Florida Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Agreement To Compromise Debt By Returning Secured Property?

If you require extensive, acquire, or generate official document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Leverage the site's user-friendly and convenient search to find the documents you need.

Various templates for business and personal functions are organized by categories and states or keywords.

Step 4. Once you locate the form you want, click the Get now button. Choose the pricing plan you prefer and input your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to locate the Florida Agreement to Compromise Debt by Returning Secured Property in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Get button to find the Florida Agreement to Compromise Debt by Returning Secured Property.

- You can also access forms you previously downloaded in the My documents tab of your profile.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

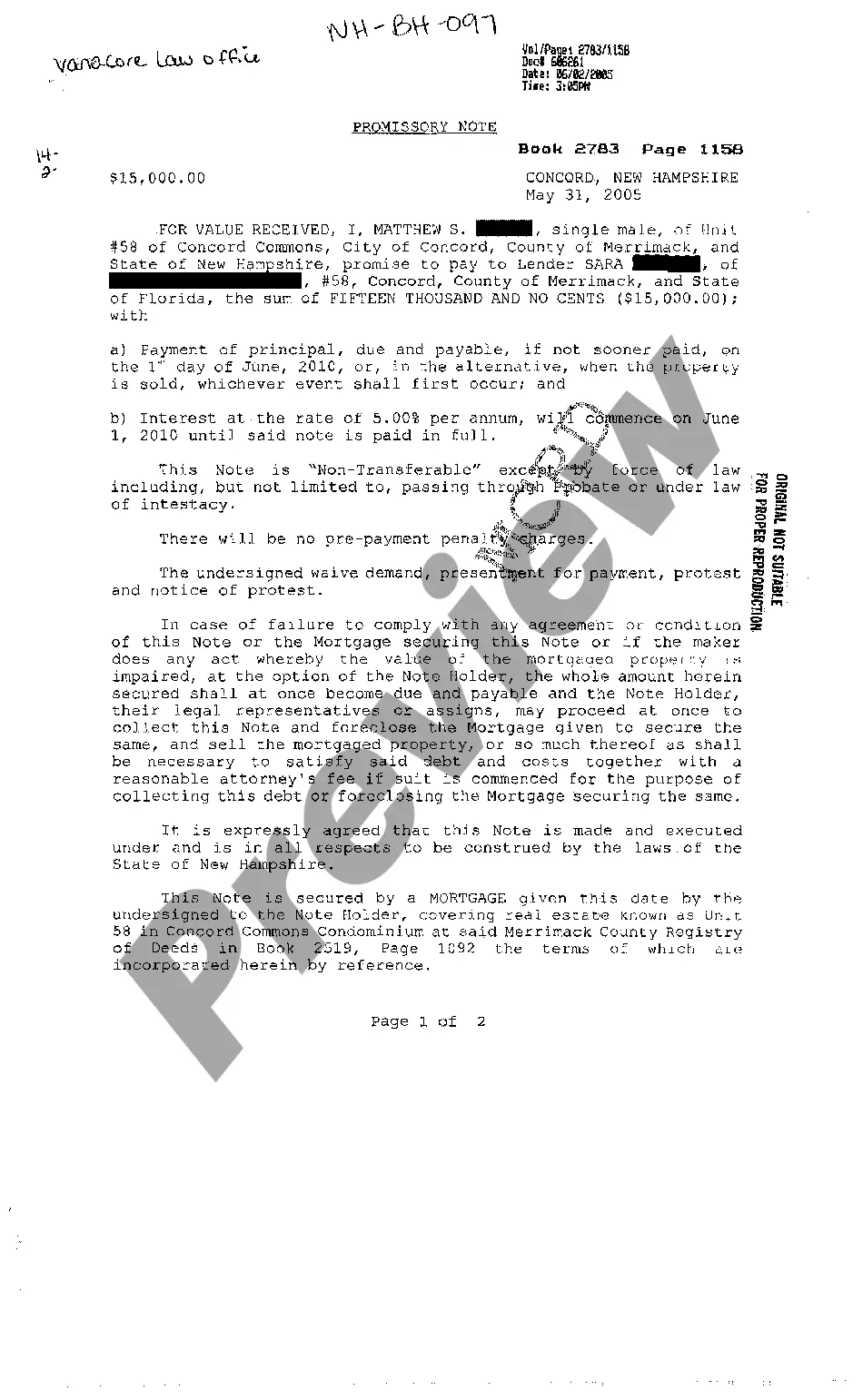

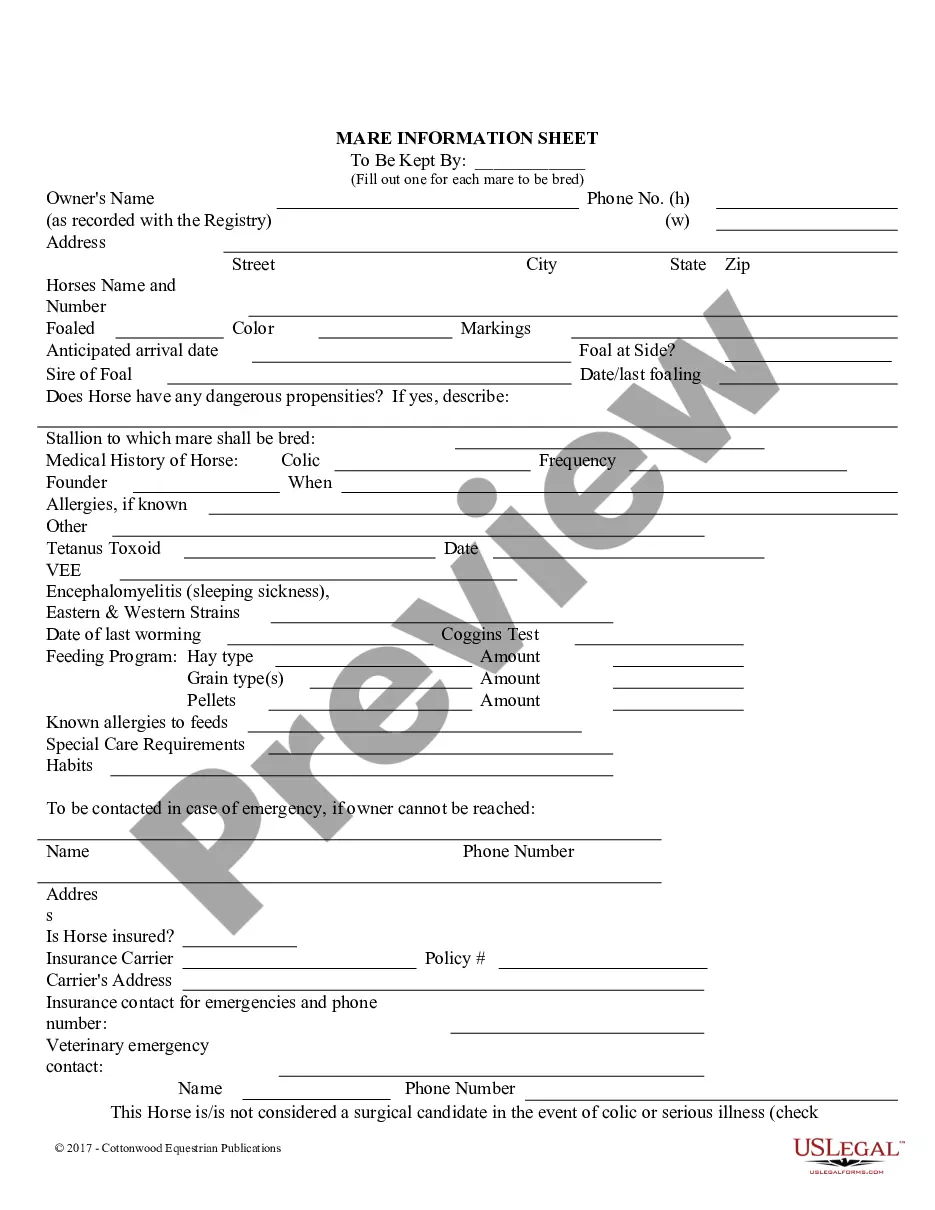

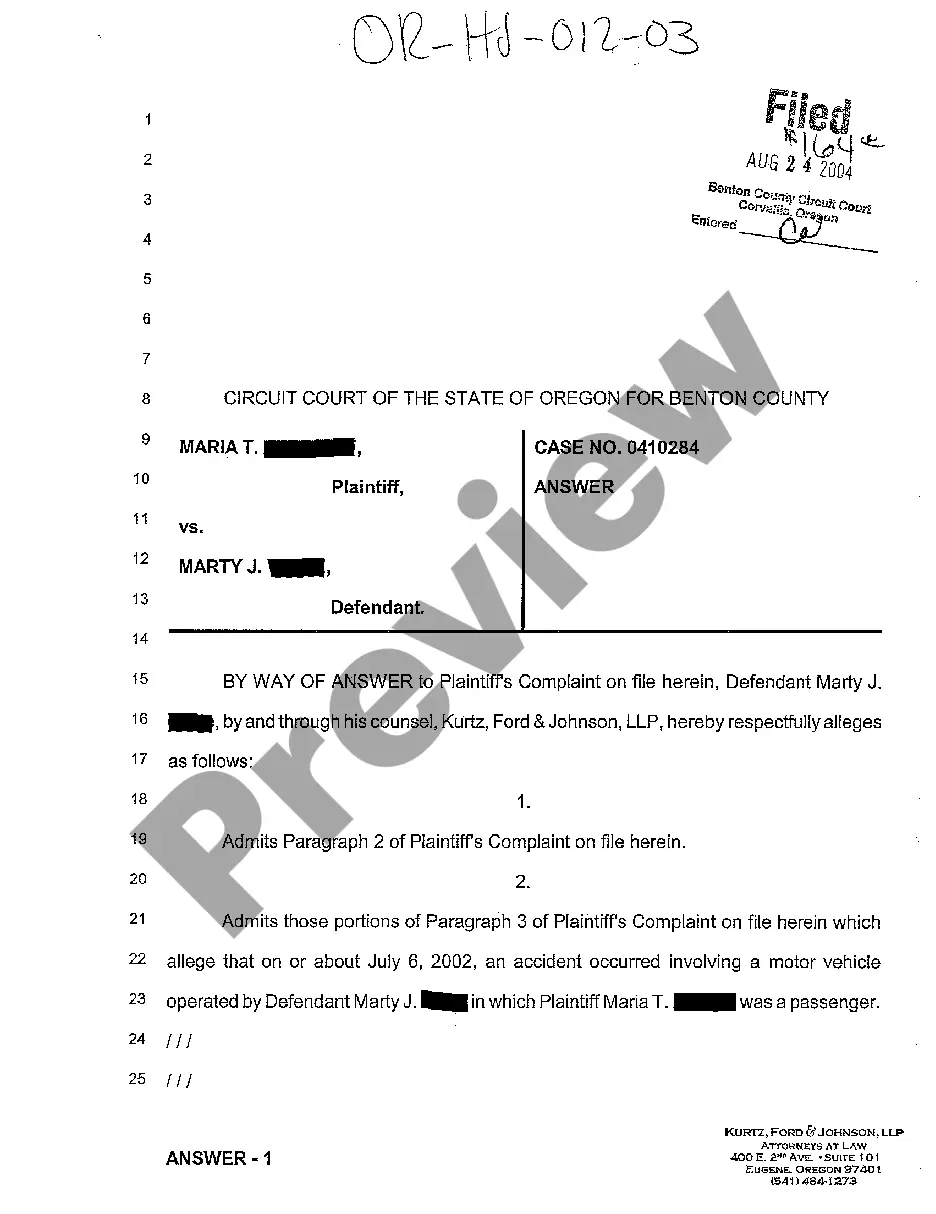

- Step 2. Use the Preview feature to examine the form's content. Make sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Exempt property in the Florida Constitution includes specific assets that cannot be seized by creditors. This includes homestead property, certain personal belongings, and retirement funds. Utilizing the Florida Agreement to Compromise Debt by Returning Secured Property can help you keep these exempt assets safe while managing your debts effectively.

The rescission statute in Florida allows individuals to cancel specific contracts or agreements under certain circumstances. This law is especially relevant in consumer transactions, protecting against unfair practices. When navigating financial agreements, including the Florida Agreement to Compromise Debt by Returning Secured Property, understanding this statute can provide critical insights into your rights.

Yes, the Constitution of Florida provides that certain personal properties are exempt from creditor claims. These exemptions aim to ensure that individuals can maintain a basic standard of living despite financial difficulties. When utilizing the Florida Agreement to Compromise Debt by Returning Secured Property, it's important to familiarize yourself with these legal protections.

The personal property exemption in Florida allows individuals to retain specific assets during bankruptcy or creditor claims. This exemption covers various items, including vehicles, household goods, and retirement accounts to a certain limit. When using the Florida Agreement to Compromise Debt by Returning Secured Property, understanding these exemptions can help you safeguard your possessions.

In Florida, certain personal properties are exempt from creditors. These include a portion of your home’s equity, personal items like clothing, household goods, and specific tools necessary for your job. Furthermore, under the Florida Agreement to Compromise Debt by Returning Secured Property, you can protect essential assets when negotiating debt resolution.

In general, after ten years, debts are usually beyond the statute of limitations, meaning creditors cannot successfully sue you for repayment. However, it's important to note that some creditors may still attempt to collect the debt through other means, like phone calls or letters. If you find yourself in this position, exploring options like the Florida Agreement to Compromise Debt by Returning Secured Property can provide clarity and a potential resolution.

After seven years of not paying a debt, the debt typically falls off your credit report, which can provide relief for your credit standing. However, creditors may still attempt to collect the debt, as Florida law allows for certain collections to persist beyond this timeframe. If you are dealing with this situation, consider the Florida Agreement to Compromise Debt by Returning Secured Property, which can help you resolve your financial obligations amicably.

In Florida, several actions can restart the debt statute of limitations, such as making a partial payment or acknowledging the debt in writing. Once you make a payment, the clock resets, so debt collectors may pursue you again. It's crucial to understand the implications of a Florida Agreement to Compromise Debt by Returning Secured Property, as this option may allow you to manage your debts without the concern of resetting the statute.

To make a claim against an estate in Florida, you must file a formal claim with the court handling the estate's probate process. This claim needs to be submitted within a specific time frame, typically within three months of the first publication of the Notice to Creditors. Utilizing the Florida Agreement to Compromise Debt by Returning Secured Property can also help you explore options to settle your debts effectively while ensuring you understand your rights during this process.

In Florida, exempt property generally includes personal belongings, homestead property, and certain amounts of bank accounts and retirement funds. Typically, surviving spouses and minor children have the right to claim exempt property from an estate. If you're involved in a Florida Agreement to Compromise Debt by Returning Secured Property, knowing about exempt property can greatly influence how debts are handled and which assets you can retain.