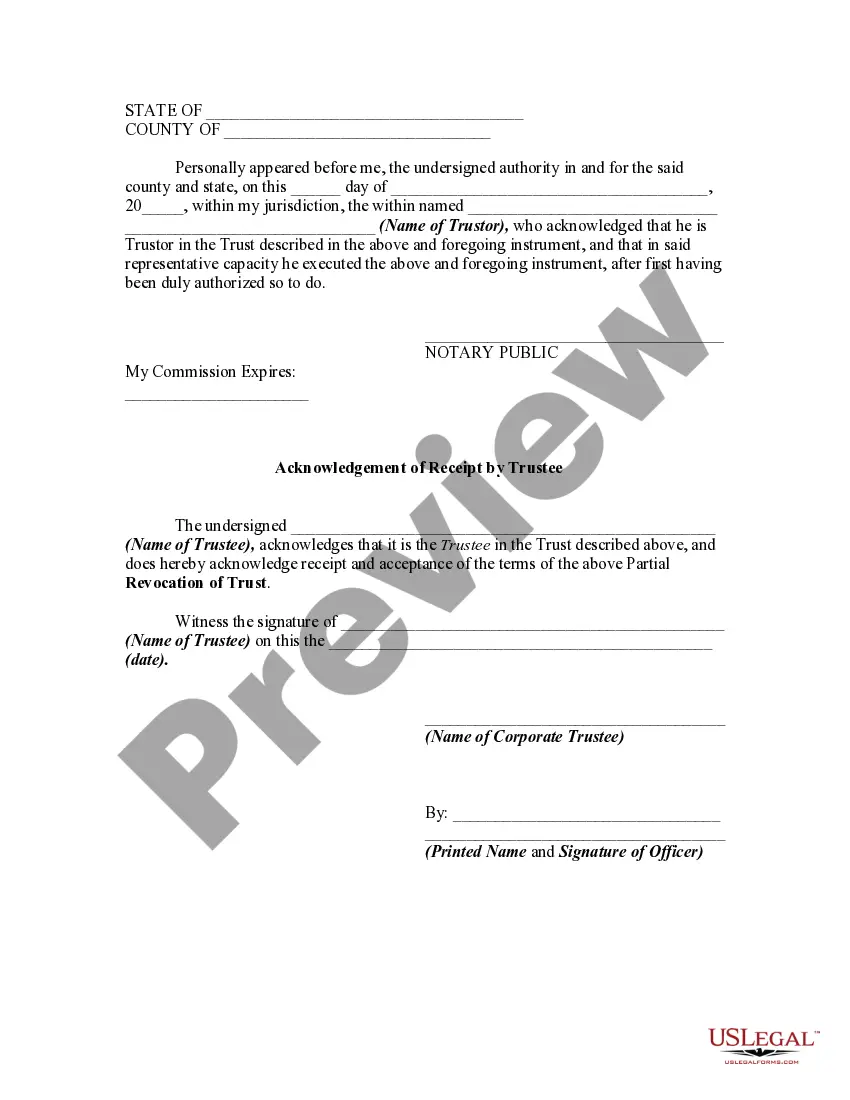

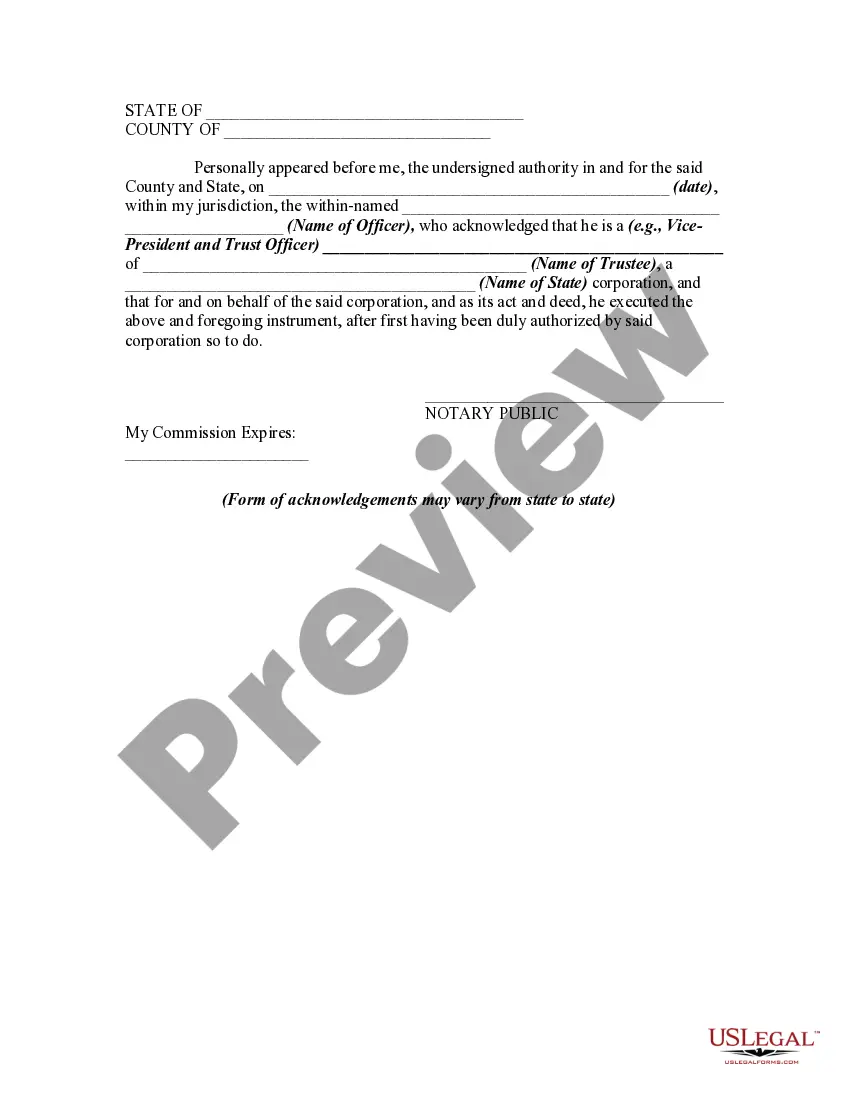

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Florida Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

Locating the appropriate authorized document template may prove to be challenging. Obviously, there are numerous templates accessible online, but how can you identify the legal form you need? Utilize the US Legal Forms website. This service offers an extensive collection of templates, including the Florida Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, which can be utilized for both business and personal purposes. All forms are verified by experts and comply with both federal and state regulations.

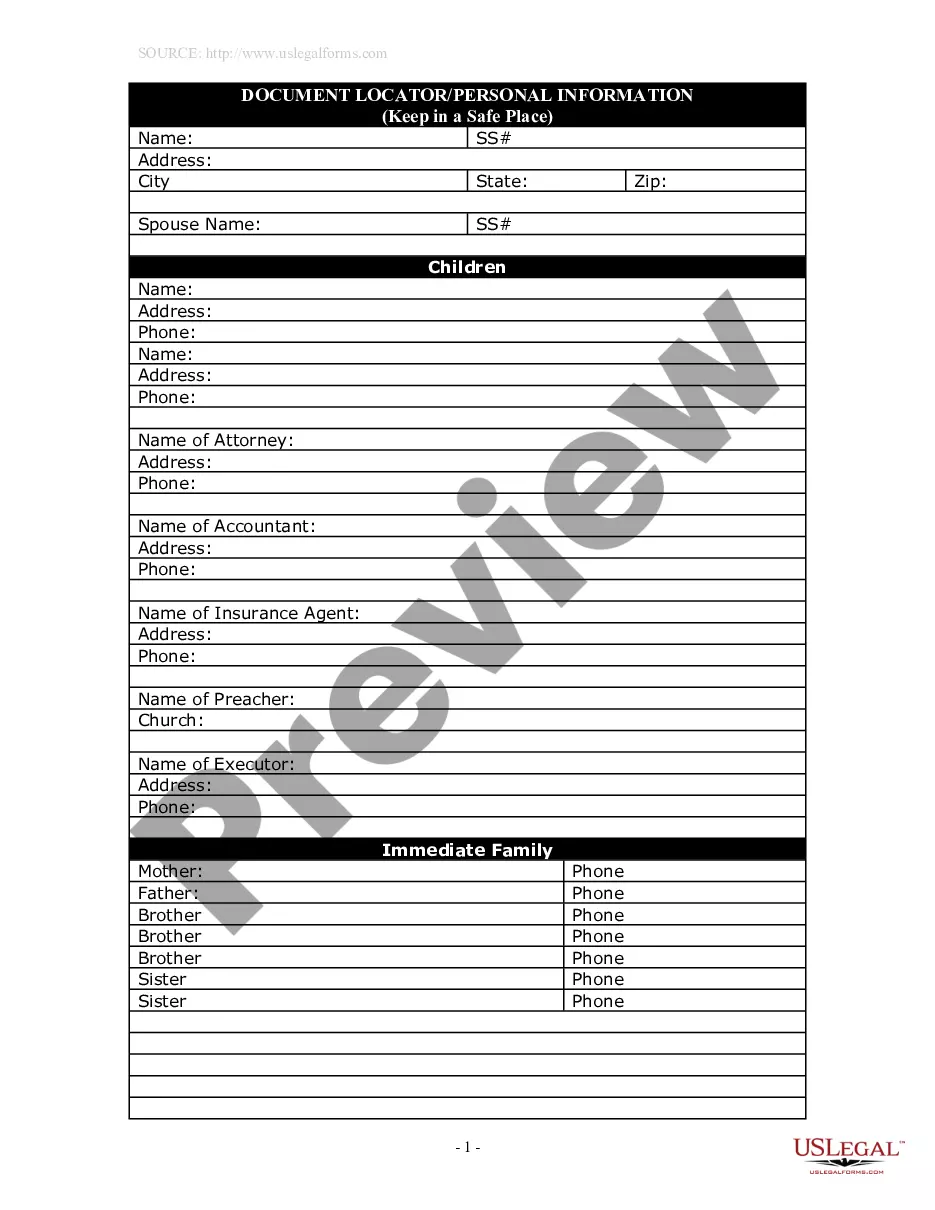

If you are already registered, Log In to your account and hit the Download button to obtain the Florida Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

For new users of US Legal Forms, here are straightforward instructions you can follow: First, ensure that you have selected the correct form for your locality. You can review the form using the Review button and examine the form outline to confirm it is the appropriate one for you. If the form does not meet your needs, utilize the Search field to find the correct form. Once you are confident that the form is suitable, click the Buy now button to acquire the document. Choose the pricing plan you prefer and provide the required details. Create your account and finalize the order using your PayPal account or credit card. Select the file format and download the authorized document template to your device.

- Complete, modify, print, and sign the obtained Florida Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

- US Legal Forms is the largest repository of legal forms where you can access a variety of document templates.

- Utilize the service to obtain well-prepared papers that align with state requirements.

Form popularity

FAQ

To revoke a trust in Florida, the grantor should follow the outlined steps in the trust document, usually involving the creation of a formal revocation document. It is advisable to notify the trustee of this decision, ensuring all parties involved are aware of the changes. Engaging with platforms like US Legal Forms can streamline this process, providing users with the necessary forms and guidance related to Florida Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Florida's order of inheritance typically begins with spouses and children, followed by parents, siblings, and other relatives. The state law provides clear guidelines on how assets are distributed if someone dies without a will. Understanding this order can be beneficial when considering the implications of a Florida Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

In Florida, a caregiver is defined under the statute as an individual providing assistance to a person who needs help due to age, illness, or disability. This definition is critical in various legal contexts, including trusts and estates, where caregivers may be designated and acknowledged in a trust document. If considering a Florida Partial Revocation of Trust, understanding caregiver roles is essential for proper management.

The statute of limitations for Florida income tax typically lasts for three years from the due date of the return or the date it was filed. After this period, the Florida Department of Revenue cannot assess additional tax unless fraud is involved. Knowing this time frame can provide clarity on tax obligations and any potential implications related to trust income.

Section 709.2202 of the Florida statutes defines the powers granted to a trustee. It specifies the trustee's duties, including management and distribution of trust assets, ensuring compliance with the trust creator's intent. This section is vital in understanding how revocations and partial revocations, such as the Florida Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, function.

Statute 709.2202 in Florida pertains to the powers of a trustee and provides guidelines on the authority to manage trust assets. This statute also outlines how a Florida Partial Revocation of Trust can be handled, ensuring trustees follow legal protocols. Understanding this statute is crucial for those involved in trust management and revocation.

To revoke a revocable trust, the grantor must follow specific procedures set forth in the trust document. This typically involves drafting a formal revocation document and notifying all relevant parties, including the trustee. It's important to ensure proper execution to avoid any confusion about the Florida Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

In Florida probate, exempt property typically includes assets that pass outside the estate and reach beneficiaries directly. Surviving spouses and minor children often have the right to claim this property. Understanding what is deemed exempt can impact how a Florida Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee affects the distribution of assets. This clarity can assist you in planning your estate effectively.

Revoking a trust in Florida typically involves creating a revocation document or sending a formal notice. You should clearly state your intent to revoke, along with details of the original trust. Additionally, ensuring proper acknowledgment of receipt can help validate the revocation process. If you need assistance, the UsLegalForms platform can provide templates to streamline the Florida Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Statute 709.2109 in Florida deals with the authority of agents under durable power of attorney. It defines the powers granted to an agent and outlines obligations when acting on behalf of another person. When managing a Florida Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, understanding the relationship between powers of attorney and trust revocation is crucial.