US Legal Forms - among the biggest libraries of legitimate kinds in the States - provides a wide range of legitimate record templates it is possible to download or print out. Utilizing the site, you can get thousands of kinds for organization and specific uses, categorized by classes, suggests, or keywords.You will find the latest variations of kinds such as the Florida Security Agreement in Accounts and Contract Rights in seconds.

If you already have a registration, log in and download Florida Security Agreement in Accounts and Contract Rights through the US Legal Forms library. The Obtain switch will appear on every single develop you look at. You have accessibility to all earlier delivered electronically kinds within the My Forms tab of your account.

If you wish to use US Legal Forms the very first time, here are easy recommendations to help you get began:

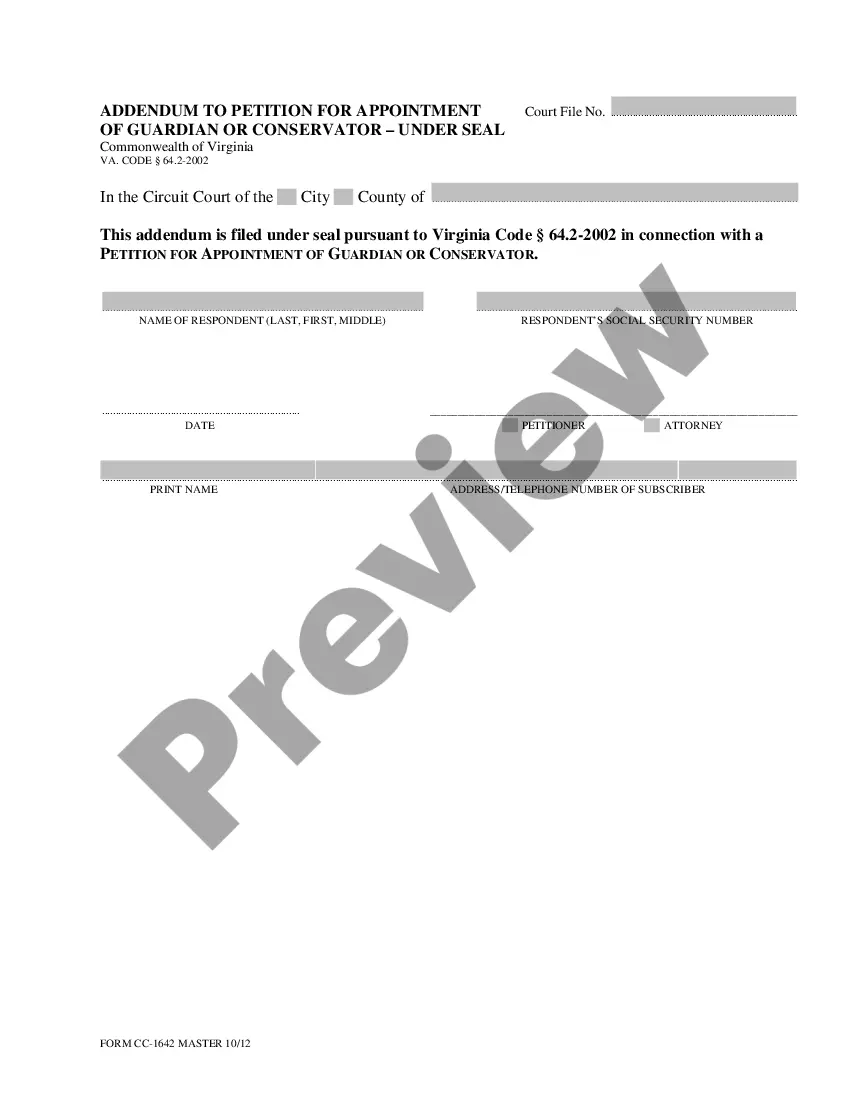

- Be sure you have picked out the proper develop to your town/county. Click on the Review switch to analyze the form`s content material. See the develop information to actually have selected the correct develop.

- In the event the develop does not match your specifications, utilize the Research area near the top of the display screen to find the one who does.

- When you are content with the form, affirm your option by clicking the Get now switch. Then, select the costs prepare you like and give your accreditations to register for an account.

- Procedure the purchase. Make use of credit card or PayPal account to complete the purchase.

- Pick the structure and download the form on your own product.

- Make changes. Fill up, revise and print out and indication the delivered electronically Florida Security Agreement in Accounts and Contract Rights.

Each design you included in your bank account does not have an expiration date and is your own forever. So, if you would like download or print out an additional backup, just check out the My Forms segment and click about the develop you want.

Gain access to the Florida Security Agreement in Accounts and Contract Rights with US Legal Forms, probably the most comprehensive library of legitimate record templates. Use thousands of specialist and express-particular templates that meet up with your business or specific needs and specifications.