Florida Estoppel Affidavit of Mortgagor

Description

How to fill out Estoppel Affidavit Of Mortgagor?

Locating the appropriate valid document format can be challenging.

It goes without saying that there are numerous templates accessible online, but how can you find the valid document you require.

Utilize the US Legal Forms website. The service offers a multitude of templates, such as the Florida Estoppel Affidavit of Mortgagor, which you can use for both business and personal needs.

If the form does not fit your requirements, utilize the Search field to find the appropriate form.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already a registered user, Log In to your account and then click the Download option to retrieve the Florida Estoppel Affidavit of Mortgagor.

- Use your account to browse the legal forms you have previously ordered.

- Visit the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/state. You can view the form using the Preview option and read the form summary to confirm it is suitable for you.

Form popularity

FAQ

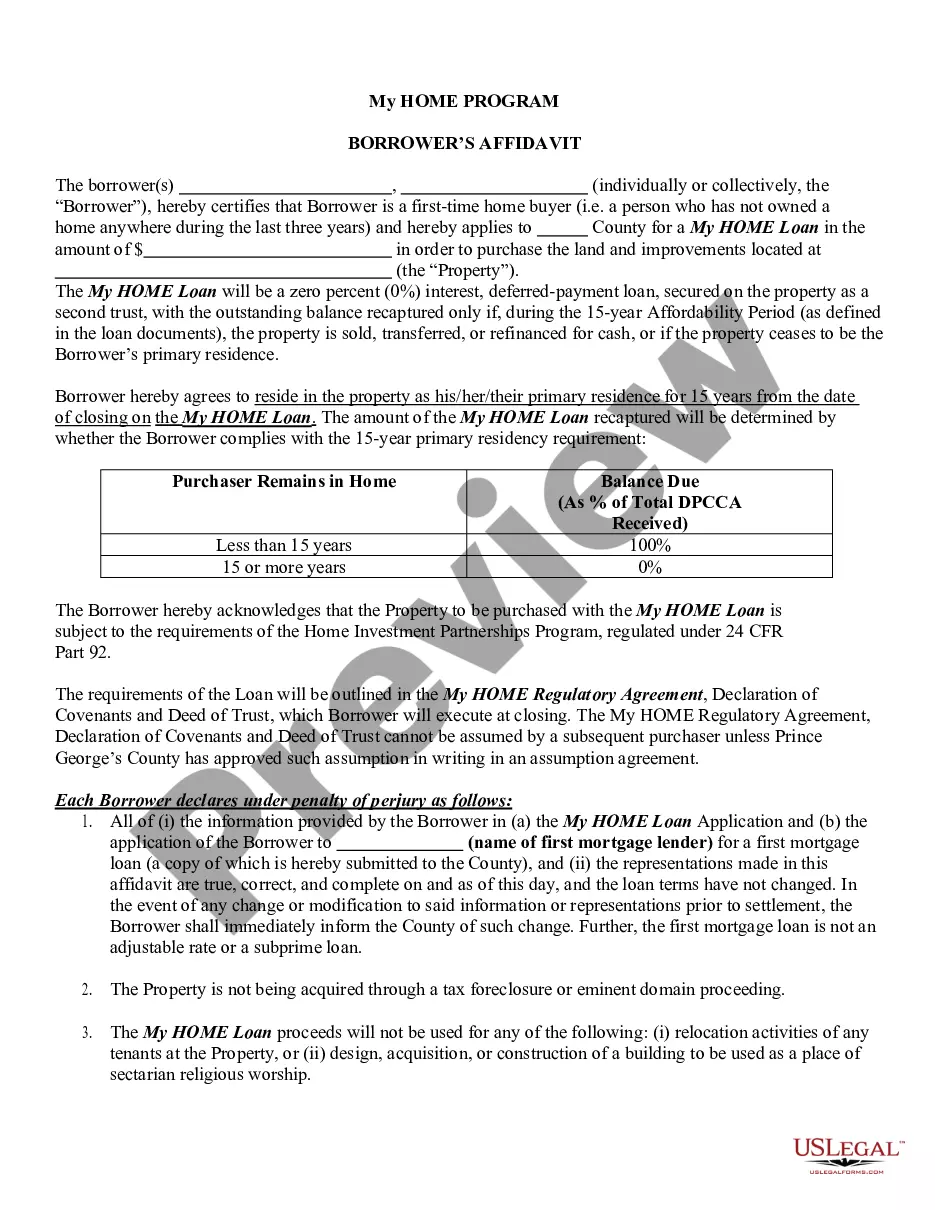

A mortgage estoppel letter serves as a formal document that outlines the details of a mortgage and confirms the amount owed by the borrower at a specific time. It acts as a declaration from the lender about the mortgage's status, making it vital during real estate transactions. Understanding the significance of a Florida Estoppel Affidavit of Mortgagor can help protect all parties involved in the sale or refinancing of a property.

Estoppel certificates are typically prepared by lenders, mortgage servicers, or their agents. They ensure that the document accurately reflects the mortgage status and any applicable terms. If you prefer to manage this process yourself, services like US Legal Forms offer tools to help you create a Florida Estoppel Affidavit of Mortgagor effectively.

Generally, the borrower or their designated representative orders the estoppel letter in Florida. This can be the mortgagor directly or a real estate professional involved in the transaction. Utilizing platforms like US Legal Forms simplifies this process, allowing you to order your Florida Estoppel Affidavit of Mortgagor easily.

The process of obtaining a Florida Estoppel Affidavit of Mortgagor typically takes a few days to a couple of weeks. It depends on various factors including the responsiveness of the involved parties and any specific requirements from lenders. You can streamline the process by using reliable services, like US Legal Forms, that assist in generating and submitting the necessary documents efficiently.

Yes, an estoppel letter is often required in Florida, particularly in real estate transactions involving mortgages. This document verifies the current status of a mortgage and discloses any outstanding payments or obligations. Therefore, obtaining a Florida Estoppel Affidavit of Mortgagor can be essential for ensuring smooth property transfers and preventing disputes.

The new estoppel law in Florida enhances the clarity and efficiency of real estate transactions. Under this law, specific requirements and timelines are established for providing estoppel letters. This aims to protect both buyers and sellers by ensuring that accurate information is readily available. A Florida Estoppel Affidavit of Mortgagor can serve as a helpful tool in navigating these updated regulations.

In Florida, the responsibility for obtaining the estoppel letter typically falls on the borrower or the mortgagor. The lender may also request this document to ensure proper communication regarding any outstanding debts or obligations. This is crucial for rectifying misunderstandings during property transfers. Utilizing a Florida Estoppel Affidavit of Mortgagor can streamline this process and provide clarity for all parties involved.