Delaware Self-Employed Ceiling Installation Contract

Description

How to fill out Self-Employed Ceiling Installation Contract?

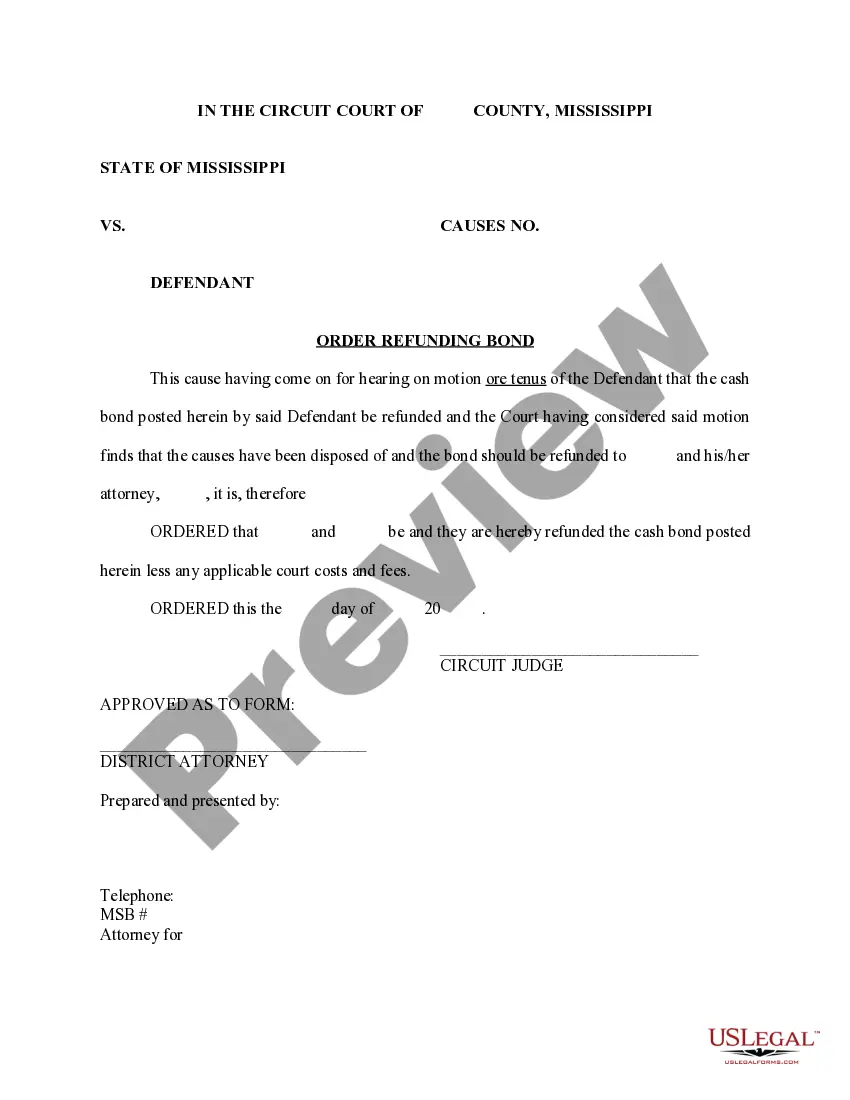

Selecting the optimal authentic document template can be quite a challenge. Naturally, there are numerous templates accessible online, but how do you find the authentic form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Delaware Self-Employed Ceiling Installation Agreement, that can be utilized for both business and personal needs. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Delaware Self-Employed Ceiling Installation Agreement. Use your account to search for the legal forms you have previously acquired. Proceed to the My documents section of your account to download an additional copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions that you can follow: First, make sure you have selected the appropriate form for your area/county. You can browse the form using the Preview option and read the form description to ensure it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the correct form. Once you are certain that the form is correct, click on the Buy now button to obtain the form. Choose the pricing plan you desire and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the received Delaware Self-Employed Ceiling Installation Agreement.

- US Legal Forms is the largest library of legal forms where you can find various document templates.

- Utilize the service to download professionally crafted papers that adhere to state regulations.

- Ensure you select the correct form for your specific needs.

- Take advantage of the preview option to review the form before downloading.

- Use the search feature if you cannot find the desired form.

- Follow the steps to create an account and complete your purchase smoothly.

Form popularity

FAQ

Yes, you can act as your own general contractor in Delaware, provided you meet all the necessary licensing and insurance requirements. This is particularly relevant if you are managing projects under a Delaware Self-Employed Ceiling Installation Contract. It can provide you with greater control over your work, but make sure to follow all regulations to avoid potential issues.

In Delaware, anyone operating a business, including independent contractors, typically needs a business license. This includes individuals working under a Delaware Self-Employed Ceiling Installation Contract. The license helps protect consumers and ensures compliance with local laws, making it crucial for all contractors to obtain one.

Delaware does require certain contractors to hold a license, especially those engaged in specific trades like electrical or plumbing work. If your work involves ceiling installation under a Delaware Self-Employed Ceiling Installation Contract, you may need to check if a specific contractor license is necessary. Always verify with the Delaware Division of Professional Regulation for the most accurate information.

While registering as an independent contractor is not always required, it is a good practice to establish your business identity. This step can simplify your tax process and help you secure contracts, including the Delaware Self-Employed Ceiling Installation Contract. Using platforms like US Legal Forms can streamline this registration process and ensure you meet all necessary requirements.

Yes, independent contractors in Delaware generally need a business license to operate legally. This requirement applies whether you are working under a Delaware Self-Employed Ceiling Installation Contract or on other projects. It's important to check with your local government for specific regulations, as licensing can vary by county or city.

While a handyman does not require a general license in Delaware, specific tasks may necessitate licensing. If your work involves specialized trades, such as electrical or plumbing, obtaining the relevant licenses is essential. For those engaged in a Delaware Self-Employed Ceiling Installation Contract, it’s wise to familiarize yourself with local regulations to avoid potential fines. US Legal Forms can provide you with the necessary documentation and support to stay compliant.

In Delaware, a breach of contract occurs when one party fails to fulfill their obligations under the agreement. The essential elements include the existence of a valid contract, the breach of that contract, and damages suffered by the non-breaching party. If you are involved in a Delaware Self-Employed Ceiling Installation Contract, understanding these elements can help protect your interests. You can find valuable contract templates on the US Legal Forms platform to ensure clarity and compliance.

You can work as an independent contractor in Delaware without a license for certain types of jobs, particularly general labor tasks. However, for specialized work, such as electrical or plumbing, you will need a license. When entering into a Delaware Self-Employed Ceiling Installation Contract, you should confirm whether your specific services require licensing. The US Legal Forms platform can assist you in understanding these guidelines.

Yes, subcontractors in Delaware must have the necessary licenses depending on the type of work they perform. For instance, if a subcontractor is involved in specialized trades, such as roofing or HVAC, they will need to acquire specific licenses. When working under a Delaware Self-Employed Ceiling Installation Contract, it’s crucial to ensure that all subcontractors are properly licensed to avoid legal issues. US Legal Forms offers resources to help you navigate these requirements.

In Delaware, handymen are not required to have a specific license for all types of work. However, if your work involves certain trades, such as electrical or plumbing services, you will need the appropriate licenses. For those engaged in a Delaware Self-Employed Ceiling Installation Contract, it’s essential to verify local regulations and ensure compliance. Utilizing the US Legal Forms platform can help you access necessary documents and guidance.