Florida Sample Letter to accompany Revised Quitclaim Deed

Description

How to fill out Sample Letter To Accompany Revised Quitclaim Deed?

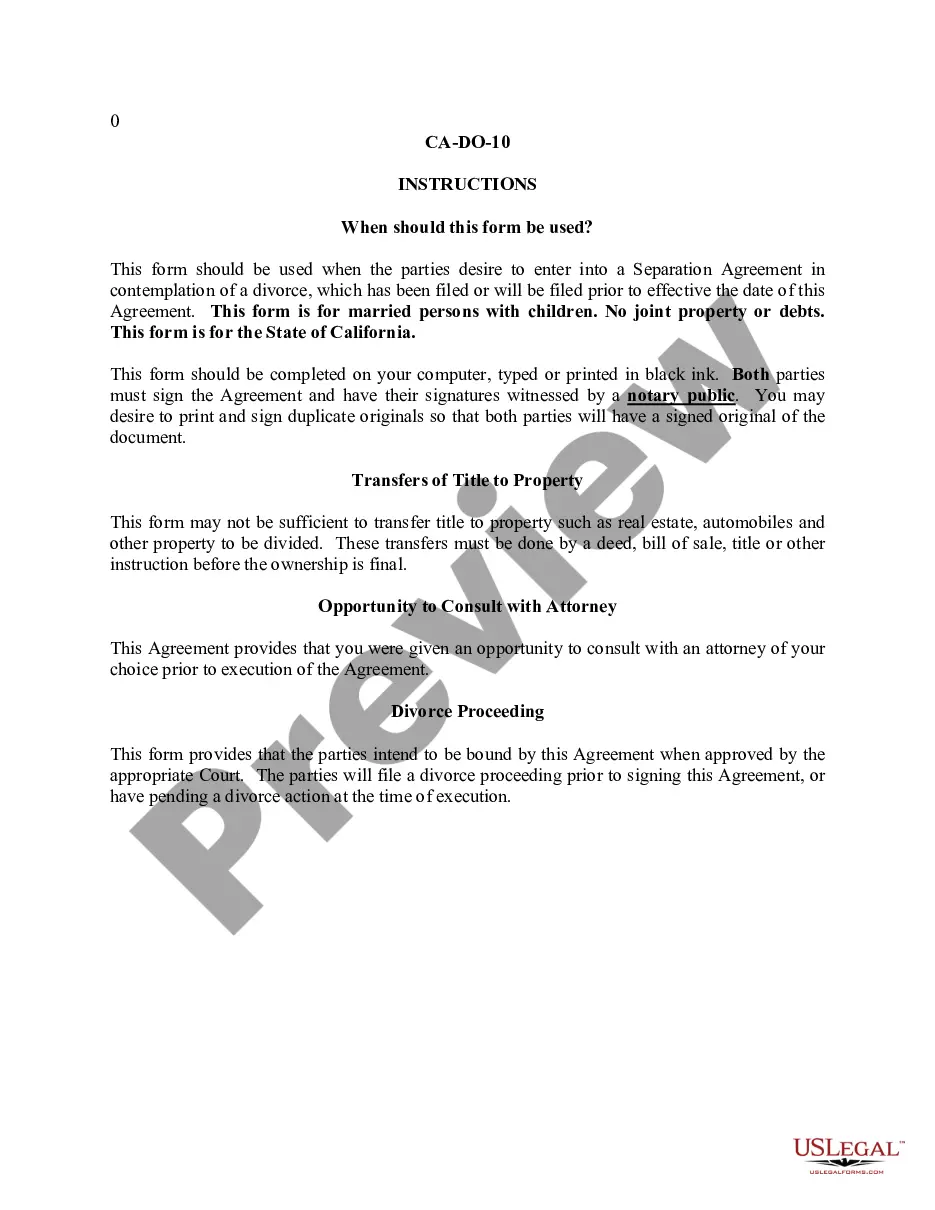

Are you presently in a situation where you require documentation for potential business or specific necessities almost every day? There are numerous legitimate document templates accessible online, but finding reliable ones can be challenging. US Legal Forms provides thousands of form templates, such as the Florida Sample Letter to accompany Revised Quitclaim Deed, which are designed to meet state and federal regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Florida Sample Letter to accompany Revised Quitclaim Deed template.

If you do not have an account and wish to start using US Legal Forms, follow these instructions: Find the form you need and ensure it is for the correct state/county. Use the Review option to examine the form. Check the information to confirm that you have selected the right form. If the form is not what you are looking for, utilize the Search field to locate the form that fits your needs and requirements. Once you find the correct form, click on Get now. Select the pricing plan you prefer, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card. Choose a convenient file format and download your copy.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Access all the document templates you have purchased in the My documents menu.

- You can retrieve an additional copy of Florida Sample Letter to accompany Revised Quitclaim Deed at any time, if needed.

- Just click on the required form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid mistakes.

- The service offers properly crafted legal document templates that can be employed for a variety of purposes.

- Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

A quitclaim deed is the simplest way to transfer real estate in Florida. It is usually used to transfer title to a person, trust, or company or to add a name to a deed.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

The first way to cancel a quitclaim deed is to draft, sign, and record a new deed transferring the property back to the grantor. As quitclaim deeds are generally used in property transfers involving family members or persons who trust each other, both parties may consent to use a new deed to reverse the document.

A quitclaim deed is like saying, ?I don't want my claim on this property anymore? and giving it to someone else. This deed doesn't promise the property is free from other claims; it just passes on whatever the current owner (the grantor) has to the new owner (the grantee).

Once your lawyer prepares the new deed, the grantor (the current owner or the party transferring an interest in the property) simply signs the new Deed in the presence of two witnesses and has their signature notarized.

Once the quitclaim deed is recorded, it becomes part of the public record. You may also be required to pay a filing fee or costs associated with properties that have an outstanding mortgage. If there is money being exchanged for the deed, documentary stamp taxes will also have to be paid.

Deed signed by mistake (grantor did not know what was signed) Deed executed under falsified power of attorney. Deed executed under expired power of attorney (death, disability, or insanity of principal) Deed apparently valid, but actually delivered after death of grantor or grantee, or without consent of grantor.

To sell a home you received through a quitclaim deed, you will still need to transfer ownership using a warranty deed. To do this, you'll need to hire a title company to perform a title search, which will generally cost between $150 and $400, but can be much more depending on the property.

Forgeryand fraud A forged deed is void under Florida law and is a third-degree felony. The term covers the fraudulent production of a legal document or making alterations to a legal document which may render it void. These forged documents can make their way into public records and be treated like legitimate documents.