Florida Accounts Receivable Write-Off Approval Form

Description

How to fill out Accounts Receivable Write-Off Approval Form?

Have you ever been in a situation where you find yourself needing documentation for either organizational or personal reasons almost all the time.

There are numerous legal document templates accessible online, but identifying forms you can depend on is not straightforward.

US Legal Forms offers thousands of template forms, including the Florida Accounts Receivable Write-Off Approval Form, which can be customized to comply with state and federal regulations.

Once you find the correct form, click Acquire now.

Select the pricing plan you require, enter the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the template for the Florida Accounts Receivable Write-Off Approval Form.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it corresponds with the correct city/state.

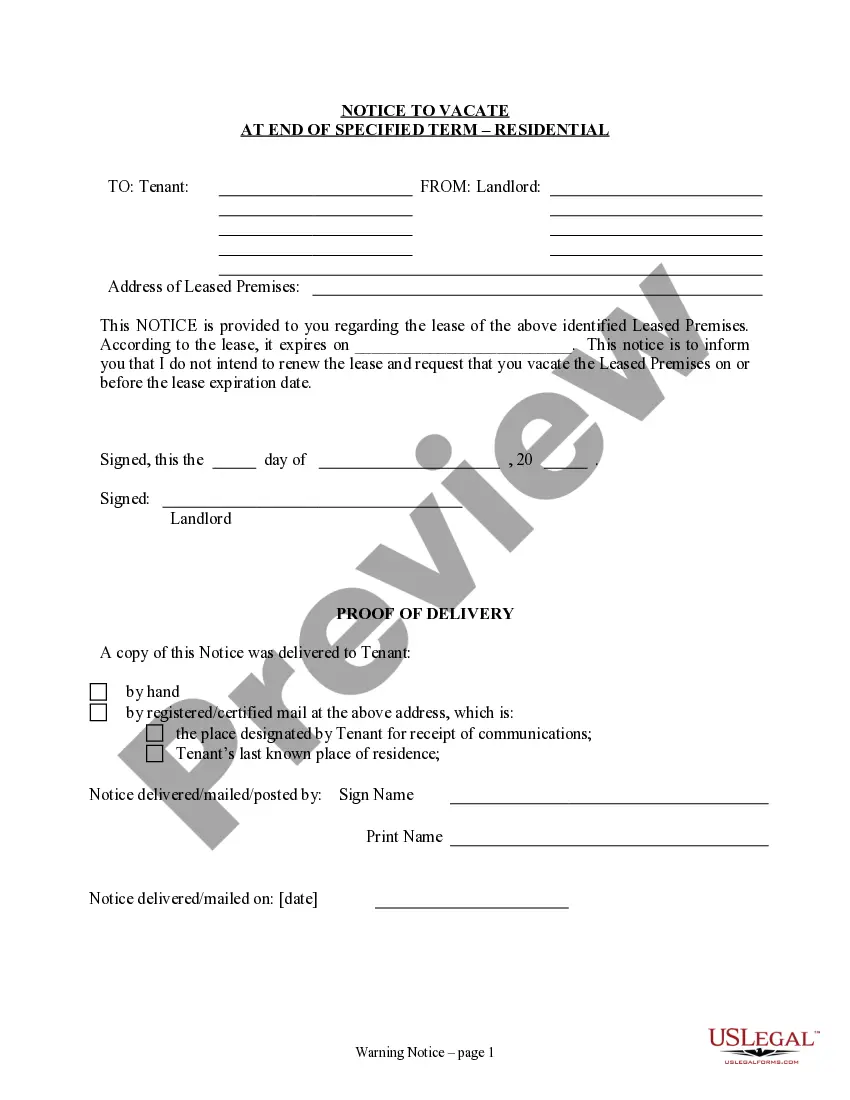

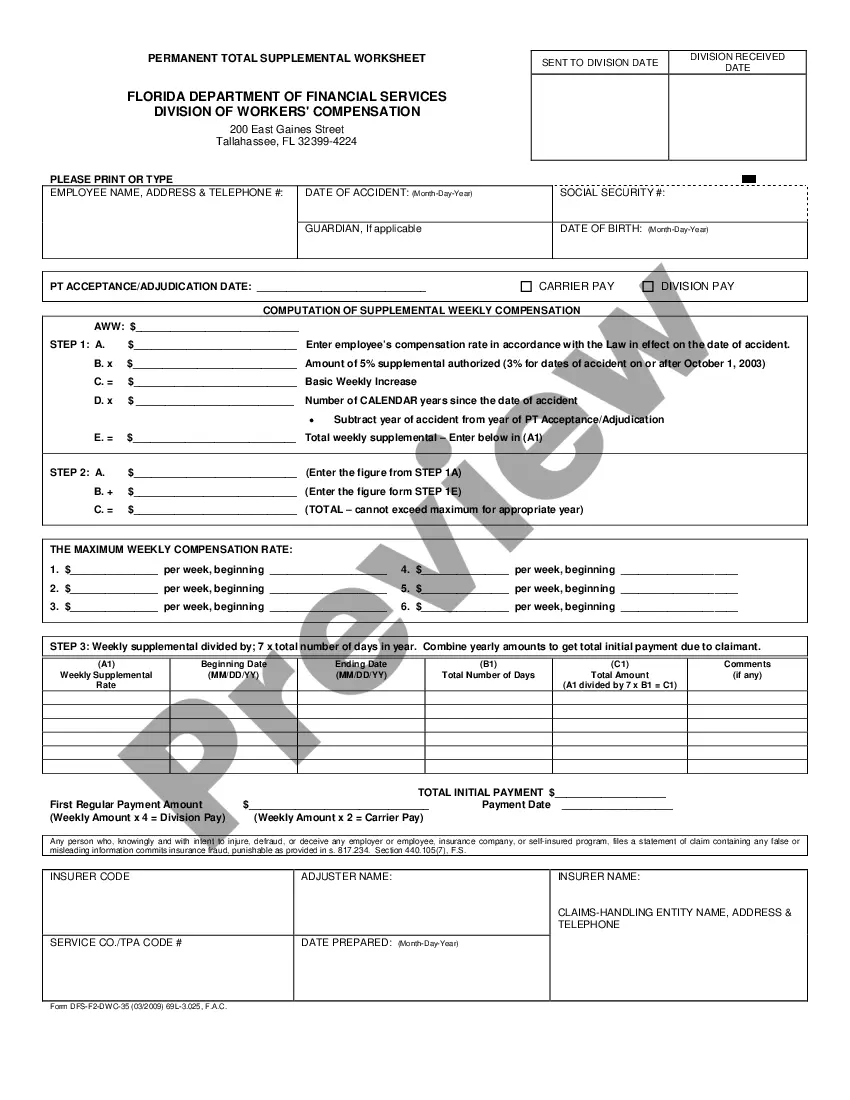

- Use the Review button to inspect the form.

- Read the description to confirm that you have chosen the proper form.

- If the form is not what you're searching for, utilize the Search field to locate the form that fits your needs.

Form popularity

FAQ

To write off an uncollectible account receivable, record a journal entry that debits the bad debt expense while crediting the accounts receivable account. This action reflects the loss, providing a clear financial picture. Utilizing the Florida Accounts Receivable Write-Off Approval Form aids in maintaining accuracy and compliance.

Calculating the write-off of uncollectible accounts entails assessing the outstanding balances and determining which accounts will not be collected. You can also take into account historical data and trends in collecting debts. The Florida Accounts Receivable Write-Off Approval Form can help in organizing this data effectively.

To write off uncollectible items, identify the accounts that are no longer collectible and create a formal journal entry. This entry should reflect the expense related to those debts. Relying on the Florida Accounts Receivable Write-Off Approval Form can provide clarity and ensure thorough documentation.

The direct write-off method for uncollectible accounts involves recognizing bad debts as expenses at the time they are deemed uncollectible. This method does not allow for estimation of future write-offs, which can affect financial reporting. You can utilize the Florida Accounts Receivable Write-Off Approval Form to accurately document the process.

The necessary journal entry for writing off uncollectible accounts involves debiting the bad debt expense and crediting the accounts receivable account. This entry acknowledges the loss and ensures your accounting records remain up to date. Using the Florida Accounts Receivable Write-Off Approval Form can simplify this task.

Writing off uncollectible receivables requires you to initiate a clear documentation process. Start by recognizing the accounts that remain unpaid for an extended period, and follow up with an appropriate journal entry. The Florida Accounts Receivable Write-Off Approval Form provides a structured approach for maintaining accurate records during this process.

You can write off uncollectible receivables by formally identifying the accounts that cannot be collected. Proceed with a journal entry to remove them from your books. Implementing the Florida Accounts Receivable Write-Off Approval Form can facilitate this process seamlessly.

To record the write-off of accounts receivable, determine which accounts are deemed uncollectible. You'll then make a journal entry that decreases your accounts receivable and notes the loss as an expense. Using the Florida Accounts Receivable Write-Off Approval Form can help document the process effectively.

The journal entry for writing off uncollectible accounts typically includes a debit to the uncollectible accounts expense and a credit to the accounts receivable account. This entry reflects the loss incurred on the uncollectible debts. With the Florida Accounts Receivable Write-Off Approval Form, you can easily manage this entry while keeping your records in order.

When an uncollectible account is written off, it signifies that you will no longer pursue collection efforts. This process also impacts your financial statements by reducing total assets. By using the Florida Accounts Receivable Write-Off Approval Form, you can ensure that your write-off process meets regulatory and accounting standards.