Delaware Last Will and Testament with All Property to Trust called a Pour Over Will

What this document covers

This Last Will and Testament, often referred to as a Pour Over Will, serves a critical purpose in estate planning. It ensures that all property not already transferred to your living trust is directed to the trust upon your death. The Pour Over Will complements a living trust by allowing assets that were not previously included in the trust to "pour over" into it after the grantor's death. Unlike a traditional will, this form emphasizes the connection between a will and an already established trust, making it an essential document for comprehensive estate management.

Main sections of this form

- Article One: Specifies the transfer of any remaining assets to the living trust.

- Article Two: Outlines the payment of debts and expenses from the estate.

- Article Three: Allows the naming of a guardian for any minor children.

- Article Four: Appoints a personal representative to manage the estate.

- Article Five: Waives the requirement for bond and formal inventory of the estate.

- Article Six: Grants broad powers to the personal representative for estate administration.

Situations where this form applies

This form should be used when you are setting up, or have already established, a living trust and want to ensure that all of your assets, including those not yet transferred, are covered after your death. It is particularly useful for individuals who want to maintain control over how their assets are distributed, minimizing the risk of state laws interfering with their wishes.

Who needs this form

- Individuals establishing a living trust.

- Individuals who have assets not yet transferred to a trust.

- Anyone wanting to ensure all assets are managed according to their wishes after death.

How to prepare this document

- Identify the parties involved, including yourself (the testator) and any trustees.

- Specify the property and assets that you wish to transfer to the trust.

- Enter details regarding any minor children and appoint a guardian if applicable.

- Choose and document the personal representative who will manage the estate.

- Sign the will in the presence of witnesses to ensure its validity.

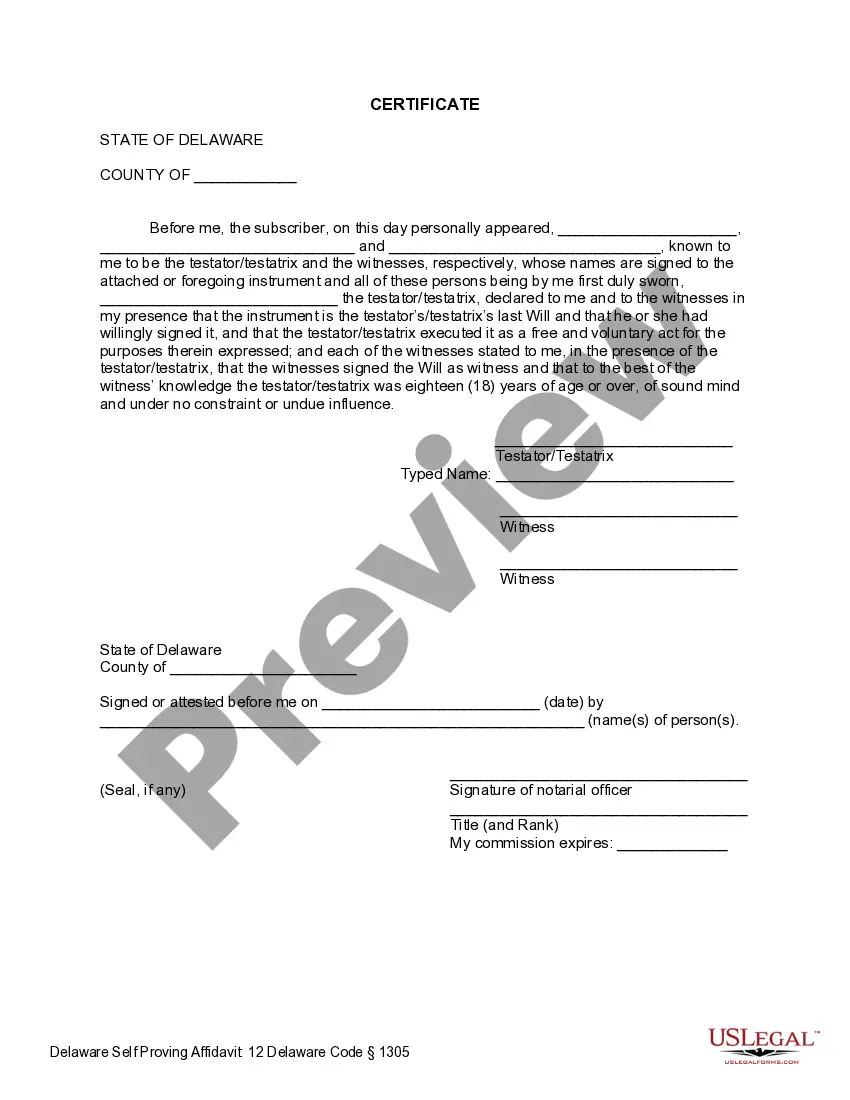

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Common mistakes to avoid

- Failing to transfer all assets to the trust while alive.

- Not appointing a guardian for minor children if applicable.

- Neglecting to have the will properly witnessed and signed.

Why use this form online

- Convenience of completing the form from home at your own pace.

- Editability to ensure all details are accurate before submission.

- Instant access to templates designed by licensed attorneys, ensuring legal reliability.

State law considerations

This form is designed for use in multiple states, particularly reflecting the legal framework applicable in Delaware. It adheres to general state laws related to wills, trusts, and estate management. Users should verify their local laws as requirements can vary by jurisdiction.

Form popularity

FAQ

Using a trust instead of a will can provide several advantages, including asset management flexibility and probate avoidance. A trust can control how assets are distributed over time, which is helpful for minor children or loved ones who need assistance. With a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, you can leverage these benefits while still ensuring all your assets are directed to the trust upon your passing.

In general, a last will and testament does not override a trust, especially when the trust includes specific directives for asset distribution. If the assets are in the trust, they will be managed according to the trust’s guidelines rather than the provisions of the will. By understanding the dynamics of a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, you can effectively ensure your estate plan works harmoniously.

Yes, a trust can override a last will and testament if the terms of the trust specify otherwise. For example, any assets placed in a trust during your lifetime will be distributed according to the trust and not according to your Delaware Last Will and Testament with All Property to Trust called a Pour Over Will. This emphasizes the importance of proper estate planning to ensure your wishes are clearly delineated.

over will functions by directing any assets not included in a trust at the time of your passing to be transferred into the trust. This ensures that everything you own can be managed under the same trust, which can make it easier to handle your estate. By utilizing a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, you streamline your estate management and ensure your final wishes are honored.

over will is a specific type of last will and testament designed to transfer assets into a trust upon your death. In contrast, a traditional last will and testament only distributes assets directly to recipients. When you create a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, you ensure that any remaining assets not already in the trust will be moved there automatically, simplifying the estate process.

Beneficiaries do not take precedence over a trust; instead, they gain their rights through the terms of the trust. In the case of a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, the distribution of assets depends on what is outlined in the trust document. This means that the trust can dictate how and when beneficiaries receive their inheritances, which is not the case with a simple will.

A trust generally holds more power than a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will. This is because a trust can manage your assets while you are alive and after you pass away. Unlike a will, a trust allows for more control over how your assets are distributed, often avoiding probate. By using a trust, you can protect your loved ones from lengthy legal proceedings.

Distributing trust property to beneficiaries involves following the instructions laid out in the trust document. The trustee is responsible for managing assets and ensuring that distributions are made according to the terms of the trust. Utilizing a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will can simplify this process, as it helps to designate any remaining assets to flow directly into the trust for distribution.

Generally, a will does not override a trust, but it can influence how assets are distributed if there are conflicting directives. A Delaware Last Will and Testament with All Property to Trust called a Pour Over Will functions to align any leftover assets with your trust. If properly executed, this ensures your property will be managed according to your wishes established in the trust.

One disadvantage of a will is that it typically goes through probate, which can be a lengthy and public process. In contrast, a trust, particularly when combined with a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, can help your estate avoid the probate process. This benefit allows for quicker and more private distribution of assets to your beneficiaries.