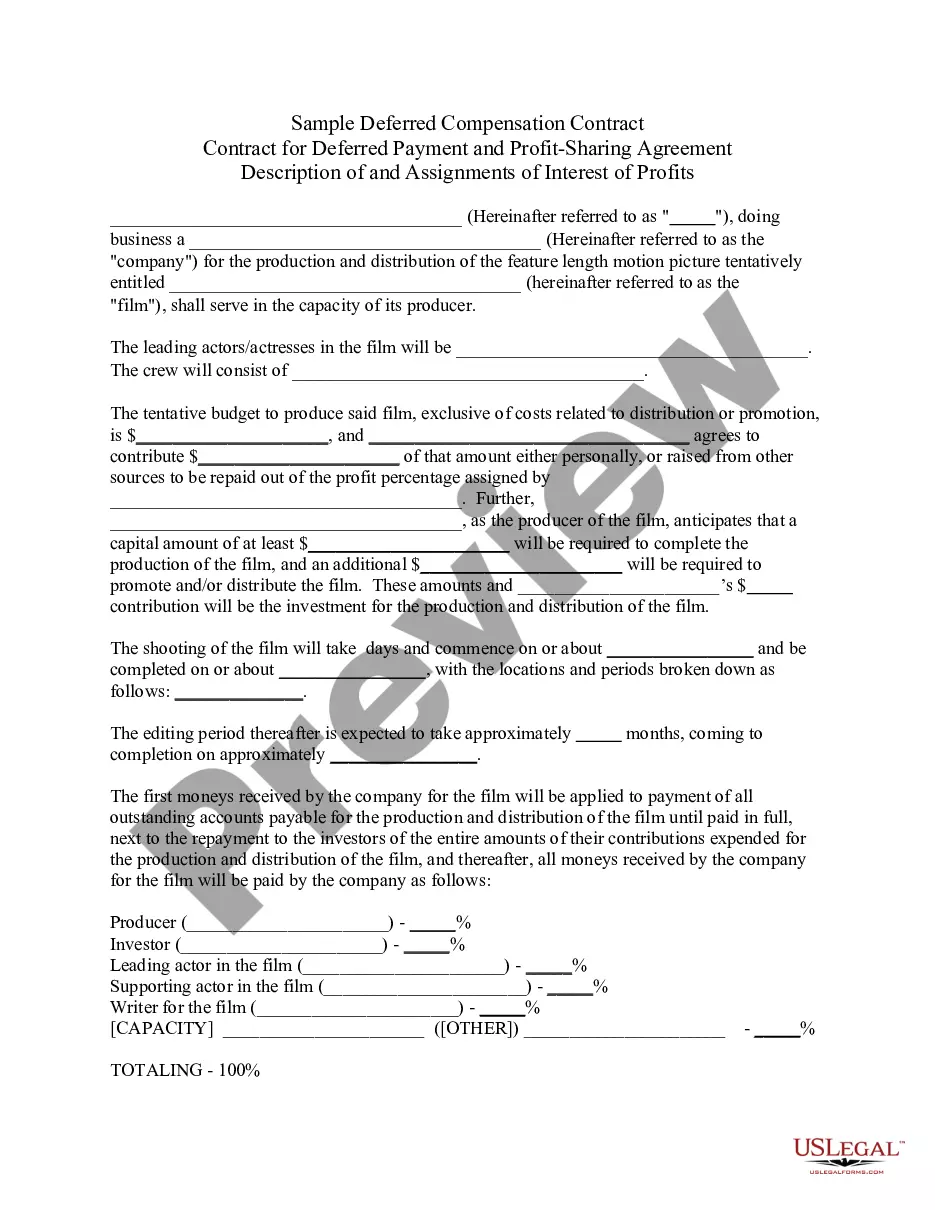

Florida Deferred Compensation Agreement - Long Form

Description

How to fill out Deferred Compensation Agreement - Long Form?

If you desire to compile, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms, which can be accessed online.

Take advantage of the site’s user-friendly and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded within your account. Click the My documents section and choose a form to print or download again.

Be proactive and download, and print the Florida Deferred Compensation Agreement - Long Form with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to obtain the Florida Deferred Compensation Agreement - Long Form in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to get the Florida Deferred Compensation Agreement - Long Form.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview mode to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your credentials to register for the account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Florida Deferred Compensation Agreement - Long Form.

Form popularity

FAQ

Florida's deferred compensation plans are managed by various financial institutions that are contracted by the state. These providers are responsible for administering the plans outlined in the Florida Deferred Compensation Agreement - Long Form, ensuring a smooth experience for participants. Choosing a reliable provider is crucial for maximizing your retirement savings. For insights on selecting the right provider, US Legal Forms can assist you with relevant information and documentation.

Deferred compensation is typically distributed upon retirement, termination of employment, or reaching a specific age. The Florida Deferred Compensation Agreement - Long Form specifies how and when you can access these funds, ensuring participants understand their options. It's important to plan for these distributions carefully, as they can have tax implications. For assistance, US Legal Forms offers resources to help you manage your deferred compensation effectively.

The director of the retirement system in Florida oversees various retirement plans, including the Florida Deferred Compensation Agreement - Long Form. This position is critical for maintaining the integrity and efficiency of retirement funds. The director ensures compliance with state regulations and works to provide optimal services to plan participants. If you need more information on retirement system management, US Legal Forms can guide you through the necessary resources.

The state of Florida deferred compensation plan is a retirement savings program that allows employees to set aside a portion of their salary before taxes. This plan is designed to help individuals save for retirement more effectively by offering tax-deferred growth. The Florida Deferred Compensation Agreement - Long Form outlines the terms and conditions of the contributions and distributions, ensuring participants understand their benefits. Using platforms like US Legal Forms can simplify the process of setting up this agreement.

Upon retirement, your deferred compensation typically becomes available based on the terms of your plan. You may have the option to receive it in a lump sum or schedule periodic payments, depending on what works best for your financial strategy. Always review your Florida Deferred Compensation Agreement - Long Form to understand your options clearly.

Setting up a deferred compensation plan typically involves assessing your financial goals, selecting a provider, and choosing the right plan type. You'll also need to work with your employer to establish the contributions and terms. For a comprehensive understanding, consult the resources available through uslegalforms for your Florida Deferred Compensation Agreement - Long Form.

The downside of deferred compensation includes potential risks such as losing your investment if your employer faces financial difficulties. Moreover, funds in a deferred compensation plan are often illiquid, meaning you cannot access them until certain conditions are met. It's vital to weigh these disadvantages when considering a Florida Deferred Compensation Agreement - Long Form.

To avoid paying taxes on deferred compensation, consider leaving the funds in the plan until retirement, when your tax bracket could be lower. Additionally, certain plans may allow for tax-deferred growth, enabling you to postpone taxes until withdrawal. Always consult your Florida Deferred Compensation Agreement - Long Form to understand your tax obligations and strategies.

Recording deferred compensation usually involves accounting for it as a liability on your balance sheet, while simultaneously documenting the corresponding expense on your income statement. This practice ensures that you represent your financial obligations accurately. Utilizing tools from uslegalforms can help simplify this process for your Florida Deferred Compensation Agreement - Long Form.

Generally, you can withdraw from your deferred compensation plan without penalty at the age of 59½. After this age, you can take distributions that are not subject to additional penalties. It's essential to review the specific terms of your Florida Deferred Compensation Agreement - Long Form, as some plans may have unique provisions regarding penalties.