Florida Deferred Compensation Agreement - Short Form

Description

How to fill out Deferred Compensation Agreement - Short Form?

Selecting the appropriate valid document format can be a challenge.

Of course, there are numerous templates available online, but how can you locate the valid form you need.

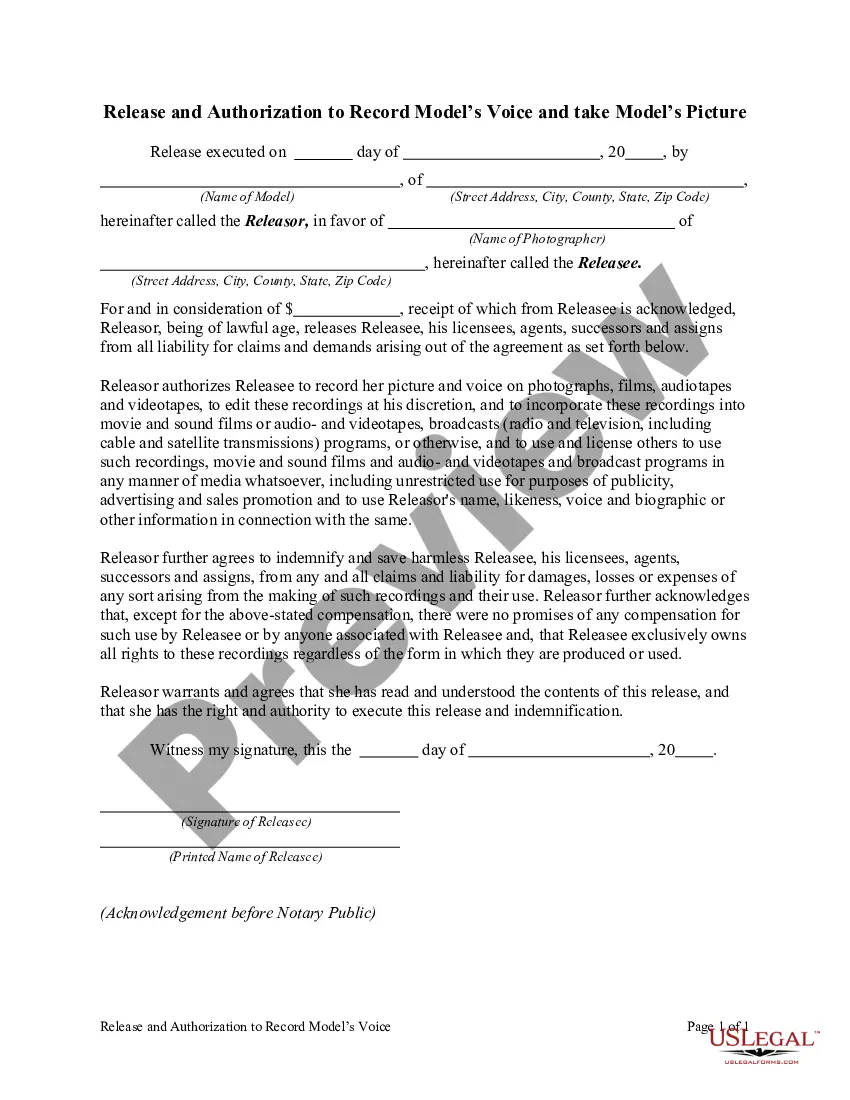

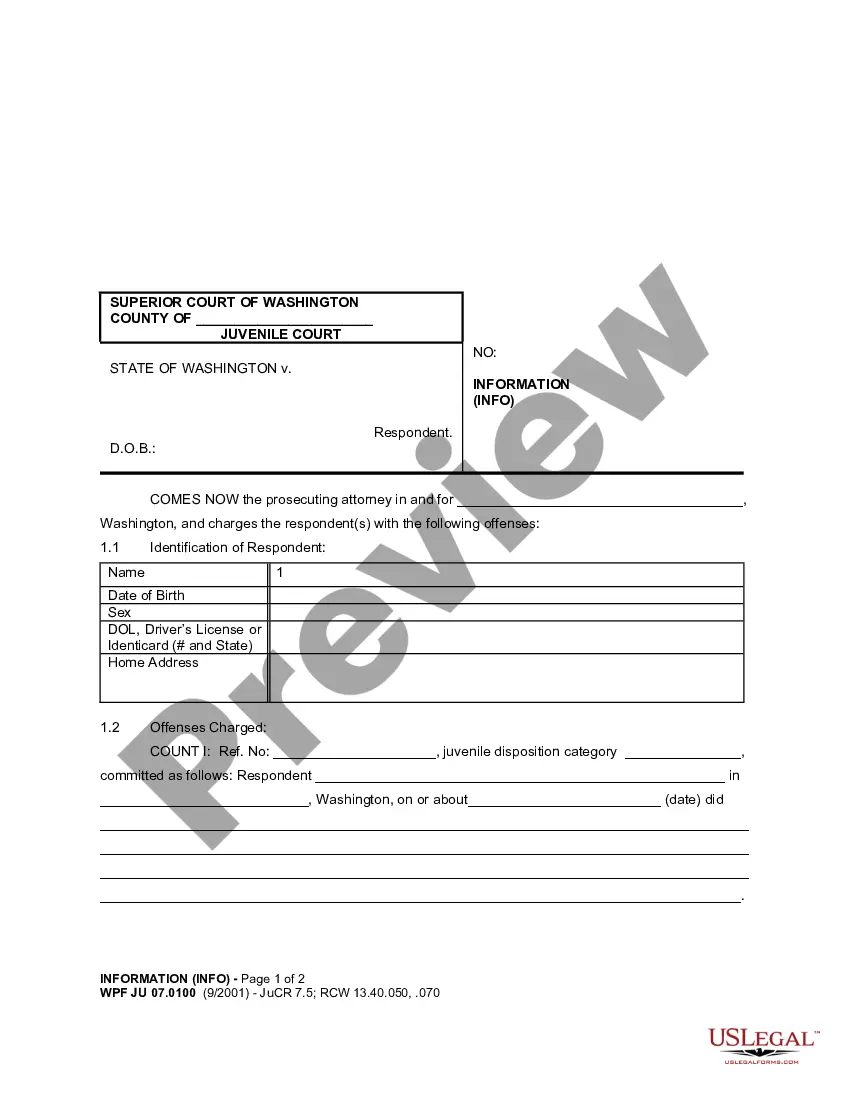

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Florida Deferred Compensation Agreement - Short Form, suitable for both business and personal purposes.

You can preview the form using the Review button and examine the form description to confirm it is the correct one for you.

- All of the forms are reviewed by experts and meet federal and state requirements.

- If you are currently registered, Log In to your account and click the Download button to access the Florida Deferred Compensation Agreement - Short Form.

- Use your account to browse through the legal forms you have purchased previously.

- Navigate to the My documents section of your account and download another copy of the document you need.

- For new users of US Legal Forms, here are straightforward steps to follow.

- First, ensure you have selected the correct form for your specific city/state.

Form popularity

FAQ

The federal tax rate for deferred compensation aligns with your ordinary income tax rates during the year of withdrawal. This means you should plan withdrawals strategically under a Florida Deferred Compensation Agreement - Short Form to minimize your tax burden. Our platform provides helpful insights and tools to forecast these impacts, enabling you to optimize your retirement income.

You can generally withdraw from a 457 plan without incurring an additional tax penalty once you reach age 59½. Withdrawals are still subject to regular income tax, but knowing this age threshold can aid in strategizing under a Florida Deferred Compensation Agreement - Short Form. This information is crucial for planning your retirement effectively.

When you retire, consider your options for accessing your deferred compensation funds. You can withdraw funds either as a lump sum or through scheduled payments. It's essential to carefully evaluate your financial needs and potential tax implications under a Florida Deferred Compensation Agreement - Short Form. Consulting our resources can help simplify this decision-making process.

A common example of a deferred compensation plan is a 457 plan offered by many employers. This type of plan allows employees to set aside a portion of their income for retirement, deferring taxes until withdrawal. For those interested in a Florida Deferred Compensation Agreement - Short Form, this plan enables effective savings while minimizing immediate tax impact. You can utilize our platform to easily set up such plans.

Typically, a deferred compensation plan is funded by contributions from employees, and in some cases, employers may match a portion of those contributions. As you navigate your Florida Deferred Compensation Agreement - Short Form, it's important to know how contributions work to optimize your retirement savings. Setting clear funding goals can significantly impact your financial future.

Setting up a deferred compensation plan involves completing an enrollment process through your employer or the designated plan provider. You will review your options and sign a Florida Deferred Compensation Agreement - Short Form to initiate your contributions. It’s crucial to consult with your HR department for tailored guidance and assistance during this process.

The director of the retirement system in Florida is appointed by the Department of Management Services. This individual oversees the administration of state retirement plans, including the deferred compensation plan. Staying informed about the director's initiatives can enrich your understanding of how your Florida Deferred Compensation Agreement - Short Form is influenced and managed.

In Florida, the provider of deferred compensation programs is often managed by the state of Florida’s Division of Retirement. They oversee the administration and ensure compliance with legal guidelines. It’s advisable to review your Florida Deferred Compensation Agreement - Short Form to identify your specific plan's administrator and available investment options.

Recording deferred compensation involves accurately tracking your contributions and any earnings on those contributions over time. You should regularly review your Florida Deferred Compensation Agreement - Short Form to ensure all transactions are correctly documented. Utilizing financial software or tools can simplify this process, ensuring that your records are organized and accessible.

The state of Florida offers a deferred compensation plan designed to help employees save for retirement while reducing their taxable income. This plan allows you to contribute a portion of your salary to a tax-deferred account, enhancing your savings potential. Understanding the Florida Deferred Compensation Agreement - Short Form can empower you to maximize your financial growth and prepare for a secure retirement.