Virginia Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

Are you presently in a location where you will require documents for various business or personal activities almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the Virginia Nonqualified Defined Benefit Deferred Compensation Agreement, designed to meet state and federal regulations.

After obtaining the right form, click on Acquire now.

Select the pricing plan you want, fill in the required information to create your account, and complete the purchase using your PayPal or credit card. Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Virginia Nonqualified Defined Benefit Deferred Compensation Agreement anytime, if necessary. Just follow the required form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors. The service provides well-crafted legal document templates for various purposes. Sign up at US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Virginia Nonqualified Defined Benefit Deferred Compensation Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and confirm it is for the correct city/region.

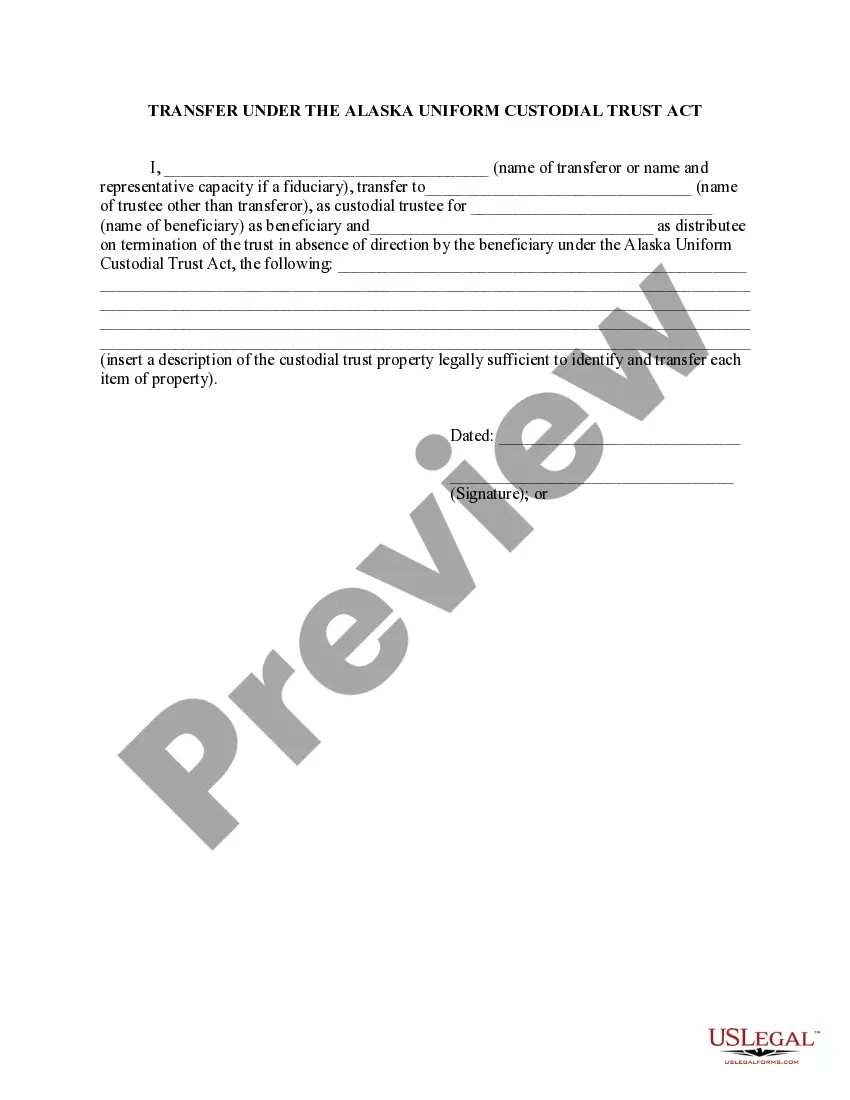

- Utilize the Review feature to evaluate the form.

- Examine the summary to ensure you have selected the right form.

- If the form does not meet your requirements, use the Search bar to locate the form that fits your needs.

Form popularity

FAQ

qualified deferred compensation arrangement is a retirement savings plan that provides employees with options to defer a portion of their salary. Unlike qualified plans, these arrangements do not have the same limitations on contribution amounts. By choosing a Virginia Nonqualified Defined Benefit Deferred Compensation Agreement, employees can create a tailored strategy for growing their retirement funds in a way that aligns with their longterm financial goals.

Participating in a nonqualified deferred compensation plan can be a wise choice, especially if you are looking to enhance your retirement savings. This type of plan allows you to set aside additional funds, potentially reducing your taxable income. A Virginia Nonqualified Defined Benefit Deferred Compensation Agreement offers significant flexibility and can be particularly advantageous for high-income earners.

The 10 year rule refers to a provision that requires recipients of deferred compensation to distribute their funds within ten years after deferral. Understanding this rule is crucial when considering a Virginia Nonqualified Defined Benefit Deferred Compensation Agreement, as it impacts your tax planning and retirement strategy. Make sure to consult with a financial advisor for personalized advice.

A nonqualified deferred compensation arrangement is an agreement between an employer and employee that allows the employee to defer a part of their income until a later date. This type of compensation is particularly beneficial for those seeking additional retirement savings beyond their primary plans. Through a Virginia Nonqualified Defined Benefit Deferred Compensation Agreement, employees can customize their contributions and timing to fit their financial goals.

Nonqualified deferred compensation is typically not classified as earned income at the time of deferral. Instead, it is recognized as income when the funds are distributed to you. Therefore, utilizing a Virginia Nonqualified Defined Benefit Deferred Compensation Agreement can help you manage your taxable income effectively, allowing you to defer taxes until later.

A 401k is a qualified retirement plan that allows employees to save for retirement with tax advantages. Unlike a 401k, a Virginia Nonqualified Defined Benefit Deferred Compensation Agreement allows for greater flexibility in contribution amounts and payout timings. This type of plan does not have to adhere to the same strict regulations as 401k plans, making it a valuable option for high earners seeking additional retirement savings.

To set up a non-qualified deferred compensation plan, start by defining your retirement goals and financial needs. Then, consult with professionals to create a legal agreement that outlines the contribution structure and payout options. You can find useful resources on platforms like uslegalforms, which provide templates for a Virginia Nonqualified Defined Benefit Deferred Compensation Agreement, ensuring compliance and clarity.

A NQDC plan works by allowing employees to contribute a portion of their salary before taxes are taken out, deferring taxes until withdrawal. These plans provide flexibility in terms of contribution amounts and timing, allowing for customizations based on individual financial situations. With a Virginia Nonqualified Defined Benefit Deferred Compensation Agreement, you're setting yourself up for a potentially more secure retirement through tailored savings strategies.

NQDC on a paystub refers to amounts that have been deferred under a Nonqualified Deferred Compensation plan. This amount represents income that employees have opted to postpone until a later date, potentially providing tax advantages in the long run. Understanding NQDC entries on your paystub is crucial as it helps you keep track of your future retirement benefits under the Virginia Nonqualified Defined Benefit Deferred Compensation Agreement.

To determine if your retirement plan is qualified or nonqualified, check the plan's structure and its compliance with IRS regulations. Qualified plans, like 401(k)s, adhere to specific criteria, including contribution limits and distribution rules. In contrast, a nonqualified plan, such as a Virginia Nonqualified Defined Benefit Deferred Compensation Agreement, allows greater flexibility but does not receive the same tax benefits as qualified plans.