Vermont Nonqualified Defined Benefit Deferred Compensation Agreement

Description

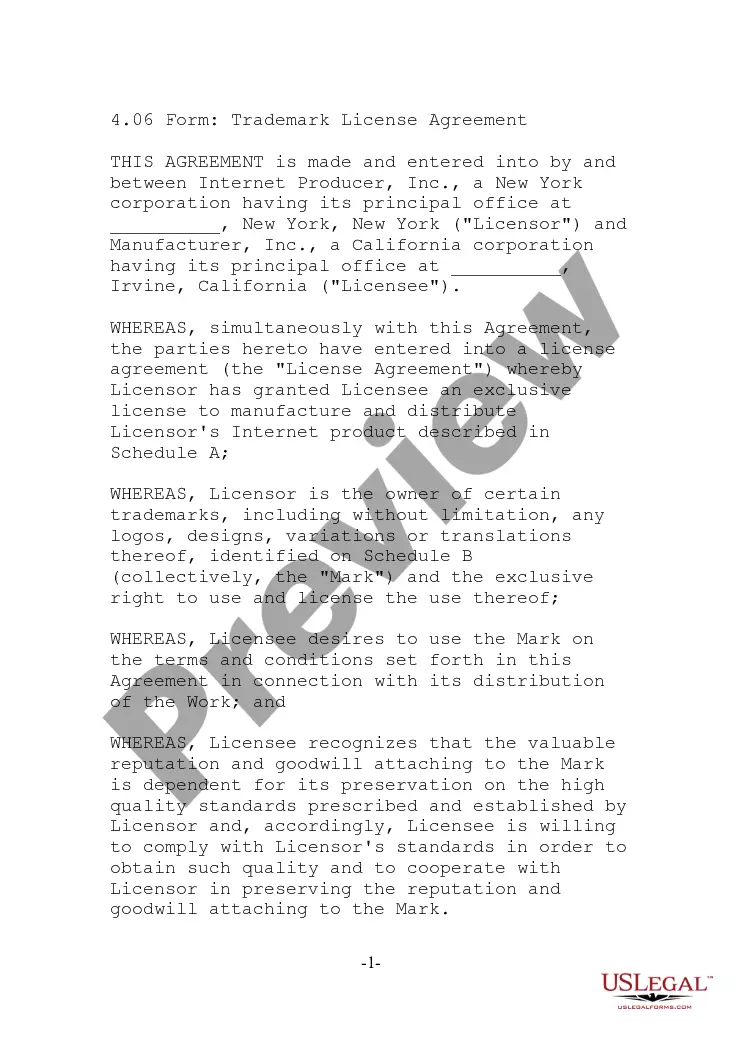

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

You can dedicate several hours online searching for the legal document template that meets the national and state requirements you need.

US Legal Forms offers an extensive selection of legal templates that are reviewed by experts.

You can easily download or print the Vermont Nonqualified Defined Benefit Deferred Compensation Agreement from the service.

If applicable, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Vermont Nonqualified Defined Benefit Deferred Compensation Agreement.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for the region/city that you choose.

- Review the form description to confirm that you have chosen the correct form.

Form popularity

FAQ

Setting up a Vermont Nonqualified Defined Benefit Deferred Compensation Agreement involves several crucial steps. Start by defining the plan's objectives and determining eligible participants. Then, draft the plan document with clear terms and communicate it effectively to potential participants. Utilizing resources from uslegalforms can simplify the documentation process, ensuring your plan complies with legal requirements and aligns with your organizational goals.

Eligibility for a Vermont Nonqualified Defined Benefit Deferred Compensation Agreement typically includes highly compensated employees, such as executives and key management personnel. Employers can choose who qualifies based on job title or performance, allowing for strategic financial planning. Because these plans are not subject to the same restrictions as qualified plans, employers have greater flexibility in determining eligibility criteria. Ultimately, this feature allows companies to tailor benefits to attract and retain top talent.

A nonqualified deferred compensation plan is an agreement that allows employees to defer a portion of their earnings until a later date, typically retirement. Vermont Nonqualified Defined Benefit Deferred Compensation Agreements specifically cater to higher earners, providing them with additional savings opportunities outside of traditional retirement plans. These plans are flexible, allowing for various payout options and investment choices aligned with individual financial goals. They also help employers enhance their total rewards package.

Nonqualified plans, including Vermont Nonqualified Defined Benefit Deferred Compensation Agreements, do not require IRS approval prior to implementation. However, they must comply with federal tax regulations to maintain their intended tax advantages. Consulting a tax professional can help ensure your plan is structured correctly. Proper documentation is vital to prevent any tax complications in the future.

To establish a Vermont Nonqualified Defined Benefit Deferred Compensation Agreement, you should begin by outlining the plan's terms and conditions. It's essential to involve legal and tax experts to ensure compliance with applicable regulations. Also, consider using platforms like uslegalforms, which provide guidance and templates to streamline the setup process. Tailoring the plan to meet your organization’s unique needs will help enhance its effectiveness.

Vermont Nonqualified Defined Benefit Deferred Compensation Agreements can be a beneficial option for highly compensated employees. They offer flexibility in retirement savings beyond the limits of qualified plans. These agreements allow participants to defer compensation and potentially reduce their immediate tax burden. Additionally, they can serve as an attractive benefit to retain key talent within your organization.

qualified deferred compensation arrangement is a financial agreement allowing employees to defer part of their salary to a future date, while still enjoying advantages not available in traditional plans. This type of agreement does not adhere to the same regulations as qualified plans, providing more freedom for both employers and employees. If you are considering a Vermont Nonqualified Defined Benefit Deferred Compensation Agreement, understand how it differs from other retirement savings vehicles.

The primary difference lies in how and when the assets are contributed and taxed. A 401k is a qualified retirement account with specific contribution limits and tax advantages. In contrast, a nonqualified deferred compensation plan, like the Vermont Nonqualified Defined Benefit Deferred Compensation Agreement, allows higher contributions and provides more flexibility in terms of payout timing and amounts.

Participating in a nonqualified deferred compensation plan can be beneficial if you are looking to supplement your retirement income. This plan allows you to defer taxes on income until you withdraw it, which can lead to significant tax savings. If you are considering a Vermont Nonqualified Defined Benefit Deferred Compensation Agreement, it is wise to assess your current financial situation and future retirement goals.

Yes, nonqualified deferred compensation can be classified as earned income. This classification means that it is subject to income tax when you receive it, not when it is earned. The Vermont Nonqualified Defined Benefit Deferred Compensation Agreement allows you to save for retirement while continuing to receive benefits from your employment. It is essential to understand how it fits into your overall financial strategy.