Florida Checklist - Key Record Keeping

Description

How to fill out Checklist - Key Record Keeping?

If you need to obtain, download, or create legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Leverage the site's user-friendly search function to find the documents you require.

A variety of templates for commercial and personal purposes are sorted by categories and states, or keywords.

Step 4. Once you've found the form you need, click the Buy Now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You may use a credit card or PayPal account to finalize the payment. Step 6. Select the format of the legal document and download it to your device. Step 7. Fill out, modify, and print or sign the Florida Checklist - Key Record Keeping. Every legal document template you acquire is yours permanently. You will have access to all forms you saved in your account. Click the My documents section and select a form to print or download again. Compete and download, and print the Florida Checklist - Key Record Keeping with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Florida Checklist - Key Record Keeping with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Florida Checklist - Key Record Keeping.

- You can also view forms you've previously saved under the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you've selected the form pertinent to the correct city/state.

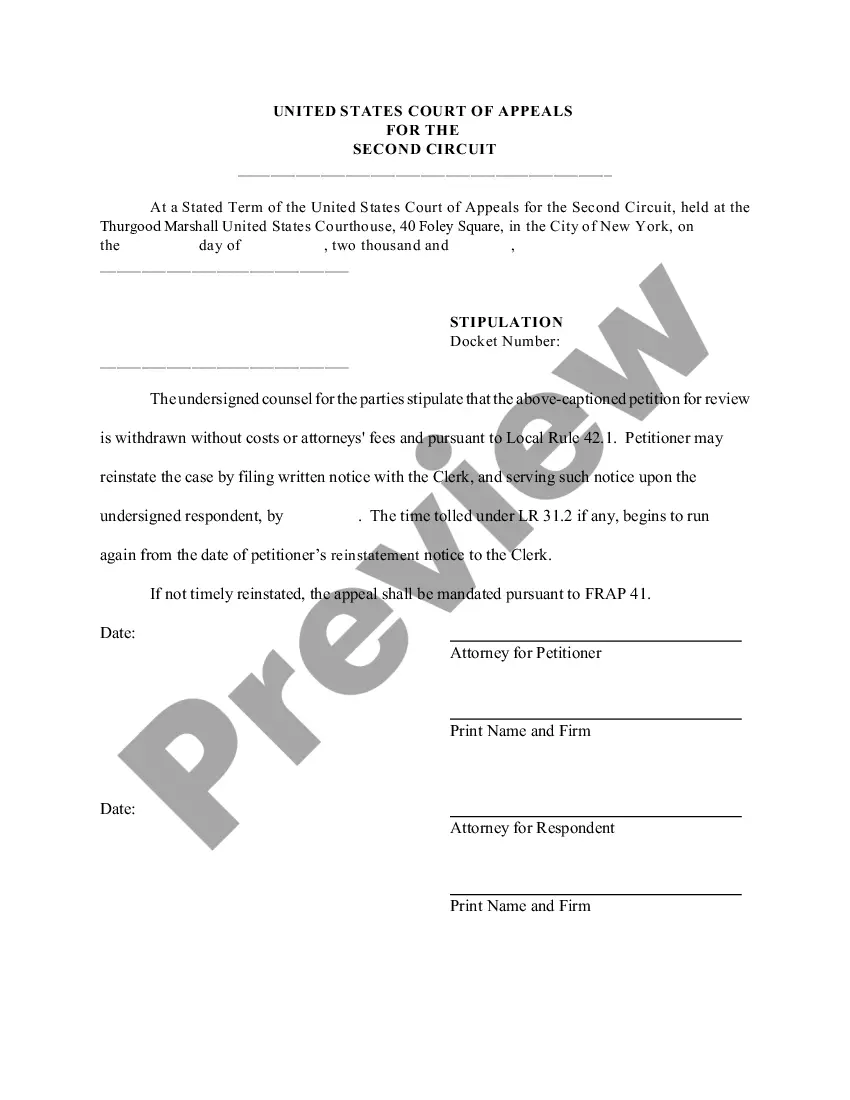

- Step 2. Use the Preview feature to review the form's content. Remember to read the description.

- Step 3. If you’re unsatisfied with the form, use the Search box at the top of the page to discover alternative legal form templates.

Form popularity

FAQ

In Florida, a homeowners association (HOA) must retain certain records for a minimum of seven years. This requirement ensures that all documentation related to financial transactions, meeting minutes, and other essential activities are available for review. Keeping comprehensive records is a vital part of effective management and aligns with the Florida Checklist - Key Record Keeping. You can simplify your record-keeping process through platforms like USLegalForms, which provides useful templates and guidelines to help maintain compliance.

In Florida, the duration for keeping employee records varies, but most federal and state laws require retention for at least three to seven years. For example, records related to payroll and taxes typically need to be kept for four years. To stay compliant, consider using a Florida Checklist - Key Record Keeping that outlines these requirements.

The statute of records retention in Florida varies by the type of record. For example, employment tax records must be retained for four years, while some employee documents, like I-9 forms, must be kept for three years after hiring or one year post-termination. A comprehensive Florida Checklist - Key Record Keeping can help you navigate these regulations effectively.

Florida law requires employers to retain certain employee records for specific periods. Generally, payroll and tax-related records need to be kept for a minimum of four years, but many documents, like those related to health and safety, may need to be stored longer. It is essential to follow a Florida Checklist - Key Record Keeping to ensure compliance with all state regulations.

Three of the seven important rules of good record keeping are: maintaining organized files, ensuring timely updates, and using clear labels. By organizing files, you can easily retrieve necessary information when needed. Regular updates prevent information from becoming outdated. Following a Florida Checklist - Key Record Keeping can enhance your record management efforts.

In Florida, several employee records must be retained for at least seven years. This includes payroll records, tax documents, and records of employee benefits. Keeping these records is crucial for compliance and ensures you have the necessary documentation for potential audits. Utilizing a Florida Checklist - Key Record Keeping can streamline this process.

The four key factors of proper record keeping include accuracy, accessibility, security, and retention. First, ensure that the records are accurate and reliable. Next, records should be easily accessible for authorized personnel but secure from unauthorized access. Following a Florida Checklist - Key Record Keeping will help you maintain these factors effectively.

As mentioned earlier, Florida employers typically keep employee records for at least three years after employment ends. In some cases, longer retention may be required for specific documents, such as medical records. Properly storing and managing these records is critical for compliance and audit readiness. The Florida Checklist - Key Record Keeping provides clear guidelines to help employers maintain their record-keeping practices efficiently.

The four primary types of records include personnel files, payroll records, tax documents, and health and safety records. Each of these categories serves specific purposes and has varying retention requirements. Understanding these distinctions is essential for effective record-keeping. The Florida Checklist - Key Record Keeping offers a comprehensive view of these record types and their importance.

Employers in Florida are required to maintain employee records for a minimum of three years after the employee leaves the company. However, certain records, such as tax documents, must be kept for longer periods. Adhering to this timeline promotes compliance and minimizes legal risks. Utilizing the Florida Checklist - Key Record Keeping ensures you follow the necessary guidelines accurately.