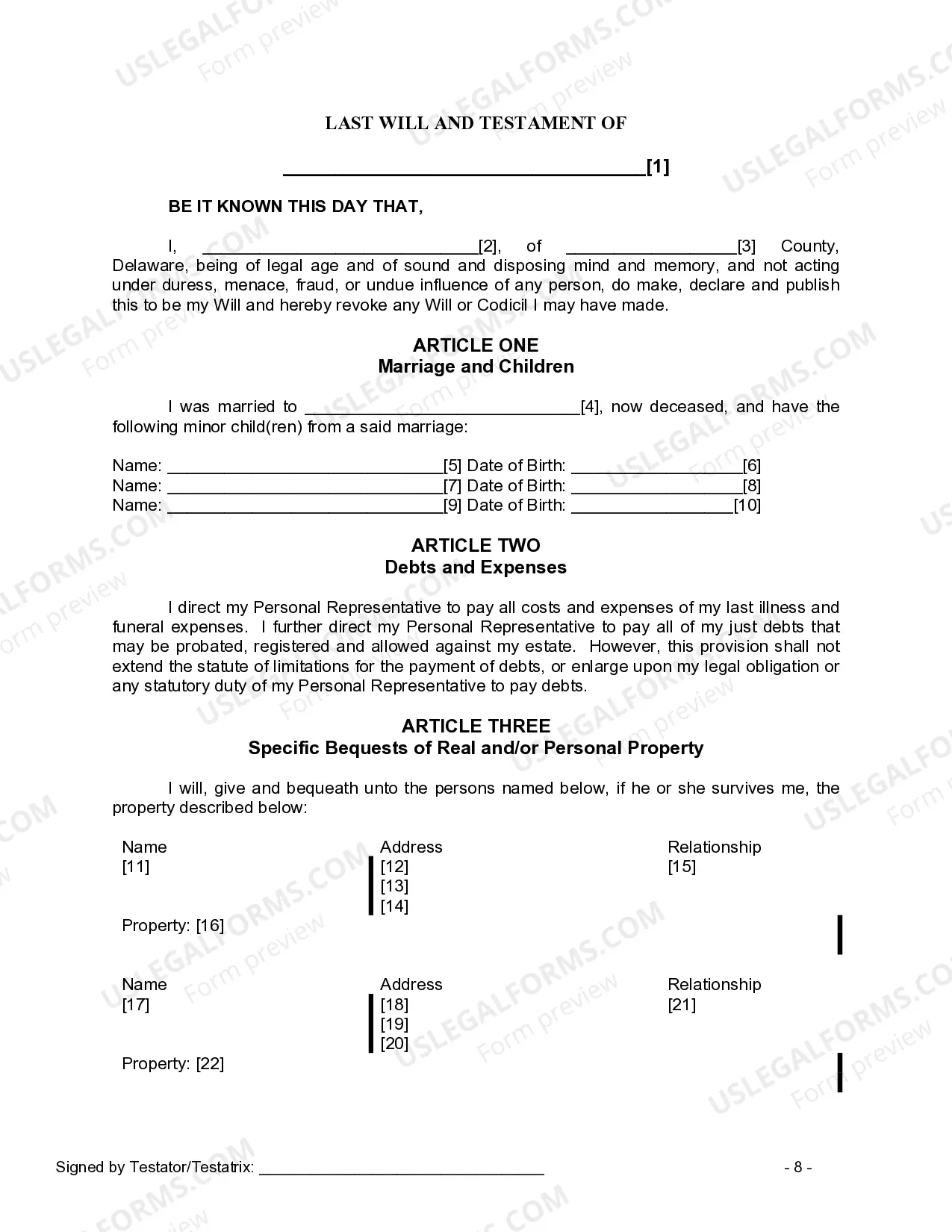

Delaware Last Will and Testament for Widow or Widower with Minor Children

Overview of this form

This Last Will and Testament for Widow or Widower with Minor Children is a legal document that outlines how your property and assets will be distributed upon your death, specifically designed for individuals who are widowed and have minor children. This form helps ensure that your wishes are met regarding the appointment of a personal representative, distribution of assets, and care of your children, providing specific provisions for their guardianship and trusts for their benefit. By using this form, you can establish clear directions for your estate, making it easier for your loved ones during a difficult time.

Key components of this form

- Personal Representative: Appoint a trusted individual to manage your estate.

- Witness Requirements: Specify that the will must be signed in the presence of two witnesses.

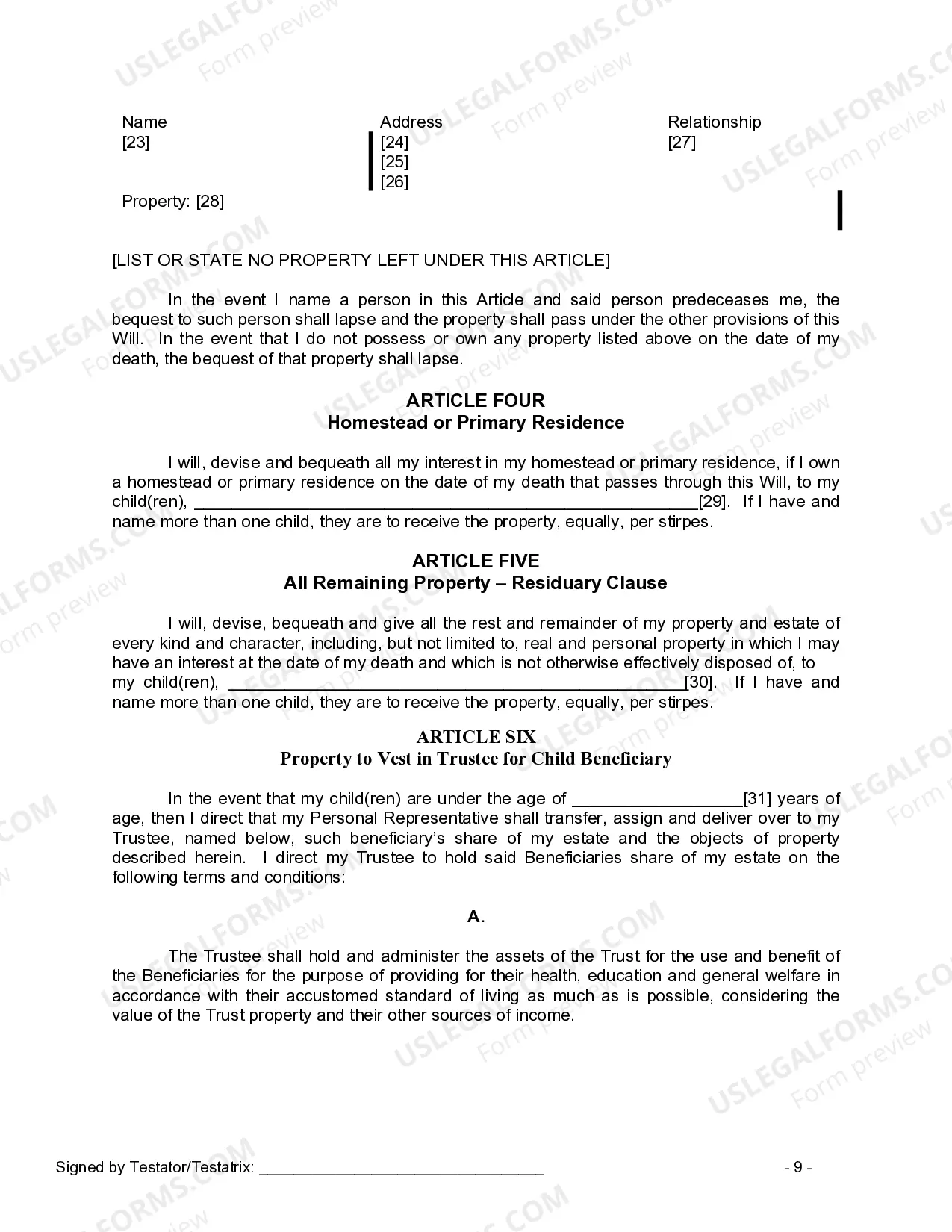

- Trust for Minor Children: Establish a trust for assets intended for minor children until they reach a specified age.

- Guardianship: Designate a guardian for your minor children to ensure their care.

- Specific Bequests: Outline any specific gifts of property to individuals.

State law considerations

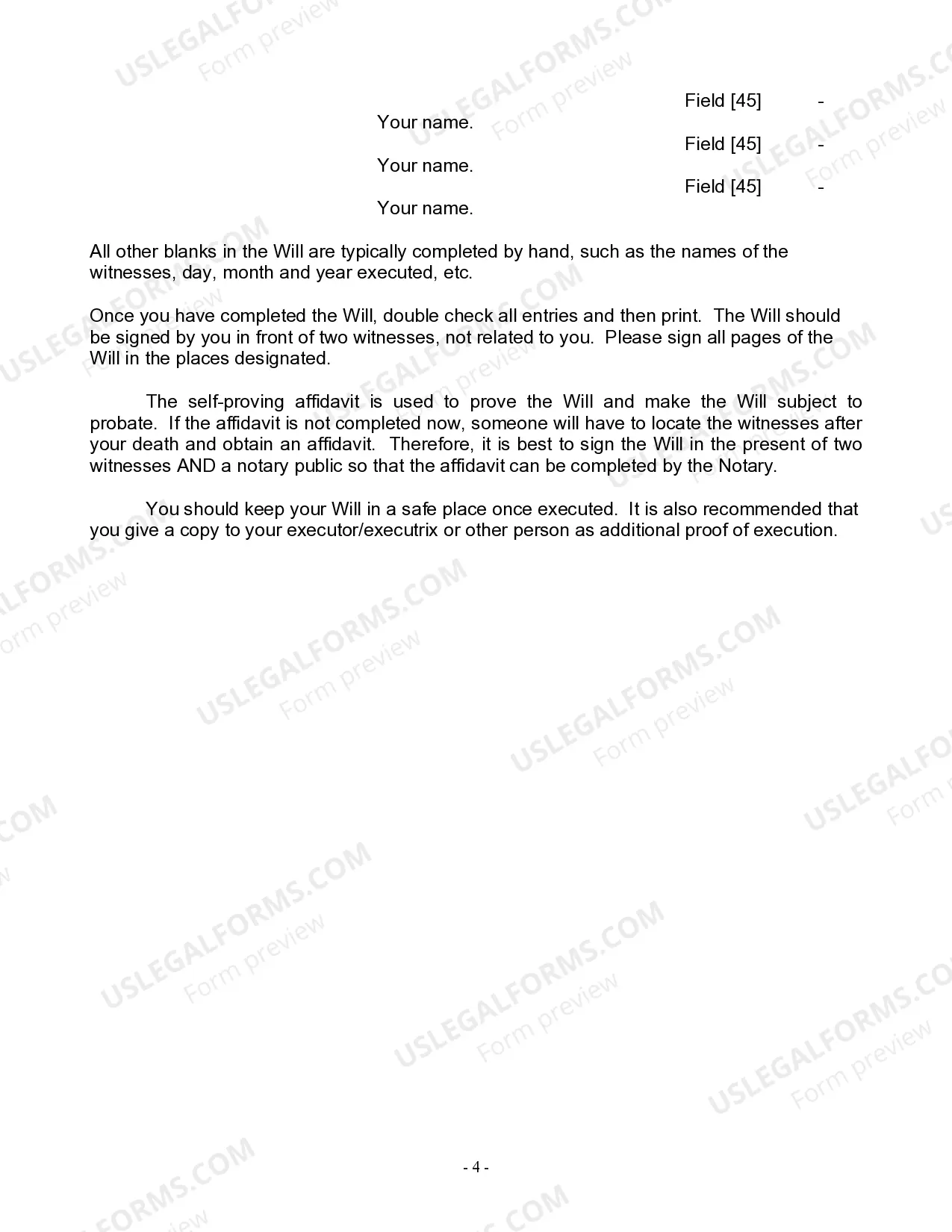

This form is designed to meet the general requirements for will execution in many states; however, state laws may vary. Be sure to consult your local laws to ensure compliance, especially regarding witness requirements and the need for notarization.

When to use this document

You should use this Last Will and Testament when you are a widow or widower with minor children and wish to ensure that your assets are distributed according to your wishes after your death. This form is beneficial if you want to address specific guardianship arrangements for your children and any assets that should be held in trust for their benefit until they are of legal age.

Who should use this form

- Individuals who have lost their spouse and wish to provide for their children.

- Parents with minor children looking to name guardians and manage assets for their benefit.

- Widows or widowers who want to ensure clear distribution of their estate as per personal wishes.

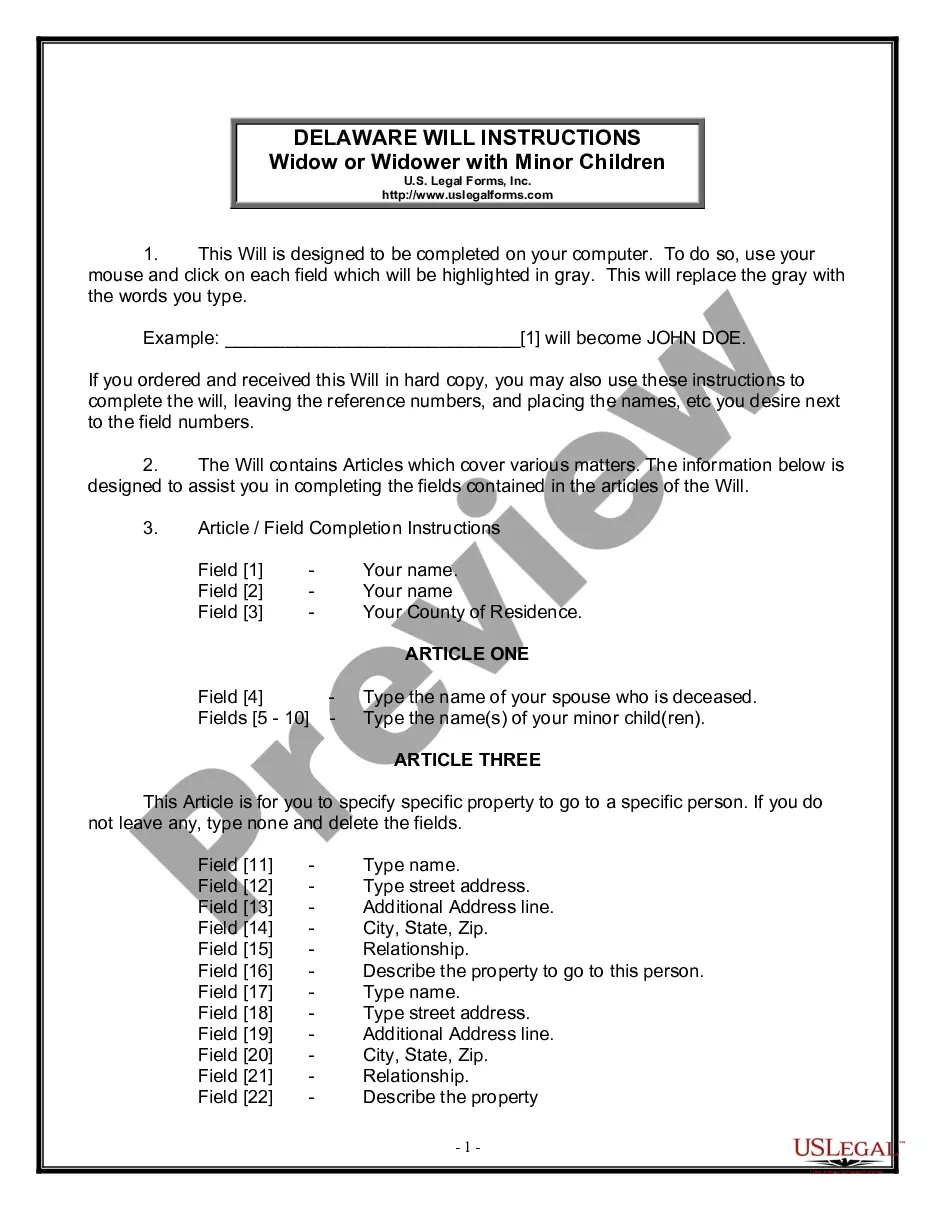

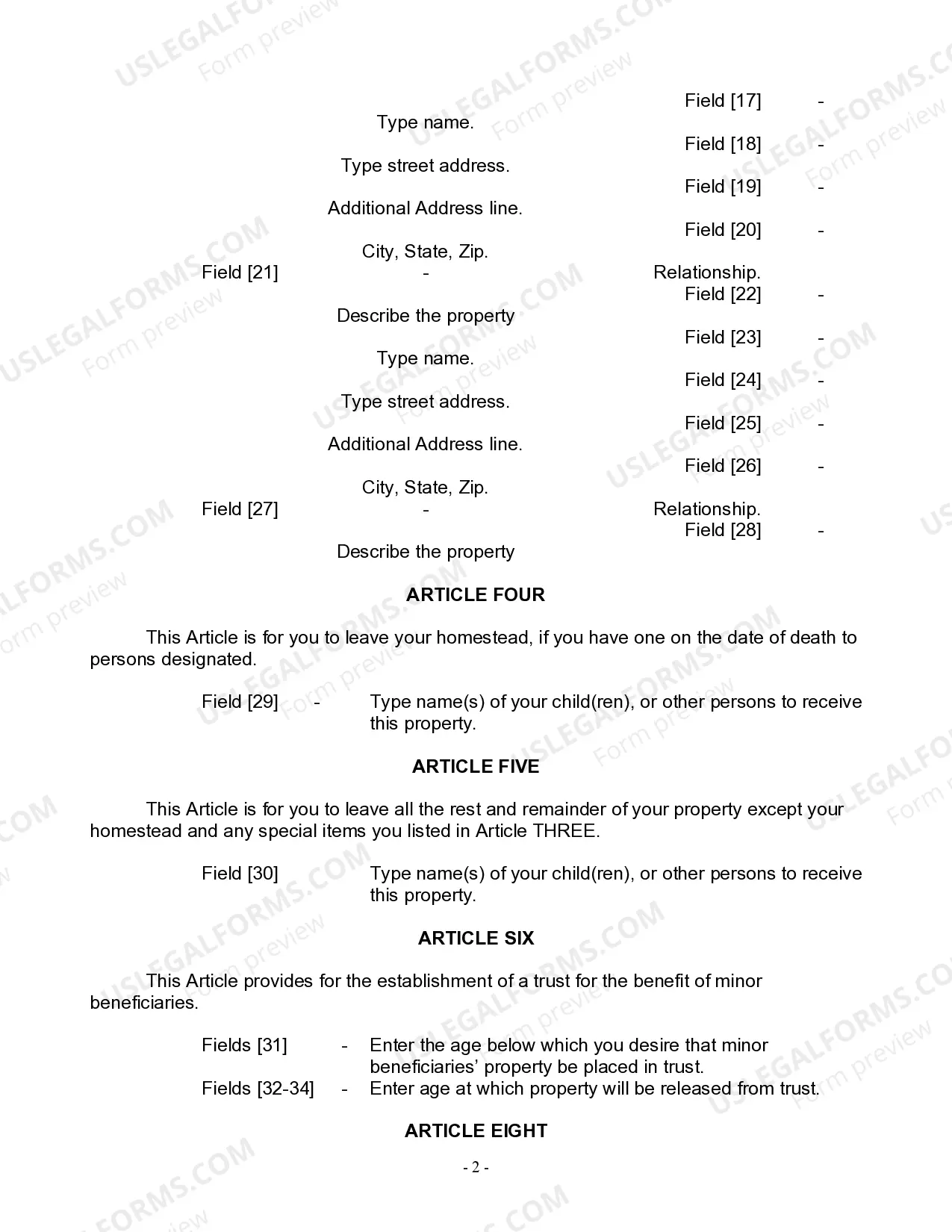

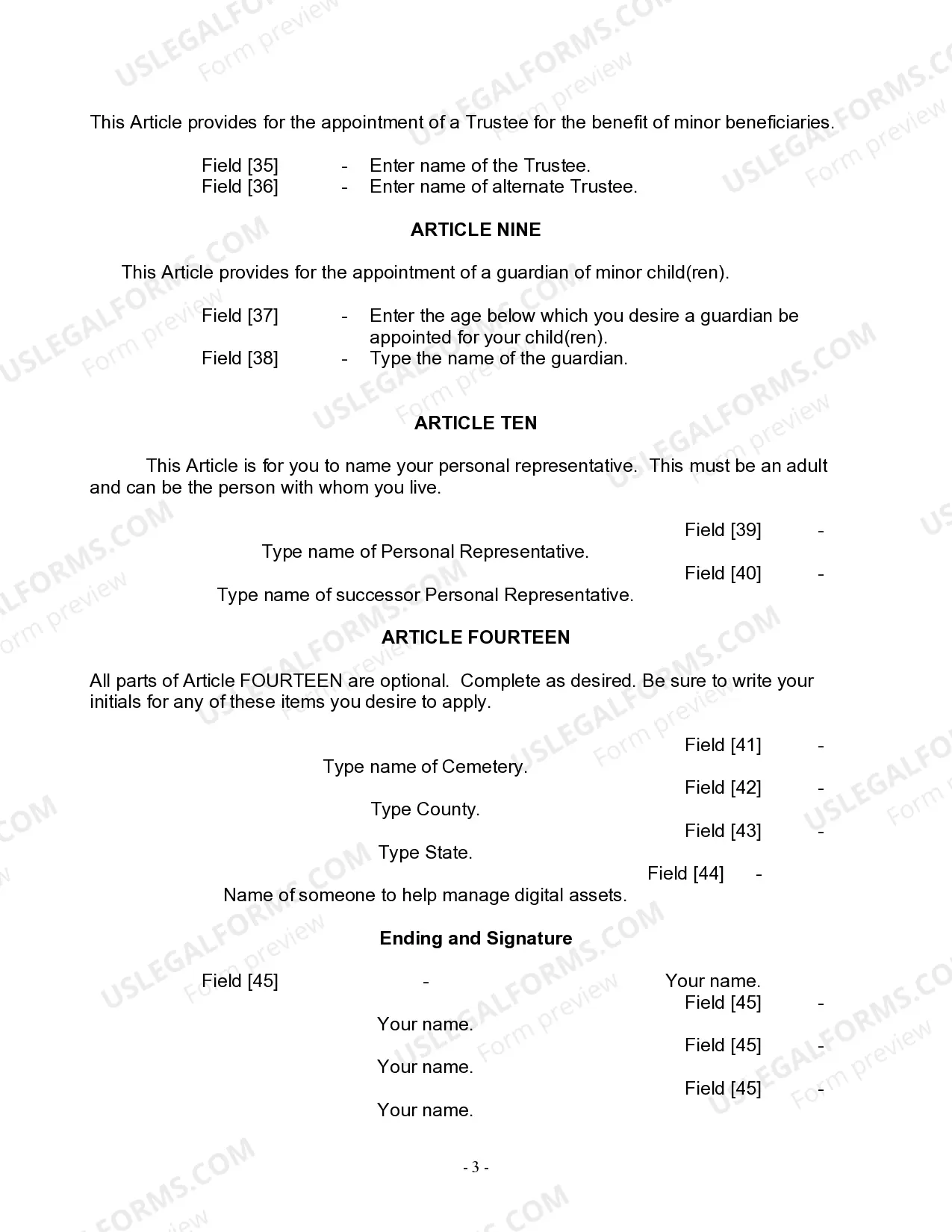

How to complete this form

- Enter your name and county of residence in the designated fields.

- Specify the name of your deceased spouse and your minor children.

- Fill out the sections detailing specific property bequests and any additional provisions you wish to include.

- Designate your personal representative and any alternate representatives.

- Sign the will in front of two witnesses, ensuring that all required fields are completed.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Typical mistakes to avoid

- Not having the will signed in front of the required number of witnesses.

- Failing to include specific provisions for guardianship of minor children.

- Neglecting to update the will after significant life events (e.g., remarriage, new children).

- Omitting to notarize the will when necessary for specific state laws.

Benefits of completing this form online

- Convenience: Fill out and download your will from anywhere at any time.

- Editability: Easily make changes to your will as your circumstances change.

- Security: Access a reliable legal document created by licensed attorneys.

Form popularity

FAQ

In Washington, notarization is not required for a will to be valid. However, if your will is self-proving, which means it is signed in front of a notary, it can make the probate process smoother. If you are drafting a Delaware Last Will and Testament for a Widow or Widower with Minor Children, consider using UsLegalForms for guidance on state-specific requirements. This can streamline the preparation process while ensuring legal compliance.

In Minnesota, a will does not need to be notarized to be valid. However, having witnesses sign your will can provide extra security and help in case of disputes. If you are considering a Delaware Last Will and Testament for a Widow or Widower with Minor Children, using a witnessed approach may be beneficial. This strategy can also be helpful if you travel or live in different states.

You can find a reliable form to create a Delaware Last Will and Testament for a Widow or Widower with Minor Children through UsLegalForms. This platform offers customizable templates that meet Delaware's legal requirements. You can fill out the form easily online, ensuring it addresses your specific needs. It's an efficient way to prepare your will without unnecessary hassle.

The executor of a will with a surviving spouse is typically the person named in the will itself. If you create a Delaware Last Will and Testament for Widow or Widower with Minor Children, it’s wise to appoint someone reliable who can act in your children’s best interests. Should the named executor not be available, the court may appoint someone based on state laws. For assistance in designating an executor, uslegalforms provides accessible resources.

A surviving spouse cannot unilaterally change the executor named in a will. If you are the widow or widower and need to make changes, you must create a new Delaware Last Will and Testament for Widow or Widower with Minor Children. This legally revokes the previous will and allows you to appoint a new executor. You can easily draft a new will through uslegalforms for peace of mind.

A spouse generally cannot change the executor of a will without consent unless they are the named executor. If you're drafting a Delaware Last Will and Testament for Widow or Widower with Minor Children, it's important to designate an executor you trust. This designation ensures your wishes are carried out as intended. You can find templates and guidance on uslegalforms to help you with your will.

To avoid probate in Delaware, consider setting up a trust or designating beneficiaries directly on assets. Additionally, a well-structured Delaware Last Will and Testament for Widow or Widower with Minor Children can minimize probate challenges by clearly outlining your wishes. This approach can streamline the transfer of assets and protect your children's future. Platforms like uslegalforms can help you with this process.

In general, a surviving spouse may have rights that can override a beneficiary designation, but this depends on specific circumstances outlined in the Delaware Last Will and Testament for Widow or Widower with Minor Children. Typically, if a will specifies a beneficiary, that designation is honored unless the spouse is entitled to a marital share. Clarifying this can be crucial for estate planning, and uslegalforms can guide you through creating an appropriate will.

Creating a Delaware Last Will and Testament for Widow or Widower with Minor Children does not legally require a lawyer. However, consulting one can provide clarity and assurance that your will meets all legal standards. This is especially important when ensuring your minor children are properly cared for after your passing. Using platforms like uslegalforms can help you draft your will effectively.

For a will to be valid in Delaware, it must be written, signed by the testator, and witnessed by at least two individuals who are not beneficiaries. A clear expression of your wishes contributes to the validity of your document. By crafting a Delaware Last Will and Testament for Widow or Widower with Minor Children, you ensure your specific desires for your minor children and assets are legally recognized.