An escrow may be terminated according to the escrow agreement when the parties have performed the conditions of the escrow and the escrow agent has delivered the items to the parties entitled to them according to the escrow instructions. An escrow may be prematurely terminated by cancellation after default by one of the parties or by mutual consent. An escrow may also be terminated at the end of a specified period if the parties have not completed it within that time and have not extended the time for performance.

Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow

Description

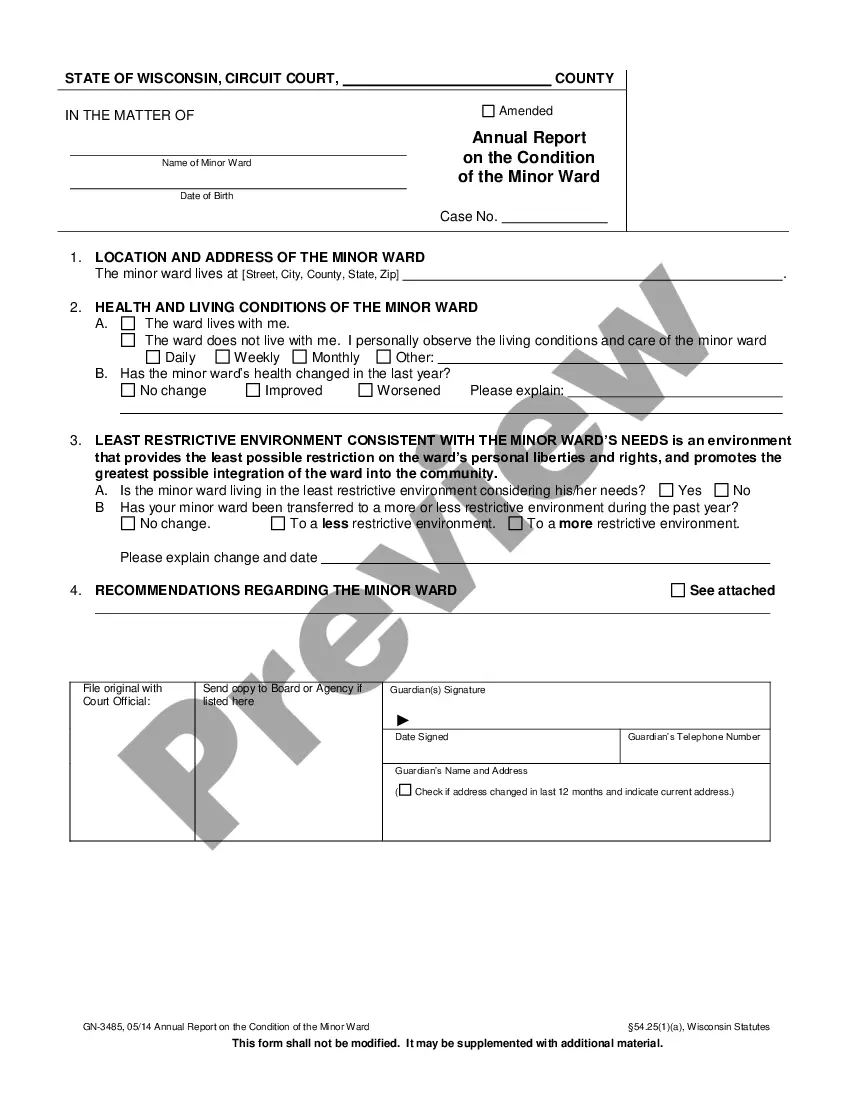

How to fill out Instructions To Title Company To Cancel Escrow And Disburse The Funds Held In Escrow?

Are you currently in a situation where you require documents for either business or personal purposes on a daily basis.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow, designed to meet state and federal regulations.

Select the pricing plan you wish, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow at any time by simply selecting the required form to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service provides professionally created legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you will be able to download the Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

- Use the Preview button to review the document.

- Check the description to confirm you have chosen the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your requirements and needs.

- When you find the appropriate form, click on Get now.

Form popularity

FAQ

Escrow refers to an arrangement where a third party holds and manages funds or assets until a specified condition is met. In real estate transactions, for instance, a title company might hold your deposit in escrow while the sale is being finalized. This helps ensure that both the buyer and seller meet their obligations before any funds are disbursed. Understanding how to use Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow effectively can enhance the safety of your transactions.

The letter of instruction for escrow is a crucial document that outlines the specific directives for the title company regarding how to handle the funds held in escrow. In Florida, these instructions guide the title company to cancel the escrow and disburse the funds appropriately. By detailing your wishes in this letter, you ensure that the process aligns with your transaction needs. If you're unsure about drafting this document, consider using USLegalForms for clear and compliant Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow.

Funds are typically released from escrow when all terms of the contract are met, including inspections and financing approvals. The escrow agent or title company will carefully review all conditions before disbursing the funds. By following the guidelines in the Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow, you can streamline this process and ensure a smooth transaction.

Escrow law in Florida governs how funds are held, managed, and disbursed in real estate transactions. This law requires that the escrow holder acts impartially and according to the terms agreed upon by the buyer and seller. Familiarizing yourself with the Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow provides you with the necessary knowledge to safeguard your interests.

Yes, Florida does have specific escrow instructions that outline how escrow agents should manage funds and responsibilities during real estate transactions. These instructions are crucial for maintaining clarity and trust between all parties involved. Utilizing the Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow can aid in navigating any complexities in the process.

If a Florida sales associate receives escrow funds on a Friday, she must deliver these funds to her broker by the following business day, which is typically Monday. Adhering to the Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow ensures that you stay compliant with state regulations, promoting transparency in the transaction process.

In Florida, an escrow deposit is typically required during real estate transactions to ensure that the buyer is serious about purchasing the property. This deposit is held by an escrow agent or a title company until the deal closes. By understanding the Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow, you can ensure proper handling of your funds should any issues arise.

Closing a transaction in escrow means that all parties agree to finalize the terms of the sale, and funds are held by a neutral third party until all conditions are met. This process protects both buyers and sellers by ensuring that funds are only disbursed once the transaction's requirements have been fulfilled. Utilizing the Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow can help clarify this process.

Terminating an escrow agreement typically requires mutual consent from both the buyer and seller. You will need to provide a written request that details your reasons for termination. Following the Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow can help ensure that the funds are handled correctly once the agreement is canceled.

To terminate an escrow, you must communicate with all involved parties about your intention to cancel the agreement. It may involve providing written notice and complying with terms outlined in the escrow contract. For accurate compliance, consider referring to the Florida Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow for detailed steps.