Delaware Exhibit A to Operating Agreement - Contract Area and Parties - Form 3

Description

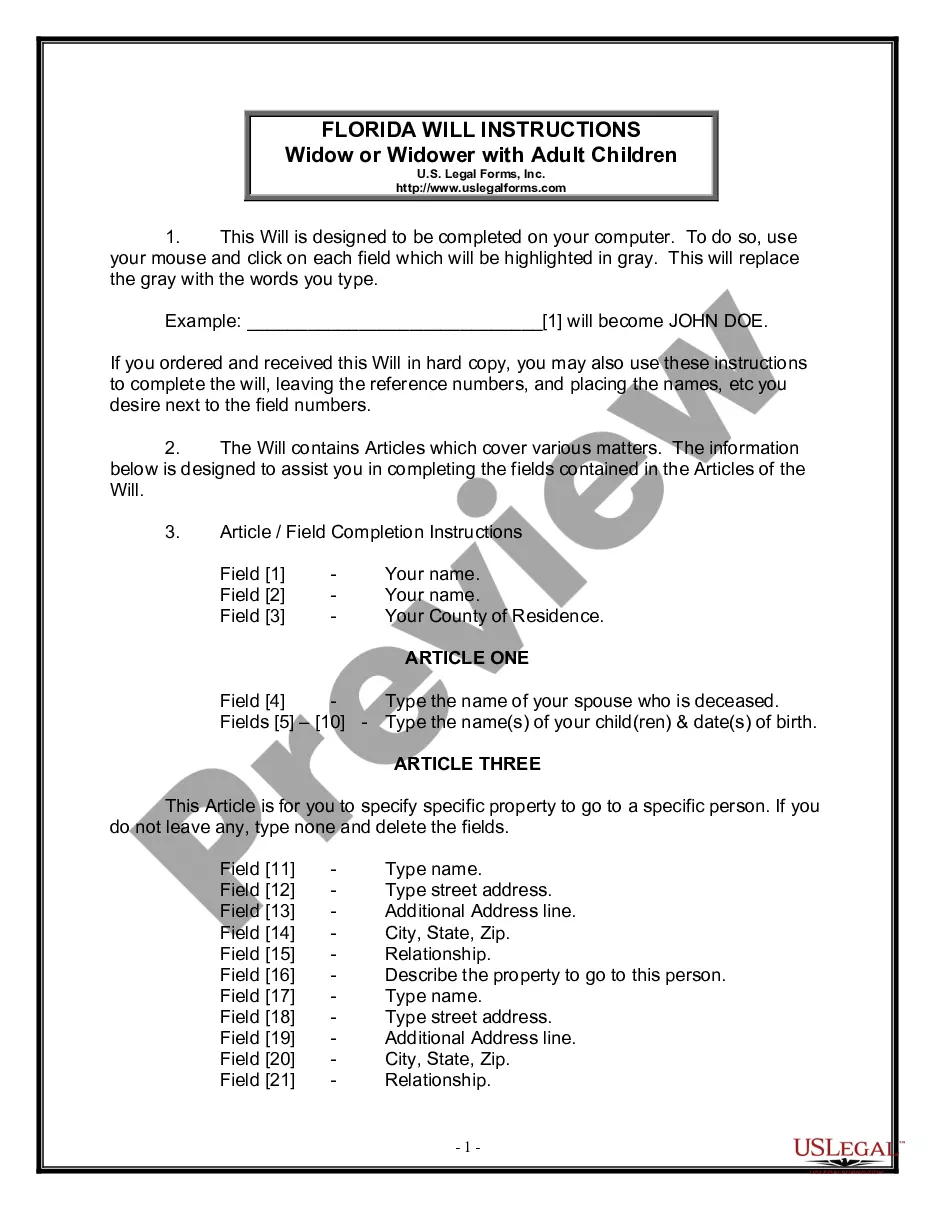

How to fill out Exhibit A To Operating Agreement - Contract Area And Parties - Form 3?

US Legal Forms - among the largest libraries of authorized kinds in the USA - provides a wide range of authorized document web templates you may down load or printing. Making use of the web site, you will get thousands of kinds for enterprise and person reasons, categorized by categories, suggests, or search phrases.You can get the most recent types of kinds just like the Delaware Exhibit A to Operating Agreement - Contract Area and Parties - Form 3 in seconds.

If you have a membership, log in and down load Delaware Exhibit A to Operating Agreement - Contract Area and Parties - Form 3 from the US Legal Forms catalogue. The Down load option will appear on each and every form you look at. You get access to all in the past downloaded kinds within the My Forms tab of your respective accounts.

If you wish to use US Legal Forms for the first time, allow me to share easy directions to obtain started:

- Make sure you have picked the correct form for your personal metropolis/area. Go through the Preview option to examine the form`s articles. Read the form outline to actually have chosen the proper form.

- In case the form doesn`t satisfy your specifications, utilize the Look for field near the top of the screen to discover the one who does.

- In case you are pleased with the shape, confirm your selection by clicking on the Purchase now option. Then, pick the rates strategy you want and provide your credentials to sign up for an accounts.

- Procedure the purchase. Utilize your Visa or Mastercard or PayPal accounts to perform the purchase.

- Find the format and down load the shape on the product.

- Make adjustments. Complete, change and printing and indicator the downloaded Delaware Exhibit A to Operating Agreement - Contract Area and Parties - Form 3.

Every template you included with your bank account does not have an expiration date and is the one you have forever. So, if you wish to down load or printing one more copy, just check out the My Forms portion and then click in the form you want.

Get access to the Delaware Exhibit A to Operating Agreement - Contract Area and Parties - Form 3 with US Legal Forms, probably the most considerable catalogue of authorized document web templates. Use thousands of specialist and status-particular web templates that satisfy your small business or person needs and specifications.

Form popularity

FAQ

Delaware does NOT require an operating agreement. However, it is highly recommended to have a LLC operating agreement even if you are only a single member LLC. The state of Delaware recognizes operating agreements and governing documents.

One of the most important sections in the operating agreement is the capital contribution section. A capital contribution section usually addresses what happens if members fail to contribute their portion of the initial start-up capital.

The most common capital contribution is cash, but you can also contribute property, such as office space, vehicles, and equipment. It's also possible to contribute services to an LLC.

By having those rules and following them, LLCs operate more efficiently." Common provisions in an LLC agreement include a statement of intent, a business purpose, the time period during which it will operate, how it will be taxed, new LLC member admissions, and member capital contributions.

Example of Contributed Capital For example, a company issues 5,000 $1 par value shares to investors. The investors pay $10 a share, so the company raises $50,000 in equity capital. As a result, the company records $5,000 to the common stock account and $45,000 to the paid-in capital in excess of par.

This clause should be used when one member contributed real property to the joint venture in exchange for membership interests and another member has contributed capital. The capitalized terms and section references used in this clause should be conformed to the relevant joint venture operating agreement.

One of the most important sections in the operating agreement is the capital contribution section. A capital contribution section usually addresses what happens if members fail to contribute their portion of the initial start-up capital.

Most often, operating agreements provide that each owner's distributive share corresponds to his or her percentage of ownership in the LLC. For example, because Tony owns only 35% of his LLC, he receives just 35% of its profits and losses.