Delaware Self-Employed Supplier Services Contract

Description

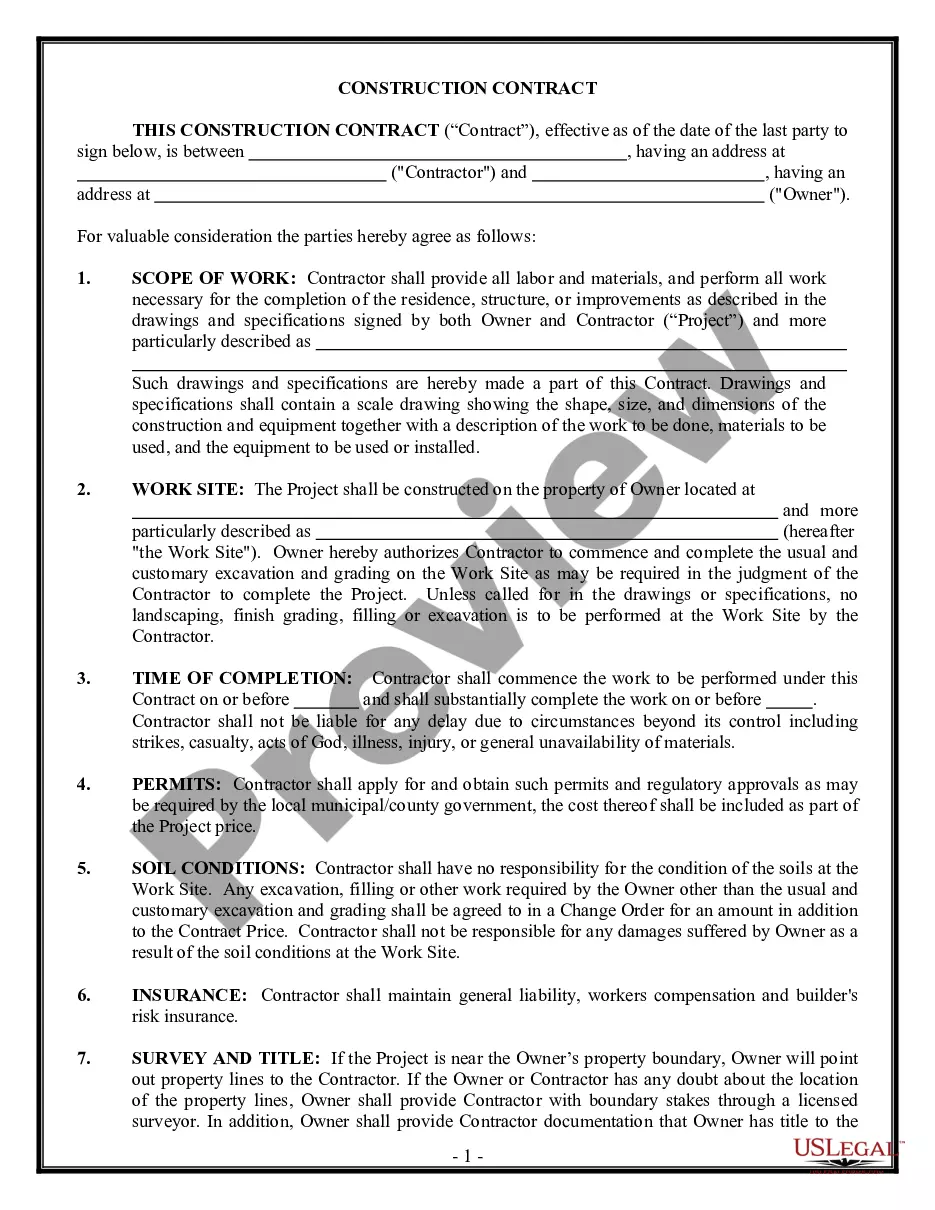

How to fill out Self-Employed Supplier Services Contract?

Have you ever found yourself needing documents for a company or individual almost every business day? There are numerous legal document templates available online, but finding reliable ones can be challenging. US Legal Forms offers a vast array of form templates, such as the Delaware Self-Employed Supplier Services Contract, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Delaware Self-Employed Supplier Services Contract template.

If you do not have an account and wish to use US Legal Forms, follow these steps: Find the form you need and ensure it is applicable to the correct city/county. Use the Preview option to review the document. Read the description to confirm you have chosen the correct form. If the form does not meet your requirements, utilize the Search field to find the form that suits your needs. Once you locate the appropriate form, click on Buy now. Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Delaware Self-Employed Supplier Services Contract at any time, if needed. Just click on the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

In Delaware, an operating agreement is not legally required for LLCs, but it is highly recommended. This document outlines the management structure and operating procedures of your LLC, which can help prevent disputes among members. If you are a self-employed supplier, consider a Delaware Self-Employed Supplier Services Contract to complement your LLC's operating agreement.

Yes, you can write your own legally binding contract, provided it meets the legal requirements of your state. Ensure that the contract includes all necessary components, such as clear terms, signatures, and dates. A Delaware Self-Employed Supplier Services Contract created using templates from USLegal can help you ensure that your contract is valid and enforceable.

Writing a self-employment contract involves detailing the services you will provide and the compensation structure. Be sure to include the terms of termination, confidentiality clauses, and any other relevant provisions. A well-drafted Delaware Self-Employed Supplier Services Contract from USLegal can ensure you cover all necessary aspects to protect your interests.

When writing a contract for a 1099 employee, specify the nature of the work, payment structure, and deadlines. It’s crucial to clarify that the worker is an independent contractor, not an employee. Utilizing resources from USLegal can help you create a robust Delaware Self-Employed Supplier Services Contract that meets your needs.

A Delaware employment contract is a legal agreement between an employer and an employee that outlines the terms of employment. This includes job responsibilities, compensation, and any benefits or rights. For self-employed individuals, a Delaware Self-Employed Supplier Services Contract serves a similar purpose, ensuring clarity in the working relationship.

To write a self-employed contract, start by clearly defining the scope of work and the responsibilities of both parties. Include payment terms, deadlines, and any specific conditions that may apply. Using a template, like those from USLegal, can streamline the process and ensure you cover all essential elements of a Delaware Self-Employed Supplier Services Contract.

To establish a breach of contract in Delaware, you must demonstrate that a valid contract existed, the other party failed to fulfill their obligations, and you suffered damages as a result. Understanding these elements is crucial when entering into agreements. A well-structured Delaware Self-Employed Supplier Services Contract can help clarify expectations and reduce the risk of breaches.

Without an operating agreement, an LLC may face challenges in governance and may default to state laws regarding operations. This can lead to misunderstandings and conflicts among members. To avoid such issues, consider drafting a Delaware Self-Employed Supplier Services Contract that outlines your specific needs and agreements.

Delaware does not require LLCs to have an operating agreement. Nevertheless, having one is beneficial as it provides a clear framework for the operations and management of the business. A Delaware Self-Employed Supplier Services Contract can help you establish this framework effectively.

While many states do not require an operating agreement, some, like California and New York, strongly recommend having one. This document is essential for defining roles and responsibilities. Consider a Delaware Self-Employed Supplier Services Contract to fulfill similar needs even if your state does not mandate it.