Florida Checklist - Action to Improve Collection of Accounts

Description

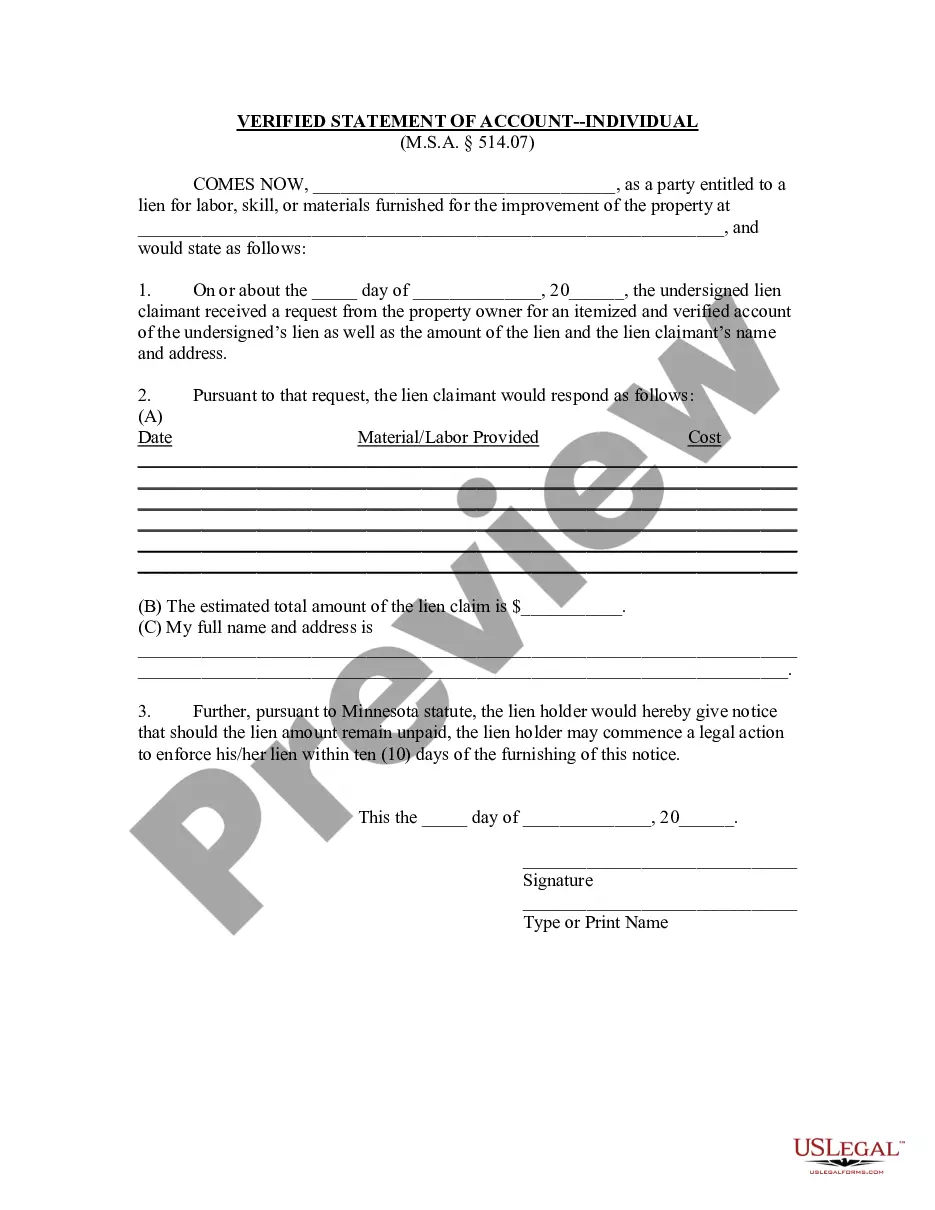

How to fill out Checklist - Action To Improve Collection Of Accounts?

If you need to thorough, obtain, or replicate legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's intuitive and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to locate other versions of the legal form template.

Step 4. Once you have found the form you desire, select the Purchase now option. Choose the pricing plan you prefer and enter your details to create an account.

- Utilize US Legal Forms to access the Florida Checklist - Action to Enhance Accounts Receivable in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to retrieve the Florida Checklist - Action to Enhance Accounts Receivable.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to examine the form’s content. Remember to read the details.

Form popularity

FAQ

The collection process typically includes identifying overdue accounts, sending reminders, and discussing payment options with clients. Each step is crucial to securing payments and maintaining positive relationships. Additionally, utilizing a Florida Checklist - Action to Improve Collection of Accounts can help you streamline your efforts and improve recovery rates.

The collections process involves several key steps to ensure success. Initially, you'll want to organize your accounts and identify overdue debts. Next, communicate with clients effectively to remind them of their obligations. Finally, consider using our Florida Checklist - Action to Improve Collection of Accounts as a guide to enhance efficiency and tackle any outstanding payments.

To improve receivables collection, consider using a streamlined invoicing system to ensure timely billing. Adopting measures outlined in the Florida Checklist - Action to Improve Collection of Accounts will help you track aged receivables more efficiently. Additionally, the uslegalforms platform offers various templates and tools that can assist you in managing your accounts receivable effectively. With these resources, you can increase your collection success while reducing overdue accounts.

To enhance debtors collection, it is essential to establish clear communication with clients. Regular follow-ups can help remind them of outstanding accounts. Implementing a structured process from the Florida Checklist - Action to Improve Collection of Accounts can guide you effectively. Tools and resources from the uslegalforms platform can simplify this process, ensuring you remain organized while increasing your recovery rates.

Improving debtor collection involves establishing a consistent communication strategy with your debtors. Regular follow-ups can help maintain the importance of timely payments. Moreover, the Florida Checklist - Action to Improve Collection of Accounts offers actionable items that will assist you in refining your debtor management process, helping you achieve better results.

To improve receivable management, consider adopting a centralized system for tracking invoices and payments. Frequent analysis of your accounts receivable aging reports can also highlight overdue accounts. The Florida Checklist - Action to Improve Collection of Accounts will provide you with effective strategies to enhance your management practices.

Strategies such as sending out timely invoices, maintaining open communication with clients, and setting clear payment terms can significantly enhance your receivables collection. Additionally, utilizing the Florida Checklist - Action to Improve Collection of Accounts will help you identify key areas for improvement in your approach.

Improving collections starts with evaluating your current processes. Consider implementing regular training for your staff to handle collections effectively, and adopt technology solutions to track payments. The Florida Checklist - Action to Improve Collection of Accounts outlines specific strategies to help you streamline these efforts and enhance your overall collection rates.

The first step you can take is to establish a clear and consistent billing process. Implementing a structured system helps ensure timely invoicing and follow-ups. Additionally, using the Florida Checklist - Action to Improve Collection of Accounts can guide you in optimizing your existing procedures, promoting efficiency.

To enhance efficiency in the collection process, integrate technology that automates routine tasks, such as sending payment reminders. The Florida Checklist - Action to Improve Collection of Accounts can guide you in implementing these technological solutions effectively. This reduces manual work and allows your team to focus on more complex issues.