Utah Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

Are you in a position where you will require documentation for both corporate or specific purposes almost every day.

There is a range of legal document templates accessible online, but finding versions you can trust isn’t straightforward.

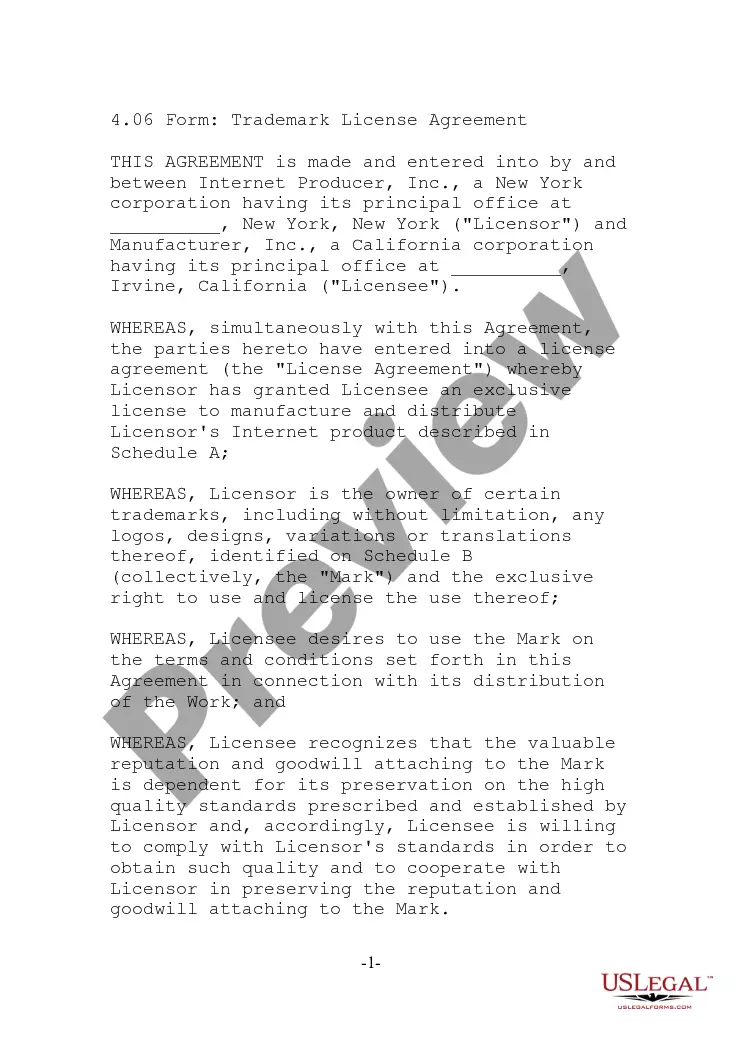

US Legal Forms offers a plethora of form templates, including the Utah Nonqualified Defined Benefit Deferred Compensation Agreement, which is designed to comply with federal and state requirements.

Once you locate the appropriate form, simply click Purchase now.

Choose your payment option, provide the necessary information for your transaction, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Utah Nonqualified Defined Benefit Deferred Compensation Agreement template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your specific city/area.

- Use the Review button to inspect the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn’t what you require, utilize the Search area to find the form that fits your needs.

Form popularity

FAQ

A nonqualified deferred compensation plan is an agreement that allows an employer to provide additional retirement benefits to select employees, exceeding the limits of qualified plans. The Utah Nonqualified Defined Benefit Deferred Compensation Agreement enables participants to save for retirement with tax-deferred growth, which can boost their financial prospects. It serves as a valuable tool for managing compensation in a way that benefits both the employer and the employee.

The 10-year rule relates to the distribution of funds from a Utah Nonqualified Defined Benefit Deferred Compensation Agreement. Essentially, this rule requires that funds in the plan must be distributed within ten years of the participant's separation from service. This rule can have significant implications for retirement planning, so it’s crucial to understand how it affects your financial strategies.

Establishing a Utah Nonqualified Defined Benefit Deferred Compensation Agreement involves several key steps. First, you should work with a financial advisor to design a plan that aligns with your long-term goals. Next, develop a formal agreement that outlines contributions, benefits, and any vesting periods. Finally, ensure compliance with IRS regulations and consider using platforms like uslegalforms to help streamline documentation and legal processes.

Utah Nonqualified Defined Benefit Deferred Compensation Agreements offer flexible options for retirement savings, particularly for high earners. These plans allow you to set aside additional funds beyond standard retirement accounts, providing greater financial security in your later years. However, you should assess your financial situation carefully, as these agreements may come with complexities and risks regarding taxation and access to funds.

A nonqualified deferred compensation plan presents numerous benefits for both employers and employees. It allows for greater flexibility in benefit design, protecting key employees while offering potentially tax-deferred growth. With a Utah Nonqualified Defined Benefit Deferred Compensation Agreement, employers can attract and retain talent, as it serves as an additional incentive. Moreover, the ability to customize contributions increases its appeal, making it a valuable tool for enhancing employee satisfaction and loyalty.

Setting up a nonqualified deferred compensation plan involves several key steps. First, you need to define the eligibility criteria for your employees, ensuring that the Utah Nonqualified Defined Benefit Deferred Compensation Agreement aligns with your business goals. Next, it's important to draft a plan document that adheres to legal requirements, clearly outlining the benefits and conditions. Finally, consider using platforms like uslegalforms, which offer templates and guidance to simplify and streamline the setup process.

A deferred compensation plan can either be qualified or nonqualified based on its structure and regulatory compliance. Specifically, a Utah Nonqualified Defined Benefit Deferred Compensation Agreement allows employers to provide additional retirement benefits without the restrictions of qualified plans. This flexibility gives employers the ability to customize benefits for key employees while also addressing tax implications. To choose the right path, understanding the differences between qualified and nonqualified plans is essential.

Nonqualified deferred compensation is generally not considered earned income until the employee actually receives the funds. In the context of the Utah Nonqualified Defined Benefit Deferred Compensation Agreement, this means that while you defer income, it does not count as taxable income until distributed. This deferral strategy may provide significant tax advantages for employees and can help in effective financial planning. Understanding this distinction is crucial for maximizing potential benefits.

A defined benefit plan for deferred compensation provides employees with specified retirement benefits based on their salary and years of service. The Utah Nonqualified Defined Benefit Deferred Compensation Agreement can include elements of both defined benefits and deferred compensation, creating a robust retirement strategy. Unlike traditional retirement plans, this arrangement typically promises a specific payout at retirement regardless of investment performance. It ensures employees have a clear retirement benefit that grows over time.

One disadvantage of a nonqualified deferred compensation plan is that the funds are not protected from creditors if the employer faces financial difficulties. Under the Utah Nonqualified Defined Benefit Deferred Compensation Agreement, employees should understand that their deferred amounts may be at risk. Additionally, participants may face a higher tax burden if funds are withdrawn before retirement. This highlights the importance of thorough planning and understanding of the risks involved.