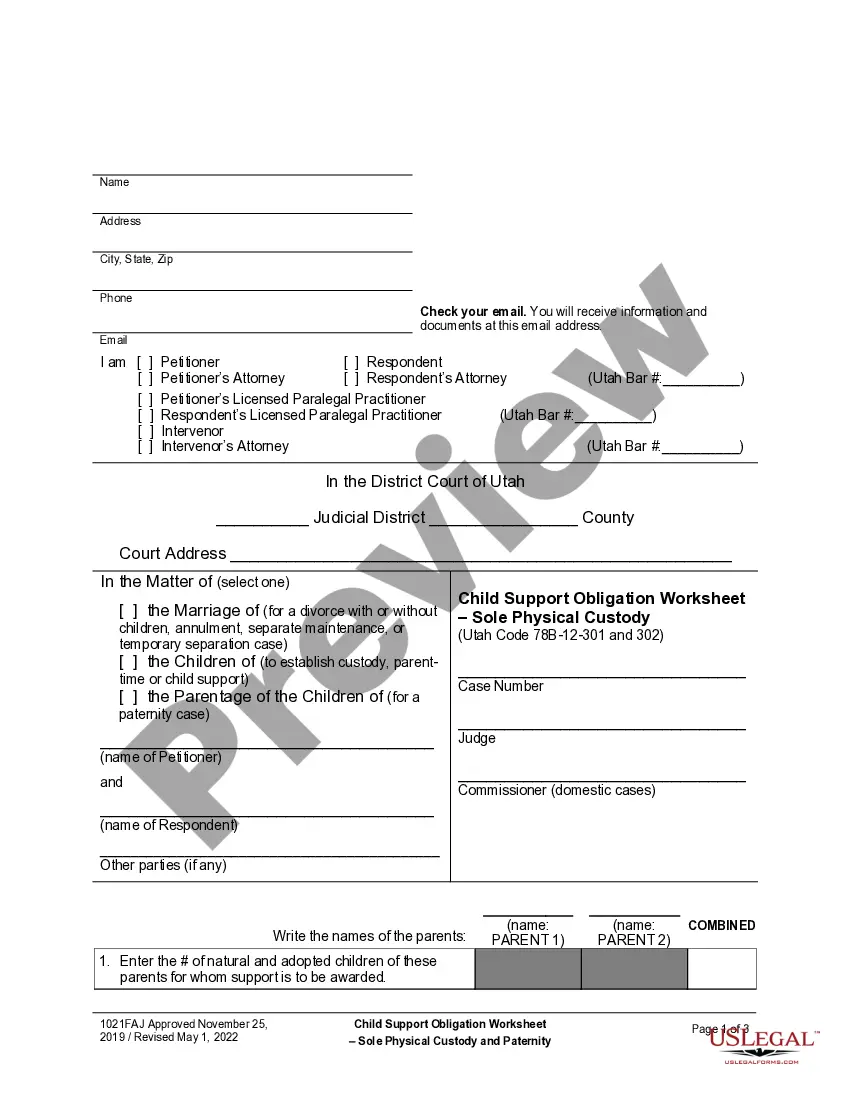

- Step 2. Use the Preview feature to review the form’s content. Be sure to read all information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms within the legal document library.

Form popularity

FAQ

Under Florida intestate succession laws, biological children hold the strongest inheritance rights of any type of child. This applies regardless of if the children were born within a marriage or not, as long as paternity can be proven, either via science or your own recognition prior to your death.

If a beneficiary believes that an estate is not being properly administered, then it is possible for them to apply to the court to substitute or remove an executor or personal representative.

The formal probate administration usually takes 6-9 months under most circumstances - start to finish. This process includes appointing a personal representative (i.e., the "executor"), a 90 days creditor's period that must run, payment of creditor's claims and more.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

A personal representative may be removed and the letters revoked for any of the following causes:(1) Adjudication that the personal representative is incapacitated.(2) Physical or mental incapacity rendering the personal representative incapable of the discharge of his or her duties.More items...

It is a common misconception that an executor can not be a beneficiary of a will. An executor can be a beneficiary but it is important to ensure that he/she does not witness your will otherwise he/she will not be entitled to receive his/her legacy under the terms of the will.

Yes. A personal representative can also be a named beneficiary in the decedent's will. For example, in a family with four siblings, one of the siblings or even the spouse may act as a personal representative. There is no law against it as long as the individual is mentally and physically fit to perform the duties.

When making a will, people often ask whether an executor can also be a beneficiary. The answer is yes, it's perfectly normal (and perfectly legal) to name the same person as an executor and a beneficiary in your will.

Executors are prohibited from acting in a manner that does not benefit the estate, heirs, and beneficiaries. If necessary, heirs may need to initiate litigation to suspend, remove, or replace the person as executor. At Mark R.

An executor (in Florida, a personal representative) can be removed from continuing to administer the Florida probate for a handful of reasons, once appointed, as set out in Fla. Stat. §733.504. Hostility or simply not getting along with the beneficiaries is not enough to be cause for removal.