Delaware Contract Administrator Agreement - Self-Employed Independent Contractor

Description

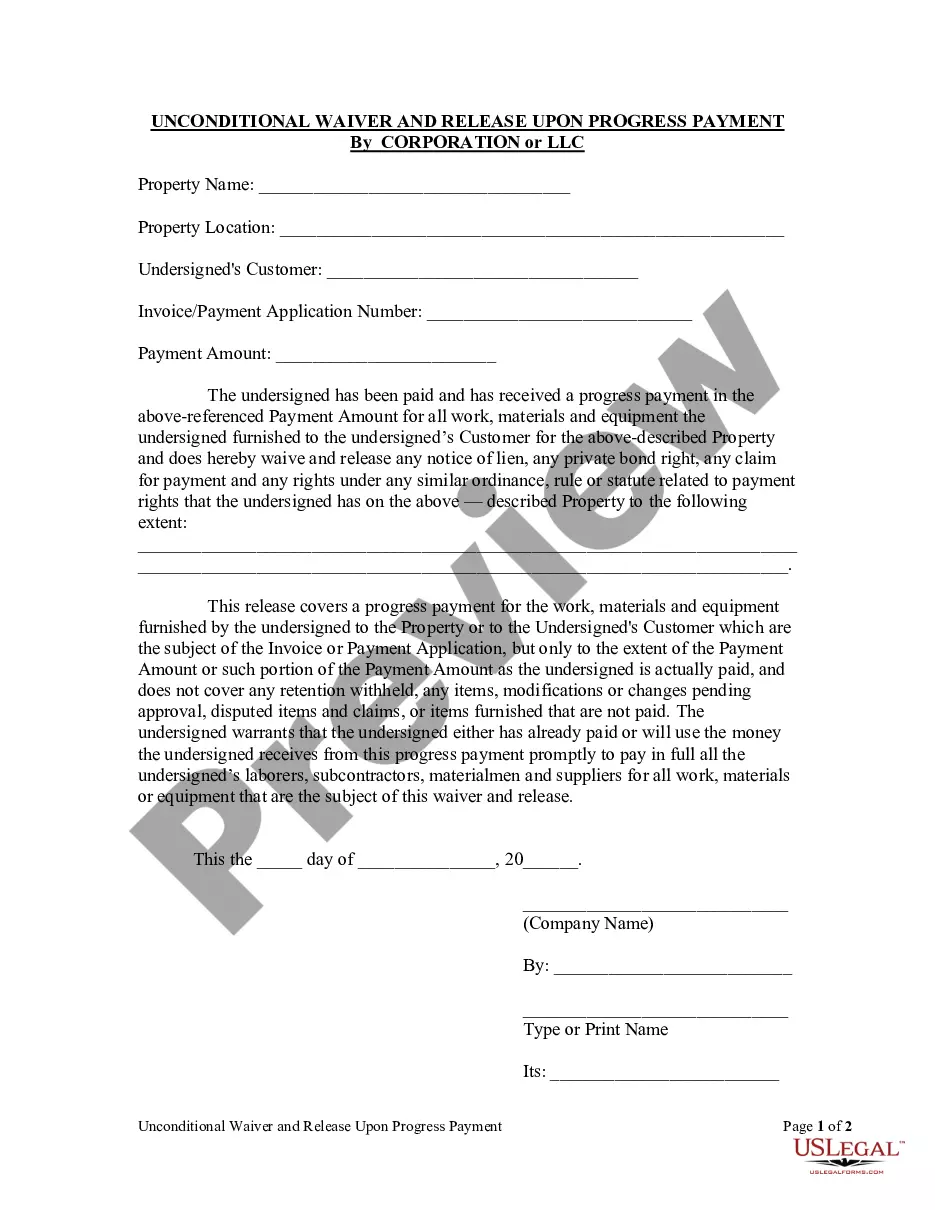

How to fill out Contract Administrator Agreement - Self-Employed Independent Contractor?

Selecting the appropriate legal document format can be quite a challenge. Certainly, there are numerous templates available online, but how can you obtain the legal form you desire? Utilize the US Legal Forms website. The service offers a multitude of templates, such as the Delaware Contract Administrator Agreement - Self-Employed Independent Contractor, which can be utilized for business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal requirements.

If you are already registered, Log In to your account and click the Download button to obtain the Delaware Contract Administrator Agreement - Self-Employed Independent Contractor. Use your account to search through the legal forms you may have purchased previously. Visit the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/region. You can review the document using the Preview option and read the document description to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident the document is suitable, click the Buy Now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the legal format to your device. Complete, edit, print, and sign the obtained Delaware Contract Administrator Agreement - Self-Employed Independent Contractor.

- US Legal Forms features the largest collection of legal forms from which you can find various document templates.

- Utilize the service to acquire professionally crafted documents that adhere to state regulations.

- Ensure your chosen form is appropriate for your needs before proceeding.

- Review the document thoroughly using the preview and description.

- Complete the purchase securely through PayPal or credit card.

- Access your forms anytime via your user account.

Form popularity

FAQ

Delaware does require certain types of contractor licenses, particularly for trades involving construction and renovations. If your work falls into these categories, you must obtain the necessary licenses to operate legally. This requirement complements the Delaware Contract Administrator Agreement by ensuring you fulfill all legal obligations as a self-employed independent contractor.

Yes, it is advisable to register your business as an independent contractor to protect your personal assets and establish your professional identity. Registration helps you comply with state laws, and it may be necessary for obtaining a business license. By completing the Delaware Contract Administrator Agreement, you can formalize your independent contractor status.

In Delaware, almost all businesses, including self-employed independent contractors, need a business license. This requirement ensures that your business operates legally within the state. Even if you are working under a Delaware Contract Administrator Agreement, applying for your business license is critical to ensure compliance with local regulations.

A business permit allows you to engage in specific activities, such as construction or food service, whereas a business license is more general and grants the permission to operate a business in a particular area. Both are important for compliance, but they serve different purposes. For independent contractors in Delaware, understanding these differences helps you avoid legal pitfalls as you navigate the Delaware Contract Administrator Agreement.

Yes, as a self-employed independent contractor, having a contract is essential. A contract clearly outlines the terms of your work, expectations, and compensation. It protects both you and your client, ensuring that both parties understand their responsibilities. A Delaware Contract Administrator Agreement helps formalize this relationship securely.

The independent contractor agreement can be written by either party involved, but it is often beneficial for the hiring party to draft the initial document. This ensures that all necessary terms and conditions are included, protecting both parties’ interests. Utilizing templates from US Legal Forms can help streamline the process and guarantee that your Delaware Contract Administrator Agreement - Self-Employed Independent Contractor meets all legal standards.

Independent contractors may need a business license in Delaware depending on the type of work they perform. While some contractors operate under their own name and do not require a license, others may need to register based on local laws and regulations. It’s advisable to consult with local authorities or use resources like US Legal Forms to navigate the licensing requirements specific to your Delaware Contract Administrator Agreement - Self-Employed Independent Contractor.

To create an independent contractor agreement, first outline the scope of work, payment terms, and duration of the contract. Next, include essential details such as the contractor's name, business address, and any specific responsibilities. For a well-structured Delaware Contract Administrator Agreement - Self-Employed Independent Contractor, consider using US Legal Forms, which provides templates and guidance for crafting clear and legal agreements.

Yes, you can write your own legally binding contract as long as it includes all necessary elements such as offer, acceptance, consideration, and legal purpose. However, ensure that the language is clear and unambiguous to avoid misunderstandings. Utilizing a Delaware Contract Administrator Agreement - Self-Employed Independent Contractor template can provide a solid foundation and help you understand the requirements for validity.

Writing an independent contractor agreement involves drafting a document that specifies the terms of the working relationship. Begin with basic information about both parties, then detail the services, payment terms, and duration of the contract. It’s also wise to address any proprietary information or conflicts of interest. Using a Delaware Contract Administrator Agreement - Self-Employed Independent Contractor can help streamline your efforts and ensure legal compliance.