Florida Agreement No Escrow Account Option Agreement

Description

How to fill out Florida Agreement No Escrow Account Option Agreement?

Gain access to the largest collection of sanctioned documents.

US Legal Forms serves as a resource for locating any state-specific document in just a few clicks, including examples of the Florida Agreement No Escrow Account Option Agreement.

No need to invest hours of your time searching for a court-acceptable template. Our certified experts guarantee that you receive the latest samples every time.

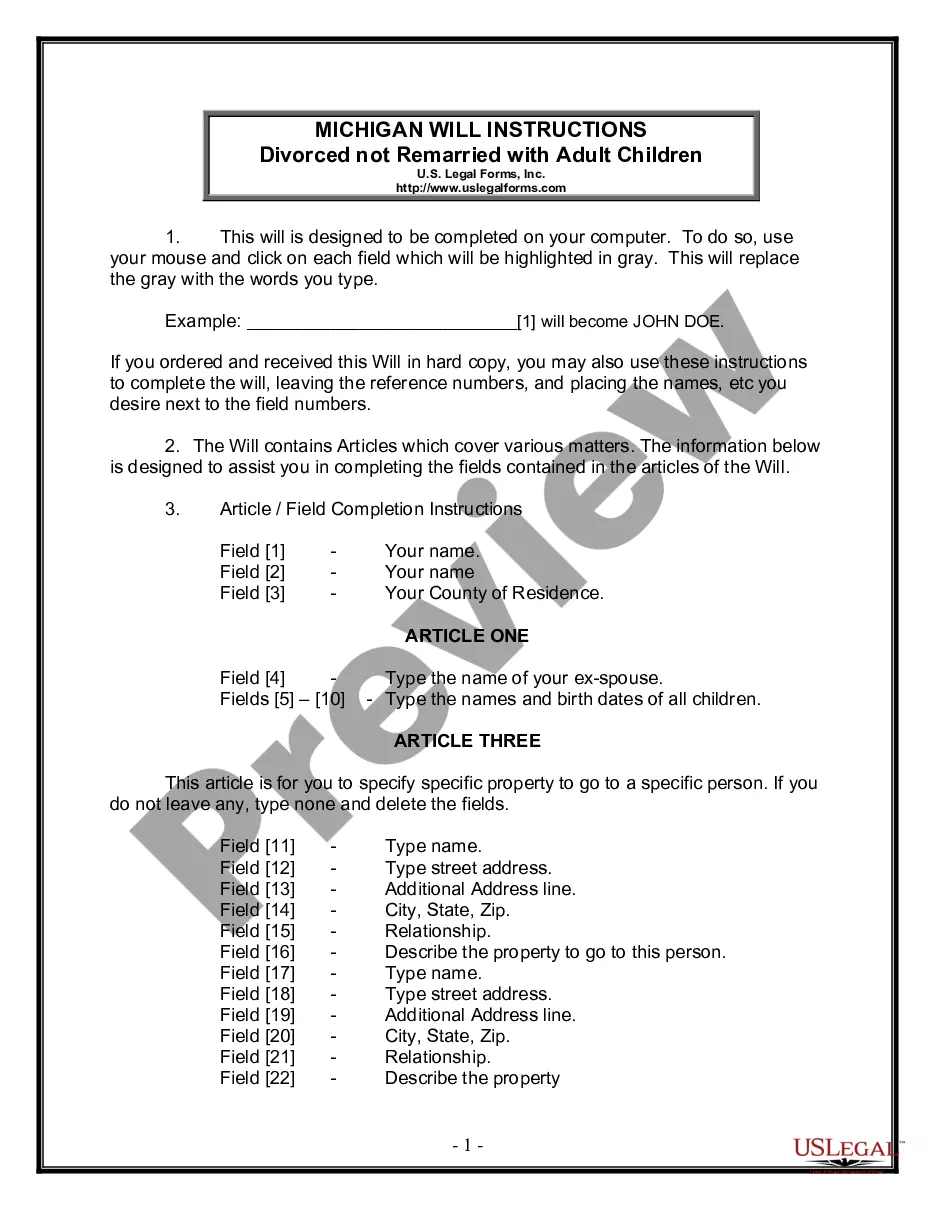

If everything seems suitable, click Buy Now. After selecting a pricing plan, create an account. Make your payment via card or PayPal. Download the example to your device by clicking Download. That’s it! You should complete the Florida Agreement No Escrow Account Option Agreement template and review it. To ensure everything is accurate, consult your local legal advisor for assistance. Sign up and easily explore over 85,000 useful templates.

- To benefit from the document library, select a subscription and create your account.

- If you have done this, just Log In and then click Download.

- The Florida Agreement No Escrow Account Option Agreement example will promptly be saved in the My documents section (a section for each form you download on US Legal Forms).

- To create a new account, follow the brief instructions provided below.

- If you plan to use a state-specific document, make sure to select the correct state.

- If possible, review the description to understand all details of the document.

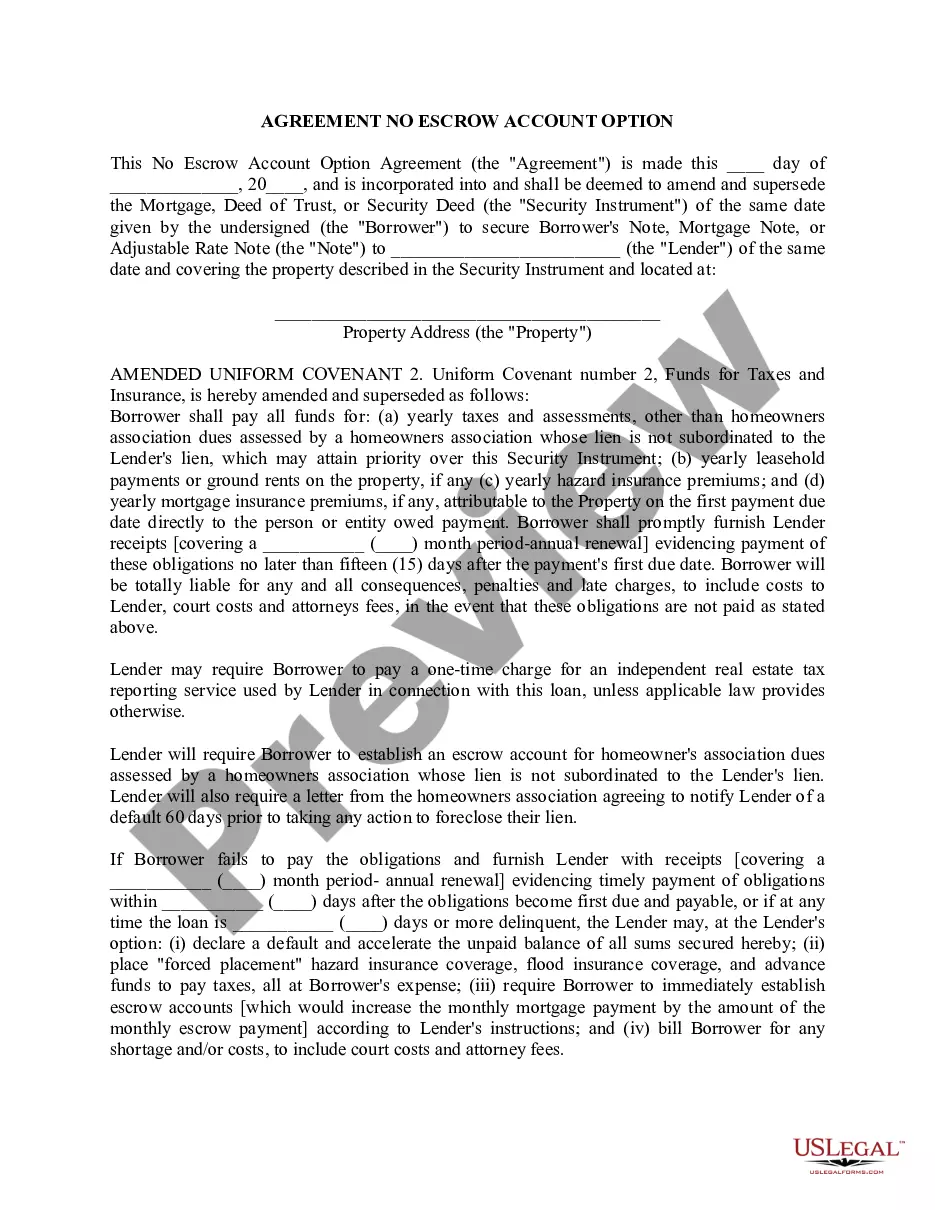

- Utilize the Preview feature if available to view the document's content.

Form popularity

FAQ

Generally, the parties to a transaction must establish an escrow account when using traditional escrow services. The buyer and seller agree on the terms, and an escrow agent is appointed to hold funds securely. However, with the Florida Agreement No Escrow Account Option Agreement, the parties can forego this step, leading to different protocols for managing funds.

An escrow agreement is typically drafted by the parties involved, often with help from legal professionals or real estate agents. The document outlines the terms of the agreement, roles, and expectations for each party, including payment conditions. In the context of the Florida Agreement No Escrow Account Option Agreement, utilizing platforms like uslegalforms can simplify this process and provide reliable templates.

The escrow is created when both the buyer and seller agree on terms and engage an escrow agent. The agent is a neutral third-party responsible for managing the funds and documents exchanged during the transaction. If you consider the Florida Agreement No Escrow Account Option Agreement, the creation of the arrangement may differ slightly, emphasizing clarity and mutual consent between involved parties.

Typically, the buyer and seller reach an agreement and then designate an escrow agent to open the escrow. The escrow agent is responsible for managing the process and holding funds until all contractual obligations are fulfilled. In cases involving the Florida Agreement No Escrow Account Option Agreement, you might identify alternative arrangements with your parties to navigate the transaction without traditional escrow.

In a typical escrow agreement, the parties involved include the buyer, the seller, and the escrow agent. The buyer and seller enter into a contract, while the escrow agent manages the funds and documents. In the context of the Florida Agreement No Escrow Account Option Agreement, it is essential that all parties clearly understand their roles to ensure smooth transactions.

In many cases, you can opt out of an escrow account, especially if you negotiate the terms of your mortgage. The Florida Agreement No Escrow Account Option Agreement is specifically designed for borrowers who prefer to handle their tax and insurance payments independently. Nonetheless, it is important to check with your lender about their specific policies before making any changes. Awareness of your options empowers you to make the best choice for your situation.

Yes, mortgage companies can sometimes require you to have an escrow account. This is often the case if you are a high-risk borrower or if your down payment is less than a certain percentage. However, through the Florida Agreement No Escrow Account Option Agreement, you may have the option to negotiate terms that allow you to avoid this requirement. Understanding your options can help you maintain control over your finances.

An escrow account is not mandatory in Florida, thanks to the provisions in the Florida Agreement No Escrow Account Option Agreement. This choice empowers both landlords and tenants to create tailored agreements based on their unique situations. Avoiding mandatory escrow can simplify transactions and foster smoother relationships. Make sure to document your agreement thoroughly for clarity and security.

Escrow is not mandatory in Florida, especially when using the Florida Agreement No Escrow Account Option Agreement. This option allows for more flexible arrangements between landlords and tenants concerning their deposits. Many property owners and renters prefer to negotiate specific terms that deviate from traditional escrow requirements. Always consult with legal experts if you're uncertain about your obligations.

Yes, you can waive escrows in Florida when both parties agree, as outlined in the Florida Agreement No Escrow Account Option Agreement. By mutually deciding to waive the escrow requirement, landlords and tenants can streamline their transaction process. It is essential to document this agreement clearly to prevent any future disputes. Working with a reliable platform like uslegalforms can help you draft the right agreements.